-

Posts

7,731 -

Joined

-

Last visited

-

Days Won

510

Everything posted by Catherine

-

Client sold stock options, and the overall transaction took several days as shares were released and sold in chunks. So the statement from the brokerage has wash sale adjustments listed for the first couple of transactions, limiting the loss. But does the wash sale rule really *apply* here? Yes, technically, shares were acquired about three days in a row, and sold either same-day or next-day. But it was all the same NQO activity, that just happened to get fully transacted over a couple of days. It could easily have all been done on the same day (and no one knows why not). We're only talking about $45 in loss here, no huge hairy deal - but it got me wondering. When I looked it up, the Tax Book says "buys" and "acquires" (identical or substantially identical) shares but nothing about one elongated transaction. Thoughts?

-

I really detest it when shysters sweet-talk the elderly into doing *stupid* things with their money. Couple years ago a client got convinced that converting her IRA to a Roth IRA was the cat's meow. Oh, she and her husband got *slammed* with tax that year. But the shyster got his juicy commission so what does he care?

-

I have a client who used to bring me all her documents in one of those tins they use to sell Dutch butter cookies. *Everything* smelled like butter cookies - but there were no cookies! So I told her she had to start leaving some cookies in the tin - or bring stuff in a folder. Sure 'nuff - folder. Piffle. I was really hoping for the cookies. In fact, maybe I'll have a piece of shortbread now.

-

I believe the gift limit is still $1,000,000

-

FDNY has it right but I'll chime in as well. State pensions are taxed when earned - so in the working years, the state income if higher than the federal income on that W-2. And there is *always* a Mass warning that the "state income is higher, please check your entries" - so annoying. On the interest entry screen in Drake, there is a box at the bottom called state-specific information. Pick MA from the drop-down and enter the full state interest. $100 is exempt per filer per year - $100 for a single person, $200 for a couple. ONLY for banks chartered in Massachusetts. So not Bank of America, not Citizens, not Santander, but yes Salem Five or Middlesex Savings or any of a zillion other small banks and credit unions.

-

@Elrod - just WHERE do you find these wonderful clips?!?!

-

My office is a mile from my house. I usually work shifted hours because of traffic; 10AM to 7PM - at which time, it's about three minutes in either direction. If I tried to get here at 8AM, it would take at least an extra fifteen minutes due to the backup at two nasty left turns (even though I go right at one of them). On the rare occasion I have left at 5PM, I can sit at the end of the parking lot for 4-5 minutes waiting for traffic to clear to let me turn out - but the way back only has one less-than-nasty left so that doesn't take more than ten minutes. Two winters ago, when the snow piles were too high to see safely at the corners, I took the (very!) long way around and that's an easy fifteen minutes with traffic, lights, and extra distance - it takes a route around a golf course and conservation land, so it's more like 5-6 miles.

-

Guess I am the odd one out here - I absolutely *detest* all-caps and stay away from it as much as possible. I find it exceedingly hard to read and annoying to deal with. But that's just me.

-

Apparently Received a Call From Fake IRS Agent.. Not Sure

Catherine replied to Chowdahead's topic in General Chat

Thanks for the warning! I am going to share with my local professional society. -

Happened to a client of mine; employer had one digit wrong and the employee only caught it at year-end in the W-2; AND it was in the first three digits. He would never have seen it if the full ssn had not been there.

- 1 reply

-

- 1

-

-

Most of the payroll returns are done (w-2's and 1099's), although a couple of clients with new contract workers did NOT read my notes about "due 1/31" and just got me info over the weekend. I have had very few tax returns come in, so far. In a way it is terrifying, because it just means the onslaught will hit even harder. But folks here have mainly been digging out from our back-to-back winter storms. The ones that have come in are mainly done. Always the "missing item x" issues but turn around has been quick because we are not yet swamped.

-

Before we all need this: Jim Cummings reading Star Wars' Darth Vader in the voice of Winnie the Pooh. Link is safe - unless you consider guffawing to be dangerous. Jim Cummings Reads Star Wars as Darth Pooh and Darkwing Daine Jr

- 1 reply

-

- 2

-

-

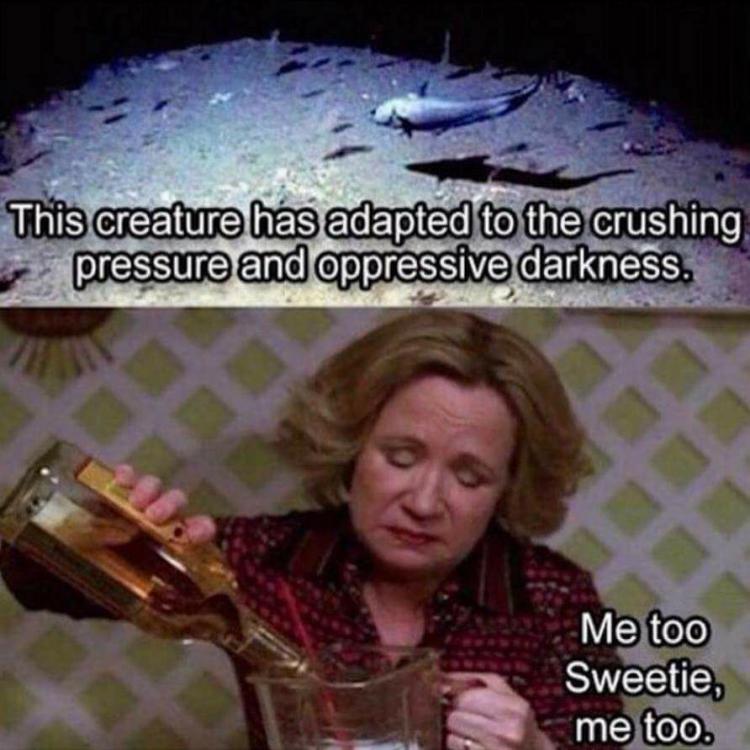

Because we have easier ways to hurt ourselves...

-

I believe it is the $28,995 is the starting point - because if this had been a cash-only transaction, that would have been the price paid i.e., the fmv. After you take that starting point, then you have to deal with the trade-in of the old truck and possible depreciation recapture on it, and all the other adjustments. But start from the final cash price.

-

This is Drake, and I thought I had done the NR worksheet B. I will re-check when I get back to my office later. Thanks!

-

I have filed extensions and gotten rejections due to a return already having been submitted. For one client, that was the first indication of identity theft. But it was a couple of years ago; the system may have changed.

-

Telling the client that the money becomes taxable income may be the impetus she needs to suddenly find "copies she had forgotten about" or to get new ones from the day care provider.

-

After a good night's sleep we all realize LOTS of things that we should have known.

-

Here's a weird one. Client came in to talk about doing her aunt's final return and estate income. Aunt lived in NJ and passed away in November. That's not the weird part. The weird part is that the aunt, in her 80's, was herself the executor of the NJ estate of a friend of hers. My client cannot find any information on what HER OWN obligations to this other estate might be. For example, where to find out if it is finalized or not, and if not, does *she* now need to finish it up? Can anyone point to a place I can send her to get this info?

-

Have a taxpayer who owns a rental property in Maine. It runs a (paper) loss every year, and it is the *only* connection the client has to Maine. Since there is Maine-source income (even though the operation is a loss), we believe we need to file in Maine - at least to start the SOL. What is the secret decoder ring trick to keeping her out-of-state wages from being subject to Maine tax? I can't find a correction field anywhere that prevents her from owing tax to the state of Maine on an $8,000 loss.

-

We had a series of them, that ALL learned that the rustle of a plastic grocery bag meant parsley on the way. Parsley to a Guinea Pig has the same effect as ice cream and cookies to a five year old.

-

Sometimes hard to do. Don't we all have clients who get corrected 1099's every May, or partnership K-1's in September? Depends on circumstances, I guess. If a "real" return can be done quickly, wait. But preferably not until September, assuming an extension shows no fraudulent return has yet been filed.

-

And the squeaky Guinea Pig gets the parsley...

-

I understand your point - but filing an extension will NOT prevent a false return being filed by someone else. I have some clients for whom we filed extensions last year (because we did not yet have full docs) and when we went to file - could NOT - because someone else already HAD. That was VERY disturbing to me -- but in a case like this, I would have no trouble with my ethics filing that "place-holder" and nearly-blank return to prevent fraud.