Unread Content 30 Days

Showing all content posted in for the last 30 days.

- Today

-

Thank you all

-

G2R Thanks for sharing this disaster with us. It certainly puts a different perspective on whether or not to use IP Pins

-

I am one of the cases. We originally filed the return September 2022 -- In January 2023 after still not receiving the refund, we learned there was ID theft. Elderly client who unfortunately passed away during all this. The fraudulant return was flagged, and luckily, not paid out. When the legitimate return was filed, the process of ID verification begin. We had to go through ID verification 7 times before it finally stuck. (well hopefully, the refund has still not produced) Originally in June 2023 we were told it could take up to 430 days. In August 2024, we were then told maybe 640 days. Called last week (you know, 2 years and 9 months after filing the original return we filed) and were told ID verification is confirmed, but it has yet to be assigned to a case worker. So, about 1,000 days later ... we are hoping the National TP Assistance will help us.

-

Here's Joe's letter to us in the NY/CT-ATP: Dear Tom and Rita, Due to significant staffing reductions at the IRS in general and in Stakeholder Liaison in particular, I have decided to leave the IRS under a deferred resignation program. You might have heard this program referred to in the press as “the fork in the road”. This means that while I will still technically be an IRS employee until the end of September I will soon be placed on administrative leave and be unable to perform any of my official job duties. Before I leave the IRS, I just wanted to let you know that it has been my absolute pleasure to work with you over the years. As I always say … working with tax practitioners is (and always has been) the very best part of my job! I am looking forward to the next phase of my life and I wish you all the best in the future. Also, due to the significant staffing reductions, I am not sure who if anyone will be taking my place. If you wish to contact Stakeholder Liaison in the future I suggest you use the contact information in the following link: https://www.irs.gov/businesses/small-businesses-self-employed/stakeholder-liaison-local-contacts Feel free to share this information with your members. Most sincerely, Joe McCarthy CPA IRS Senior Stakeholder Liaison 150 Court Street, 5th Floor New Haven, CT 06510 203.415.1015

-

It was Joe McCarthy. He was indeed great. I think he said his wife took the deferred resignation, also, but I'm not sure I remember. She prosecuted the Son of Boss or one of those schemes. They're both wicked smart and probably saved well for retirement or have already found consulting jobs. I hope they go into tax teaching.

-

And the burden of TAS failures and IRS administrative bungling falls upon the taxpayer.

-

Umm, I thought the purpose of all this was to eliminate waste. Isn't paying people not to work somewhat wasteful? Just a short time ago we were elated that IRS finally got funding to increase staff so phone wait and processing times would decrease and audits would increase in areas we knew needed auditing. TAS was the place we went to when all else failed. Taxpayers are really going to feel this. They won't be able to get questions answered or problems solved, all the while knowing that others are cheating and getting away with it.

-

Was that still Joe McCarthy? He was indeed great, very helpful and so funny that no one fell asleep during his portion of a seminar. He once told those "who have never been in an IRS return processing" campus, they really do take all the staples out and have papers scattered over the floor, which is why they request the same docs three or four times. His wife was an IRS agent. If she still was, maybe she's been downsized too. Tough to have both breadwinners in a family unemployed. And it's the IRS's and our loss to have so much expertise dismissed.

- Yesterday

-

On 16 April I heard from our CT Stakeholder Liaison that he'd accepted Deferred Resignation and expected to be put on administrative leave shortly while being paid through September. By 9 May I heard from new Stakeholder Liaisons in NY (2) and NJ who are covering the northeast. I think CT's Liaison (who was great, by the way!!) was gone by 30 April. Probably the same end-date for the former NY and NJ Liaison's.

-

-

That's all correct and you don't need to do anything else. There is the question of basis in the S corp and whether any of those distributions are taxable, so be sure to do the basis calc on the K1.

-

In doing so, I put the distribution on the K-1, Line 16D. It did not make any other adjustments to the K-1 and the tax due the IRS did not change. What may I be doing wrong?

-

And I would not issue any 1099 from the corp to the LLC, because you're creating hobby income and paying tax twice on the same income. Just leave it on the K1 as ordinary income and in the basis worksheets as distributions to shareholders.

-

20 months?!?!

-

I'm sure that someone who uses Drake will confirm that Drake is just sending a PDF via some secure method. Personally, I don't know why every tax pro doesn't print a PDF of every return and every other document they produce, for safekeeping, quick access and backup. I use a secure email service (sendinc.com) to exchange documents with clients. I can set the email to self destruct after as little as 1 day up to 365 days or never. I usually do 30 days. It's a very inexpensive service and most clients can use it easily. All they need to do is create an account with their email and a password of their choosing.

- 1 reply

-

- 2

-

-

I have ATX Max and I am trying to figure out a way to send a client their tax return straight from the tax program without having to create the client portal or create a separate PDF and send that way. Is there an easy way to do this? I have another friend who works out of Drake Tax Software and that program will do it with very little effort.

-

It's sure not going to get any better. From the TA Mid-year report to Congress The TAS itself has been reduced by 25 percent. BTW, my understanding is that those who took the offer are actually leaving at the end of this month, though they will "remain on rolls" and get paid through Sept. 30.

-

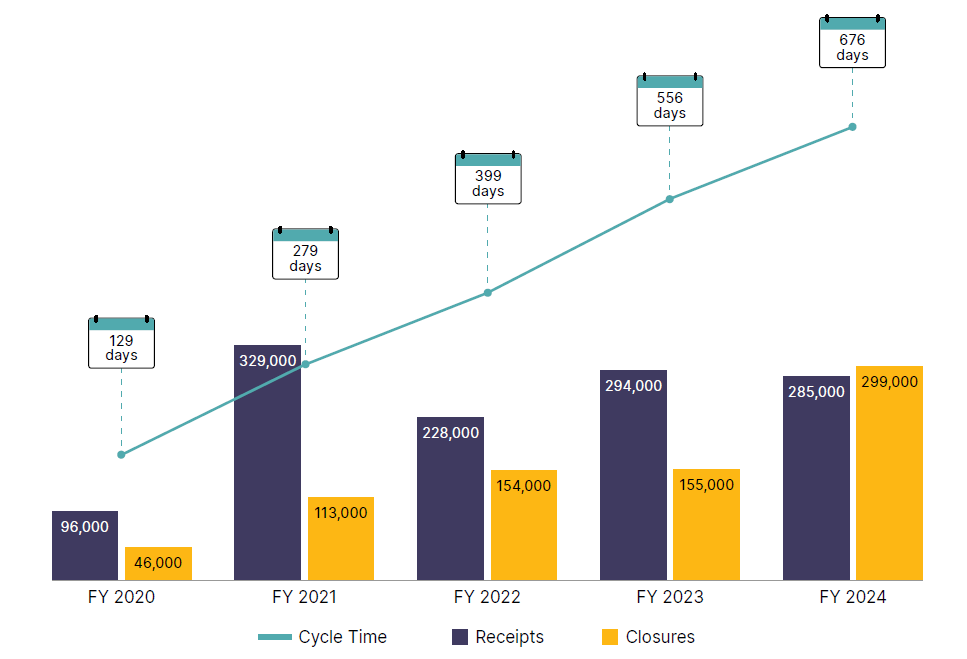

Copied from the Tax Advocate's Mid Year Report to Congress: "One longstanding filing season challenge that remains unresolved is lengthy delays in resolving identity theft cases. There are two categories of identity theft cases. One involves returns that IRS return processing filters flag as potential identity theft; the IRS flagged about 2.1 million such returns. In these cases, the IRS sent a letter to taxpayers notifying them they had to authenticate their identities before receiving their refunds. The IRS typically takes several months to resolve these cases. In the second category of identity theft cases, a thief has stolen a taxpayer’s identity and filed a tax return using the taxpayer’s name and Social Security number. These taxpayers are victims and may also be experiencing the effects of identity theft beyond the context of their tax returns. Their cases are referred to the IRS’s Identity Theft Victim Assistance (IDTVA) unit for resolution. As of the end of the filing season, the IRS had about: 387,000 IDTVA cases in inventory, and the cases were taking an average of about 20 months to resolve. “These delays disproportionately affect vulnerable populations dependent on their refunds to meet basic living expenses,” the report says. In fiscal year (FY) 2023, 69% of affected taxpayers had adjusted gross incomes at or below 250% of the Federal Poverty Level." Sometimes my mind really struggles to understand this stuff

- Last week

-

Exactly, for tax purposes the creation and involvement of the LLC is just a smokescreen for their dancing hobby, which is not a business!

-

Treat these as distributions to shareholders, unless you can convince them to repay the business.

-

S-Corp, Medical Office, The Dr and her employee husband love to dance. The question is, they have paid for all their pleasures from their Corp checking account. I have not deducted the pleasure expense from the Corp return. The question is, the expenses, although not a Corp. expense flows to their personal return via K-1 and is counted as taxable income. To make things more interesting, the client set up an LLC to receive income and pay expenses for their dance activity. They are going to issue 1099-NEC for the services (dance expense) they paid for out of the Corp. which has bloated the ordinary income on the K-1. Since the expenses were paid with a corporate check, it seems to me that the S-Corp (Medical Office) should 1099-NEC the LLC that was set up to handle their dance activity and the LLC should 1099-NEC the expenses they had for dance instruction, etc. Going forward this will not be a problem as corrected measures are in plane. I hope this makes sense, thanks for your help.

-

I definitely would be forced to retire. I hope that everyone remembers Eric before you spend all of your profits. Also, a special Thank You to Judy for her pristine Moderation and all of the rest of you who reach out so generously to help those of us in need. I couldn't do this without all of you.

-

- 11

-

-

-

Total price with discount; plus Tax and Processing was $2,603.32

-

Married Couple Revocable Trust Owns LLC in Non-Community Property State

G2R replied to G2R's topic in General Chat

Trust was setup years ago. LLC was just setup last year and owns the rental. I got the EIN letter from the client, they state 1065 as the expected form filing. -

I never received an early renewal offer, and they can't show that it was sent to me. Did everyone else receive an offer? If so, what was the pricing for Max all in?