-

Posts

4,551 -

Joined

-

Last visited

-

Days Won

25

Everything posted by Pacun

-

answer no for now and then yes when you file if needed.

-

I think people outside the US will use the old rule Refund=2000 (600 and 1400)

-

I have a client with a child, both US citizens, that live in Europe. How do I enter $600 non-refundable child tax credit and $1,400 refundable additional child tax credit like before?

-

Yes, they do. Just read the instructions carefully and see if they qualify for the refundable portion. Also, please make sure student is not full time graduate student. That will eliminate AOC.

-

MD seems to be asking for 1099-R when people are paying 1/3 from 2020 Covid withdrawal from IRA. Has any one know how to overcome that? Federal and MD efile files were created. Federal was accepted and release MD efile from held to created. I transmitted MD and it was rejected by agency.

-

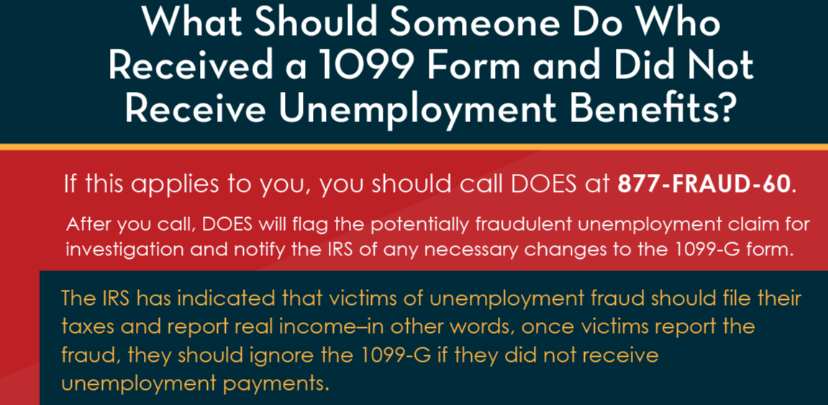

Be prepared for the IRS to send letters to your clients who moved from or within DC and never got the 1099-G. Since they didn't collect unemployment, they didn't expect a 1099-G. So they never brought it to us and we filed their taxes and the IRS will match it later. As Judy said, this could be coming up in a couple of years.

-

oops, DOES is DC. So, I have the answer to the first question. This 877 is only for DC unemployment fraud reporting.

-

Two questions: Is the number listed on this notice a national number and good for any identity theft? Will the IRS guidance apply to any type of income reported by identity theft or this rule is only for unemployment and ONLY for this year? I have a client who worked all year and suddenly got a 1099-G for $20K and that bumps him out of EIC, making a huge difference on his refund (he owes). I am glad that the IRS will process these returns and deal with the other issue later.

-

I meant to say, non-refundable, which makes sense because DC has not added Child care credit as refundable. By the way, the instructions read that you have to enter line 10 or 11 in the box. So I guess we have to manually do it.

-

There must be a glitch on the form. I think I had one that I already filed. I will check to see if she had a tax liability for DC and amend if needed. PS: I just checked and my client didn't have a tax liability, so I won't need to amend. See if you can override the box on line 21 and enter the amount of the credit from line 10 or 11 from Federal 2441. PS: Override is possible but it takes the credit as refundable regardless of what option you have in the federal. Oh well, I have only a couple of clients with 2441 that live in DC.

-

I know this might not be the case in your situation, but it is a good idea to keep it in mind. Let's say that her gain is $350K and his gain is only $100K. $100K is taxable.

-

I don't like override but it is available on some boxes just by right clicking. If a box doesn't have "override" go one level up and override that entry. I don't like overrides because they can mess up the whole return not just the form involved.

-

house sale satisfied 121 excl and rental for some time

Pacun replied to tax1111's topic in General Chat

Before I make my opinion, I would like to know why did they have suspended passive loss? Depending on the situation maybe carrying the loss was a mistake. On the last day of the rent, I stop taking depreciation on the asset by transferring to personal use. Knowing when it house was rented and when it was used by the owner is important because you could have non-qualified use period. -

File 2021 or amend 2020? Why will you send him back if amending 2020 is easy and not paying tax on 1/3 in 2021 is also easy. Take the client and if you have questions, we are here to help.

-

It is too late for 2020 but he can put back 2/3 which should be .5 for 2021 and .5 2022. Or he can put back 1/3 for 2021 and he will have a whole year to send the other 1/3. Ask him to send 1/3 now and see if the 401k holder accepts it. I have a client who sent it back sent the money with the wrong form and the custodian sent back they whole enchilada. Make sure you amend only if he is able to redeposit the money. It seems that you can use 8915-F to accommodate for 2021.

-

If he does that, his basis will be 0 and everything he gets becomes profit. FMV while on the company's book and a distribution sound good to me.

-

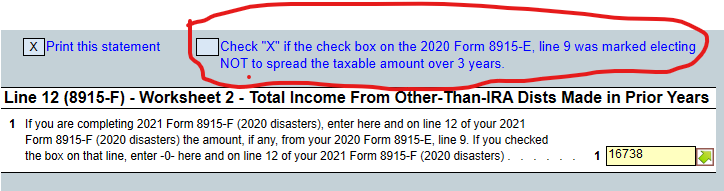

When form 8915-F is required, you have to pdf it and attach it. So, I doubt it will be needed if everything was paid in 2020 unless the client changed his mind and wants to re-invest the 1/3 or less of the distribution. They way I understood it last years was: you have a choice, pay everything this year and you are done. Or pay or re-invest 1/3 and do the same in 2021 and 2022.

-

They could become collectibles if you frame them on the wall. As I stated on another post, I feel weak when it comes to crypto. Even NFTs are not going to be collectibles when some more regulations are drafted. There are L1 and L2 projects that will break the collectibles into pieces and they will not longer be non-fungible which is, currently, a nice distinction from the other cryptos.

-

As we know, the easiest way for the numbers to flow to correct locations is to have both 8915-E and 8915-F along with 1040 when working with a client. In any event, going back to my question: Is form 8915-F still needed when the client decided to pay all taxes in 2020? The reason of my question because of this: Also, It seems that using form 8915-F, the client, who decided to pay all taxes in 2020, can change his mind and deposit back some money now for 2021 and/or 2022. It seems that this can be done without amending 2020. AS someone mentioned about making stupid mistakes on another post, I calculated the return and this retired person didn't owe anything to MD, but when I removed form 18915-E, I had to enter the amount being reported as taxable, and I did it on the wrong worksheet and now he owned MD more than $700. The federal amount owed was still correct but MD doesn't tax distributions (in this case) it is comes from 401k and I entered it as IRA by mistake. I wonder how if other states do the same.

-

Kim, Please see topic "Huge Cons DIV" where others and I have listed how we do it.

-

If H and R was correct, the situation is harder since letters have been ignore. There is nothing to amend and time is against client as mentioned by others. Unless, he still has to pay penalty even if reported on line 7, in which case an amended return is in order.

-

Remember, like kind exchange only exists in real estate. All gains are taxable in your situation.

-

As we know, each year is different and a separate entity for EVERYTHING not just for stimuli. Amend if necessary. I just filed 2021 and amended 2020 because a client had the second stimulus check in his hand but lost it. My partner (not tax preparer) gave me a message that this person didn't get the second stimulus. Since I have done their taxes for years, I said: "it is impossible that the IRS didn't send the second stimulus". When I talked to the client, he gave me his version and I amended.