Leaderboard

Popular Content

Showing content with the highest reputation on 05/27/2015 in all areas

-

For a balanced perspective on this story, here is NAEA's position: IRS in an announcement late yesterday stated "criminals used taxpayer-specific data acquired from non-IRS sources to gain unauthorized access to information on approximately 100,000 tax accounts through IRS' 'Get Transcript' application. This data included Social Security information, date of birth and street address." We believe it is important for our members to understand the issue at hand here. In the first place, IRS was not "hacked." More to the point, criminals did not break into IRS databases and steal 100,000 accounts. The criminals had the keys, obtained elsewhere--they came in the front door and fraudulently posed as taxpayers. While your clients may not be particularly interested in this fine distinction, we believe the distinction is one worth making, both to your staff members and to your clients. Members may have already heard of the breach either through the media or social networks (we posted to NAEA's Facebook page last evening), but we wanted to make sure that all NAEA members were aware of the issue--and that IRS had shut down the "Get Transcript" application. Please take a minute or two to read IRS' announcement, which provides quite a bit of useful information, including details on what the agency believes happened, how many taxpayers are affected, and what the agency is doing in response (including an offer of free credit monitoring). In our conversations with well-placed current and former IRS officials, we gleaned a few other items for your consideration: IRS has not yet sent the letters to the taxpayers whose data has been compromised. Those letters should be going out shortly--perhaps by the end of the week, though frankly we don't have a high level of confidence on this-and we expect to receive a copy, which we plan to share with our members.We do not know how long the "Get Transcript" function will be shut down. Our guess is that it may be a very long time before IRS reopens it.IRS plans to post FAQs (Frequently Asked Questions) to its website--perhaps today3 points

-

An elder/medicare lawyer asap is the way to go. This may not be the only issue, and it is better to have plans in place before need. The elder care specialist will know what to do and when.3 points

-

According to the article, the thieves hacked the IRS transcript system. They already had the taxpayers' names, birthdates, SS #s, and addresses, which is all they needed to get in. So all they got that they didn't have before was tax return transcripts. And what are they going to do with those? All I can think of is present them to banks and take out big loans in the victims' names. Note that the personal data they used to access the system was exactly what was stolen in the massive Anthem breach. I wonder just how many people who ever had Anthem Blue Cross/Blue Shield signed up for free credit monitoring. Doing so will at least prevent the bank loans. I wonder what other disasters these poor folks have in store for them in the future. Also note that in the "old days" (last year), the only people who could get transcripts instantly were tax pros who had POAs and had been vetted to use eservices. Taxpayers could request them online or by phone but had to wait a few weeks for them to arrive by snail mail. Now the parties are reversed. CPAs, EAs, and attorneys can no longer get transcripts through eservices, only taxpayers can. Someone high up in the IRS had to distrust tax pros enough to push for that change (the initials KH come to mind). I couldn't believe there was that much of a problem with credentialed preparers gaining unauthorized access to a taxpayer's records--we had to present a POA, PTIN, license number, CAF--lots of safeguards there. Now we are locked out. Anyone with stolen Anthem data is allowed in. What is wrong with this picture?3 points

-

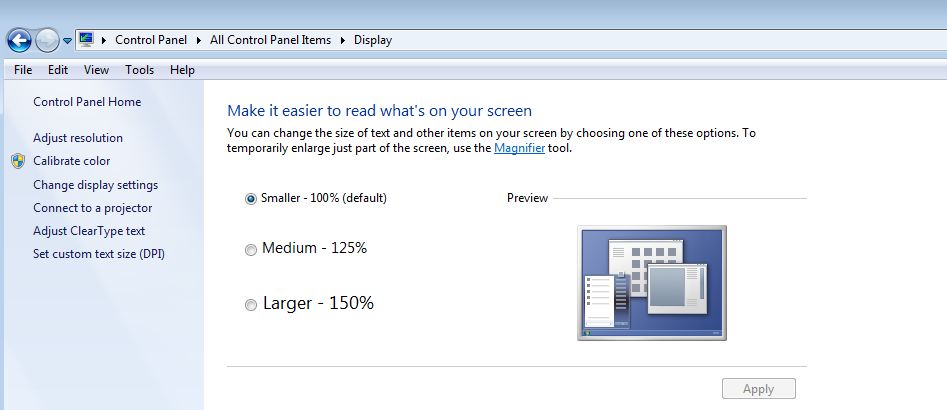

First off: Not an accountant or enrolled agent (I am an IT/Helpdesk). Second: I found that when the DPI is raised past 125% that the menu's in Peachtree get all mashed (like in the picture at the top, as well this seems to help with the ability to check of multiple gl?). Right click your desktop, select Screen Resolution> click Make Text and other items larger or smaller (just above the OK button)> Changing the DPI to Smaller fixes the mashed up menu's. For my client we had to buy them a magnifier to put over the monitor (so as not to use the settings on the computer to adjust the DPI (dots-per-inch).2 points

-

I suggest start by contacting the 401k administrator and asking them what kind of documentation they need in a situation like that. In my experience, if you talk with them nicely they're usually pretty helpful.2 points

-

The number you are calling is the ACS general number for W-2 returns. For Sched C's use -3903. You will be routed to any one of about 15 different offices. You do not have to speak to Fresno as everything is in the system. The best time to call is at 8AM when the lines open up; or after 5PM when there is less traffic. Mon and Fri are the worst days. I have been getting through recently in about a half hour.1 point

-

This is not a new issue. We hear this from customers who paper and e file. A few years ago, there was a large number lost, based on the more than a few our customers with this issue. Thus, we recommend in addition to keeping the paper copy for compliance purposes (the electronic storage regulations are not something I am comfortable with as I do not want to allow the IRS access my computer at will to ensure my compliance, nor do I want to have to report any potential data loss, such as a computer change, versus the no proof required+ assumption the IRS makes that I did keep the paper records), we suggest paper filing. For those who prefer to get proof of delivery, mailing with some sort of delivery receipt might be a comfort.1 point

-

1 point

-

Joe: It hasn't been 25 years since they changed it. They have never allowed a tax credit for the local taxes. They changed it 12-15 years ago. It used to just be a calculation, if the state tax was $1000, and the "piggy-back" tax was 50% of the state, then you added $500 to the taxes for the locality, and your total tax was $1,500. Then they decoupled the "local piggy-back" tax from all the same deductions/exemptions. So the math changed. Actually the local tax went UP from this change, and the state taxable income could be lower than the local tax. Following the example above, the state would get $1,000, and maybe the local tax could be $505 or $520. However, this whole case is centered on the piggy-back tax and why the taxpayers could not get the tax credit on the local tax. So, if they paid another state $2,000 in income tax on the same income, why did they only get to claim the credit against the $1,000, and not the $1,520? The Wynnes blew that all apart. The Comptrollers office is still spinning. According to the MACPA, (MD Assoc of CPA's) the Comptrollers office advised them that the Comptrollers will process refunds for MD taxpayers who are affected by this ruling. Fat Chance. Technically, you get to amend your clients returns back to 2006, when the case was originally filed, or when the Howard County Circuit Court Sided with the taxpayers in 2008/09. So that $300 can become $1,200 to $1,800 pretty easy. I have not been able to find out how far back we can amend. I can see the Comptroller office's stating that the "three year" rule might apply. It doesn't. The filing of the court case should have tolled the statute. Lets do lunch. Rich1 point

-

Church/clergy issues are my bread and butter. Perhaps I can help. Churches (and other employers) have historically done premium and other medical cost reimbursements in the form of a Medical Expense Reimbursement Plan (MERP) and more recently using a Section 105 Health Reimbursement Arrangement (HRA). One provision of the ACA made stand-alone HRAs illegal as of 1/1/2014; as of that date HRAs are permitted only if the employer offers it in conjunction with an ACA compliant group health insurance plan (such plans are known as integrated plans). Many employers (including scads of churches) didn't get the memo and continue offering obsolete MERPS and stand-alone HRAs. The bottom line is the reimbursement must be treated as additional income. That will likely require amended 941s and W2. It will also require a change in procedure for future activities. By the way, it is important to note that the employing church/ministry cannot designate any portion of the reimbursement-recategorized-as-salary as clergy housing allowance because the law prohibits making housing allowance designations retroactively (there is one exception to the general rule but it is so rare that I'll not bore you with the details). Rita is correct--clergy are not subject to FICA. Clergy have what is often called a 'dual tax status'. That is, they are (almost always) considered an employee of the church for income tax purposes but are always (100% of the time) considered self-employed for social security tax purposes. I.e., they must pay self-employment tax--unless they opted out of SECA by filing Form 4361--but that's a different conversation. Therefore, the employing church/ministry should never withhold FICA on clergy compensation. The clergy person should make quarterly estimated payments to cover their SECA liability. However, as an alternative strategy, the IRS permits (and even encourages) the clergy taxpayer to have his/her employing church/ministry withhold extra income tax in an amount equal to the SECA tax liability. Hope this helps.1 point

-

1 point

-

"The IRS said it is notifying taxpayers whose information was accessed." See.....Ya don't even need E&O insurance.1 point

-

The sorting center in Dayton is being closed. Sorting will all go 90 mile east to Columbus. Streamlining at its finest. I have heard from people inside the local post office that slow downs, not processing bags of mail and other things are being committed as the workers protest the closing. I have this on first person information. It is frustrating because our clients want to blame us for things not being delivered timely or at all.1 point

-

1 point