Medlin Software, Dennis

Donors-

Posts

1,813 -

Joined

-

Last visited

-

Days Won

83

Everything posted by Medlin Software, Dennis

-

IRS issues draft of revised Form W-4 for 2020

Medlin Software, Dennis replied to Elrod's topic in General Chat

There would be questions 4x per year instead of once per year, at least for tax preparers... As much as I do not like how employees try to blame employers for incorrect WH (which trickles to me, for which I have to say the employer, via our software, withheld exactly what the employee directed via their W4) - if the process was easy enough to remove most questions, there would be nothing for me (us?) to process at all. Kind of like how modern consumer vehicles have become reliable enough there is much less need for skilled mechanics (just people who can replace what a computer tells them to replace). While I do not spend time digging into the issue, I have to wonder if those who were opposed to a very similar change for 2019 were worried about how the new form will actually be easier, versus claiming it will be harder. From my personal perspective (payroll) it is absolutely little effort to program, and the form itself reads easier than the old form, for those who traditionally have had issues getting close to even at the end of year. Of course, change is good for me/us, and when eventually there is a new administration in charge, there will be change again since net pay and appearing to give more has been an issue for every administration going back for quite some time. -

IRS issues draft of revised Form W-4 for 2020

Medlin Software, Dennis replied to Elrod's topic in General Chat

Subject to changes in the final regulations/instructions! The current reading states to "either" select Box 2, or use 4c. -

IRS issues draft of revised Form W-4 for 2020

Medlin Software, Dennis replied to Elrod's topic in General Chat

"1, 3, 5, and possibly check the box in step 2 " At least in our software, we will enforce box 2 being exclusive (box 2 means nothing can be selected in 3 and 4, or the form is invalid). Box 2 means no allowances and higher withholding (via higher dollar brackets), see draft Pub 15-T. -

Will not resolve the issue pre fire date, but will lessen liability moving forward. Remote home offices can work, but it takes specialized setup and monitoring to keep the employer liability to a level they can afford compared to the cost of a contractor or an in house employee. CA office work is reasonable for worker's comp, but one also needs to look at straight business liability on the home, as employer can have defense costs and/or liability should anything happen on the premises which has to do with work or the work space. Employee trip going to the kitchen for lunch, delivery person trip on the step while leaving a package, kids have an accident in the office, etc. CA also has some rules about business expense reimbursement, in addition to all of the other employee regulations. The other issue of firing and contracting, is the employer will have to be even more vigilant about not invoking anything which can be seen as control over the contractor, because of the prior employee status. On its face, the switch will raise red flags if the status is ever contested. Would have been better to have happened before the move so there was never any remote employee status.

-

"The company uses a payroll company and has paid all the CA SWT & OASDI etc on this employee." The employer has already submitted to CA jurisdiction via withholding CA items. If the employer wanted to make a case for no nexus, they should not have registered with CA and withheld for CA.

-

IRS issues draft of revised Form W-4 for 2020

Medlin Software, Dennis replied to Elrod's topic in General Chat

Can;t disagree. There will be some who will need to use the additional WH field. The form itself does not state the implied allowances, but those who are like your example likely have already made adjustments. Personally, the whole "allowance" deal is being left in place to lessen push back from the states who use the federal form for their own WH calculations... From a purely payroll perspective, all employees should be using separate W4 or equivalent forms for federal and state. This has been my advice for years (for several reasons, such as telecommuting and domicile changes), but has become more important in the last couple of years. -

Nexus exists, taxes are owed, employer has a CA office (with all the rights and responsibilities) in the employee's home. The duties are physically performed in CA. Employer likely is not covered for WC and liability since they likely have not counted/listed their CA location.

-

IRS issues draft of revised Form W-4 for 2020

Medlin Software, Dennis replied to Elrod's topic in General Chat

Box 2 checked, means taxable is not lowered by any allowance amount, and a "higher" rate schedule is used. Otherwise, "implied" "allowances" are 3 for married jointly, 2 for any other status, and the "standard" rate schedule is used. -

Where to Get Free Donuts on National Donut Day June 7, 2019

Medlin Software, Dennis replied to Elrod's topic in General Chat

Sometimes my kids miss the old days when I was a donut slinger... Something about grabbing them right out of the fryer, setting in the glazer, and eating them before the glaze dries... -

IRS issues draft of revised Form W-4 for 2020

Medlin Software, Dennis replied to Elrod's topic in General Chat

A draft of Pub 15-T has been posted, with proposed withholding calculation methods. Have not reviewed it yet... -

IRS issues draft of revised Form W-4 for 2020

Medlin Software, Dennis replied to Elrod's topic in General Chat

"I think the fallback (once the software has changed) will be the employees wages at that company as if they were single taking the standard deduction, which essentially is single 0." For new hires after Dec 31 2019, no valid form will likely be single (as always). The difference, again just guessing using the earlier proposed calculations, will be an implied allowance number. I can't remember if married was 2 and single 1, but I do not remember any with a zero implied. -

IRS issues draft of revised Form W-4 for 2020

Medlin Software, Dennis replied to Elrod's topic in General Chat

For the small number who have not already adjusted their W4 data, I suspect many will not care about the new form either. Those who have already updated, will be able to use the form's instructions, or get advice from whomever helped them in the past. --- Those who do not manage their withholding well already (meaning have not already adjusted because of over/under for 2018): Are the ones who complain to their employer that the employer did not withhold enough or withheld too much. Employer should never give tax advice, and is likely to tell employee to consult with their tax person. I cannot count how many times I had to prove the calculations we use are accurate when employees complained to their employer. Are not likely the tax customer of anyone here. --- IIRC, the implied allowance figures will be reasonable, allowing new hires to easily handle the new form with just Step 1, and Step 5. While this may not get the big refund many seem to like, and could result in a balance due, it will not often result in underpayment penalties. The new form has a section for actual dependent adjustments, instead of "allowances". Over time, this should be less confusing. --- " but I guess the problem is that many of us don't want to do calculations and become responsible for clients' withholdings. It's like doing the tax return twice; but they won't want to pay you very much for a W-4 form. " This is interesting, at least to me. Employers cannot help fill out the form, so who should? When one of my customers asks what they should say to their employers, are you saying the employer should just say "not me", versus to consult with their tax expert? At present, I have no better advice than to consult with the emplyoee's tax expert, since that is the person/firm who (in addition to the employee) has the needed information. Their tax expert has already taken on responsibility for the tax prep, so providing suggestions for a W4 should not increase liability at all. If the employee does not want to pay for the half hour to get W4 advice, then the expert could do something like credit some or all of the W4 fee towards tax prep at EOY. All I am after is having fair advice to give employers (to give to their employees). I am open to suggestions... Currently, could be all of part of: Employees control their withholding via their current valid W4 form. Employers must blindly follow the employee's directions (via valid W4). Employers should not assist with W4 prep, since the employer is not likely serving as the employee's tax expert. Employees needing help with their W4 should consult with their tax expert. -

One of the two jobs options is a "do nothing" option. The instructions say it should not result in under withholding. This could work for those who are lazy. One of the other options should be very accurate, and the other option should be reasonably accurate.

-

IRS issues draft of revised Form W-4 for 2020

Medlin Software, Dennis replied to Elrod's topic in General Chat

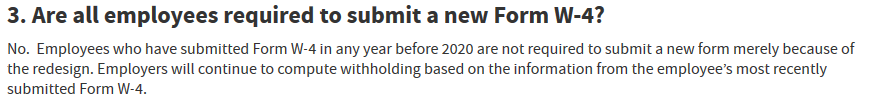

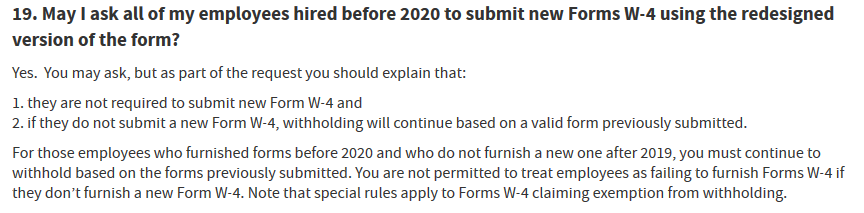

I suggest you revisit FAQs 3 and 19. The Only item I did not see referenced is the fact that there is one, and only one class of non new hires who must use the new form (those claiming exempt), but since there is not likely to be a change in the exempt forms aging out each year, there is no reason to include the existing rule in a FAQ about change (if one were to apply logic to tax dealings...). FAQ 16 ONLY applies to hires after Dec 31 2019. "The new form is not required at all, other than for new hires, those filing exempt (by the normal deadline), and those wishing to use something other than their currently valid form. Jan 1 2020 does not make the existing valid in place forms invalid." My earlier statement is supported by the entirety of the FAQ. -

IRS issues draft of revised Form W-4 for 2020

Medlin Software, Dennis replied to Elrod's topic in General Chat

For calculations, yes. -

IRS issues draft of revised Form W-4 for 2020

Medlin Software, Dennis replied to Elrod's topic in General Chat

Referring to the upcoming possible new form for 2020, you are incorrect. The new form is not required at all, other than for new hires, those filing exempt (by the normal deadline), and those wishing to use something other than their currently valid form. Jan 1 2020 does not make the existing valid in place forms invalid. -

IRS issues draft of revised Form W-4 for 2020

Medlin Software, Dennis replied to Elrod's topic in General Chat

Software can easily calculate whatever the wonks come up with. In most cases, the wonks provide the formula! (CT WH is one exception). Have not seen or heard any new examples of the new calculations. IF, the new calculation will be similar to what was proposed for 2019, there will be "implied allowances" per status. This makes sense (still can't believe I wrote that) since there is no requirement for employees to provide a new W4, and since states also rely on the soon to be old federal W4. Likely there will be two forks to the 2020 FWH calculation, one using pre-2020 W4, and one for the 2020+ W4. No problem for a programmer to handle. Yes, there will be many questions we are all paid (thankfully) to answer... The privacy shouters will complain about "having" employees "required" to share personal info, but the form allows additional deduction dollars and additional taxable dollars, without having to state the reason. It is perfectly fine for an employee not to state an "other income [4a]" figure. -

Draft is available. https://www.irs.gov/pub/irs-dft/fw4--dft.pdf Changes: No "allowance" figure, Head of Household Status, Dollar amount for dependent credits, Annual other income (add to taxable wages), Other deductions (if more than standard deduction). Instructions/suggestions for handling multiple jobs in the household.

-

It is an "ignored" problem everywhere, at least for payroll and withholding purposes. For employers it is terribly complicated already, and that is without considering their remote employee may work while in a other locations (not at the agreed upon location) and never tell the employer... There are several states (the last time I looked) that tax based on employer location (coupled with taxation for the location worked), which is where the double hit can come into play. In theory (or maybe fact), should I travel to NY and take a work call or an email, I have to report wages to NY (maybe even NYC or Yonkers depending on location). Going back to basics, an employee should be reporting (time clock, paper, whatever) all time worked and at what location(s). Employer is responsible, but employee usually has to provide the data unless there is tracking involved. Employer then has the required information to register with the proper jurisdictions, assign wages appropriately, and so on. It an employee is allowed to be remote, employee also has to monitor what their employer reports, and handle, via their own returns, any wages subject to taxation not already handled by the employer. Jock taxation (pro sports) is a fine example, with a wealth of references. Not that I wanted a certain player to sign with "my" team, the tax burden he would have faced was a factor in his decision, since it does not appear my "home" team would have increased their matching offer to make the player "whole" compared to having 81 games in a more tax friendly location.

-

A first and a second (in more than 3 decades). 1. Tips incorrectly handled for 2019 Q1 (at least from what the customer shared). Deducted from net pay (tipped out each shift), but not added to income. Employees did not catch this (and they likely would not, since the error results in more net pay since not enough taxes were withheld). CPA (my customer) noticed on the Q1 941. While annoying, and will cost the CPA some effort to fix, no real out of pocket cash loss for the employer or CPA. 2. A customer, who prepares payroll for others, handled tips properly for 2018, but made a setup change BEFORE printing W2 forms, which caused the reported/declared tips to be "regular" other income. W2s were given out with no reported tips. Looks like a wash for tax liability, but still a bad deal as the employer is likely changing payroll providers (and dealing with and explaining to unhappy employees). For this arena, I post this as something else to add to your check lists, to watch for cases where your client is a tipped employee, but their W2 has no SS tips shown. (I have asked, but have not yet heard how the issue for number 2 was found. I think it was likely an employee's preparer.) For payroll preparers, a modest check list reviewed for every payroll run would have never let this error slip past. I will be adding another warning routine to warn if deducted tips are more than declared tips, proving again more than half of my programming is adding warnings.

-

- 1

-

-

https://www.bna.com/payroll-blog/ A reasonable free source for relatively current info. They post most Friday's (although the latest was April 12). It is one of the many places I monitor to try to catch changes before they happen...

-

NT-Idrive advice for dummies

Medlin Software, Dennis replied to NECPA in NEBRASKA's topic in General Chat

I lean towards over the top. What I mean is for backups out of my control, such as third party online, I only backup copies of my self made encrypted backups. This way, if the third party does get hacked, and someone figures out a way to break their encryption, they would have to then break my encryption. The idea is not to be the low hanging fruit. Just as important, after completing your first backup with a new system (and periodically going forward), try restoring the backup. This will show you any missing items, or missing instructions you need to have. There is no point spending time on a backup if you are not certain you can restore from it...- 1 reply

-

- 3

-

-

I get the "I thought obtaining payroll software would do my payroll for me" from time to time.

- 1 reply

-

- 3

-

-

-

If the 2020 W4 is similar to the one proposed but delayed for 2019, MANY will simply need to select their filing status. This should be close enough for those who are not already doing more than "status and allowance" on the current form. Could also be the existing on file form will still be honored (as was proposed earlier, and is NOT a programming burden at all), so there may be no requirement for all employees to resubmit. Yes, the employee would have to enter figures into those boxes (if they wish). That is the only way they could be used for calculation of paychecks... The privacy issue is a non starter. The employee has the ability to enter direct "other" wage information if they wish, but they can also use calculations to enter the desired adjustment in the other box(es) instead.

-

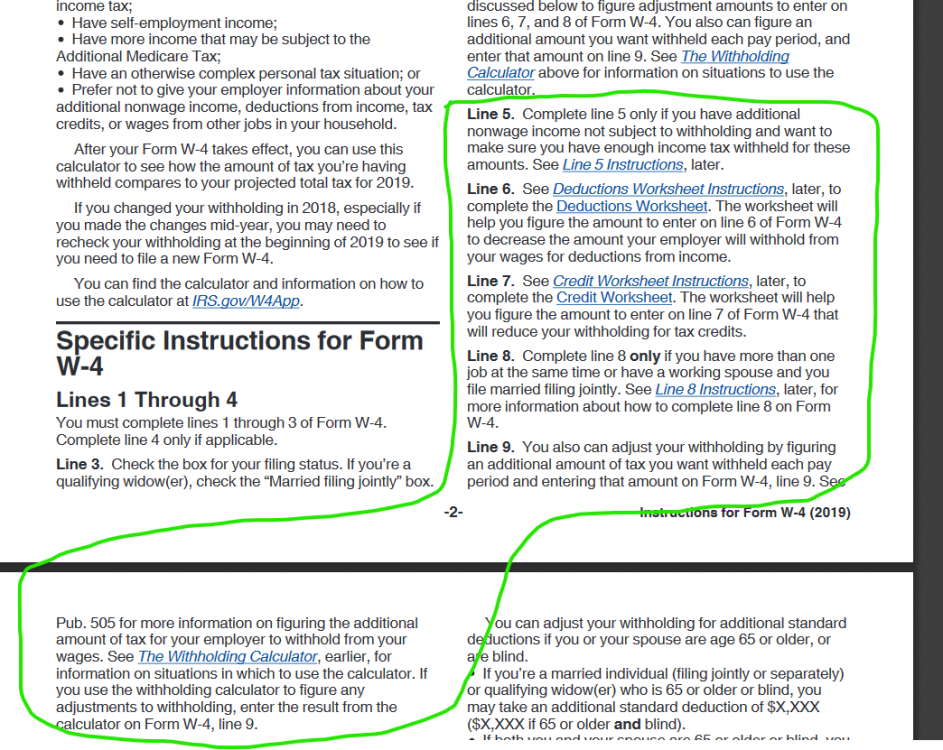

I can only guess at present, since there is no draft form (supposed to be released in May). What I base my guess on is the one floated for 2019, then delayed, primarily because of payroll industry lobbyists (I think, but I could be wrong). I had (and kept) programming code to calculate using the new W4. I needed four new data points (actually 8, as there is a chance at least one state will copy). Since those data points directly affect the calculation, my preference is to include those data points on the stubs, so the employee can self calculate / self check their paycheck. NonWage Income, Additional Deductions, Tax Credits, and Other Taxed Wages (that is what I called them anyway). The following link appears to be the instructions for the former draft version. https://www.irs.gov/pub/irs-dft/iw4--dft.pdf --- And: Filing status: Line 3 is used to indicate the employee’s tax filing status. The draft 2019 Form W-4 has checkboxes to indicate that the filer is single or married filing separately, married filing jointly, or head of household. Instead of claiming allowances based on filing status using a separate worksheet, the number of allowances will be calculated automatically based on the filing status that is checked – 2 if single or married filing separately, and 3 if married filing jointly or head of household.