-

Posts

814 -

Joined

-

Last visited

-

Days Won

10

Everything posted by HV Ken

-

You need to see if your state also honors this approach. NY does not!

-

They do have different phone numbers already. I read posts all the time about EAs calling PPS to ask about their client's stimulus payments. This is one reason why EAs with real problems can't get through.

-

NY has a DOC ID on the license which changes with each renewal. The first 3 characters of this 10 character field are a requirement for NY efile.

-

I make people get their transcripts if they don't know or have confidence in their info. It is very easy to go on Get My Transcript and request them to be mailed. I do that in my office and tell the clients to get them to me when they receive them in the mail. Of course this is not 100% fool proof, but it has prevented a host of problems.

-

IRS to automatically issue refunds on tax-free unemployment benefits

HV Ken replied to Yardley CPA's topic in General Chat

The key language is the UNLESS in this paragraph: Taxpayers do not need to file amended returns unless the calculations make the taxpayers newly eligible for additional federal credits and deductions not already included on the original tax returns. And of course they are not going to examine to see if filing a superseding return to go from MFJ to MFS provides a better result now. We still have work to do. The IRS is only going to grab the low hanging fruit.- 1 reply

-

- 1

-

-

If they added these advanced calculations into the base software and increased the price, everyone would complain. With ATX Advantage, or now it seems you can buy just the advanced calculations without going all the way to Advantage, this allows consumers choice. Those who don't need them can get their software for less. Those who do want them pay more. Seems like a good approach to me. This is not an uncommon approach in the software industry. I upgraded to Advantage a few years ago and it is an important tool for my business.

-

This is updated now.

-

If they were going to pay with an efile debit, efile the return and initiate the payment using Direct Pay.

-

We are still waiting for the IRS to update their schema. ATX has posted about this on their daily blog.

-

Has anyone claimed an additional dependent on an efiled 1040X?

HV Ken replied to Abby Normal's topic in General Chat

It's there starting in 2019. Try it. You'll like it! -

Scenario: Some people have already filed. MFJ, they have UI, and are above the $150,000 threshold. Now all the sudden MFS may provide a better result. But they already filed! Perhaps a paper-filed superseded return could be used here, but how many months before that gets processed given the backlog? MY BRAIN HURTS!

-

The following tips were posted on the ATX blog today. What they are saying is this: since our programming practices are too lazy to find and fix our memory leaks, you need to close the program every 15 minutes and reboot your computer three times per day. ----- The following are best practices that you should use in order to ensure optimal ATX performance: Restart computers daily to clear the computer's memory, helping your system work more effectively. Close ATX and/or PCR whenever you leave your desk for an extended period (e.g. for lunch or a meeting), or, at least at the end of your day. Like a computer restart, this also helps clear memory used by ATX/PCR, and will help the application work more efficiently. Roll over returns for clients at least 1 day before the appointment, and make sure to close ATX and/or PCR at the end of the day. If you have to rollover the return just before the appointment, close ATX and restart to refresh the memory at your next possible opportunity. Close and relaunch ATX and/or PCR prior to opening large returns with many forms or records. Large returns require more memory to calculate, print, and e-file--so restarting the application in advance will give you the most system resources possible to handle this.

-

I was hoping to choose between TaxDome and Taxaroo before this season got underway but never managed to. So now it will be on my to do list for after this season's filing deadline. If the finish line gets moved, I may be able to look into these sooner. Thanks GGRNY for sharing your experience!

-

Paper the file the return. That will build in a big enough delay!

-

Tell us how you really feel! (And I agree with you)

-

It wasn't reported that way pre-2020. Only thing available is 25d - total income tax withheld.

-

All I heard after Technically was blah blah blah! Like the teacher on Charlie Brown!

-

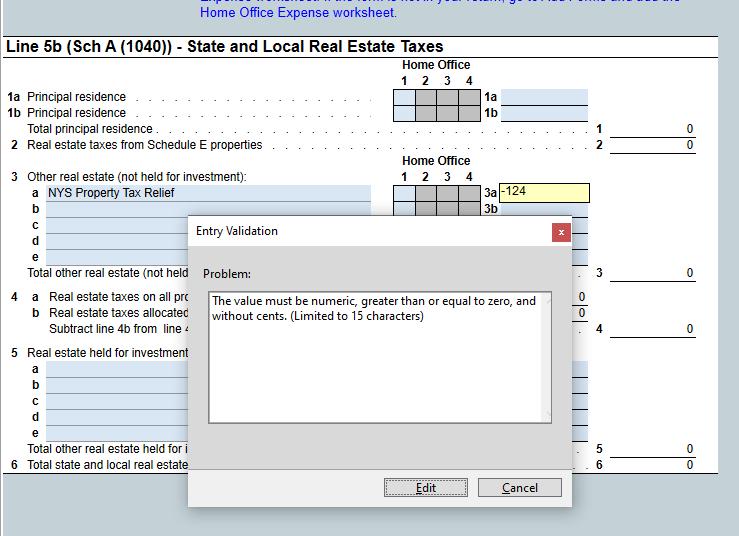

In previous years (dating back to the stone age), putting a negative number in these fields was acceptable. This was useful when we needed to enter reductions to provide an easy-to-see trail. This year, it is not allowed. UGH.

-

You need to look at Step 4 on page 2, lines 9 through 13. You will see here the adjustment. This is after Worksheet A comes in to play.

-

-

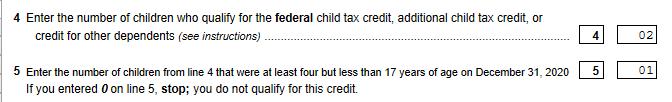

Line 4 is the number from the federal return. You should see a 2 there. Line 5 is for children >= 4 and < 17. You should see a 1 there. The Form and ATX are correct. They should have at least explained why they closed the ticket.

-

GRRRRR!!! I'm liking my workaround even more!

-

Yes - the difference is the presence of the 4562.

-

I am seeing this more this year than in years past. I always have the Task Manager up to give me an idea of when I need to close the program to free up the memory issues inherent in ATX's lazy programming practices. Whatever you do, don't click on CLOST PROGRAM. This will cause you to lose any unsaved work. Instead, "X" the error window, save your changes, then close the program as you normally would.

-

Has anyone claimed an additional dependent on an efiled 1040X?

HV Ken replied to Abby Normal's topic in General Chat

Yes, but it will reject if the dependent is already used elsewhere, just like an initial 1040. I used this strategy last year when the college kid took their dependency for their $1,500 W-2 costing the parents the AOTC. e-file the amended return for the college student wait e-file the amended return for the parent adding the college student and AOTC Worked like a champ!