-

Posts

4,515 -

Joined

-

Last visited

-

Days Won

191

Everything posted by BulldogTom

-

That is really cool. I never knew it was there. I don't get a lot of rejects. Thank you so much Jack. Tom Modesto, CA

-

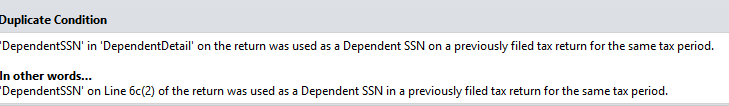

Return rejected for SSN used on a previously filed return. From this message, can you tell which one it is on the return. There are 4 dependents on the return. Thanks in advance. Tom Modesto, CA

-

Not sure if she is going to share... Tom Modesto, CA

-

So I asked my wife if a porterhouse steak was close enough to heart shaped to qualify as a valentine? She said sure! My wife is the best! Tom Modesto, CA

-

In CA under AB5, they are employees. Tom Modesto, CA

-

Override, but on the proper forms. Normally I don't have all the back up documentation, so I override until I get it to exactly what the prior year return says. Then I save and roll over. Tom Modesto, CA

-

Exactly! Tom Modesto, CA

-

I usually take a quick look at the prior year and if there looks to be anything significantly wrong, we talk about amending. But if it "passes the smell test", I don't dig and I don't do the extra work to enter unless there are carryforwards that I want to roll forward. I am not looking to seek out amended returns that I did not prepare. I just can't bill enough to make it worth my while. Tom Modesto, CA

-

In cases like this, I usually go back to the prior year and enter the return so that all of the carry forwards roll into my first return. Since you are only making the prior return look like what they provided you, you can do it quickly and override fields if you don't have the schedules or detail from the prior year. Then you have everything clean in the year you picked up the client. It is also a good way to get to know what happened on the prior year so anything that changes dramatically, you can ask about. Anyway, that is how I do it when I have a new client with any kind of carryforwards. Tom Modesto, CA

-

That was what I was afraid of. Whether SALT caps or TCJA, I had a feeling this was not going to be deductible. Thanks DANRVAN. Tom Modesto, CA

-

It is a long and winding story. My client was estranged from his sister many years ago. She did not include him in her will when she passed, and specifically dis-inherited him. Everything went to her other brother with the stipulation that he must live 6 months after her passing or everything goes to charity. She dies, her brother inherits and starts liquidating the estate. 7 months later, brother dies unexpectedly. My client is now administrator of 2 estates as he is his brother's sole heir. And yes, he gets his sister's stuff as well. The court appoints my client as successor trustee for sister's estate. As he starts looking into it, he discovers that the property taxes were not paid on the sister's home that the brother sold when he was executor. So my client paid the property tax (even though it sounds like it should have been cleared in escrow - I know! but it is what was paid). This is the Bay Area, so he is already SALT capped. Can I pass this through to him and if so, can he deduct them on his personal return. I am not crying for my client. His sister's home and his brother's home were both in the bay area and paid off. If he does not get any deduction, he is going to be OK. Tom Modesto, CA

-

Pretty sure I know the answer but just double checking. In the final year of an estate, property taxes that are flowed to the beneficiary are subject to SALT limitations under the new tax law. Am I correct? Thanks Tom Modesto, CA

-

OT - Micros POS - Anyone have a client using this software

BulldogTom replied to BulldogTom's topic in General Chat

Micros POS software is owned by Oracle. Tom Modesto, CA -

OT - Micros POS - Anyone have a client using this software

BulldogTom posted a topic in General Chat

@jklcpa , please don't move this. I know it should be on the other forum but no one reads those posts. Do any of you have a restaurant client that uses Micros POS software? If so, do you know who they use for support and customizations? I am looking for a vendor that is highly skilled in this software. It would be great if they were in Northern California, but at this point I will reach out to anyone who I can get a great reference for. Thanks Tom Modesto, CA -

I am not interested. There are way to many variables in the outcome of a tax return. Withholding is just one of them. If I take on a new client because I helped them out with the W4, and next year the result is not what they wanted, I have an unhappy client. In order to make this work, I need to know everything that might go into the client's return, including what they might change from the prior year into the new year. I have a hard enough time trying to keep my regular clients (you know, the guy who told me he was going to semi-retire this year and then had the best year his sole proprietorship ever had!) who I know happy. Bringing in a client based on projecting their next year return is just not enough reward for the hassle. So yeah, I am not really interested. Not taking a shot at you Medlin, just giving the explanation as to why this suggestion is not for me. Tom Modesto,, CA

-

can I start a tax return on ATX Max when state form is not available?

BulldogTom replied to cl2019's topic in General Chat

This is normal. CA returns appear about 2 days before the efile window opens in a normal year. Then it is the waiting game for that one off beat or new form you need to complete the return one return that you want to get out fast. But there is no issue with the information flowing to the forms in most cases. Tom Modesto, CA -

I generally will not take on 1099's or W2s from a client who I don't do the tax return for. Just not worth it to me. For my business clients, I prepare the 1099's for free if I do the bookkeeping (it is loaded into the price I charge for bookkeeping). If I don't do the bookkeeping and just the tax return, I charge a nominal amount (like $25) if the W9's are available. If I have to chase the w9's, I charge more. For most of my bookkeeping and business clients, it is the same contractors every year so it is not a big deal to produce the forms. I just consider it customer service. Tom Modesto, CA

-

Thank you Judy. Tom Modesto, CA

-

If you post what your issue is, there may be an answer from one of the members. Or they may tell you it requires a support call. I have been on Max for 18 years. We usually have to call support once a year for something related to the install. The rest of the questions we get answered on this board. Yes, support for ATX sucks. There is no way around that fact. But, I still like the program and I know enough to make it work for me because I have used it for so long. Welcome to the group. Tom Modesto, CA

-

I am having a brain fart. Can I get some help with the entry in ATX on a gift tax return? Client (H&W) gave 600K to each of their children who are married. The list is 300K to each child and 300K to each son in law. Total gifts by H&W is 1.2 million. I know I need to make 2 returns because it is community property in a community property state. No issue there. Each spouse will have 600K in gifts on their return. On the H return, do I show the full 300K to each child and then 50% split, or 150K to each with no split? Thanks Tom Modesto, CA

-

keep getting error - attempt to connect to server

BulldogTom replied to schirallicpa's topic in General Chat

We had that problem a few weeks ago. Could not update or get onto the ATX website to download the program on our laptop. Called ATX and they changed some settings in our internet connection and it cleared up. Funny that we did not have the problem on the desktop, just the laptop. Both Dells, both set up the same when we bought them last year. Only affected the laptop. Tom Modesto, CA -

Client just called and said they were going to do a 1031 exchange of two rentals for a different rental. But they did a refi on one of the properties a few months ago. Is there a problem with this? My spidy senses are saying there is, but I don't have my reference material in front of me right now. Thanks Tom Modesto, CA

-

Thank you. That seems late. Must be the extender bill that Congress passed that they need to test for. Tom Modesto, CA

-

Any announcement on the opening of individual efile yet? Tom Modesto, CA

-

Yes, ATX Max 2018 worked all of last year on the laptop. Tom Modesto, CA