-

Posts

5,225 -

Joined

-

Last visited

-

Days Won

329

Everything posted by Abby Normal

-

Treasury may consider delaying Tax Day to Sept. 15, Mnuchin says

Abby Normal replied to ETax847's topic in General Chat

Pause the world. I want to get off. -

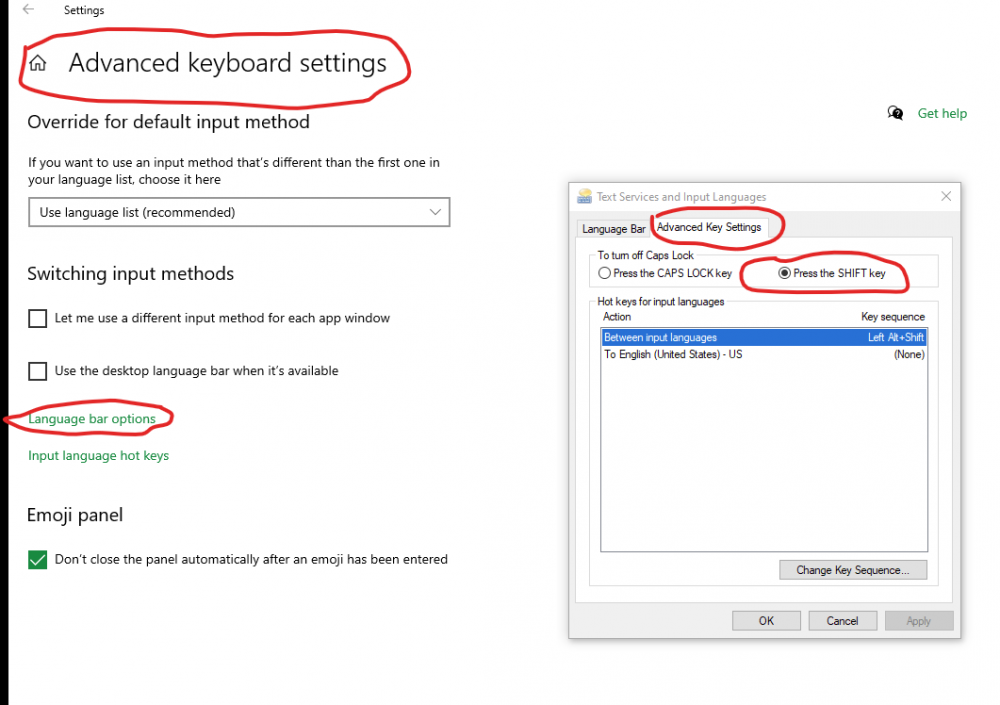

This will sTOP yOU fROM tYPING lIKE tHIS. The downside is you can't turn off Caps Lock with the Caps Lock key, only the shift key. Win10 Go to Settings. Search for Advance keyboard settings. Use the search feature. It's too hard to navigate too, because it's buried so deep. Click on Language bar options link. Click on Advance Key Settings tab. Select Press the SHIFT key to turn off Caps Lock Win8 Go to : Control Panel\All Control Panel Items\Language Click on Advanced settings. Click on Change language bar hot keys link. Click on Advance Key Settings tab. Select Press the SHIFT key to turn off CAPS LOCK.

-

I've never heard of it, but a quick search shows you're not alone. Unfortunately, I found no solution either. Sorry!

-

Glad it helped! A lot of links changed when Wolters Kluwer took over CCH.

-

I was just able to log into https://support.atxinc.com/

-

None of the states I deal with have a late filing penalty, just late paying penalty. So if states don't conform, that's just leverage to get the records in for those who usually owe.

-

Hey, the fewer extensions I need to do, the better!

-

I don't feel that I can do my job efficiently without knowing a good amount about the computers and other technology I use all day long. That and I like to be able to fix things myself. When I use to hire people, I would ask them to do simple tasks like copy/paste, and if they struggled with that, I would not even consider hiring them.

-

Ironically, I'm older than you. I just became interested in, and fell in love with, computers and programming in the mid-70s' and I've frequently read computer articles for the past 40 years, or so, driven partly by curiosity and partly by a fiercely independent streak. Windows was the 5th operating system I learned, and I got a late start on that, sticking with DOS until Win95. I also wrote accounting and other programs in the 80s, while I was controller at a small manufacturing company. BUT I still have to rely on IT guys that know more than I do. And, like Dilbert, it's a double-edged sword because people are always asking me to help them with all of their technology, not just computers.

-

Amended returns received before the deadline are considered superseding. I think the IRS (when they finally get around to opening the mail) can handle the return either way.

-

The new Edge browser is copying data from both firefox and chrome without your permission. https://wccftech.com/microsoft-edge-is-reportedly-stealing-data-from-firefox/

-

If you copied the files over correctly, ATX will find the database when you install it. If the database has errors you can run the bat file to repair the database. ATX's instructions say to copy the subfolder, but I would recommend copying the entire C:\ProgramData\CCH Small Firm Services and C:\ProgramData\Wolters Kluwer folders. (Warning: ProgramData is a hidden systems folder. You might need to change folder view setting to show hidden folders. Or just copy paste the above paths into file explorer address bar.) https://support.cch.com/kb/solution.aspx/000048812 https://support.cch.com/kb/solution.aspx/000041746

-

If you have wash sales + multiple transactions, the code is 'MW'. You can have more than two codes. I believe my record is 5. And they have to be entered alphabetically (BOMW).

-

You should probably defer the Win10 May 2020 update, if you're using Chrome, until they get the kinks worked out: https://www.forbes.com/sites/gordonkelly/2020/06/19/google-confirms-serious-new-problems-for-chrome-users/#23f1c42832af The ironic thing is that the new edge is based on Chrome: https://support.microsoft.com/en-us/help/4501095/download-the-new-microsoft-edge-based-on-chromium

-

No one recommends using IE, due to security concerns, but a lot of older government websites were designed for IE. I believe you need to use it for FBAR filings? And you have to use Adobe for FBAR, so I set up IE to open pdf in the browser (not my normal preference) and use it for FBAR filings.

-

The voucher itself or the client letter?

-

eservices login is my home page when I open IE because for years, you had to use IE to access.

-

Glad you stumbled upon us! We're like the Shire in Lord of the Rings.

-

ATX, unfortunately, tries to connect to their servers every time you start it. If your internet is down or their servers are having problems, ATX will open slowly. This is true even if, like me, you have the preferences set to not check for program updates or form updates. That's the first thing I turn off every year.

-

I was just able login. Try another browser or call the eServices support phone. I use both Firefox and Internet Explorer to access eservices. https://www.irs.gov/e-services

-

MD has done a decent job of closing down these fraudulent tax shops, some with big name franchises.

-

My question would be, has the partnership included the cumulative excess business interest expense in the basis adjustments on the worksheets? My gut tells me the answer is no, because they can't know what has happened at the partner level. The next question is, is the adjustment listed just for this year or is it the cumulative amount for all years?

-

Found this: Perhaps the most complicated aspect of the new law is what happens to the BIE once it is limited. Defined as excess business interest expense (EBIE), the amount becomes nondeductible in the current year and is carried forward to future years. It can only be deducted if, in a future year, the same activity that generated the EBIE in the first place now generates EBII or EBTI. Taxpayer A above, for instance, has EBIE reported to her from her interest in Partnership X. That EBIE will not be deductible in 2018 and will be carried forward to 2019. The only way for A to eventually receive a tax benefit and deduct the EBIE will be if X itself generates EBII or EBTI in 2019 or beyond and reports it on A’s K-1. Despite EBIE being currently nondeductible, A is still required to reduce her basis in X to the extent of her allocation of current year EBIE. Even though it is a carryforward and potentially deductible in the future, basis is reduced immediately. That may lead to basis limitations in other areas, such as the inability to take future losses because of at-risk limitations, or the recognition of gain on a distribution in excess of basis. To the extent that the taxpayer disposes of the investment before getting a tax benefit for the carryforward, the carryforward disappears and is added back to the basis of the investment for purposes of calculating gain or loss on disposition. https://andersen.com/publications/newsletter/Q3-2019/part-i-the-business-interest-expense-limitation-when-investing-in-partnersh

-

To say that, without mentioning fear of getting sick or dying, or causing a family member to get sick or die, is leaving out the larger picture.