Medlin Software, Dennis

Donors-

Posts

1,813 -

Joined

-

Last visited

-

Days Won

83

Everything posted by Medlin Software, Dennis

-

As a sidebar, Drake ended up, several years ago, buying a programming language, as I suspect they were heavily invested in its use. The programming language company was run by a major force in the modern use of the BASIC language, but he was not setup for his unexpected demise. The company floundered, and his widow finally found a buyer after a few years. I have not seen any further development in the language, despite what we used to call vaporware promises, which actually makes sense since they bought it for their own needs.

-

There are instances where the paying agency will issue a W2 or 1099, and the caregiver's situation makes the funds not wages and not taxable earnings. Seems odd, but it true, as the paying agency is not always in a position to know the tax status of the recipient. For instance, IHSS payments to a person residing in the home of the person needing care are not wages, but they do count towards EIC.

-

Here's a reason to not host your data

Medlin Software, Dennis replied to Abby Normal's topic in General Chat

SSN's cannot be considered private, and DOB (if even required to be stored, only in a handful states at present) for regular payroll needs (not counting HR needs) are certainly not private. The employer has a duty to not make the data any more public. I can make a great case allowing software to securely encrypt, then store online (encrypted again) is more secure than a desktop or laptop in any office, home, or wherever it may be. There are people who are using known insecure OS's. People who use no security, not even a Windows login. And so on. It really is (past) time to believe the end user knows the risks and responsibilities. Back in the 90's, sure, most computer users were computer experts. Now? Maybe a small single digit percentage. Heck, taking your computer to a "tech" is a risky adventure these days, as the "tech's" are likely to resort to wipe and reinstall, rather than do any investigation, and they are very likely not to be able to restore or retain all data. I am not saying online is the be all end all solution, just a great way to lessen data loss due to human action/inaction. I am saying proper online storage is exponentially more secure than data only stored locally. The majority of my time is pondering and trying to prevent the most unthinkable human actions. At some point, which may have even already happened, software has to be more about stopping things than actually doing things. -

Here's a reason to not host your data

Medlin Software, Dennis replied to Abby Normal's topic in General Chat

Hackers can find anything. The key is to have backups, and to anticipate total data loss at any time. Nothing wrong with having data securely online. Of course, one has to plan for no connectivity, as well as total failure, which means you still cannot get away from local live data and local backups. The recent well known issue is not the first, nor will it be the last. While there is uproar over the recent issue, more get upset when AMZ goes down and they cannot watch their streaming service. In my case, I have been resisting adding a cloud component until the right solution came along. It will be available this year, but includes a secure local copy of the data being maintained, not just online data. Essentially it is a forced backup, with the online backup being the working data. It will offer what many customers want, access from any allowed computer, such as home and office. Heck, data issues are not always hacker related. A couple times a month I hear from customers who are dealing with embezzlement and other employee caused issues. -

Just as the ability to repair physical things will always provide a living, so will dealing with government rules. As frustrating as it is, it is still a good reliable source of lifetime employment in any location across the country (even before remote work taking over). It is what I tell myself certain days, such as the Friday before end of year payroll forms are due out... How about WA Cares for grins? Tell employers to withhold, change the rules to still require withholding, but not remitting, and now a complete pause - with future instructions as to how to return what was withheld. While I did not follow too carefully, it walks like another case of a private concern offering some magic beans to politicians for their next campaign, while making a profit themselves, and in this case, the residents fought back and at least temporarily won. While I have my own feelings about the ever growing forcing of state "saver" programs (three states so far), I will undoubtedly buy stock when the company providing the back end, money management, and legislation samples, and selling (no pun intended) the politicians to their version of the holy grail, goes public (delayed by COVID). Or how the ERC for W4 was taken away after the fact, and the funds given to other "interests". Or how the Form 7200 which was supposed to get money to employers within weeks, took months, if ever, to get processed. I am still waiting for a refund for a deceased person, filed in Spring 2020. Had to be paper filed (I cannot remember why ATM), and while not a large amount, keeps the estate open while waiting. Then again, it could be the looming end of year payroll reporting deadline talking...

-

The ONLY way to be sure what was backed up is complete, and usable, is to do a restore. Replying on a "completed" message, or even seeing some sort of file, is not enough. The file could be empty, incomplete (not containing all you need), etc. After a few months, you will have a good idea of the size your backups should be, and monitoring size may be sufficient (in addition to 1x or 2x per year testing the full restore). "Security" software is usually not. There are plenty of baked into Windows functions which protect all but the most novice and inattentive computer user. This time of year, I get many messages from customers who claim my download does not work, when the issue is "security" software deleting files without warning. Ironically, a recompile will easily fool the security software (not that there is anything nefarious in my software). The flaw is not searching for known exploits, but the "security" software vendors WAG at what a future exploit will be. Plus, they have a FINANCIAL SURVIVAL interest in showing users they are being "protected", making false positives quite profitable, with little to no penalty. People believe their "security" vendor before believing their "security" vendor could be imperfect - knowingly! Plus, a good backup system negates the need for any add on "security" software because you could be back up and running in a short time, on a new or wiped computer.

-

Always makes me chuckle that the SSA programmers cannot strip out the non numerical characters. It is a simple function in any programming language. I would do it for you, but some of the other agencies which use the same file structure might allow the non numerics, and some customers like the non numerics for other reports. Also makes me chuckle when other agencies claim to use the SSA format with no alterations, which is only true about 50% of the time. For next year, send images of the error messages. Likely not something you have to change more than once, such as some sort of invalid character in a field.

-

As long as the "fireproof" safe is not in the same potential harm area as your computer, this is not bad at all. I would personally add one or two more drives, and make them monthly swaps, with the offsite storage at a different (third) location. A bit more work than using online backups as your second and third location, but can be easier to manage. Once There is a good backup system in place, keep reviewing it. Testing to see if the backups contain what you actually need, considering the area of "harm", etc. Backup plans are not "set and forget" - without testing, there is no point even having a backup! (When you get a duplicate key made, the first thing to do is see if it works....)

-

Maybe "Do you have a fiduciary, family member, or other person you would like to get copies of any documents"? Some will already have their affairs in order and a plan in place, some may not and you might even trigger them to consider their final affairs.

-

And more likely to happen, make sure you have a good full backup before letting any tech "expert" touch your "live" computer. Today's incident is a customer who thought they had some sort of nefarious software on their machine. A certain national company who comes to your site sent someone out, who "cleaned" things up by doing some sort of "tune up". (Likely an off the shelf software anyone can use, likely for free!) Unfortunately, whatever was done removed their PDF software, and the customer had no idea what PDF software is, or what it does, other than they could no longer view PDF files. This is not the first time I have had customers share their experiences in this vein. Usually it is a failed transfer of all data and programs to a new computer (which is way more complicated than some sort of $99 service can do), with the customer having no idea of the consequences, and having no backup. The next common is when a "backup" system is put in place, and when needed, it is found to only have the things in the pics, photos, and documents folders. Ironically, the same type of customer who relies on the call out services have never availed of our free - included - secure online backup storage, or even made a backup of any type at all. They usually assume we were somehow connecting to their computer to make backups for them. -- I assume I will (again) have to bug out with 15 or less minutes notice, so I have all things securely online in backup form, so I do not even need to grab my computer. The pro photos we do not have digital copies of, the photographer has them securely stored (we asked after our last bug out).

-

OR is a relatively easy state (compliments to the staffers who manage it). They are even enlightened enough to have a test submission process, which does not ever get mixed up with live data (calling out NY for an incident several years back...)

-

The most common "error" is not an "error", it is a warning, that the submitter and the employer's EIN's are the same. This is a warning only, and does not prevent submission. The SSA defaults to the submitter not usually being the employer... Next often is an incorrectly formatted piece of data, such as a phone number having anything other than the 10 numbers. Other than those two items, anything else is usually a setup or data entry issue, and is usually only seen with first time efilers. Personally, this is the first year I efiled W2 data, and both the signup with BSO, and the submission (with the warning about the matching EIN's) went smoothly.

-

Before treating and backup source as functional, test a FULL restore. Some online sources take an inordinate amount of time for a full restore... Plus, you may not have realized the default settings will not likely backup everything you wished to be able to restore. I am willing to repeat one day's work. Thus, I backup once a day, at my off peak times (lunch, usually). I have an SD card, an external hard drive, a personal AWS location, and a separate secure online location. I use various free or low cost backup software, such as CloudBerry and Cobian.

-

The upload process is done well, and "should" be an example for the other tax agencies. More so that they have baked in the accuwage (testing) process, instead of making folks download a new app (and possibly java) each year. The BSO and dealing with the likely case of forgetting the password you may not have used in a year, is another animal. Printing and mailing, especially if your software is approved for self printing on blank paper, is a snap., Especially since paper copies are needed for employees, and the employer. SSA will not be late in getting the forms scanned as they likely hold up personal returns processing waiting to try to match income.

-

I put one of my minions (kids) on that job. I too, used a call out service, once. I have seen where a local service has community locations from time to time and have heard of a bank or two offering a shredding day. UPS stores and mail drops may offer shredding.

-

The slow processing is yet another reason all TP's should spend the effort to not get into a refund situation, or a penalty situation. I suppose that puts extra work (if wanted) and extra income opportunity for preparers, as preparing a mock return before the deposit deadlines are getting to be a necessity, unless depositing 100% of prior year is not going to cause a refund situation. It will be interesting to see how fast returns are processed for 2021, such as for those who had a new child during 2021. Since the IRS failed to provided the planned method of reporting new births, those parents were not able to receive the monthly child payments, and will possibly/likely be wanting to get the credit (likely a refund) ASAP. Al eligible parents will be wanting their remaining amount of the credit as well...

-

There are other "self" issues. Consumer printers are completely unreliable as to where they print on a page. The "printable" area on a page may not be properly reported by the printer's software, resulting in not being able to precisely print at a certain location. In my case, I have to provide a way for users to manually adjust the print position. Just the slop of the paper feed system induces a certain amount of inaccuracy. (Jet printers generally flip the paper only once so pre printed numbered checks have to be reverse collated in the tray, and jet printers cannot print as close to the bottom of the page as other printers.) Then there is the issue with PDF's no longer being reliably accurate as to what the preparer wanted. The user can substitute fonts, adjust margins, etc., making the entire reason for a PDF (so it looks the same on any printer) moot. I get that issue nearly daily - why can I not save a "check" as a PDF and have someone else print it? Print quality is another issue. No bold, must use certain font's and sizes, etc. Of course, the user can cause issues there, by settings such as econo mode, inferior paper, old ink/toner, etc. Another issue is duplex. It is allowed on many forms, but consumer printers and paper choices may cause bleeding, which puts the submitter AND us at risk for penalty, so no duplex for us.

-

I have no idea what their process is. As some have said, include a check and send to the with payment address seems to get some response. Self scanning is not likely ever coming. I suspect the IRS is grabbing data only, not the entire form, so self scanning would not work (plus the skew and stretch issues). As someone who prepares data files for others to efile, the IRS is the least cooperative/friendly. While I would rather it be different, it does have the appearance (all tax agencies, not just IRS) of protecting turf. IOW, if it was reasonably easy to efile, many would be out of a job, and/or many would have a less complicated world to go to when they punch their ticket and go to private practice. Heck, some years there are form "changes" of an 1/8 inch or so, for no apparent reason (no new data, no change in overall placement, etc.). There are simply pressures outside of getting data into tax agency "silicon". Even my fav, SSA, has paper form issues. (Their efile is very stable!) Paper W2 forms need to be "approved" every year. The 2022 paper W2 was posted a few days ago. But, the black and white printed approval process will not even start until late Q3 or even Q4. I suspect the same folks who approve the forms (there are only one or two) have other priorities/responsibilities, but still... On top of that, the mailing address they give is not recognized as valid by USPS, so one cannot use priority mail to get tracking info!

-

NT-Just a mom bragging about her son

Medlin Software, Dennis replied to NECPA in NEBRASKA's topic in General Chat

Terrific news. Have a good friend who recently retired from UA (flight attendant) after more than 40 years. She was not even in the top 50 of seniority... Several other friends are A/P at SFO. One of our sons wanted to be a garbage man (we would not be allowed to ride with him!). Back then, there were no ready made garbage truck toys. Pilot was next, but at the time, his only route was through the regionals, and he prefers a different lifestyle. He then went into medical research for 5 years, and is now working towards trauma surgery. For us, we are most proud of his volunteer time at local free clinics, community based clinics, and at a VA facility. I fully expect him to take up flying again, once he chooses where to practice. (He is a strong believer in not being few times in the air per year private ticket guy. He wants to be up a couple times a month, at least, to keep current.) -

Question on asset category

Medlin Software, Dennis replied to NECPA in NEBRASKA's topic in General Chat

-

Question on asset category

Medlin Software, Dennis replied to NECPA in NEBRASKA's topic in General Chat

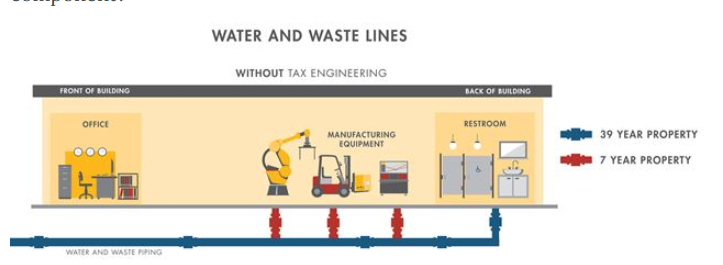

Interesting. (what used to be) common sense might lead to not be part of the building, since the item still has value, and may still be required to maintain, sans the existence any other improvements (such as a building). For instance, a bare lot in a subdivision or commercial lot might have the utilities prepped well before any structures. An RV park may have no significant buildings at all, just utilities for the sites. Also have to at least consider who is legally responsible. For instance, maybe up to the meter is the utility, and from the meter in is the property owner. Could be some other local custom is in place. -

Check your printer software settings. Unless ATX is forcing a setting, your printer settings will be used. Even when software asks for something, the printer may or may not respond...

-

E-file starts Jan 24th, I think

Medlin Software, Dennis replied to Catherine's topic in General Chat

I would not expect any earlier, now that the IRS is likely matching to received W2 data. With employer W2 deadline being end of Jan, starting accepting returns about a week before (likely queuing) seems to make sense (not than sense has anything to do with it). I still say no one should get in a refund position, ever more so with the delays which may be the new norm. (Exception for those who have more refundable credits than liability.) -

CYA. The old provider only has figures until they were fired. Whether or not they should even have issued a W2 is something I cannot answer. Likely though, they were contracted to "handle" the payroll, including funds, so they are also in the liability chain for then they were engaged. Thus, to C their A, they filed forms using the information they had. The new provider was likely (and properly) given existing YTD figures, so the checks and reports they create would be accurate. This is the "rub", as they prepared complete year forms, and not just forms from when they were engaged. The employer needs to find out if both were submitted to the SSA, and go from there. Hopefully the former company did not file. If the former company, or both, filed, then the employer will need some "c" forms submitted.

-

Sometimes, yes. Personally, after decades, I can get dry and factual. I also lean toward being candid. It is not a normal CR thing, to be candid. Most teach and do the sugary type of replies. I just can't. Yes, it is faster for me to be candid, but it is also faster for the customer to get a clear concise, no BS reply, even if they are the issue. I try hard to not make judgements, even when being lied to. I rarely even look at the sender information, not even to confirm if the person is an actual customer. (One exception is when I suspect it is a third party, such as a computer "expert" trying to get me to help them do their job, or fix their error. Usually it is a transfer to a new computer failure type of problem.) As one of my customers, you likely have received such a message from me at some point I am "over" the rude customers, and those who try to blackmail (it is a thing, "give me something for free or I will post negative things all over the internet" is one example). I cannot control them, so I do not try. I stopped monitoring reviews, as there is nothing I can do about them. Engage, and they get what they want. Thankfully, I have a well defined (to me) type of customer, and enough of them to stay in business. Even more fortunately, some will write to express thanks. And of course, I have been allowed to post here which can be good therapy. Even though this is a public forum, where anyone can search, my venting will sometimes attract customers who feel like minded. To end this post with a good, I was able to locate a certain bit of information last night, needed by certain customers (but not yet in the public domain), and one of them emailed to ask for a copy of the reference. I appreciate those who trust, but verify... and they expressed thanks for being on top of things. Candidly, I pay for a service which ferrets our certain things, as I just don't have the resources to do all of the research myself. I still usually find the data before the paid resource, but having a second "set of eyes" on things means I miss less (if anything at all).