-

Posts

8,221 -

Joined

-

Last visited

-

Days Won

300

Everything posted by Lion EA

-

I might pay for the Compass class on the retention credits, especially the part about deferring SE tax for sole proprietors. All the 941 stuff is over my head; I try NOT to get involved with payroll. But if any of the deferrals get forgiven down the road, I don't want clients mad at me because I didn't tell them to do it. I enjoy learning new things, but the last 12+ months have had way too many new things for me to learn!

-

They've said the payments will stop 15 January...

-

Thank you, Sara, for giving yourself and all of us a pep talk. I feel more behind than ever. However, I've taken lots and lots of webinars and on-demand courses and have lots more scheduled this week and January. I think my brain is full. But, like you, I know our clients can't begin to deal with all the new laws without us. And, we have each other!

-

And mom/son threw some more things at me. I did a pro forma with the things they said, things I knew. But, neither son nor mom know about the Fulbright funds, amount, timing, anything. He already has nearly $15,000 income for 2020 with NO withholding BEFORE the Fulbright, and most of it is SE. Thanks, Max, for the heads up about the timing. Knowing it might be available to him this month/this year lets me know to ask more questions. Going to email them right now.

-

Our daughter is in a professional choral group Concinnity that's part of Consonare. They were anxious to be singing again so explored signing in unconventional places (outdoors) masked and distanced. It started raining during one of their recordings, and they put up a poll to ask if they should edit out the rain noise; I think it was 100% for leaving in the sounds of nature. They have an outtakes roll with things like wind blowing over music stands and beeping car locks. https://www.consonare-sing.org/

-

Pre-pandemic, our church had an 8 am service with no music and a 10 am with music. Until the frigid weather, we still had the 8 am outdoors with no music and a 10 am Zoom service with a prelude and one hymn. The Christmas services had more music, of course.

-

anyway to change estimates already set up in efile

Lion EA replied to schirallicpa's topic in General Chat

I think the client has to call to change. Just tell her how much additional to pay and have her do it via IRS's DirectPay. Or if she's within one of the safe harbors, just tell her how much to save to pay with her returns. -

Don't be shy about asking your good clients to refer you to other good clients just like them, family, colleagues, etc. And, make sure everyone you know knows what you do, your broker, lawyer, banker, church friends, neighbors, kids' friends parents, the small businesses where you shop, everyone. Just say that you're expanding your company and have room for a few more good clients. Your business will grow rapidly, and you will forget your old company!

-

Hubby Steve is director of music, and his choir members were missing choir. He started doing Zoom Choir, preparing a theme each week (maybe Advent hymns or the history of some hymns or...) talking, playing through some things, then everyone else muting to sing along. The choir emailed him "topics" to cover. Steve has a free Zoom account with time limits and had enough "material" for 30 minutes, thinking that's all anyone would want to sit on Zoom, but his choir didn't want to stop until they were cut off at 40 minutes. Now he uses the church's paid Zoom account, because choir goes on for an hour or even longer. A former parishioner who moved away to CO joins the Zoom choir as does another who moved to the other end of CT and some who have work or family obligations that keep them out of "regular" choir/not available Thursday evenings at 7:30 normally. But, now they're not commuting home from NY or don't have to get a babysitter for kids or can even be preparing dinner or eating as they turn on Zoom. They love Zoom choir. And, Steve's been able to coax a few choir members into "leading" a hymn on Sunday/pre-recording it for him to insert into our Zoom church on Sundays.

-

Our 176-year-old church has a small choir loft. We don't have enough bell ringers to ring with any frequency, so can end up ringing a descant or accompaniment to a choral anthem or even alternating verses with a hymn. The choir has a couple of volunteers who can ring and sing at the same time, but not more than a couple. If we have very many ringers at a time, the bell tables squish the choir up under the sloped roof &/or onto the stairs! As you say, no one has been in the choir loft since mid-March, except for Steve who does record preludes each week.

-

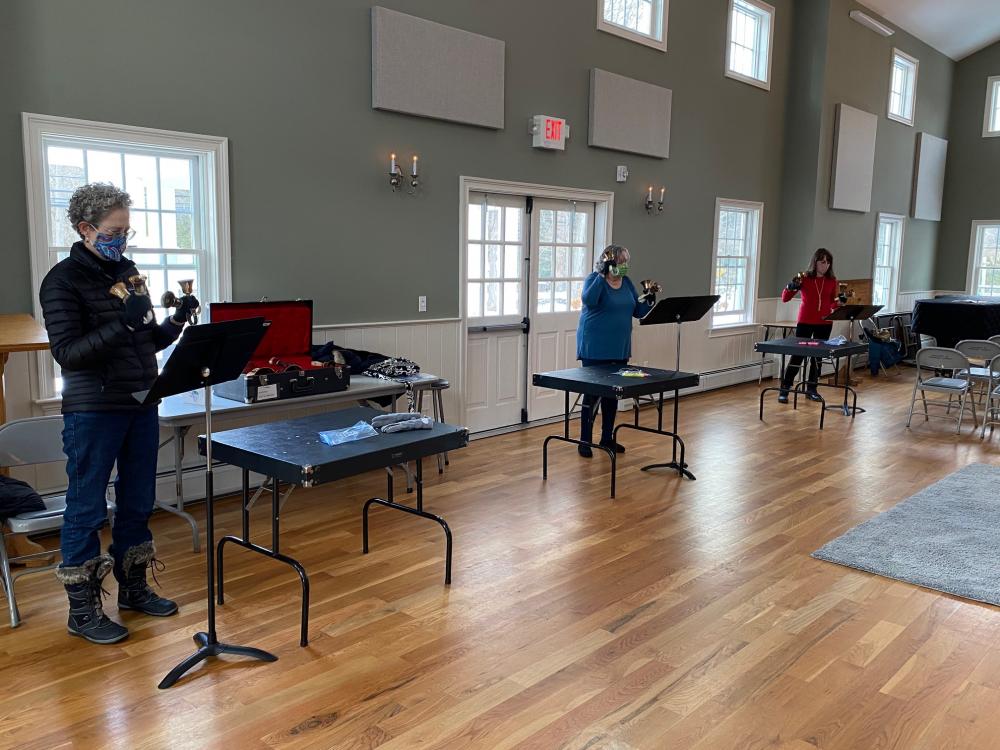

I'm the old lady in the middle. We're a tiny church in a tiny town, so don't have enough volunteers to ring handbells very often. I accuse my husband, the music director, of marrying me to make sure he has at least one handbell ringer for Christmas Eve! If this were a normal year with live choirs instead of pre-recorded music, the younger gal on the right would be singing in the choir and not available for handbells. I've done four-in-hand very, very seldom; three-in-hand a bit; and even that was more often needed to add a bell to a hand for a particular passage and then return to just one in that hand. Hubby Steve found handbell music that could use three, four, or five ringers with NO shared bells. We were close together for a minute for Steve to snap the pictures on his iPhone to pick one for the bulletin. Otherwise, we rehearsed 20+ feet apart, masked, with the windows/doors open, and for less than 30 minutes for about three rehearsals. We moved a bit closer as you see in the last picture for recording. We each had our own baggie with our gloves/markers/pencil/wipes. Our bells are old; two of us had a bell that needed to be in a precise position to ring, so we missed those a couple times when trying to ring softly as harmony but could bang them out when melody. We played something based on We Three Kings, so Steve will use the recording again in January. We're ALL ready to ring again sometime. The tall gal's husband would join us so we can have four, probably for Easter.

-

-

So, a client/mom just emailed me... "And, looking forward, when he [note: son/also client] (finally) gets his Fulbright -- how are those funds reported?" Considering it's 27 December, funds might not arrive until 2021, but with my usual 2020 luck they might be in an account in the ethernet someplace that he actually can draw from -- constructive receipt. Anyone have any experience with a Fulbright? I need to call my sister and try again to messenger live with granddaughters and finally eat breakfast/lunch but will start searching this afternoon.

-

It poured down rain, running through our garage but not flooding our basement. Washed away all the snow, though, and then turned bitter cold and icy. We had a nice Zoom church service Christmas Eve, and a few relatives from far and wide tuned in for a bit of it so got to see some faces, wave hello. FaceTimed with grandson/our "kids" yesterday. Still haven't heard from DIL when we can Messenger Live our granddaughters. They run an inn/restaurant in PA so were shut down by the governor and could only offer take-out for Christmas and New Year's. They aren't busy but are bored and depressed and broke. Plus son just had neck/back fusion and can't drive or work or pick up his daughters. One of their former employees has Covid; hasn't been an employee since last March, though. My ill/housebound sister in IL attended the National Cathedral's Zoom Blue Christmas service, so that tells you how she's doing. She hasn't been available yet for a phone call from us. All in all, hubby and I are having some relaxing holiday time with Stew Leonard's pick-up filet dinner with all the sides that's lasting us about three dinners and watching movies/Netflix/Prime and both of us getting some work done (he's teaching piano today via FaceTime, and I'm doing a few more hours of on-demand 2020 tax updates). We put up some decorations, received a photo book of our grandson's first year in the mail, a few presents. Hubby's director of music at our church, and I'm a frequent liturgical assistant and bell ringer, so Christmas is usually a frantic build-up. This year, Steve had all the music recorded ahead of time (including three bell-ringers with two bells in each hand) and I was reading the same Christmas readings and leading the prayers, but all sitting down at home with Steve (instead of him in the church balcony and me at the prayer desk) while he was the audio/visual guy pulling up the music and sharing his screen at the appropriate times. We got to have much more music than on recent Sundays, so that was festive. I miss hugging my grandchildren/seeing my grandchildren but overall the differences this year were positive: seeing relatives that are far away, less stress (especially since our "midnight" service was at 8 pm), self-quarantining with a husband I love, etc. Hope you all can have a Happy Holiday Season in a different way this year. After all, it's our pre-tax season, too!

-

In the past, a taxpayer could take their last paystub to H&R Block to qualify for a RAL or RAC. However, their return would not be e-filed until they returned with their W-2. (Full disclosure: I worked in a Premium office and don't think I ever did a RAL or RAC.) PS: After leaving Block, I make sure that I charge MORE than Block. I still do NOT do RALs or RACs or any other bank products.

-

Tony Nitti writes in Forbes with great clarity plus some dry humor: https://t.co/YD0adQWmNa?amp=1

-

The estate is most likely on the cash basis for tax purposes, so a 2020 state tax payment will be a 2020 deduction when the 1041 is filed in 2021. Or, a payment during the estate's tax year. (There could be exceptions, such as for an accrual based business being run by the estate, but you didn't mention anything like that in your OP.) Someone who prepares more 1041s will jump on here.

-

Good point, Medlin. When we had an interim priest and I was treasurer, I attended the seminars run by our diocese presented by William F. Geisler (from CA, I think): the seminar for the treasurers AND the seminar for the clergy, in case I could learn plus pick-up the handouts for the priest as we conducted a search. That was years ago, though. Our current priests' husband is in the financial field, so we talk finances together; I send him links re legislative changes, IRS clarifications, etc. They do have their own CPA who specializes in clergy taxes, so we are not going to do this wrong! When our diocese again runs financial seminars, I will strongly suggest our priest and her husband attend.

-

I'm especially proud of being able to toss it to the new-ish treasurer. And to an assistant treasurer (who was the prior treasurer for a long time) whose husband was our senior warden one winter when Paychex prepared an incorrect W-2 for a former priest, so she and her husband (not currently on the vestry) sorted out something similar in the past and remember how time-consuming it was. That discovery was made by the priest's tax preparer in February or later, and he was a bulldog until it was redone correctly. I think we paid Paychex fees to get that one right so late. So, I'm happy that I spotted this potential problem via a spreadsheet I don't normally receive while it's still 2020. And that it's not my responsibility to fix it !! Thank you all for jumping (pun intended) in. Merry Christmas and all the other winter holidays!

-

Thank you, all. I'm a volunteer who pays the bills, but not payroll. I only saw the priest's w/h due to it being on the same sheet as the lay employees' 403(b) contributions which I needed to pay the EE and ER parts to Fidelity. But the clergy classes I've taken made the priest's w/h jump out at me, so I dumped it all in the treasurer's lap with links to a couple of pubs and what I remember on the topic. I don't know if it was a one-time error due to bonuses being on that payroll making the Paychex computer hiccup or all year or even for all of her tenure. I've had no reason to see her past W-2s nor our payroll reports nor her tax returns. The diocese urges us to use Paychex, because they sold them on their clergy expertise, so I hope Paychex will fix this to the satisfaction of our church and of our priest and her tax preparer.

-

Thanks. I alerted the treasurer and another assistant who used to be treasurer. We have one more payroll this month and the 4Q reports to try to make this right. I hope it was just one odd pay period because it had a bonus in it and not the whole year! But, it's not my problem -- I keep telling myself. But it is my church and my priest and I want us to do it right. Thank you both.

-

I know we have some clergy tax experts on here. Paychex handles our church's payroll, and it's called in by the church administrator. As a volunteer at this Episcopal church, I make the 403(b) plan contributions for the two lay employees. The administrator has been sending me half the Paychex spreadsheet that has that week's payroll, so I never saw withholding details other than the employEE 403(b) -- the only w/h I needed to know to calculate employER contributions and matches. Last week, she emailed me the full sheet and I saw all the w/h details, including our priest's withholding. Our church has been (or did last week) withholding OASDI, Medicare, and federal and state income tax from our priest's wages. Is that correct? Any cites for me?

-

I use ProSystem fx and frequently e-file multiple state returns, often with one state requiring a copy of the other state's return or other states' returns &/or a copy of the federal return. I have not filed any Kansas or Oklahoma returns, though. I don't understand your question. Are you getting an e-file diagnostic? Have your read the ATX KnowledgeBase or contacted ATX to ask them how to do what you need to do?

-

I purchase AnswerConnect. (I'm a ProSystem fx user, not ATX.) I like it. I learn more about it the longer I use it, and it has become more intuitive over time, guessing what I meant even if my phrase isn't how the tax code words it or if I misspelled something. I can use it from within a tax return, so it knows where I am and what I might be asking, and open it on its own and even when Googling or using another browser. Make sure you install the browser app. Then whenever you're searching for something, if there are AnswerConnect articles/laws/explanations/code/etc., an AnswerConnect pop-up will appear at the top of your results; you can open it if you're seeking a tax answer or ignore it (it takes up very little space) if tax is not what you want. Also, if you have young staffers who Google for any question, AnswerConnect will still pop up to lead them to substantial authority. The CCH tax experts, writers, and lawyers are constantly adding new information and rewriting old. I have found them responsive to my questions and suggestions. I love the charts and other more visual aspects, too.

-

I like IRS worksheets to see how numbers flow, especially for something new or different. But definitely get used to how your software works re EIP reconciliation. I remember the first year of HSA deductions and an early-season client. I looked at all my entries, was getting the bottom line I expected, and the 1040 had the numbers right. I had not stepped through the Form 8889 line-by-line, though, because this was one of my rare clients that liked to sit here while I prepared her return. She got home and called me about a number on a wrong line, appearing that she rolled over into an HSA, I think. Luckily, that wrong line yielded the same result -- but I was embarrassed. (That client now lives across the country, so I have a good excuse to prepare her returns without her in my office.) I learned to step through new forms thoroughly, not just data entry but also each line on the final form as it will be filed, no matter how much a client is pushing me to finish!