-

Posts

7,165 -

Joined

-

Days Won

406

Everything posted by jklcpa

-

Agree to expensing also. With the mention of cost seg studies and upgrades, it originally sounded as though this was part of a larger project.

-

Fwiw, I don't think this falls into the 15-year categories of either land improvements and definitely not qualified leasehold improvements. I think that, while this isn't directly within the building, it would be a 39-year leasehold improvement because it is related to the operation and workings of the building's internal systems and it doesn't fit into any other category.

-

Congratulations to Andrew. I hope it is everything he's dreamed it would be.

-

Not here. Water/sewer line laterals belong to the property owner who are responsible for cost of repairs or replacement.

-

Oh, sorry, I thought that was obvious from my answers. Anyway, cbslee's answer made clear how I would classify each asset.

-

Above answers - for sink is based on that it sounds like this is a new space or with new purpose and no existing sink that was being repaired. Also, this is assuming that the stove and refrigerator being "commercial grade' may possibly exceed the de minimis threshold. I'm sure someone here will come along with another viewpoint.

-

cbslee has been posting updates periodically, this one being the most recent from late last week:

-

Gail is correct that tiebreaker would only apply in this situation if both unmarried parents try to claim the same child. Pub 501 has 2 clear examples of this in the "Dependents" section an under the tiebreaker explanations:

-

I use a spreadsheet that starts out very similar to yours except mine has 3 distinct sections. The first is like yours with an additional column for late fees, discounts & adjustments. The second section has the date of collection, a total column that ties to payments received and has columns for each quarter that are used for my state gross receipts reporting. Finally the third section is for my insurance purposes with a total that ties to total billing and with columns for total hrs, total billing that is then spread to columns for tax, review, compilation/bkkpg, other.

-

Should we former Saber users ask Eric for a tiger roar when we visit this forum?

-

As Joan said best, it's always a surprise when ages come up. I think of everyone as still being the ages from years ago when the forum was started. I'm 61 and I think of everyone here as my age or younger, and yes, I do know who some of the younger ones on here are. The posts about no one remembering the old TV shows always makes me laugh too. I was a very young girl but do remember watching reruns of shows like The Honeymooners and variety shows such as Steve Allen, etc.

-

Gee, you've certainly been a member of this group for long enough that you should know that we are a generous group and it's rare that any post goes unanswered here, and it's also a slow time when many of our regulars aren't back yet. Perhaps the lack of instantaneous help was also because it took some time for members to find time in their own busy schedules to visit the site and respond. Please remember that this is not the official ATX forum.

-

Is this the correct way to release suspended Passive Losses?

jklcpa replied to BulldogTom's topic in General Chat

Was it remaining basis of depreciable property written off as scrapped or when it was replaced? That would also be on 4797 and not be a complete disposition. -

Is this the correct way to release suspended Passive Losses?

jklcpa replied to BulldogTom's topic in General Chat

The passive loss on 4797 would be first subject to the at-risk limitations and then the passive activity rules. The transactions are reported on their respective forms for the type of transaction, so yes, there would be both Sch E and the 4797. There should also be a Form 8582 and its worksheets that calculate what portion of the losses are allowed and the portion disallowed that will carryforward. If the sale was a complete disposition, the software would have a checkbox or some way to indicate that so that the loss from that activity would be allowed in full, and that would also be run through the 8582 calculations. -

At first I did too except for the next part about taxpayers being confused about all the new things and mcb's practice being there to help. I agree with you about the POA for your interpretation though.

-

Hmm, I took the OP to mean that clients were asking about sending friends and relatives in as new clients.

-

To everyone here, I hope you all have a happy, healthy, and prosperous 2022!

- 12 replies

-

- 11

-

-

-

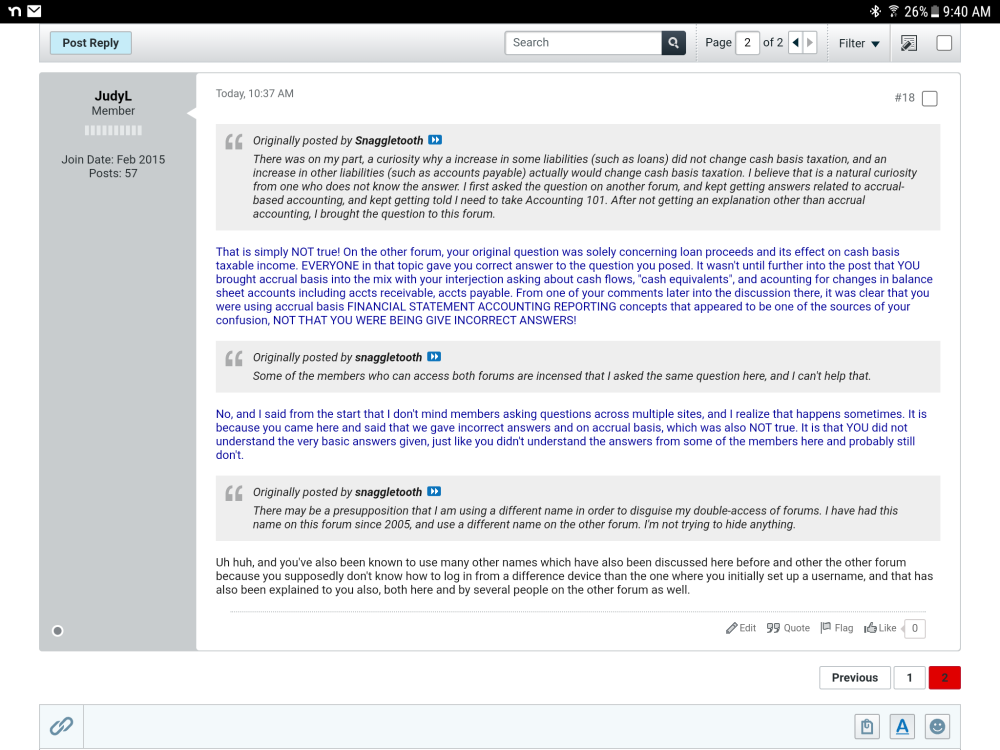

Well I will respond so that people know that you are over on the other forum trying to CYA and still saying that we gave incorrect answers when it was you that didn't understand the concept and the very basic answers given, and it was YOU that LATER ON brought accrual basis FINANCIAL ACCOUNTING REPORTING concepts into the discussion. Also, after you posted on the other forum, early on in the discussion another one of the members there also tried to tell you nicely that it was unreasonable to expect anyone there to comment on the discussion here on this forum without seeing the EXACT questions and EXACT comments that were provided.

-

@Corduroy Frog Did you forget that there is overlap of members across these professional forums? I don't mind that people ask the same questions on multiple sites, but I find it totally rude and insulting of you to post on another forum that those of us that took the time to try to help you here did not address your question properly, that we were addressing it as accrual basis, and gave you incorrect answers when, in actuality, it is you that didn't understand the concepts or the answers that were provided above. You can be sure that I will not waste any of my time helping you in future on any forum, no matter what other name you may post under either!

-

Thank you, Rita!

-

Thanks, Lee. I'm going to pin this topic through the end of January.

-

It's true that the 457 withdrawal is taxable earnings for income tax purposes, but for social security earnings it is counted when it is earned and not when it is paid out, so the payout would not cause a reduction or payback in social security benefits.

-

Still, your question shows lack of understanding of basic bookkeeping and taxation. The additional borrowing would increase cash and increase loans payable, both balance sheet accounts. This has no effect on profits or taxable income whatsoever no matter what accounting method is used.