Medlin Software, Dennis

Donors-

Posts

1,813 -

Joined

-

Last visited

-

Days Won

83

Everything posted by Medlin Software, Dennis

-

"correct amount" Very true, and sad. The only correct amount is to under withhold to some comfortable factor, then, as some do (me included), spin up a realistic estimate of actual annual liability the last week of each year, and make a deposit to have withholding plus the deposit cover the projected liability (or at least to get into the no penalty range). It is silly to have enough withheld, knowingly, to get a refund, and just as silly to get into penalty. While I still opine tax preparers are the place employees should go for W4 advice, many preparers do not want the extra work, leaving the employee's to try to get advice elsewhere. The new form will make it worse for those who do not study, since there are no "allowances", and new fields which some will not understand at all..

-

15 and 15T were posted early on the 24th. One thing I learned over several decades is people just don't like change. I can agree. But, society has changed to the point where the first reaction of trouble is to prove it was not your fault, so I have to also react using common sense, like not letting someone who has important data (such as payroll data) continue to put themselves (and by the blame game, me) in jeopardy via using a known unsafe OS. It is not me who stops updating the OS... If people knew someone holding their data was using an outdated OS, they would/should bolt. One thing which is tough to argue is there is zero excuse for using an outdated OS when the cost is so small. No one was forced to use Vista, XP was perfectly viable and supported. But, many who stuck out with XP over Vista have ignored the consequences of continuing to stick with XP. As an aside, I was just reading that a certain country has figured out how to get past two factor authentication, which so many "experts" think is the solution to security... which is why any behavior other than assuming and acting as if all data could fall out of your hands, is unwise.

-

A real "prepper" would show zero clues to anyone outside of their circle, and would not ask for such advice from even their tax person .

-

I have customers, preparing payroll for others, that are griping because they still want to use XP or another obsoleted OS (By the maker of the OS). At the turn of the century, I had some who did the same, insisting they could only use a DOS based OS. I have some who are in "business" claiming they have no internet access, which I know is untrue (except for a monastery), and they must have a CD. (Wayfair makes it untenable to continue to offer CD's based on how certain states implemented Wayfair, and the minuscule number who still ask for a CD.) If I were to have someone else handle data for me, I would ask for information showing their hardware and software maintenance policies and status.

-

Those processing will now have to have P15 AND P15T on hand. The calculations will only be in 15T (the last time I checked, but certainly could change...). "Draft" versions are available on the IRS web site as of Nov 28.

-

And it is always blamed on the sender, since the recipient likely has zero idea how their email gets to them, if at all. Thinking back on my Moose Lodge customers, the interesting thing is their cloud filter company has full and instant access to the entire content of all messages which pass through their system. The "tech" who resolved the issue I was having was able to pull up messages I had sent, read them, and white list my information so I do not get filtered. Another item to consider, is any outside company likely has the same ability, so one must consider all email as being posted on a wall for anyone to read, unless you control the entire process (which is possible if you manage your own domain). What I have had to do, on the fly, was add a way for my customers to also provide their text message number, and carrier (because of number portability, one cannot "detect" the carrier automatically), so I can send a subset of their receipt by text. Of course., not all carriers are part of a public list (to know their domain), so for some, I have to send text messages to all text messaging domains I can document (~60), and deal with the rejections... I could pay for a third party to send the text messages, but I do not like messaging out of my control.

-

For business use, the server should not be doing any filtering at all, other than "maybe" for certain items You setup. Filtering must be done locally, so it is in your full control, and yes, you must check your spam every time you check any mail. The message you miss, or do not see as soon as it was received, could be one which costs you a large amount. While I don't do it present'y, as I have a well setup system (over years of use), I "used" to wash my mail through a test only system, so there was no way to open or click "links", or to have html images link to =the outside. I would delete unwanted in the text system, then the remainder I would see in a reader which allowed html messages. It was an extra step, but reduces the change of a loose nut at the keyboard opening something they should not. I suppose the most practical advice is if you never see a spam message get past your filters, or if you see a good message in your spam folder, your filters need adjustment as they are too strict. "Greylisting" is not terrible wen available, if your situation can work with slightly delayed incoming messages, since spammers do not usually try to resend.

-

At least new to me... There are cloud based (claiming to be) spam filters which are increasing in use. The problem is their customers usually have no idea how to see the blocked messages - if they even can - and not all are bouncing blocked messages. These cloud filters aggregate all mail washed through them - from al of their customers. One which is annoying me at present has a rule where any untrusted sender (IP address) which passes more than 20 messages in a day to any combination of their customers, gets blocked for 14 days. They offer no way to contest their trust status. I am seeing this mostly on corporate type domains, but the number is spreading to other common domains as well. I share this as a warning, that more than ever, sending an email, and not getting a bounce, it is no guarantee your message made it to the recipient's account, not even to their spam folder. This is the same type of issue which makes antivirus programs nearly useless, as over protection blocks good things, and means one has to look at all things to make sure nothing was lost. Most of my customers who are affected had no idea their mail was being handled in a way which blocks wanted messages... so this is something all should check for themselves if you want to be sure you are not losing good messages.

-

Forgot Password on old XP computer

Medlin Software, Dennis replied to cred65's topic in General Chat

It is not what I think, it is clear passwords can be worked around as described in the second post. Most password schemes have a reset function, which can be used, with relative ease, to reset 9guessing using pet names, etc.). It is my contention that any password which can be reset is of no use against a pro hacker, since the reset process may not be secure. Your physical phone does not have to be stolen to be "lost". Someone can claim they are you, and get a SIM card for your number, then change the info so your number is no longer in your control. With your number, they may be able to access things with two factor, since they will have your phone number to receive calls and text messages. Phone providers have implemented auth methods to prevent this, but you have to "enable" the new security process. For instance, one of my family plan members needed a new sim, and had to get me to share my secret code (or add them as an auth admin) to be able to get the new sim. Had I not had the additional security on, with the proper phone number and name, they could have gotten a sim for any number on my account... -

Forgot Password on old XP computer

Medlin Software, Dennis replied to cred65's topic in General Chat

Thus, showing again, passwords are often a complete waste of time (such as meeting the security practices item in another topic). Any password which has a workaround or reset capability should not be bothered with (if it can be avoided). Even two factor items, such as getting a code via text message is untrustworthy, since it is still fairly easy for someone to "steal" your cell phone number away from you (unless, ironically, you setup a security process such as two step with your cell provider!). -

Is tip income considered in 401K matching?

Medlin Software, Dennis replied to David's topic in General Chat

Cash tips, if the employee reports them to the employer, do appear on a paycheck as income for tax and other calculations, then deducted (since already received). If the employee elects to pocket their cash tips, and not declare through payroll (presumably - ha - reporting on their own), then they lose out on including their actual income for many purposes, which those types of employees learn the hard way if they ever need to show all income for a car or property loan, or to qualify for things like housing programs. -- Tipped employees do get the shaft often. Some states do not consider tips as "income" when needed to calculate unemployment, family leave, or other benefits (good employer lobbies, no employee lobbies). -

Just for my own amusement, is someone else preparing the payroll and then putting the filing onus on you? Payroll liability is convoluted enough, many will not prepare forms unless they prepared/handled the entire payroll, because of the chain of deep pockets liability potential. The liability potential is a stretch, but defense is not cheap.

-

I have not look at this specific item in a while. As I remember it, while the IRS prefers/suggests one set of forms per EIN, they (at least used to) accept multiple forms from one EIN. Personally, I would do one or the other for all forms, and not issue one global 941 with separate (by location) W2/W3 submissions.

-

W-2 Reporting box 12 Code DD for 2019

Medlin Software, Dennis replied to artp's topic in General Chat

IIRC, the exception is valid unless specifically revoked. Have not seen any revocation, but I have not looked hard either. -

I would end services with both. I would likely provide copies of all relevant documents (what I was required to have kept ONLY, nothing extra) to each, and prepare two more sets, one for each attorney to be sent as soon as I receive authorization from each party. This may keep me out of subpoena/court, which is an expense I may not be able to recover recover easily. Preparation at my timing may be better than under pressure of a court order. If each knows the other will get the same set of required documents, it may reduce the need to involve me in any squabble. Depending on my requirements/restrictions, maybe I can ethically use the same letter to each, with a cc statement or something at the bottom. I would make sure I was not in possession of anything I was not required to have. For instance, if I am required to keep 4 years of documents, I would rid anything more than 5 years old. (The extra year is to avoid any issue with calculating the time down to a day or month.) Documents I am not supposed to have cannot do me any harm... The process should be exact, or close to, my process for firing a client. Upon final dissolution, if asked, I might choose one to resume services for one. I would not entertain accepting either until final dissolution.

-

A necessity for any computer with data or information other than your own (and really, for all computers these days). It is a reasonable protection step which, if ignored, can be used against you if there is a breach. At least with the editions of Windows I use, it is "baked" in and seamless. The other encryption to be aware of is to encrypt your backups before they go to other media or the cloud. Do not rely on the backup service to encrypt for you. In other words, you handle the encryption first, using your own key, then upload or copy to storage.

-

For applications which did not succumb to the direction to store items in the Windows Registry, this can still be true... But, most device users are so well insulated from file management, the odds of a good copy are slim. Like is often the case, this is a good and bad thing.

-

From a support perspective (if you ever want a reasonable chance at receiving support), let software install and use the folders the maker determines work best for their software. Makers have reasons for selecting the folders they do. When you elect to use something else, you are "on your own" in most cases. If you are looking for security with the encryption, with a current computer, running encryption on all drives is not a huge burden. If encryption is desired, encrypt all, since not doing so may miss something on the raw drive you were not aware of.

-

The reliability of manual copy of data or apps went away with DOS... All applications should be "installed', and all data should be backed up and restored using the application's built in backup and restore functions. In many cases, the same application version used to make the backup should be used for the restore (contact the application vendor for specifics).

-

Upgrading our server from Windows 7 to Windows 10

Medlin Software, Dennis replied to Teresa K's topic in General Chat

-

Upgrading our server from Windows 7 to Windows 10

Medlin Software, Dennis replied to Teresa K's topic in General Chat

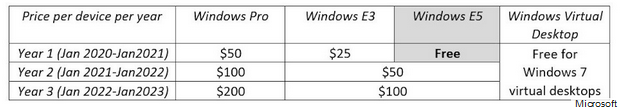

Agreed, but some may choose not to. My point was not about the merits of paying MS for extended support, it was the fact that it can be done, that W7 can be safely used after Jan 2020, if one wishes to avail themselves of the paid support. Companies (such as WK!) and individuals who claim otherwise are simply incorrect. Even further, while no one should believe XP is still viable, MS has, and continues to (May 2019 for instance) release security updates for XP and other unsupported editions. It is easy to do the math and realize MS knows many use XP, and it is cheaper to support XP unofficially than to deal with XP security issues. There is a good chance this policy will repeat with W7 after Jan 2020, but then again, offering paid extended support may be a trial balloon so see if they can really stop supporting an OS. I suspect that if there is another major need for a security update, which would save MS support costs, they will provide it free, XP to present. -

From the OP: "The company they are contracted with requires them to receive their pay in their own personal name with a 1099, they can't receive it in the name of the company they are starting." This is a common red flag that the person doing the work is really an employee, but to take the job, they capitulate to the employer's policy. If the entity receiving the 1099 must be a particular person, then it is an employee/employer relationship since the "employee" cannot send someone else to perform the task, and cannot be in business for themselves (since it must be reported to a particular person, not the person's business). As provided in the OP, nothing more than a scam to avoid WC, matching taxes, benefits, etc. Think Uber, DoorDash, FedEx, etc. DD is one I am slightly familiar with based on reading their documents. DD has verbiage making it appear the dasher can hire out the deliveries to others, but it is not really practical, since DD actually has verbiage which would limit the dasher's selection of employee's or subs.

-

Upgrading our server from Windows 7 to Windows 10

Medlin Software, Dennis replied to Teresa K's topic in General Chat

Jack offers a great tip. it is usually less risky to obtain a new computer with the desired OS preinstalled, compared to upgrading an OS. Arguably the main bene is having a known working setup (the old machine) on standby for 6 to 12 months while you get moved into the new machine. Hardware is CHEAP compared to recovering from a loss of data (via hardware failure, human failure, etc.). -

Upgrading our server from Windows 7 to Windows 10

Medlin Software, Dennis replied to Teresa K's topic in General Chat

False. W7 can be used as safely as today, via paid support, for three more years. The paid support is not cheap, but it is available. -

Upgrading our server from Windows 7 to Windows 10

Medlin Software, Dennis replied to Teresa K's topic in General Chat

Indeed! As seen when the OS is updated, having application items affected by an OS upgrade causes issues (which is should not), and while the issue is MS caused, the support is pushed away from MS. There are other ramifications, but the result is still the same, so what cbslee says.