-

Posts

5,217 -

Joined

-

Last visited

-

Days Won

328

Everything posted by Abby Normal

-

Where does the Fax # come from on Cover Sheet

Abby Normal replied to BulldogTom's topic in General Chat

That may be controlled by ATX, so only you can use the software. Call your sales rep. -

I've never been to Kentucky. I would like if this actually happened. Let's revisit after May 1st.

-

I just gave you the first result of both systems.

-

I learned from the best. Rich came to my office when I switched to ATX to give me a jump start. How nice was that. I still remember how confusing the whole letters thing was.

-

This can be true because the mortgage interest and real estate taxes move back to the Sch A, and you don't have to worry about depreciation when you sell.

-

https://fossbytes.com/10-best-free-antivirus-software-list-2017/ I would stay away from the Russians and the Romanians.

-

That would be the highlight of my year!

-

They may not have variables for those forms. In which case, you'll have to edit each letter manually.

-

Comodo is good. I use it on my virtual machine.

-

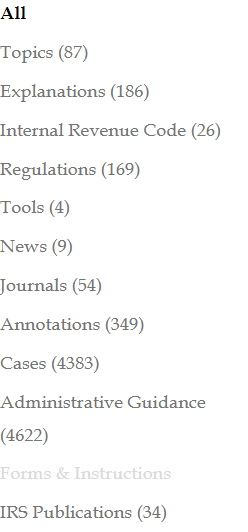

And the AnswerConnect UI is much friendlier. Intelliconnect UI is so clunky it's aggravating to use and it takes longer to find what you need.

-

Open up any return that has the NY forms you want to do the letter for, then go to the Forms menu (Alt+F - NOT the Add Forms button), and click on Client Letter. Resize the window to a useful size. At the bottom of the Templates list (left side), you should have a Blank template. Double click to open it. First thing, do a 'save as' and name it. Type whatever you want in the letter, inserting variables (drag n drop) into the letter. At the top of the Variables column, you can switch between federal and state variables. Save the letter, but before you close it, export it to your documents (Templates menu, Export). This will save it as an rtf (rich text format) file, which comes in handy as a backup in case ATX screws up your letter. And also next year, you can import the letter. Check your variables next year in case ATX changes them.

-

-

AnswerConnect results: ¶570, Cash Method of Accounting for Small Businesses, Including Exceptions for Inventories, UNICAP, and Small Construction Contracts Summary The cash method of accounting and other simpler accounting methods have been made available to more taxpayers. Most taxpayers who meet a $25 million average annual gross receipts test will be able to use the cash method, will not be required to apply the inventory or uniform capitalization (UNICAP) rules, and will not be required to use the percentage of completion method for small construction contracts. Background An accounting method includes both an overall system of accounting and the accounting treatment of any individual item. The accounting method used for tax purposes must clearly reflect income and must be consistently applied (Code Sec. 446(b)). Taxpayers can compute taxable income using the cash receipts and disbursements method or cash method, the accrual method, any other special method allowed under the income tax rules, such as a long-term contract method, or a hybrid method that combines any of the above methods (Code Sec. 446(c)). Cash method of accounting. The cash method is the simplest of the overall accounting methods (Code Sec. 446(c)(1)). Under the cash method, taxpayers report income in the year in which it is received in the form of cash, property, or services with a determinable value. Cash-method taxpayers take deductions and credits in the year in which the expenses are actually paid, unless a special rule requires the expenses to be taken in a different year to clearly reflect income (Reg. §1.446-1(c)(1)(i)). Certain taxpayers cannot use the cash method for tax purposes and must adopt the accrual method. Under the general rule, entities that cannot use the cash method are: (1) C corporations, (2) partnerships that have one or more C corporations as a partner or partners, (3) tax shelters, and (4) certain trusts subject to tax on unrelated business income (Code Sec. 448(a)). However, despite the general rule, C corporations and partnerships that have one or more C corporations as a partner or partners can use the cash method if they meet a $5 million gross receipts test, are farming businesses, or are qualified personal service corporations. In addition, the cash method cannot be used by a taxpayer if the purchase, production, or sale of merchandise is an income-producing factor. In that case, the taxpayer must keep inventories and use the accrual method for the inventory items (Reg. §§1.446-1(c)(2) and 1.471-1). Large farming corporations. Large C corporations and partnerships with a C corporation partner that are engaged in the trade or business of farming are generally required to use the accrual method (Code Sec. 447(a)). Farming C corporations and farming partnerships with a C corporation partner that meet a $1 million gross receipts test and family farming C corporations that meet a $25 million gross receipts test are not required to use the accrual method and can use the cash method instead (Code Sec. 447(d)). Exceptions to the required use of the accrual method also apply for certain types of farming businesses. A family farming C corporation that is required to change its method of accounting because it does not meet the $25 million gross receipts test must compute a Code Sec. 481 adjustment and include the amount in income over a period of 10 years, beginning with the year of the accounting method change (Code Sec. 447(f) and (i)). Prior to the Taxpayer Relief Act of 1997 (P.L. 105-34), a family farming corporation could avoid the 10-year recognition period by creating a suspense account that deferred recognition of the Code Sec. 481 adjustment indefinitely, pending the termination of the corporation or the happening of certain other events. For tax years ending after June 8, 1997, new suspense accounts could not be established, and existing suspense accounts were gradually being phased out over a period of 20 years (Code Sec. 447(i)(5)). Businesses with inventory. Businesses must take inventories at the beginning and end of each tax year in which the production, purchase or sale of merchandise is an income-producing factor (Code Sec. 471(a); Reg. §1.471-1). Although businesses with inventories generally must use the accrual method, certain small businesses do not need to account for inventories and can use the cash method. Small businesses qualify for this exception if they have average annual gross receipts of $1 million or less, or are engaged in certain trades or businesses and have average annual gross receipts of $10 million or less (Rev. Proc. 2001-10 and Rev. Proc. 2002-28). UNICAP rules. Businesses that produce real or tangible personal property or acquire property for resale must use the uniform capitalization (UNICAP) rules and include the direct costs and a portion of the allocable indirect costs of producing or acquiring property in their inventory costs (Code Sec. 263A). However, businesses may qualify for an exception to the UNICAP rules for personal property purchased for resale if the business has average annual gross receipts of $10 million or less for the preceding three tax years (Code Sec. 263A(b)(2)). This exception does not apply to real property acquired for resale (Reg. §1.263A-3(b)(1)). Other exceptions to the required use of the UNICAP rules also apply, including exceptions for costs of raising, harvesting or growing trees, costs of producing animals or producing plants with a preproductive period of two years or less (unless the taxpayer is required to use the accrual method), and qualified creative expenses of freelance authors, photographers and artists (Code Sec. 263A(c)(5), (d)(1) and (h)). Long-term construction contracts. Taxpayers generally must account for their long-term contracts using the percentage of completion method of accounting (Code Sec. 460(a)). Under the percentage of completion method, taxpayers recognize income from the contract as the contract is completed. The income for the year is equal to the percentage of the contract that was completed multiplied by the gross contract price. The percentage of the contract completed during the tax year is determined by comparing costs allocated to the contract and incurred before the end of the tax year with the estimated total contract costs (Code Sec. 460(b)). The required use of the percentage of completion method and most of the cost allocation rules for long-term contracts do not apply to small construction contracts, home construction contracts, and residential construction contracts. A small construction contract is any contract for the construction or improvement of real property that: (1) is expected to be completed within the two-year period beginning on the commencement date of the contract, and (2) is performed by a taxpayer whose average annual gross receipts for the three tax years preceding the tax year in which the contract is entered into do not exceed $10 million (Code Sec. 460(e)(1)). In addition to the percentage of completion method, taxpayers can report income from small construction contracts under the completed contract method, the exempt-contract percentage of completion method, or any other permissible method (Reg. §1.460-4(c)(1)). Changes of accounting method. Taxpayers cannot change from an established accounting method to a different method unless they first obtain the IRS’s consent for the change (Code Sec. 446(e)). The IRS has issued procedures that taxpayers must follow in order to receive the IRS’s consent for an accounting method change (Rev. Proc. 2015-13). The IRS will grant automatic consent for certain changes in accounting method that are in the IRS’s "List of Automatic Changes" (Rev. Proc. 2017-30). Code Sec. 481 adjustments are generally required in order to prevent duplication or omission of income items resulting from the accounting method change. NEW LAW EXPLAINED Single gross receipts test added for cash method, inventory, UNICAP, construction contract rules.—A single $25 million gross receipts test has been put in place for determining whether certain taxpayers qualify as small taxpayers that can use the cash method of accounting, are not required to use inventories, are not required to apply the UNICAP rules, and are not required to use the percentage of completion method for a small construction contract (Act Sec. 13102 of the Tax Cuts and Jobs Act (P.L. 115-97)). Comment The combined effect of the statutory changes is to replace a number of different gross receipts tests for determining what is a small taxpayer with a single gross receipts test with a $25 million threshold. In nearly all cases, the $25 million threshold is a significant increase from the prior thresholds which ranged from $1 million to $25 million. The changes not only increase the number of businesses that will qualify as a small taxpayer but also greatly simplify the gross receipts determinations. Gross receipts test expanded. The exception to the general limit on the use of the cash method for small businesses is expanded for tax years beginning after December 31, 2017. Under the exception, a C corporation or a partnership with a C corporation partner that meets a gross receipts test can qualify to use the cash method of accounting (Code Sec. 448(b)(3), as amended by the 2017 Tax Cuts Act). A C corporation or a partnership with a C corporation partner meets the gross receipts test for a tax year if its average annual gross receipts for the three-tax-year period that ends with the tax year preceding such tax year do not exceed $25 million (Code Sec. 448(c)(1), as amended by the 2017 Tax Cuts Act). The average annual gross receipts amount of $25 million is adjusted for inflation for tax years beginning after December 31, 2018, using the Chained Consumer Price Index for All Urban Consumers (C-CPI-U) in the cost-of-living adjustment (see ¶125) (Code Sec. 448(c)(4), as added by the 2017 Tax Cuts Act). Caution Tax shelters are not allowed to use the cash method even if they meet the gross receipts test (Code Sec. 448(a)(3)). The steps for the gross receipts test are: determine gross receipts for each year in the three-tax-year period; compute the average annual gross receipts for the three-tax-year period; and determine if the average annual gross receipts for the three-tax-year period are $25 million or less (to be adjusted for inflation for tax years beginning after 2018). Example A C corporation wants to determine if it can use the cash method under the expanded gross receipts test for the 2018 tax year. For the three tax years ending with the 2017 tax year, the corporation has gross receipts of $21 million, $26 million and $25 million (tax years 2015, 2016 and 2017, respectively). Its average annual gross receipts for the three-tax-year period are $24 million (($21 million + $26 million + $25 million) ÷ 3). The corporation meets the gross receipts test for 2018. Comment Many additional C corporations and partnerships with a corporate partner will be able to use the cash method under the $25 million gross receipts test since the prior test capped the amount of qualifying annual gross receipts at only $5 million. Comment The other exceptions to the general limitation on the use of the cash method continue to apply for qualified personal service corporations and taxpayers other than C corporations. Thus, qualified personal service corporations, partnerships without C corporation partners, S corporations, and other passthrough entities are allowed to use the cash method without regard to whether they meet the $25 million gross receipts test if the cash method clearly reflects income and the entity is not a tax shelter (Conference Report on H.R. 1, Tax Cuts and Jobs Act (H. Rept. 115-466)). A taxpayer making a change in accounting method under the Code Sec. 448 rules limiting the use of the cash method should treat the change as initiated by the taxpayer and made with the IRS’s consent for purposes of any Code Sec. 481 adjustment (Code Sec. 448(d)(7), as amended by the 2017 Tax Cuts Act). The special Code Sec. 481 adjustment periods for Code Sec. 448 accounting method changes of up to four years and up to 10 years for a hospital have been eliminated for tax years beginning after December 31, 2017 (Code Sec. 448(d)(7), prior to amendment by the 2017 Tax Cuts Act). Compliance Tip Taxpayers make a change of accounting method by filing Form 3115. The taxpayer should follow the IRS procedures for accounting method changes (Rev. Proc. 2015-13 and Rev. Proc. 2017-30). Use of cash method by large farming corporations expanded. The exception to the required use of the accrual method by large farming C corporations and farming partnerships with a C corporation partner has been expanded. For tax years beginning after December 31, 2017, a farming C corporation or a farming partnership in which a C corporation is a partner can use the cash method if it meets the $25 million gross receipts test of Code Sec. 448(c) (discussed above) (Code Sec. 447(c), as amended by the 2017 Tax Cuts Act). Comment Many additional farming corporations and farming partnerships with a corporate partner will be able to use the cash method under the $25 million gross receipts test since the prior test capped the amount of qualifying annual gross receipts at only $1 million. Comment Since the test for family farming corporations was already set at average annual gross receipts of $25 million, the rules in Code Sec. 447 that applied to family farming corporations are no longer needed and have been removed (Code Sec. 447(d), (e), (h) and (i), prior to being stricken by the 2017 Tax Cuts Act). However, the rules under former Code Sec. 447(i) for establishing suspense accounts for Code Sec. 481 adjustments from accounting method changes will continue to apply to any suspense accounts established before the date of enactment (Act Sec. 13102(e)(2) of the 2017 Tax Cuts Act). A farming corporation or farming partnership with a corporate partner making a change in accounting method under the Code Sec. 447 accounting method rules should treat the change as initiated by the taxpayer and made with the IRS’s consent for purposes of any Code Sec. 481 adjustment (Code Sec. 447(d), as amended by the 2017 Tax Cuts Act). Exception to required use of inventories expanded for small businesses. The exception to the required use of inventories for taxpayers that qualify as a small business has been expanded. For tax years beginning after December 31, 2017, a business is not required to use inventories if it meets the $25 million gross receipts test of Code Sec. 448(c) (discussed above) (Code Sec. 471(c)(1), as added by the 2017 Tax Cuts Act). Any taxpayer that is not a corporation or partnership should apply the gross receipts test as if each trade or business of the taxpayer were a corporation or a partnership (Code Sec. 471(c)(3), as added by the 2017 Tax Cuts Act). Thus, in the case of a sole proprietorship, the $25 million gross receipts test is applied as if the sole proprietorship were a corporation or partnership (Conference Report on H.R. 1, Tax Cuts and Jobs Act (H. Rept. 115-466)). Caution Tax shelters that are not allowed to use the cash method do not qualify as small businesses that can avoid using inventories (Code Sec. 448(a)(3); Code Sec. 471(c)(1), as added by the 2017 Tax Cuts Act). A business that meets the $25 million gross receipts test can use a method of accounting for inventory that: treats inventory as non-incidental materials and supplies; or conforms to the business’s financial accounting treatment of inventories (Code Sec. 471(c)(1)(B), as added by the 2017 Tax Cuts Act; Conference Report on H.R. 1, Tax Cuts and Jobs Act (H. Rept. 115-466)). A business’s financial accounting treatment of inventories is the method of accounting reflected in an applicable financial statement or, if the business does not have an applicable financial statement, in the business’s books and records as prepared in accordance with its accounting procedures (Code Sec. 471(c)(1)(B), as added by the 2017 Tax Cuts Act). An "applicable financial statement" is defined in Code Sec. 451(b)(3) (see ¶580) (Code Sec. 471(c)(2), as added by the 2017 Tax Cuts Act). A taxpayer making a change in accounting method under the exception to the required use of inventories for small businesses should treat the change as initiated by the taxpayer and made with the IRS’s consent for purposes of any Code Sec. 481 adjustment (Code Sec. 471(c)(4), as added by the 2017 Tax Cuts Act). Exception to required use of UNICAP rules expanded for small taxpayers. The exception to the UNICAP rules for small taxpayers that purchase personal property for resale has been expanded. For tax years beginning after December 31, 2017, a taxpayer is not required to apply the UNICAP rules for the tax year if it meets the $25 million gross receipts test of Code Sec. 448(c) (discussed above) (Code Sec. 263A(i)(1), as added by the 2017 Tax Cuts Act). The expanded exception to the UNICAP rules applies to any producer or reseller, other than a tax shelter, that meets the $25 million gross receipts test (Conference Report on H.R. 1, Tax Cuts and Jobs Act (H. Rept. 115-466)). A taxpayer that is not a corporation or partnership should apply the gross receipts test as if each trade or business of the taxpayer were a corporation or a partnership (Code Sec. 263A(i)(2), as added by the 2017 Tax Cuts Act). Thus, in the case of a sole proprietorship, the $25 million gross receipts test is applied as if the sole proprietorship were a corporation or partnership (Conference Report on H.R. 1, Tax Cuts and Jobs Act (H. Rept. 115-466)). Caution Tax shelters that are not allowed to use the cash method do not qualify as small businesses that can avoid the UNICAP rules (Code Sec. 448(a)(3); Code Sec. 263A(i)(1), as added by the 2017 Tax Cuts Act). Comment The prior exception to the UNICAP rules only applied to small taxpayers that purchase personal property for resale while the expanded exception to the UNICAP rules applies to any producer or reseller, other than a tax shelter, that meets the $25 million gross receipts test (Conference Report on H.R. 1, Tax Cuts and Jobs Act (H. Rept. 115-466)). It also appears that the exception will apply to real property acquired for resale. A taxpayer making a change in accounting method under the exception to the UNICAP rules for small businesses meeting the $25 million gross receipts test should treat the change as initiated by the taxpayer and made with the IRS’s consent for purposes of any Code Sec. 481 adjustment (Code Sec. 263A(i)(3), as added by the 2017 Tax Cuts Act). Small construction contract exception expanded. The small construction contract exception to the required use of the percentage of completion method for long-term contracts has been expanded. For contracts entered into after December 31, 2017, in tax years ending after such date, the exception applies to a construction contract entered into by a taxpayer: who estimates at the time the contract is entered into that the contract will be completed within the two-year period beginning on the contract commencement date; and who meets the $25 million gross receipts test of Code Sec. 448(c) (discussed above) for the tax year in which the contract is entered into (Code Sec. 460(e)(1)(B), as amended by the 2017 Tax Cuts Act). A taxpayer that is not a corporation or partnership should apply the gross receipts test as if each trade or business of the taxpayer were a corporation or a partnership (Code Sec. 460(e)(2)(A), as added by the 2017 Tax Cuts Act). Thus, in the case of a sole proprietorship, the $25 million gross receipts test is applied as if the sole proprietorship were a corporation or partnership (Conference Report on H.R. 1, Tax Cuts and Jobs Act (H. Rept. 115-466)). Caution The expanded exception for small contraction contracts cannot be applied by a tax shelter that is not allowed to use the cash method of accounting under Code Sec. 448(a)(3) (Code Sec. 460(e)(1)(B), as amended by the 2017 Tax Cuts Act). If a taxpayer changes its method of accounting based on the small construction contract exception, then: the change is treated as initiated by the taxpayer and made with the IRS’s consent; and the change is made on a cut-off basis for all similarly classified contracts entered into on or after the year of change (Code Sec. 460(e)(2)(B), as added by the 2017 Tax Cuts Act). Practical Analysis William D. Elliott, Partner at Elliott, Thomason & Gibson, LLP in Dallas, Texas, comments that the group of taxpayers that may use the cash method of accounting was expanded in several respects. A gross receipts test of $25 million annual gross receipts is added to permit cash method. The types of farming C corporations was expanded to include the $25 million gross receipts test. Professional service corporations with C corporation partners or passthrough entities are entitled to the cash method, apart from the $25 million, if income is clearly reflected. Other liberalizations were enacted on inventory requirements and uniform capitalization rules for $25 million gross receipts taxpayers. Small construction contracts are made exempt from percentage-of-completion accounting method. The general effective date is 2018. ►Effective date. The amendments made by this section generally apply to tax years beginning after December 31, 2017 (Act Sec. 13102(e)(1) of the Tax Cuts and Jobs Act (P.L. 115-97)). The amendments made by this provision for small construction contracts apply to contracts entered into after December 31, 2017, in tax years ending after such date (Act Sec. 13102(e)(3) of the 2017 Tax Cuts Act). Law source: Law at ¶5425, ¶5500, ¶5505, ¶5530, and ¶5550. Committee Report at ¶10,330. Act Sec. 13102(a)(1)-(4) of the Tax Cuts and Jobs Act (P.L. 115-97), amending Code Sec. 448(b)(3), (c), and (d)(7), and adding Code Sec. 448(c)(4); Act Sec. 13102(a)(5), amending Code Sec. 447(c) and (f), striking (d), (e), (h) and (i), and redesignating (f) and (g) as (d) and (e), respectively; Act Sec. 13102(b), amending (b)(2), redesignating Code Sec. 263A(i) as (j), and adding new Code Sec. 263A(i); Act Sec. 13102(c), redesignating Code Sec. 471(c) as (d) and adding new Code Sec. 471(c); Act Sec. 13102(d), amending Code Sec. 460(e)(1)(B), striking (e)(2) and (3), redesignating (e)(4), (5) and (6) as (e)(3), (4) and (5), respectively, and adding new Code Sec. 460(e)(2); Act Sec. 13102(e), providing the effective dates.

-

Ok, I did a basic search for 'cash basis method of accounting' and got this from Intelliconnect (see next post for AnswerConnect): U.S. Master Tax Guide® (2018),1515,Cash or Accrual Accounting Method Taxable income must be computed not only on the basis of a fixed accounting period ( ¶1501) but also according to the method of accounting regularly employed in keeping the taxpayer's books ( Code Sec. 446; Reg. §1.446-1(a)). 28 A method of accounting includes the overall method of accounting for income and expenses, as well as the method of accounting for special items such as depreciation. There are two common overall methods of accounting for income: the cash basis and the accrual basis. The cash method (cash receipts and disbursements) is the accounting method used by most individuals. Income is generally reported in the year that it is actually or constructively received in the form of cash, or its equivalent, or other property. Income is constructively received when it is within the taxpayer’s control, but has not been actually received ( ¶1533). There is no constructive receipt, however, if there are substantial limits or restrictions on the right to receive the income. Deductions or credits are generally taken for the year in which the related expenditures are actually paid, unless they should be taken in a different period to more clearly reflect income, such as depreciation allowances and prepaid expenses ( ¶1539) ( Reg. §1.446-1(c)(1)(i)). 29 Under the accrual method, income is accounted for when the taxpayer has the right to receive it—when all events that determine that right have occurred. It is not the actual receipt but the right to receive that governs. Expenses are deductible on the accrual basis in the year incurred—when all the events have occurred that fix the amount of the item and determine the liability of the taxpayer to pay it ( Reg. §1.446-1(c)(1)(ii)). 30 See ¶1540 for a discussion of the all-events test as it relates to economic performance. The accounting method used by a taxpayer must clearly reflect income ( ¶1525). An approved standard method of accounting (i.e., the cash basis or the accrual basis) ordinarily is regarded as clearly reflecting income. An individual may use one accounting method to keep his or her personal books and another for the books of his or her trade or business. A taxpayer may use different accounting methods if the taxpayer has two or more separate businesses as long as separate and distinct sets of records are maintained. However, the use of multiple accounting methods is not permitted if there is a creation or shifting of profits or losses between the taxpayer's various trades or businesses ( Reg. §1.446-1). 31 Except as otherwise required, a hybrid method combining two or more methods of accounting—such as a combination of the cash method as the taxpayer's overall method of accounting and the accrual method for inventories—may be used so long as the combination clearly reflects income and is consistently used ( Reg. §1.446-1(c)(1)(iv)). 32 Taxpayers that are required to use inventories ( ¶1553) must use the accrual method to account for purchases and sales ( Reg. §1.446-1(c)(2)). 33 Furthermore, the following taxpayers must generally use the accrual method of accounting as their overall method of accounting for tax purposes: C corporations; partnerships that have a C corporation as a partner; charitable trusts that are subject to the tax on unrelated trade or business income ( ¶655), but only for that income; and tax shelters ( Code Sec. 448(a) and (d)(6)). 34 Qualified personal service corporations ( ¶273) are treated as individuals rather than as corporations for this purpose. Businesses Allowed to Use Cash Method. Notwithstanding the general requirements above, small businesses, farmers and ranchers ¶1519, and qualified personal service corporations are not required to use the accrual method of accounting and may use the cash method unless the entity is a tax shelter ( Code Sec. 448(b), as amended by the Tax Cuts and Jobs Act ( P.L. 115-97)). Small business may use the cash method if its average annual gross receipts for the three tax years ending with the prior tax year do not exceed $5 million ($25 million for tax years beginning after 2017) ( Code Sec. 448(c), as amended by P.L. 115-97; Temp. Reg. §1.448-1T(f)). 35 For tax years beginning before 2018, additional exceptions to the accrual method requirement are provided for taxpayers having average annual gross receipts of $1 million or less, regardless of their trade or business, and for taxpayers with eligible trades or businesses having average annual gross receipts of $10 million or less, that are exempt from the requirements to account for inventories ( Rev. Proc. 2001-10; Rev. Proc. 2002-28). 36 For tax years beginning after 2017, most taxpayers qualifying under these exceptions will be able to use the cash method under the $25 million gross receipts test . Footnotes 28 FED ¶20,606, FED ¶20,607; ACCTNG: 200; PTE §38,201 29 FED ¶20,607; ACCTNG: 208; PTE §38,210, PTE §38,215.05 30 FED ¶20,607; ACCTNG: 210; PTE §38,220.05 31 FED ¶20,607; ACCTNG: 206.05; PTE §38,205.05 32 FED ¶20,607; ACCTNG: 6,400; PTE §38,225 33 FED ¶20,607; ACCTNG: 15,060; PTE §38,215.05 34 FED ¶20,800; ACCTNG: 6,050; PTE §38,215.05 35 FED ¶20,800, FED ¶20,801B; ACCTNG: 208.10; PTE §38,215.10 36 FED ¶20,803.75; ACCTNG: 6,050, ACCTNG: 15,058; PTE §38,215.10

-

I efiled a 2016 1040 and it ack'd the same day.

-

I resisted for years, but the advanced calculations plus AnswerConnect made it worthwhile for me this year.

-

I can view answers in Chrome but not Firefox. Weird. Thanks! Edit: It was my https everywhere addon that wouldn't let me view that page.

-

Yes, I have Advantage and the highest level of AnswerConnect is included.

-

Mostly it just has better analysis and a nicer interface. If you try them side by side, you'll want AnswerConnect.

-

Requires login.

-

To recap, boxes 1, 3 & 5 on the W2 will all be the same after adding in the Social Security and Medicare. We used to have to do an iterative calc on that but not anymore.

-

AnswerConnect is not the same as CodeConnect, it's more complete. It's also new this year, I think. If you don't have AnswerConnect, sounds like it's redirecting you to CodeConnect. All 3 products use the same login.

-

The answer connect mobile site looks pretty nice on my phone. (Using Firefox Android)

-

AnswerConnect is the top of the line product and there are 3 levels of that. I thought Max users had the lowest level included, but maybe not. Intelliconnect is the basic package and CodeConnect is mid-range. I noticed that Tax Line Research has not been updated for 2017. Maybe it died in 2016?

-

Form 4562 Depreciation - has ATX announced a date?

Abby Normal replied to BulldogTom's topic in General Chat

Until it's in ATX, nothing else matters. I don't need final, just draft like the 4562.