Unread Content 30 Days

Showing all content posted in for the last 30 days.

- Past hour

-

Yes, it did. Now it goes to the Senate.

-

I thought I saw a headline this morning that the bill has passed the whole House. But doesn't it still have to go through the Senate? I usually wait for it to become law. Then we'll get some info and summaries and the IRS can start working on the forms and processing of it all.

- Today

-

If they listen to me. If the come in next year with the same thing, they pay the $50 fee. Being near a border, the OOS withholding is the bigger problem (though KY [usually] is a much higher taxed state, they generally get twice the refund from KY than they pay OH).

-

Proposals are pretty consistent that a share of some costs will be passed to the states, e.g., Medicaid, education, disaster response. This means that even if federal taxes go down, state taxes will have to increase. This kind of negates the argument that an increase in SALT deductions benefits blue states. Residents of red and blue states alike will find themselves bumping into the cap. Many of the proposals also add a lot more complexity to the tax code. Tip income is exempt at certain income levels and certain occupations. Interest on loans for certain cars will be deductible--how do you calculate that without a lot of paperwork? It goes on. If they are going to pass this thing, let's hope they do it soon because our CE providers need time to put together courses and we need time to take them and digest it all .

-

I am familiar with the OAR, it has been around for several years. But it does not exclude out of state sourced income from Oregon taxable income, regardless if the other state taxes income or not; it is still subject to Oregon tax per ORS 316.048.

- Yesterday

-

You are doing business in the state. CA has never made an issue of unlicensed preparers or preparers unlicensed in CA preparing returns. They recognize all EAs, CPAs and Attorneys from other states to practice in CA. That being said, if you are organized as an LLC, Corp, Partnership or any entity organized under the SOS of your state, they do want you to register as a foreign entity and pay the fees and taxes associated with doing business in CA. They do like their nexus. Not a problem for me as I am a SP, so my Sch C just goes to them with my 540NR, no special filing required. I keep my workpapers for my allocation of income and expense but they have not audited me on my application of the market based sourcing rules. The statute is running on my first year filing an NR with them, so I might see a letter at some point before it runs out. Tom Longview, TX

-

Absolutely, but most of the credits go to the parents and kiddie tax gets billed to the person who is trying to avoid CG or Interest Income for themselves.

-

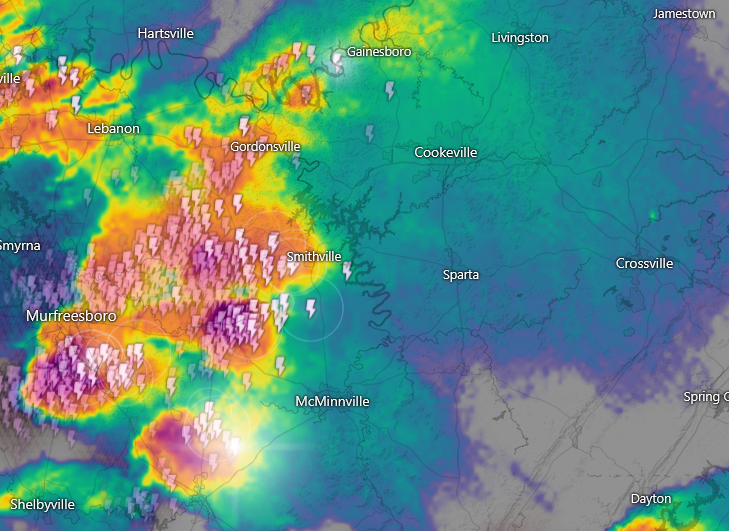

Correct! I have 4 weather apps on my phone: Windy One Weather Google Weather Weather Wise I use mostly the Windy site on the computer. Also fond of https://www.lightningmaps.org You can add weather radar to lightning maps, too. It's a setting.

-

If a client asks me how a proposed tax change might affect them, I don't mind answering their question if there is a fairly clear answer.

-

Tax items in reconciliation bill

Lynn EA USTCP in Louisiana replied to kathyc2's topic in General Chat

a local CPA contacted me late last week for my comments on the proposed raise in the SALT cap to $30,000. I advised her that in all my 36 years of practice I've never commented on a proposed bill. -

Standard response to client inquiries: there is no sense in discussing anything until a bill has been passed and signed. Until then, all bets are off.

-

I also charge $25 - $50 for dependent returns, with the option I keep for myself to give them a courtesy discount down to $5 or $10 or even $0 (say if the kid had one W-2 and $27 in withheld tax). But I want to see it before I price-quote, and anything that involves credits, kiddie tax, and multi-state issues is not done for a measley $50.

-

It looks like the "Windy" format.

-

The DOR refers to OAR 150-314-0435 with respect to Market Based Sourcing

-

The 2023 IT-201-X can be e-filed and any NY schedules that are normally included with the IT-201 would be included.

-

I go back quite aways myself as I like many moved from the Maine produced software (Saber?) to ATX. I miss hearing from Rita and a number of others I no longer see post. I got ready to renew my software this AM and got a threatening email from WK that I appeared to be attempting to access my account from different locations! I had to replace my older computer about a month ago and suspect that is the problem. I have had no small difficulty in connecting with anyone at ATX. Unable to get my rep. What a hassle ! Finally got a call back from tech support which hopefully will resolve the problem. She advised that they had sent out a number of these emails so I am evidently not the only one. This after over twenty years as a client.

-

What is CA's rule for preparing CA resident tax returns by out of state preparers?

-

I agree that in your example your fee could be considered an out of state source of income. However, I do not see any authority which would exclude it from your Oregon taxable income under ORS 316.048. Since the starting point is federal AGI, I am not aware of any provision to subtract it out for determining Oregon taxable income. Also, I don't see any reason why income from non-income tax states would be treated differently from states with income tax for Oregon taxable income, since Oregon taxes all sources of income, but allows a credit for tax paid to another state.

-

Tornado warnings all afternoon for Tennessee. Damage reports just now coming in. We're OK in Manchester - about an hour plus away from Rita.

-

Oftentimes the child is a student somewhere who has income in three states! Our fee for dependent returns is $50, like Patrick trying to avoid them claiming themselves and leaving us with a mess to clean up. More if the child has investments, plays with cryptocurrency, or has income in another state.

-

The rule in CA is "where the benefit of the service is received, that is where the tax lies". In practice, it means that any client who is a resident of CA at the time I prepare the tax return received the benefit of that service in CA. Therefore, the income I received from that client is taxable to CA. Even if they come to my office in Texas, CA considers the benefit received in the state. I have a few clients that are non-residents of CA but who still have CA sourced income. Because they do not reside in CA, the preparation of the 540NR is not sourced to CA and I don't pay tax on it. The benefit of the service was received in their home state. I think OR is pretty much spelling out the same schema for their income tax sourcing rules. Tom Longview, TX

- Last week

-

There are so many online and remote services now that the question arises where is the income nexus. Market Based Sourcing says if I whose business is located in Oregon prepare a tax return for a resident of Seattle WA, that the income nexus is where the services were received instead where my business is physically located. Another example: My accounting software is online which is also used by my larger business clients. This accounting service provider is headquartered on Long Island NY, but the actual software is hosted by Amazon Web Services in some server farm at an unknown location. Market Based Sourcing says that where the service is received is the key nexus location. Frankly, it's a new idea to me.

-

@Abby Normal what website did you get that radar image from. I have not seen one like that before. @RitaB take care of yourself. This spring the weather is not fooling around. Tom Longview, TX

-

-

I think I follow what you are saying now. For example you prepare a tax return for a Washington resident. You are saying your fee is not subject to Oregon Income tax? Your not talking about whether the client has Oregon sourced income but whether you do for your services?