Medlin Software, Dennis

Donors-

Posts

1,813 -

Joined

-

Last visited

-

Days Won

83

Everything posted by Medlin Software, Dennis

-

Tax provisions in the American Rescue Plan Act

Medlin Software, Dennis replied to Yardley CPA's topic in General Chat

Great sentence. I try to remember, even when I am certain I am correct, others may have different experiences and perspectives. I fight this one often, as I am of the mind of taking action to fix things first, and have had to learn how to listen, and just share my experience without saying my was is the only/right way. I am facing a repeat of dealing with my instincts, as only a first grandchild can bring up. I have not yet - but it is inevitable - tried to force my opinions on the parents. We did spend some time explaining how we may share our opinions, but we are not the ones in charge, so our opinions can be ignored with no repercussions, and we will not be hurt when reminded we are not in charge! -

Tax provisions in the American Rescue Plan Act

Medlin Software, Dennis replied to Yardley CPA's topic in General Chat

Not preparing for others, I had no idea what this rule was. The first search result I opened was a case where the rule was waived for a short time, because of late changes (2013?). I definitely learned something. There must be a way to safely avoid stockpiling rules, such as the prior exception, if that is what makes sense for the TP's interests. I always look at the pubs similar to a DMV booklet. Good as reminders, but when it gets down to "it", refer to the law itself, if the pub is not including a quote of the law. Then, there are always considerations for how the rule is (if at all) enforced. Refer to the talk about S Corp owner health insurance not on a W2 as a recent example. Many offered ways to accomplish the proper taxation, even when the rule (has to be on a W2) was not followed, and none reported any issues with the "alternatives". We also are in a time when MANY employees and employers are ignoring nexus (work at home) issues. Indeed, the workplace rules are outdated, but they still exist. How many work at home employees have the required labor posters in a highly visible area? If EIP3 has a taxable component (as a quasi repayment in some cases), it is still a win to pay tax on the amount rather than not get it at all. -

Tax provisions in the American Rescue Plan Act

Medlin Software, Dennis replied to Yardley CPA's topic in General Chat

The tickler in the EIP's specifically is the "no pay back if too much received" rule. If it was accounted for eventually, then when one files would not matter greatly, as it would level out eventually. With the ability to plan and maximize, in certain situations, knowing any overage is to be kept, is what has people jumping to see how they can maximize. While a PITA because it is new, and short timing, it really is no different than any other tax planning. As I see it, those who can gain (some would say game, but I call proper planning): A dependent who can self file for 2020 (covered in other threads) and deceased TP during 2020 with no filing requirement (File to get EIP 1 and 2 if not already received), 2020 income high enough to eliminate or lower credit (if not already filed for 2020). I could be missing other scenarios, like one someone touched on where EIP 1&2 might have allowed, with certain timing, for dependents to receive credit for two separate parent returns. -

Can't help with ATX. IHSS is not taxable wages if the provider and recipient reside together, such as parent caring for child/adult child/other adult (and possibly a live in, although that is not something I have researched). For TY 2020, CA seems to have resolved sending W2 forms to those who it does not apply to. The reason I mention it is it may be the receipt of the W2 implies the amount is taxable wages. You may want to get some sort of statement or affirmation from your client stating they only provide care for a qualified resident of their home. Also of note, in some states, not all states allow the provider to be a relative (CA does).

-

>2% Shareholder/Employee & Health Insurance

Medlin Software, Dennis replied to Lion EA's topic in General Chat

Close. The second W2 should also show the amount as state taxable (if the state has WH), and possibly some local taxes as well. 2008-1 states the amount is wages, so Box 1 resolves the federal issue. But other boxes/figures may need to be handled as well. In other words, the amount is taxable wages, unless specifically excluded (such as SS, Medi, FUTA, CA SDI, CA ETT, and SUTA). Gets worse, as some local items look at one amount as taxable and other taxes look at something else (sometimes varying within one state!). Worker's comp wages are another possible issue, one where the "company" may not want to include, but if the shareholder/employee needs to make a claim, they will rue not having WC wages reported correctly Does not resolve the employer issue, as the employer would have to create a W3c and 941x, and come up with some sort of note/excuse for not including the amount for WH calculation(s). -

>2% Shareholder/Employee & Health Insurance

Medlin Software, Dennis replied to Lion EA's topic in General Chat

I am losing my office room to make way for a "spare" room. My wife is simply giddy with anticipation (and shopping). She is arriving a few weeks early, once again, proving the kids run things around here. -

>2% Shareholder/Employee & Health Insurance

Medlin Software, Dennis replied to Lion EA's topic in General Chat

Keep it simple. Show your son the the math, the amount of taxes he will personally pay if the W2 is not corrected, versus the cost of getting a correct W2 and W3 prepared. No need for you to "bend" things to get the desired result, even for family. My own family coverage is >$24k per year, so it would be a good bit cheaper to pay even a crazy amount for the "c" forms versus losing the above the line deduction of the >$24k. -

>2% Shareholder/Employee & Health Insurance

Medlin Software, Dennis replied to Lion EA's topic in General Chat

It took me several years to get to a good place on this issue. What I mean, is from the payroll perspective, accepting it is wages needing to be reported via constructive receipt. While not likely enforced, a freshly minted auditor could win an income shifting case if the amount is only added to the W2, and not handled via paychecks. The "subject to withholding" clause is also important, point out simply adding the amount to W2 is not enough (despite the arguments it will be a wash because of the deduction). I get questioned by all sorts of people claiming my interpretation is incorrect, because most argue based only on the 2008-1 direction to include on W2, ignoring the part about "wages" and "subject to withholding". Online searching will usually result in links for the tax prep perspective, and the proper handling through payroll aspect is usually never noticed, or is ignored. I always admit to being human, as there are no better options at present <smile>. I expect a new cycle of proving I am human begins today, as I await the birth of my first ipok tek (grand daughter) today. -

>2% Shareholder/Employee & Health Insurance

Medlin Software, Dennis replied to Lion EA's topic in General Chat

Likely a costly choice. Likely not something caught either, so it comes down to your comfort level for the return information you prepare. There are so many opinions on this issue. Because 2008-1 was all about deduction ability, many ignore what I see as the key, the amount is wages. While the end result is mostly a wash tax wise, a proportional amount should still be added to every pay check because of constructive receipt, to avoid plain old tax shifting. -

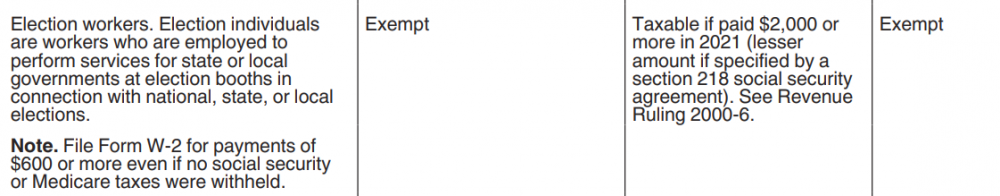

Correct! In the U.S., election workers are noted specifically in IRS Pub 15. They do get some possible exemptions, since the majority are one day workers, but once they reach a certain amount of earnings (as shown in Pub 15), their wages are subject to SS and Medicare. Yes, even government payroll personnel can make mistakes, such as issuing a 1099 for employee wages. (From 2012 Pub 15, Columns are: Type of employment, Federal WH, SS/Medi, FUTA)

-

Likely separate, especially with the EIP differences. I would also wait until the EIP 3 is determined (or fails) because of the net income by proper timing as discussed in a different thread. Assuming no other items which would benefit parents by keeping, if allowed, as dependent.

-

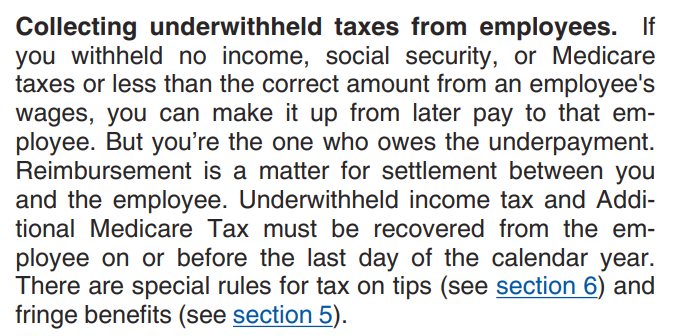

I suppose the employee could gross up their taxable wages to reflect the employer paying the employee shares, and file similar to a missing W2, if the employee is in need of filing soon. That may be what I would do if facing this (as the employee), since it leaves the rest of the burden on the employer, other than the employee needing to monitor their SS statements to make sure the correct amount of wages is reported, and the correct amount of contributions (probably a process for asking for corrections for those items). The employer, being a govt agency, likely is not going to fix unless pushed, as someone will have to take on responsibility for the error and associated costs, which is not something all govt employees (especially if an at will employee) may be willing to do voluntarily. (A bit jaded today, as I am dealing with a quasi govt employee who made an $8k blunder, and is hoping I let it slide, or that I will fall for their "if the insurer does not pay" clause. The issue was a medical billing coding error, and when prompted for a correction, they did not repair in a timely fashion.)

-

IMO, the W2 is not correct, not valid for the given employee, and should not be used as is. Reporting the amount as tips would not work for me either. The problem was caused by payroll, and that is where the solution comes from. The employee could choose another option, the form claiming the employer did something wrong, but that may bot be a comfortable way to go. I suspect, face to face (such as it is now) with a payroll manager at the county would get results. I suspect you could use it as is, and deal with the likely eventual W2c, but that could cost your client more money, and may not make them happy. The client has no responsibility, at present, to pay for the employer's mistake, which is why you cannot find a form to allow a W2 employee to pay their own SS and Medicare contributions.

-

That is not true. 941x and W2c exist for many reasons. Per Pub 15, the employer is responsible for depositing both parts. This would cause the need for 941x. Employee does not have to agree to pay the employer back, so the employer would then issue a W2c, which would include the amount "withheld" (corrected), and increased wages (the amount the employer has to add to cover the employee amounts the employer had to pay).

-

Filing Early Could Cost You $1,400 ?

Medlin Software, Dennis replied to JohnH's topic in General Chat

The proposed EIP 3 may give an amount for dependents over 16yo, unlike EIP 1 and 2. Still speculation, but there is no point filing early and losing what may be a gain. Example: Parents and one adult dependent (for the sake of this example, a disabled adult) Parents: EIP 1 and EIP 2, nothing for adult dependent. Parents elect not to claim dependency for 2020 (-500 federal, and for sake of example, -300 state), making adult child eligible to file and receive EIP 1 and 2 (+1800). If EIP 3 passes as proposed (1400, adult dependents eligible): Wait to file until EIP 3 is paid. Parents receive their own, plus 1400 for the adult dependent from prior qualifying TY. Parents then file, without dependent, and because there is no claw or pay back requirement, keep the 1400. Adult (the parents child) files, and receives their EIP 1, EIP 2. Likely for 2021, the child files separately again, to get EIP 3. With the proposed EIP 3, the net: Parents, +1400 EIP 3 for 2019 adult dependent, less 1600 for loss of credits on their 20 and 21 returns. Child, +1800 for EIP 1 and 2 (20 return) and EIP 3 of 1400 on 21 return. Parents, - 200, Child +3200, net +3000. --- Disregarding EIP 3: Parents -800 (20), Child +1800 (20), net +1000 -

Pub 15: Does not appear to be the TP's problem, other than possibly getting a W2c if the employer and employee do not agree on a repayment (causing the employer to add the employer paid employee amount as wages).

-

Filing Early Could Cost You $1,400 ?

Medlin Software, Dennis replied to JohnH's topic in General Chat

Timing is always an issue to be reviewed. In the case of the EIP's, there is timing to maximize, such as what is popular in the media, and items not so popular, such as an adult child not being a dependent for 2020 (but not filing until potential EIP 3 is paid, so the parents get the "dependent" amount, which does not have to be paid back, then the adult child files to get their EIP 1, 2, and eventually 3). No moral issues, as it is something done all the time, like bundling income and/or expenses for the best benefit. -

Parent died 12/3/2020 but didn't get 1200 stimulus

Medlin Software, Dennis replied to katri's topic in General Chat

I was able to use my mom's SSN to see no payment was sent (DoD 3/2020). While there was no requirement to file a personal return for 2020, as the PR, it makes more sense for me to be able to prove I filed, and a free efile process added EIP 1 and 2 for an 1800 refund, since I could not correctly say the EIP's were received. -

I see both sides (I am a programmer). In my case, I came to find out a few of my customers were creating negative amount paychecks. Problem is, there is no such thing. I know what they were doing and why, but they failed to realize the consequences. The reason for the error (and it is an error in their processing) is they never figures out the consequences were never having correct payroll records, and not accounting for the tax consequences of essentially providing a gift to the employee (in their payroll records). Indeed, they were handling the "issue" by collecting money from the employees, but it was not accounted for in their payroll records. I do spent a large amount of time trying to anticipate "moves" which a human might make, versus the "old days" when all computer users were experts in their own right. Whether or not allowing something makes sense has nothing to do with it, if a field is not supposed to be a certain thing, I cannot let it be entered incorrectly, as it will certainly come back to cost me in some way since modern computer users believe and expect their hardware and software makes them an expert, and will prevent them from making ANY mistakes. (The "I just paid to use your software, not teach me how to process payroll" syndrome.) Having come from a write software for my own use, to write canned software, it is a constant battle to remember canned software must try to handle even the most unexpected human actions (some say 90% of code is to prevent loose nut at the keyboard issues).

-

Could be a disabled over 16 child/adult, with the federal $500 credit (plus whatever the state offers, if any) as dependent is less than EIP 1, 2 and possibly 3. Good tax planning and action if the TP's figure it out.

-

"encountered an unexpected error" I would still report this to the software vendor. Proper programming "catches" and prevents this message - this is the message shown when the application does not handle an error - it is the OS's way of showing "something" before the application crashes/fails/exits ungracefully. Any time you come across a repetitive printer error, it is a good time to "clean up" your Windows registry. Unfortunately, there are almost always "remnants" in the registry. With printer "remnants", strange things can happen. I have never found an automatic way to clean printer remnants (maybe because I know how to do so manually?), but just a few days ago, I had to again. I use an outdated label printer. The software for the label printer is also outdated. From time to time, the software cannot "find" the printer correctly, and loses not only my saved addresses, but the label parameters as well. When I remove all remnants of the label printer, the printer software suddenly starts working correctly. If you are comfortable using regedit, you can search for a printer you know you have installed ("brother" as an example). When you see a registry item for the search term, you can examine the rest of the node to see if there are "old" items, and delete them. Or, you can remove all printer items, then reinstall your current printer/printers.

-

And still, CA will stick to the minimum wage base allowed by the feds, and the feds will not raise the minimum wage base, so even without the fraud, the CA fund will be upside down again, until the PTB slip some funds out of the general budget to cover the shortfall, probably after a few years of credit reduction. Example for one employee, no claims in ~30 years, for a recent year. 51% of the amount paid in is covering expenses caused by failed businesses, over payments, and by the fund not collecting enough from ongoing businesses. This is before the effects of the pandemic, on the state funds, will have to be accounted for. Several states considered changed for UI collection for 2021, with MN holding up their calculations until just a few days ago. CA, and most other states, just plowed forward, and are falling behind. As of a few days ago, 18 states are upside down in their UI fund (borrowing from the fed fund). The amount is over 48 billion. This amount is likely growing by the day. Employers in those states should consider planning for the first level of credit reduction of (.3%).

-

the 2020 version was posted (IRS) 2/7/2020. I do not see even a draft 21 version yet.

-

Second Economic Impact Payment for Non-Filers

Medlin Software, Dennis replied to JohnH's topic in COVID-19

I was just told I was blackmailing a customer because the 941 form was changed. -

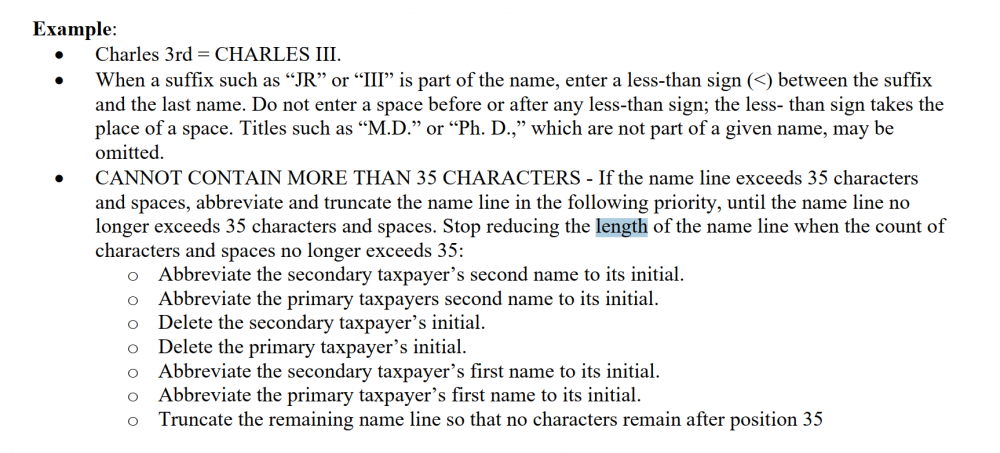

Snip from IRS Pub 4164. (The software could handle this, but the refund paper check issue might be a reason not to auto adjust.) This is just one example, but I have seen others where the name fields (combined) is limited to 35, and each part of the name is limited to 20.