BHoffman

Donors-

Posts

595 -

Joined

-

Last visited

-

Days Won

32

Everything posted by BHoffman

-

See Arizona form 309 to claim a credit for taxes paid to another state.

-

https://www.irs.gov/taxtopics/tc607.html

-

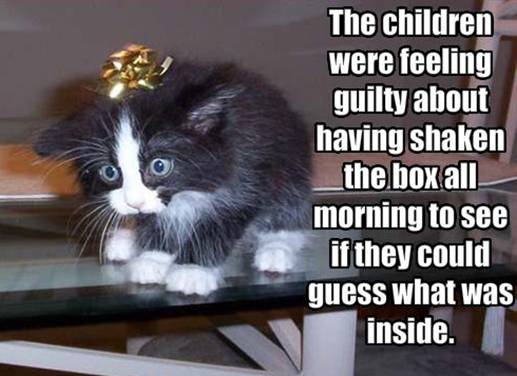

Joan - sorry for your loss. My 18 year old cat is fading and I dread the time when I have to make The Decision. We don't get over losing our little pet family members, we just get used to it. It's hard and it sure hurts for some time. FDNY - I think pets have a shorter lifespan than we do is because, given enough time, they would find so many ways to manipulate us with their cuteness that we would be their slaves (more than we are now).

-

I agree with jklcpa.

-

Well, I am going to say that no you're not. You decide who's right It looks like you are the one who initiates all of the conversations. What happens if you just don't ever email or call this guy again? I think he'll either float away or you can pretend you don't know who he is j/k. You would certainly be able to tell him that you don't want to work with him anymore because you can't get a response.

-

See Rev Proc 2013-30 for late elections. Why can't the shareholder take a 2015 payroll check? BTW: I have never regretted my habit of calling all of my business clients, including those little Sch C filers, in November to ask how they are doing.

-

Wondering if the TP treated it like an operating lease and just deducted the lease payments?

-

....and here is an answer: http://www.unclefed.com/AuthorsRow/TaxBusProf/deathofshrareholder.html

-

Hi Lion - the nonprofit was in existence for a long time before the nice people got roped in. They lost most of their charitable contribution deduction due to the 5 year carryover period. They got totally screwed. It's a mess and I'd like to help them out, but Sec 731 and 732 are pretty clear So, it looks like the nice people own land and real estate assets in an SCorp with zero basis and a huge tax bill when/if they sell. If they leave the assets in the SCorp until they die, will the inheritors of the SCorp be able to adjust the basis to FMV on date of death?

-

Hi Lion - another attorney confirmed that the partnership agreement language regarding the forfeiture of units by the nonprofit was OK.

-

According to the partnership agreement, if PtrA loses his nonprofit tax status then he forfeits his partnership units to PtrB. PtrA lost his nonprofit tax status, or rather the IRS took it away.

-

Thanks - I read the ATG and some other things. The parties are absolutely not related at all.

-

It's a long story. Back in the 90s, a fancy financial advisor talked these nice people into making a charitable contribution of cash, securities, and land to PtrA, and then a fancy lawyer created a corporation held by the nice people. The corporation and PtrA formed a partnership that held the charitably contributed assets. The nice people were unable to take the full charitable deduction as it was large and expired after 5 years. IRS audited them for this issue and found no change. Then, PtrA lost his nonprofit status, and that caused him to forfeit his partnership "units" to PtrB per their agreement. The partnership terminated. PtrA didn't put anything into the partnership except the charitable contribution from the nice people. The nice people received a tax benefit for the charitable contribution deduction allowed back in the 90s. Now that PtrA forfeited, I believe PtrB's basis should include PtrA's basis minus the tax benefit of the original charitable contribution. I think that is the actual "economic substance" of the thing, but I don't think that's how the law is written. To answer your questions: I don't know if PtrA took a loss or not. The parties are not related. PtrA really contributed nothing that B didn't give him. I'm signed up for some partnership tax courses this summer. Partnerships are my least favorite and this is a real dinger.

-

I think it's going to be Sec 731 and/or 732. And I think it's going to be a long and boring day.

-

Thank you Jack. Can you point me to anything official? The numbers I've given have a few more zeros at the end so I'm concerned and this is unchartered territory.

-

So, the land becomes the personal property of Partner B with a basis of $1,000? And if he sells the land for $1,500, he would report a taxable gain of $500? Sorry to be so thick and thanks for your patient answers. Never dealt with a forfeiture before.

-

Nope. It's a plea for help. My burned out brain cells have not rejuvenated yet from last tax season and the Phoenix heat isn't helping

-

Partner A forfeited his interest in Partnership AB. The partnership agreement states that upon forfeiture, the assets transfer to Partner B.No hot assets, no liabilities. Nothing except assets and equity.Assets were:Land basis $1,000Securities basis $200Real estate basis $100Partner A held 99% before forfeiture. Partner B held 1%. Before the forfeiture, Partner B's total basis in the partnership was $100.Upon forfeiture, the partnership terminated leaving all of the assets to Partner B.What is Partner B's basis in the assets?

-

Lenders usually add back depreciation when they use tax returns instead of financial statements, so I'm a little confused. Your client might be best served to have at least a compilation prepared and signed by a CPA on the (GAAP) accrual basis if he's shopping for a loan and willing to use his company assets as collateral. What happens to the SCorp assets if the owner defaults on the building loan? Agree that the building should not be in the SCorp.

-

I don't think you can separate them. See 8582 form instructions page 5 here: http://www.irs.gov/pub/irs-pdf/i8582.pdf In the right hand column: "A partner or shareholder may not treat as separate activities those activities grouped together by the partnership or corporation."

- 1 reply

-

- 4

-

-

It's called a 1031 exchange and you can read about it here: http://www.irs.gov/uac/Like-Kind-Exchanges-Under-IRC-Code-Section-1031 Unless your client made arrangements for 1031 prior to the sale (usually with an exchange facilitator), the gain is taxable.

-

IMHO: $1,785 is not a material amount. If possible, you could track it down in client's books and correct the date of the transaction(s) to 2014 before finishing the 2014 tax return (preferred). We can assume the 2013 tax return is correct, and the client's 2014 books are wrong due to his violation of the closing period. Or simply report the amount as 2014 income and finish the tax return now rather than amend the 2013, and then spend the necessary time to find the badly dated transaction(s) in client's books and fix them later. This would not be my advice if the amount was material. I wouldn't change the balance sheet or the M-2 or create a prior period adjustment as these options will result in an understatement of income. This is a timing issue and a relatively small amount, but I would still recognize it as income either in 2013 by amending the return or else in 2014 by adding it to gross revenues.

-

Thanks! I was missing me some RitaB humor Hope every one is winding down a little. I'm caught up with the big stuff and can finally take a little breather. (gasp)

-

Many beloved taxbook forum users seem to have migrated here and I miss you: RitaB and JohnH especially. Wondering if you'll accept an old (and I do mean that in a figurative sense) Drake user?