-

Posts

1,633 -

Joined

-

Last visited

-

Days Won

62

Everything posted by Medlin Software, Dennis

-

Hard to grasp. One thing for certain, we all will pay in many forms. Thus, we all have a duty to ask for, accept, and use all possible aid we have access to, business and personal. The philosophical aspect in interesting to discuss. There is no free money. It all has to come from us. If we have access to funds we do not partake in, we pay at least twice.

-

The "next" proposed aid bill is out. 1800+ pages IIRC. Of course, it is from one party, so it could be a dud, or more likely, will be negotiated to "something". More stimulus payments. 24 weeks for PPP expenses. Extra $13 per hour for essential workers. 10k in student loan forgiveness. But wait, there's more! (many more items, my eyes are getting fuzzy). These are the first 4 which would effect me in one form or another. Another I think I caught was the PPP funds "returned" would be reserved for applicants with less than 10 employees.

-

Agreed 100%, normally. But the "bully" news about the repay if not necessary date, the unknown definition of "necessary", and of the forgiveness criteria makes this not normal. Even some who are clearly in need are hesitant to let anyone know they received the loan, and are considering payback because the likelihood of the list of loan recipients becoming public (and maybe a neighbor business complaining that they got something the neighbor failed to get). (Interestingly, I saw an opinion which is precedent for corps and the definition of "necessary", which if applicable, means all corps could easily claim "necessary".) Having the rules change after a legal loan app and legal loan acceptance are consummated is ridiculous. I am NOT saying I believe the new rules or suggestions are out of line, but the rules were the rules on April 3, and for the mom's and pop's, they should be able to rely on the documents in their hands, not some later news release that if other funds were readily available, they need to turn back their legal loan or face fines and jail. We went from "all should apply for the free money", to "you better really have a need or you are getting fines and maybe jail time". Remembering and documenting the need on April 3, or whatever the application date was, will be tougher 8 weeks after funding when the lender forgiveness app is due. Real questions I am getting (likely because there is no one source of information, and because my customers know I will reply). Am I keeping someone else from getting a loan as the news talked about? (Not likely, there are still funds available at the moment, applications are being accepted, and at least some of those who failed has application/documentation issues, which could have been corrected. Either way, your obligation to self, employees, and customers, is to remain viable.) Is there a fixed dollar criteria to prove my need? (No, you have to affirm whatever is on your application. How you affirm is up to you, although there are reasonable suggestions which can be followed.) What can be forgiven? (No one knows for certain. The only prudent course is to spend as normal, similar to the prior year, as best you can under current conditions.) Can my lender not approve forgiveness? (Certainly. You should be carefully documenting what you believe are allowable items for forgiveness, as well as a statement, letter, or memo stating why the loan was "necessary".) - I do not normally offer such detailed suggestions to my customers, as it is not in my normal scope of support. But, we need each other, so we are sharing, both ways, our experiences, knowledge, and suggestions.

-

ineligible taxpayers should return their stimulus pymt

Medlin Software, Dennis replied to schirallicpa's topic in COVID-19

Hear Hear. If the amount is a credit on the 2020 return (as is what I believe to be the case), then those who were alive on any date in 2020 should be eligible (including some COVID babies!). For those who passed before 2020, it seems reasonable there could be a claw back attempt, but at first, I remember reading articles which stated no claw backs. Like PPP forgiveness, until we see the rules, it is only a guess, since I suppose the credit could be given a specific must have been breathing date range. -

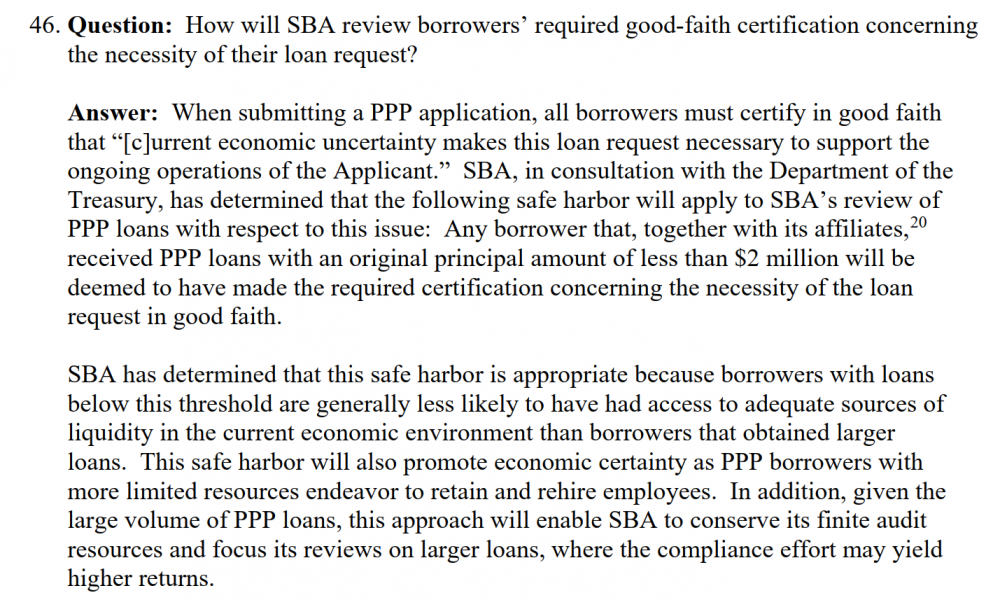

I have been getting a large number of questions about the ethics of taking a PPP loan, and what the qualifications are. After way too much thought, I came up with what seems like a reasonable reply. If a business is eligible for a PPP, and likely forgiveness, it is a complete disservice to the business, self, employees, and customers to not do so. (This still allows for those who have other reasonable alternatives to not take a PPP, given the Apr 23 "guidance".) It is no different than decisions a business owner makes daily, such as where the best buy for supplies can be had, recording items for tax deductions, etc. There is an obligation to keep the business viable, and it is an ethical (or for a corp, a legal) REQUIREMENT. The one which really made me think (and for good or bad, share with the customer) is an MD who has less income at present, but probably can get by if all goes perfectly. The problem is, he may get COVID, or staff, or someone have to take leave if a family member is affected (which is out of pocket for at least two weeks). He was thinking of not applying. When we chatted about him being easily able to affirm the loan app statements, and the loan making it possible to survive should something else happen, he derided to apply, for his staff and patients' sake. Note, there is no requirement he seek aid privately, or even come out of pocket. He realized he could not afford FFCRA PTO while waiting for repayment (without seeking a loan), and had already realized what will happen should he be unable to work. There is also no requirement to ask for forgiveness, even if foolish not to do so. The other reality is, we are all going to pay for the billions/trillions in aid, which if you accept that, not taking what is allowed means you pay (at least) twice. This led to a discussion about the loan app affirmations, and how to ethically live with them. I found many JD types who have posted their thoughts and opinions online, and finally came up with one which is not only reasonable and thorough, but is in mostly plain language. I know nothing about the firm, other than this one article, to take it for what it is worth. I am sharing this because I suspect many here have the same struggle personally, as well as hearing the same from their clients, especially with the press all over the now May 14 "no questions asked give back" date. The other issue is many applied the first day, before the Apr 23 information was published, and their terms were much looser. I have seen where a company is preemptively seeking a ruling so they can keep their funds based on the original rules, when they applied, not the Apr 23 rules. https://www.velaw.com/insights/new-treasury-guidance-on-certification-of-necessity-for-paycheck-protection-program-loans/ "There is no bright-line test for determining the necessity of a PPP loan." Their section under the heading of "Documenting the Good Faith Determination of Necessity" is the best advice I have found for a business owner to self handle.

-

I was sent that by a snarky customer who was disagreeing my suggestion to, under the present (and long existing rules) remember their PPP forgiveness is clearly not 100% of payroll costs, partially because the amount forgiven must be counted, less the effective tax rate for the company, proprietor, partners, whomever pays taxes at the end. This is not a "now" issue, it is a several months down the road issue. I chortled at the angry customer's message, as it was written as if AICPA sets the rules... AICPA is also begging for the PPP rules to be altered, such as letting the recipient determine their magic 8 weeks and raising the other allowed expenses to 50%, which some are reading as the actual rule, causing even more confusion.

-

Opinions Please - Workers Comp costs & PPP forgiveness

Medlin Software, Dennis replied to BulldogTom's topic in COVID-19

If one looked at it as not getting the loan amount 100% forgiven, but 8 weeks of allowable expenses forgiven, then one should be VERY happy. Makes sense actually, as the PTB seems to have wanted to get enough out to cover the 8 weeks, with no shortage. The extra amount is trivial in interest cost, and can be paid back once the forgiven amount is known. 1% annual on just over 2 months is all it will cost... We do not know what the forgiveness rules will be. I am hoping for a reasonable combination of incurred and paid, but even a literal "and" is still a great bene. Anyone who expected 100 forgiveness was not hip to the likely rules, or figured they could stuff expenses. It may even be that those who ask for much over 70% of their loan amount to be forgiven will raise red flags. I saw some wonk's calculation stating that flat expenses will result in something like 70 to 75% forgiveness (of the total) to be asked. (Too tired to do the math or look for it again.) --- I have a gut feeling the intent of forgiveness is mainly paid (cash basis), since there is supposed to be enough actual money out to match for forgiveness ask. I think the "incurred" ties more in with the no prepayment shenanigans. It could also be tied to something legitimately prepaid being allowed to 8/52 "in". Examples are some sort of annual bill paid during the 8 weeks might have to be calculated 8/52. Maybe someone pays health care quarterly for example, and the payment was just before loan funded, and 8/52 would be nice to have for this. I am getting asked all sorts of crazy (to me) scenarios, the latest was if I though an unpaid payroll from January could be paid during the 8 weeks and forgiven. -

Opinions Please - Workers Comp costs & PPP forgiveness

Medlin Software, Dennis replied to BulldogTom's topic in COVID-19

The 75% relates to the max forgiven, the max to be forgiven (currently) has to include at least 75% payroll type expenses. The loan itself, can be "offset" (so it is not fraudulent) on any allowable item, payroll, rent, any of the items on the application. Must separate the loan from the forgiveness. Should be no issue for an ongoing concern to eventually have enough allowed expenses to properly cover the loan amount within 2 years. The loan was only 2.5 months (in most cases) of allowable expenses. Forgiveness is an entirely different animal, with unknown rules at present. That is where the business as usual spending is the only viable option. On the side, practice calculating and planning for maximization, and if it can be afforded even if not forgiven, maximize to your comfort level during week 8. I feel for those who were funded early, and maybe their magic window closes before the rules are published, but some are fighting for some allowance in setting the magic window. -

Opinions Please - Workers Comp costs & PPP forgiveness

Medlin Software, Dennis replied to BulldogTom's topic in COVID-19

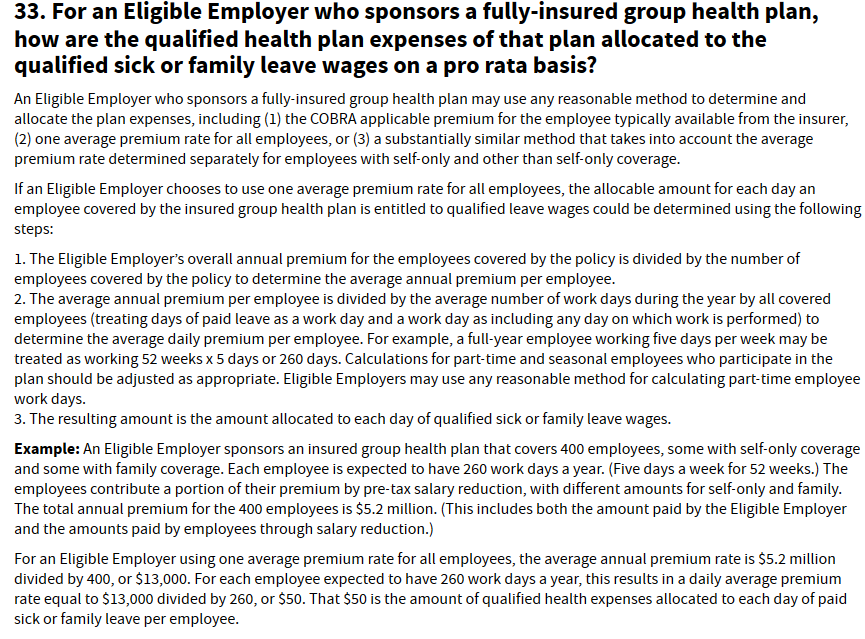

Here is one example the IRS came up with to calculate qualified health plan expenses for FFCRA PTO. Hopefully the SBA does something similar for eligible incurred items. -

Opinions Please - Workers Comp costs & PPP forgiveness

Medlin Software, Dennis replied to BulldogTom's topic in COVID-19

Just remember and remind endlessly, all is speculation until the SBA rules, and until you see your lender's add on rules. So normal business is best, with some planning for week 8 being reasonable, if it does not hurt normal business. The actual bank employee doing the review is also an unknown factor. For instance, if the examiner has no accounting or payroll experience, or has a large amount, they may be tougher/easier than someone with a modest understanding. Just like FFCRA, PPP was intended (and will be put on reelection post cards and sound bites) to cover all costs of having the employees. Neither may work out perfectly that way, but so far, that is how the DOL and SBA have been interpreting the law. Consider how the national WC group is/has making/made regulation so the FFCRA PTO wages, unlike normal sick or PTO pay, to be excluded from WC calculations. As John points out, some states do not fund WC the same way (WA is another example), so there will be variances. It I were a webinar maker, I would say normal course of business, if you can afford it, pay outstanding items during week 8, have an off cycle paycheck run on your last magic date, etc. In other words, try to spend as much as you can afford not considering forgiveness, which might be eligible, during your 8 weeks. The intent of the law implies certain things (incurred, paid), but it is how the policy makers interpret "and" is what we are all waiting for. Based on the FFCRA rulings, it could be reasonable the actual costs 8/52 could be included. It is also possible paid costs, which are not easily seen as pre or post payments, can be included. (And as being "in addition to" not "also".) And as already shared, even the 8 weeks is up for alteration... -

Opinions Please - Workers Comp costs & PPP forgiveness

Medlin Software, Dennis replied to BulldogTom's topic in COVID-19

Like I used to say in a former avocation, "it ain't nuttin' 'till I call it". Until the SBA finally comes out with the actual forgiveness rules/application, all anyone can do is guess. This was supposed to happen about a week ago, but the current "word" is May 15. Being late puts all PPP recipients in limbo, especially the ones who were able to secure a PPP early, since they have little time to adjust. Those who are funding now are in a bit better shape for forgiveness adjustments. This is a serious game we are playing, and the rules will not be decided until after the game is over for some... --- The current information is "incurred and paid". There is some talk of how to interpret this, but until the SBA rules, it is just talk. For now, I would take the known issue of pre or post paying items (don't) as being accurate, and stick with items you can show were "billed" or "paid" during the magic 8 weeks. (Even the magic 8 weeks has some possibility of being altered.) I would also be ready to only show the items which were incurred and paid as a backup, the ultra safe with today's information. Anything which is outside of the norm, say did not follow a similar pattern the last year, be ready to give a good business reason, not just because it can be forgiven. (This, opening an SEP so employer can stuff SEP deposits for nearly free is unlikely to fly unless it was planned and documented before March.) So Tom, at present, I would say the 8k, the incurred and paid is safe to pay and believe will be forgiven. (I would do the math, maybe the payroll is higher during the 8 weeks, which makes the averaging over the year not as favorable.) If the regular method, as can be shown from last year, is to make the $10.4k payments during the 8 weeks, I would personally do it, and try for that, since it is the normal course of business (with the idea "incurred and paid" will be softened). --- I am "over" the idea of what gets paid with what funds. The audit is not going to want to see what account money went into and out of, they are going to look at the funds loaned, and the allowable expenses proved. This ties in with going about normal business, and asking for forgiveness based on your normal costs. As long as you have enough allowed expenses to cover the forgiveness ask (and eventually the rest you do not return), you will be good. --- A similar issue (figuring out what applies) will come up with 941 forms. One of the items allowed to be added for credit is qualified health plan expenses "allocable" for FFCRA PTO wages. I have not found (or really looked yet) for a definitive explanation. The draft 941 instructions have no explanation. I am first guessing is is the qualified health plan costs calculated on an hourly basis, for the same number of hours paid for FFCRA PTO. This is not "incurred and paid" from what is known so far, only "allocable"... offering hope that there will be some sort of reasonable definition for this and PPP. (There I go, hoping for reasonableness from government...) --- Since the banker is going to follow the SBA check list (when it eventually comes out), plus the bank may add some things via their legal department, plus the individual banker may ask some things based on their own skills and knowledge, documentation is critical. What used to be common sense is critical, if it feels like PPP stuffing, it is PPP stuffing uless you can prove to a someone who did not get a PPP it was not. My current actual advice is to conduct business as was done last year, and not to stuff. There are exceptions, such as if it makes sense to pay a retention bonus to get laid off employees off the dole. If you receive a bill in your 8 weeks, pay it, even if you normally wait until the due date. Be prepared for a literal "incurred and paid" interpretation, just in case, and account for all costs during your 8 weeks, and try to pay those costs within the 8 weeks. (Even though I do not think it will really come to that.) --- Interesting also I saw something that the SBA is saying there is money left, keep applying. If that is true, then we may have hit the spot where all who want to apply, and can fill out the app properly, have or will be funded. This is great, as there is also a fair amount of talk about those who can scrape by feeling bad about applying, for the fear of blocking someone on worse shape. I feel different, if eligible, then it is a disservice to your business, employees, and customers not to apply, even if your needs are less critical then your neighbors. The first rule is survival. No different than trying to negotiate your rent, and accept your "earned" savings, even if your neighbor does not have the same skill. -

That could make someone fall of their bowl laughing. The other funny theory is the shortage was caused by people not being able to "go" at work, or bring home paper from work,m and had to buy more for home use. We all pay somehow, there is no such thing as free money... CA Prop 13, property tax limits, so we have crazy other taxes and fees. Certain areas pay for schools via wage taxes. My personal property tax includes sewer (I pay to go with my property tax, not my water bill), some include sewer with water fees.

-

If a check arrives, or a DD was made for my mother, it will be used to pay back admin expenses, and if the IRS tries to claw back, the estate can pay it. If a check arrives, I will likely get it via mail forwarding. If there was a DD, I will not know until at least July when the probate court date finally comes. I expect it will be a check, based on the little financial information I can access of my mom's... DOD was Pi day 2020, so it may be interesting to see how a check is addressed...

-

switching from Dell PC to IMac.

Medlin Software, Dennis replied to schirallicpa's topic in General Chat

As a programmer: The "features" of the different OS' are enough there is no one good programming tool to make an application appear the same on all platforms. There are some tools which can be used, but the resulting app is so "plain jane", it looks unprofessional IMO. If there was such a multi platform programming tool, I would give up my 20+ year tool immediately, but there just is not one that is good enough. While I am a small player in the game, the 800lb gorillas also agree, and if they have not done away with their apple apps, they are so outdated or limited, they are hardly functional. (Referring to general business apps.) Once there was good desktop publishing for Windows, the last/only niche for apple machines was removed. Web based apps are a possibility, but that seems to have gone nowhere either, such as chrome books. As with VHS over Betamax, the consumer has spoken, loudly, so unless you need or want to use an app which is only available or best works on a non Windows machine, Windows is the only practical way to go. -

Working though the form... Have the physical form worked out for printing, now onto the needed data! All is subject to change on the final form. FFCRA PTO reporting will require TWO totals, one for the "2 week" versions of the leave, and one for the "10 week" version of the leave. Not likely too many will be on the 10 week leave, versus UI, as the benefit is less than UI, and employers are likely to be willing to fire/rehire, but just in case, employers need to keep separate totals for the type of leave paid. There are MANY new fields on the 941, and a full page "worksheet" which needs some of the 941 figures to calculate, and some of the results going on the 941.

-

I have a customer who is on their 8 week clock, but cannot open. They hope to open during week 8. For them, paying a retention bonus makes sense for PPP forgiveness, as well as to entice some employees to get off the dole. It is a fine line as some want to stay on their 39 weeks of dole, as it is more income, but a rehire offer ends their UI eligibility. The employer is likely to "ask" who wants to work, with the retention bonus, rather than just rehire or quit option. Those who do not return will never be offered their position back. They are rehiring some now, and working them part time, with full time payment, doing things they can do while closed. -- EmployER paid retirement contributions are plainly countable as forgivable expenses. The dilemma is a moral one, as it is with any item you pay in your 8 week window which is not normal during that specific 8 weeks. If, for example, you would have paid into an SEP at some point during the year, and pay the same amount during the 8 weeks, that is just a timing issue, which many can live with (unknown about the bank auditor). If you start a new SEP plan, as a way to maximize, then it gets grey (at least). If you start an SEP or make an extra contribution, just to maximize, it may be harder to live with. If there is a deeper audit, by someone who gets payroll processing, then any out of cycle items could be flagged. Many employers will be altering their payroll cycle to weekly, with a payday on or about day 1. Many employers will be paying three months of health care expenses during their 8 weeks. Easy, and probably will not be questioned, as it is just a matter of paying the third item a little earlier than normal, such as the day the bill comes in instead of the due date. Watching out for easy to see prepayments will likely be needed. I suspect, but we cannot know yet, banks will have a set of audit guidelines. They will want actual tax type forms, check stubs/direct deposit records, and other actual documents, lease, retirement plans, etc. The bank has no incentive either way, as they are fully insulated (and paid well) as long as they perform good faith. I have been approached by a few people looking to back build payroll records, which I kindly decline (there are experts saying use some sort of payroll software, not hand done payroll). PPP forgiveness, can be easy, if one just pays as normal and does not worry about forgiveness maximization. Those that seek to optimize will work at it a little. Those that want to maximize will work at it a bunch, and take some risks. Likely, by judging carefully the bank's application process details, one can make a reasonable guess as to their forgiveness "details".

-

Draft 941 form and instructions have been posted in the IRS web site. The new 941 is three pages...

- 1 reply

-

- 1

-

-

To me, the process is interesting as it requires projections based on the impossible to know. Personally, my "hit" will not be until Q4 2020 and Q1 2021 because of the timing of my income. So in my case, it makes sense to spend more now, to try to alleviate the income loss later. Thus, hiring someone to free me for more programming raises costs now, but could lower income loss later (assuming I come up with something to generate more income). Works well for PPP expenses. --- Reading opinion from "experts" is also interesting. Getting to the max forgiveness seems to be a hot topic, and at least one online book. For instance, paying reasonable bonus amounts, giving short term raises, opening a SEP IRA and making deposits, etc. There is a sub specialty of information (opinions) for those who are self employed in some form.

-

Recovery attempts work best if the drive has been untouched since the data disappeared. Any sort of wiping or reformatting reduces the odds greatly. Before recreating, design and implement a good backup plan. 1. Decide how much work you are willing to recreate. For me, it is half a day. This becomes your minimum backup frequency. I backup onto: a portable drive connected to router, a second computer on my local network (my backup computer, ready to go if main fails), a web server I control, and an AWS cloud account. Twice a day "incrementals". Weekly full. Monthly full. Quarterly full. (I use Cobian backup and CloudBerry for software to upload/download to my storage points. I use two different storage software in case one fails.) I do not trust the online services. The main reason is most people use the defaults, and do NOT manage to backup all important data - not realizing it until they need their backup. 2. TEST AND RETEST. Unless you actually go through a simulated recovery (say into a separate folder on your drive), you have no idea in you know what if you really can recover. There is no point in having backups unless you routinely prove you can recover from them (use the recovery process, and make sure you are backing up what you need to recover). 3. DO NOT trust any sort of local network backup exclusively. Your local network may fail, your computers both get damaged at the same time, etc. You should have at least two different online/remote storage points in addition to any local storage. 4. Do ask the software vendor about any second set of local files. Unfortunately, if there was one, the software vendor would likely have already made it known as a feature. In my case, we store automatic backups (for power outage) in a special folder, and also in a folder the usual free or low cost online backup vendors may "catch" and use as part of their default settings. Candidly, drive space is no longer an issue, so all important software should be storing backups set on your drive as a cover for human errors.

-

Should be a rule, all ABnB owners should live next door. Would reduce the party house issues. Locally, such rentals require a permit process and license (ToT gets properly reported and neighbors have a chance to object), so depending on your relationship with the client, maybe ask if they have complied with all government regulations.

-

PPP discriminates against self employed

Medlin Software, Dennis replied to DANRVAN's topic in COVID-19

More PPP funds appear to be coming available, in addition to the 10 mill Shake Shack has decided to return... Time will tell if banks really do or did use first come, first served, as there are at least two class action suits already filed with clean appearing data showing banks processed high dollar (meaning high commission paying) applications first, then tried to stuff in a non statistically likely amount of lower dollar loans just before funds ran out. The commission amount is absolutely great income for a bank compared to their normal activities, especially so since they have no liability for the loans. I have no idea what the SBA rules are, or if there is any penalty for not going in order received, but this will be interesting to watch. -

PPP discriminates against self employed

Medlin Software, Dennis replied to DANRVAN's topic in COVID-19

Given the current lack of available funding, and the week delay for application, it is unlikely those who applied on the 13th have even processed yet, unless they have a special relationship with the bank they applied through. Many who applied on the 6th, right after their bank opened their process, are still waiting. At this point, it may be wise to at least consider something else, even if less beneficial. -

The cynic in me says someone's primary has passed, and no longer cares about the ramifications. The whole aid process was done so piecemeal because of bickering, there is no way anyone will understand it until it becomes history. But, I cannot say I could have done better, and I am not crazy enough to become a politician. The funny part (and comforting part I suppose) is at least the DOL is straight up about using their interpretation of Congress' intent, versus the actual law text.

-

Check the status via the tracking. I had to do the same the day before the budget shut down, and someone still accepted the piece even though the office was closed. It sat for a month or two before processed, but it was there.