All Activity

- Past hour

-

I agree with Abby Normal on the crypto investing. As for your second question, if you are simply suggesting that the client considers an IRA and are explaining the effects it would have on their tax return, then you are not giving investment advice.

- Today

-

IRA accounts aren’t limited to low-interest instruments - never have been. My tIRA and RothIRA accounts are held in IRA brokerage accounts with Fidelity and Vanguard. I can invest them in any manner I wish. For me, that is 50% fixed income (CDs, govt bonds, etc) and 50% equity (in the Vanguard Total Market Index ETF). And I rebalance periodically to maintain the 50-50 ratio as market conditions ebb and flow. So don’t fall into the trap of thinking IRA’s can only be held in bank Money Market accounts or other low-paying instruments. And I would never suggest that someone toss their money into a crypto scheme and call it an investment. By that’s just me …

-

Crypto is a pyramid scam that will come crashing down someday, and it's also very bad for the environment because of the huge amount of electricity it consumes. When summers get really hot and you have to cut back on cooling or even have a blackout, remember the strain that crypto puts on our electric grids. And IRAs only earn pennies in interest if you have them in cash investments. Although these days, interest rates are providing better returns on safe investments. I have some CDs in my IRAs, but stocks should eventually give better returns.

-

About 18 years ago, I was suggesting my clients to open IRAs when they came to do their taxes and in instances when lowering their taxable income would make other credits bigger... in addition to the lower tax liability as a result of contributing to an IRA. I also suggested when Obama care required a penalty or to return premium credit but I have stopped suggesting IRAs because they earned pennies in interest. I have been following and watching Lark's videos and for a couple of years I have seen he promotes Crypto IRAs. https://itrust.capital/LarkDavis and those look promising to me. I have two questions: 1.- Have you used crypto IRAs? if not, what do you think about them? 2.- If I suggest my clients to contribute to an IRA, am I giving financial advice? Thank you in advance for you comments.

- Yesterday

-

I had one client receive a letter stating that the IRS could not apply their overpayment to their estimates for 2025. No reason was given. No money was refunded either.

-

I understand that and it would help many of my clients; buy personally, with both of us in our 80s and both still working, with meager SS, taxable income is not much of a problem.

-

This bill is an abomination and needs to die in the Senate.

-

Things like direct deposits of refunds, direct debits of balances due, application of overpayments to estimated taxes, are computerized functions that should and used to work almost seamlessly. And if they still are, the computers that spit out letters are getting the wrong information. The DOGE kids had gotten into the IRS systems at one point. Could they have somehow messed up the coding? I can't imagine why electronic transactions and/or automated responses have become unreliable. I have seen a number of know-it-alls mess up their computers by rapidly clicking away without reading what is on the screen. If the kids inadvertently broke something, they surely know enough to fix it so hopefully these odd letters will cease soon.

-

However your taxable income will go down due to the increased standard deduction and the increased Section 199 A deduction.

-

The increase in the standard deduction doesn't help those of us who have SE tax.

-

I use login.gov, but looks like I will have to create an ID.me account. Am dreading it. Why do they make everything so hard for us and what thanks do we get? I just got a letter saying that I owe them the amount that I had direct withdrawn the day that I filed. I have proof that it went to the IRS:USATAXPYMT., over a month prior to this letter.

- Last week

-

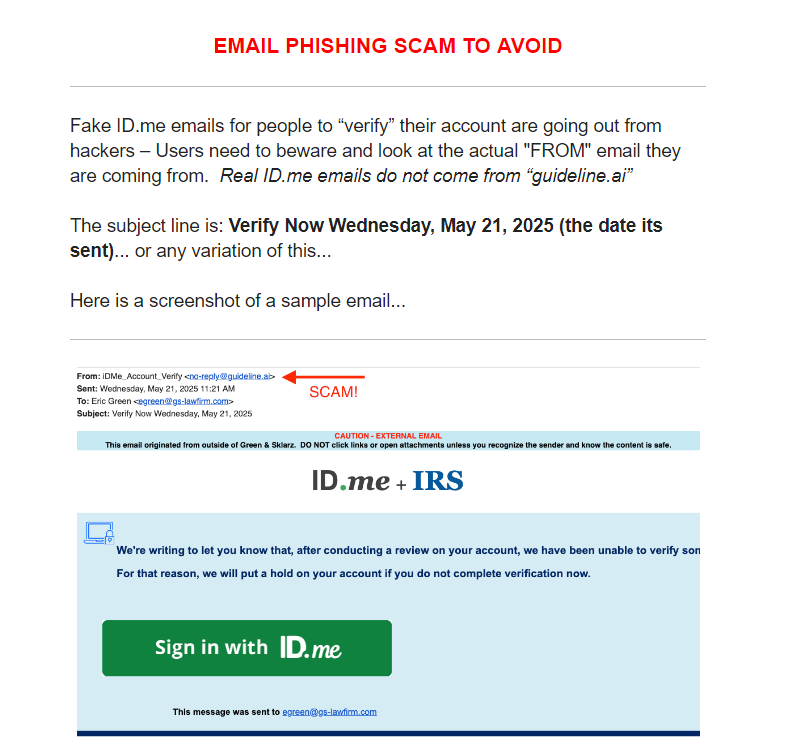

I registered for login.gov and id.me, so looks like I'll need to be on the lookout for scams with either one. I don't think I'd fall for it since I never click on links unless I'm expecting them, but one never knows when there might be a lapse in attention. And that one has a fairly legitimate look to it (well, except for the big red arrow and the word "SCAM" )

-

I use e-services so infrequently that there is always some new requirement to get in. I hadn't bothered with it until yesterday and went through the ID.me process. I had opted for the login.gov to access EFTPS instead. Just watch, now it will probably change again in the near future!

-

Well, that's really sneaky

-

After passing in the Senate, it then has to be signed into law. After that it can take effect.

-

Eric Green of Tax Rep Network sent out a warning today about this. He got one yesterday, as did a local colleague. Here's what he sent out:

-

I really hate temporary provisions!! (Like built-in obsolescence in appliances.) More moving parts to account for when tax planning.

-

These items caught my attention: "The bill includes a temporary boost in the standard deduction — a $1,000 increase for individuals, bringing it to $16,000 for individual filers, and a $2,000 boost for joint filers, bringing it to $32,000." "There is also a temporary $500 increase in the child tax credit, bringing it to $2,500 for 2025 through 2028. It then returns to $2,000 and will increase to account for inflation." "The bill increases the “SALT” cap to $40,000 for incomes up to $500,000, with the cap phasing downward for those with higher incomes. Also, the cap and income threshold will increase 1% annually over 10 years." "The tax breaks for tips, overtime and car loan interest expire at the end of 2028. That’s also the case for a $4,000 increase in the standard deduction for seniors." "Among the various business tax provisions, small businesses, including partnerships and S corporations, will be able to subtract 23% of their qualified business income from their taxes. The deduction has been 20%"

-

I downloaded the full bill from the house and skimmed through it. The 4,000 for over 65 as written is in additional to the higher standard deduction. It adds a new paragraph to 63(f) and doesn't replace it. Even those that itemize will receive the 4K deduction. Phase out starts at 75/150K. Interestingly, as currently written the 4K is the same for all filing statuses. The "no tax on tips" and "no tax on overtime" appear to be an after AGI deduction. Takes away the payback limit of APTC based on income . Nothing to extend the PTC for those over 400% FPL from IRA. Hopefully the Senate will correct that. If not, a couple in 60's but not eligible for MC with income of ~85K will go from paying ~7K to ~20-25K for insurance. Interest on auto includes such things as ATV, motorcycles, campers, trailers, etc. Residential energy credits go away after 2025. Requires states to collect fee of 100/250 when plating hybrid/electric vehicles. Lots of other items that are going to be a PITA. A lot of the items start for 2025 tax year. After they pass, IRS will need to issue procs, companies will need to learn what new info they need to provide, forms will need to be revised, software will need to be reprogrammed, etc. Uggh!

-

You didn't miss it, but the proposed legislation going to the Senate is supposed to have an additional $4,000 of standard deduction for seniors. Those over 65 were already getting a higher standard deduction, so I suspect that this won't be a full $4,000 increase from what a senior was getting already.

-

I haven't looked. Seems like I saw a headline about that as one of the proposals. But there are proposals, then there are what's actually in the bill. Let's see what the Senate passes and the House/Senate joint or compromise bill.

-

Here is a detailed article by the AP: https://apnews.com/article/trump-tax-breaks-bill-medicaid-80b5781377bcd0870a1dccb3c7b8dc05

-

Am I missing the "No tax on Soc Sec" ? I see it no where in the bill.

-

Yes, it did. Now it goes to the Senate.

-

I thought I saw a headline this morning that the bill has passed the whole House. But doesn't it still have to go through the Senate? I usually wait for it to become law. Then we'll get some info and summaries and the IRS can start working on the forms and processing of it all.