Unread Content 30 Days

Showing all content posted in for the last 30 days.

- Past hour

-

Today I put my EA status into inactive (still cost $140). Looking over my shelves of reference material and law books, I realized most of them are now obsolete. Prior big changes in the tax code have made us adaptable and fast learners. The year the ACA went into effect, coupled with new rules on expensing vs capitalization, all passed in December, sent us rushing into the classrooms and seminars, but learn we did. We now have so much to unlearn. The bits and pieces I've read of specific provisions of the BBB struck me by their complexity. You can deduct car payment interest if this, that and another thing. Seniors get a bigger deduction but being married may take it away. Energy Star certification meant to go into effect this year is gone, and taking energy credits is now a labyrinth of rules soon to expire anyway. I doubt that the new above-the-line charitable deduction will be as simple as it sounds. With the exodus of expertise at the IRS, I doubt the agency will be of much use helping us navigate these changes. On top of all that complexity, I personally don't agree with the majority of the changes. I don't want to invest any time into learning the detailed details. I am a lifelong academic who spent most of my career in the Ivy League, doing taxes on weekends. Once I retired from academia, I couldn't stay out of the classroom--got a Master's in Taxation and usually took way over the required number of CPEs. It truly pains me to say for the first time in my life that I just don't want to learn about something, but this awful bill is it. I tried to semi-retire this year but the office needed my help. Now I feel that my over three decades of experience are of no use in this new, morbid tax environment.

-

The source of confusion is that there have been so many versions of the bill. The bill the House passed and sent to the Senate eliminated taxes on Social Security for many beneficiaries. The Senate Parliamentarian said that did not meet the rules for passing the bill by reconciliation (requiring a simple majority to pass) instead of the normal route (60% majority). They took it out and instead granted seniors an extra $6k deduction. The original version would have reduced payments into the SS Trust Fund because taxes on SS are dedicated to the fund. The passed version does not impact those payments because the extra deduction is not tied to SS. Apparently the inexperienced political appointees at the SSA don't know the difference and sent out that totally wrong email. At least I hope it was due to lack of knowledge rather than intentionally meant to deceive.

- Today

-

Every amount in the tax code needs to be adjusted for inflation and back inflation. One small simple sensible bill.

- Yesterday

-

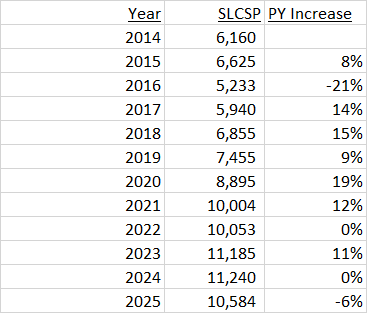

You are misinformed on so many levels. In 2004 I paid 2,740 for individual coverage for myself and teenage kid. By 2013 that had basically doubled to 5,335 for just myself. This is actual data for what SLCSP was for me. No annual 20% increases. Want to talk subsidies? How about subsidies for tax free employer coverage estimated at 300-350B a year. Medicare Part B is funded 25% from premiums and 75% from general funds. 6,660 per person times 66M people and you are talking about 435B annual. The only people not being subsidized were those of us with individual policies. According to KFF increase in spending is lower since ACA was enacted.

-

That would be too sensible.

-

@Abby Normal @kathyc2 @mcb39 You all just made my point. The ACA was supposed to make healthcare more affordable, and it did the opposite. That is not opinion, that can be searched on any website and proven out. Prices still went up after the ACA became law by about 20% per year, but the Federal Government started paying some of the extra cost. The pandemic hit and the cost continued to go up (labor costs skyrocketed for healthcare workers) and the Federal Government stepped in and paid more. Demand is up because the prices paid by the people getting the insurance were artificially low. The price of health insurance is not going to go down, the corps that run our healthcare are not in the mood to take them down and the shareholders will punish the stock price if they do. There will be a lot of sticker shock in November when people renew their insurance on the insurance marketplace. There will be some that will be forced onto Medicare, some that never really qualified that will now have to prove they qualify and won't get subsidies, and then there are the folks that cannot afford to pay for the coverage. I expect to see a lot of dissatisfaction with Healthcare Insurance, perhaps even anger, when the new year enrollment periods open. Congress never seem to learn that when the Fed Government subsidizes something, the prices don't go down, because demand goes up and the law of supply and demand always comes into play. Tom Longview, TX

-

Why didn't they just raise the $32K ($25K) used to determine if any of SS was taxable, and the $12K ($9K), used to determine how much was taxable? I have been preparing taxes for over 20 years and don't remember them ever being raised. Adjust these amounts for past inflation now, and then adjust yearly to avoid this issue in future years instead of using this band-aid approach.

-

I don't judge my clients or their choices. I only recommend, advise and explain the law. They aren't going to stop gambling just because we tell them it is a bad choice. IMO

-

I am still filing 2021 just to get my clients up to date. The most recent ones had refunds that they will never see. What is fair about that? If they owed, they owed interest and penalties regardless of the window.

-

Excruciating for self=employed people then. I remember deductibles that kept climbing right along with premiums. We had to pay in order to protect what we had and never collected any benefits. I worked a part-time job just to pay for health insurance premiums and the deductible was always higher than the bill.

-

Perhaps someday Billionaires will realize that they are standing on our shoulders

-

From IRS 2022 published tax return data: 7.9M returns had PTC for a total cost of 54B which works out to 6,853 per return 594K returns with AGI over 1M, had a QBI deduction of 95B. Assuming a 35% rate, that's 33.3B of tax or 55,992 per return. Millionaires did fine before QBI. But they were the ones that needed "help".

-

If only that were the case. It goes much further both disqualifying some completely, making it harder and more burdensome to enroll and making it much more expensive. If this doesn't lead to universal healthcare, then there's no hope for us.

-

Ah, yes back to corporate healthcare focused on maximizing the profits of Insurance companies and pharmacy benefit managers. Back to rural hospitals and local pharmacies going out of business. Back to the U S A with the highest per person healthcare costs in the world.

-

I remember before ACA insurance premiums were 15% of my gross income. I remember rates increasing on average 10% a year. I remember calculating that at some point I wouldn't be able to continue paying them without taking money from retirement accounts. I remember researching putting assets in a trust so a prolonged hospital stay wouldn't wipe me out if I could no longer afford payments. So, instead of saying people should remember what "normal" ACA is, how about remembering what some of us went through before it was enacted? Would you like me to remember back further when my Dad had cancer and the small company Mom worked for changed carriers and they refused to enroll him?

-

More details here: https://www.kff.org/policy-watch/how-will-the-2025-budget-reconciliation-affect-the-aca-medicaid-and-the-uninsured-rate/

-

If my memory serves correctly, those enhancements to the program by the previous administration were supposed to be temporary because of the pandemic. So now there is no more pandemic, and we go back to normal Obamacare, which a lot of folks forgot what it was like. Tom Longview, TX

- Last week

-

Medical debt is already one of the leading causes of personal bankruptcy

-

So they have 6 months to reflect upon their bad choices and change their behavior before the new rules take effect?

-

Depends on extensions and filing dates. If you filed 10/15/22 with an extension, the window is still open.

-

I think that horse is a jackass.

-

This is one HUGE step backwards. I was talking to a friend, with a family of 4 paying $400/month for a great plan. Now, she'll pay more for a less great plan, if she can even afford it all. She was opposed to Obamacare when it started but now she loves it. Or, should I say, loved it. A lot of people are going to feel a lot of pain.

-

Yep. I pointed that out months ago. No more subsidies for anyone over 400% FLP. Can't repeal it outright, so death by 1000 cuts. Also not being talked about is clean energy credits end 9/30/25 and residential energy credits end 12/31/25.

-

To me, it seems like a reversal of why partial SS income was being taxed in the first place. This appears to benefit high income taxpayers and does nothing for low income taxpayers who did not pay tax on SS income anyway.

-

If you have clients who buy their health insurance through one of the Marketplace Exchanges there are a number of changes. The annual enrollment window has been shortened by one month No more automatic re-enrollment - everyone will have to resubmit all of their documentation every year. The Premium Tax Credit repayment cap will expire at the end of this year. The Enhanced Premium Tax Credit also expires at the end of this year. So far Congress has not renewed the large Premium Tax Subsidies paid to Health Insurance Companies to hold down the health insurance premiums of health insurance offered on the Marketplace Exchanges.