-

Posts

7,725 -

Joined

-

Last visited

-

Days Won

510

Everything posted by Catherine

-

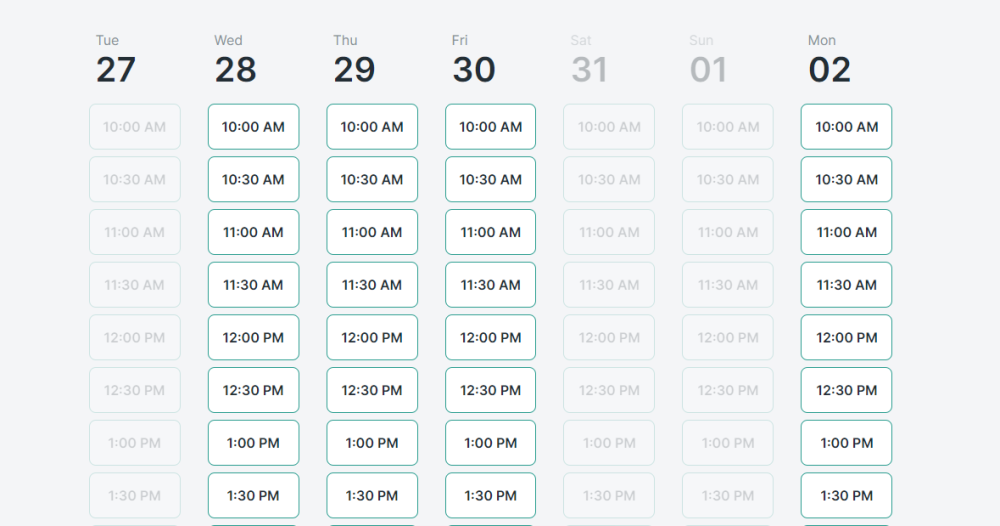

A number of years ago I started using the free version of you can book me. You set up times when you are available, and people can see all the times free and choose what they want. Confirmation goes out to them including a link to change it later if needed. Highly recommended! Looks like this:

-

How will Sch C and D look like for this single person (Crypto)

Catherine replied to Pacun's topic in General Chat

I had a client who mined bitcoin (briefly, for one year) some time ago. He did not track electric usage, and only got a few coins. Basically ran his computer overnight on it. So yes, bitcoin mining can be a hobby. -

That is not a good thing, and I'll watch Drake carefully as they move forward. Since I am slowly scaling back, it may be worth sticking with them just so as not to need to deal with a new program and vendor for fewer returns every year. Plus any new vendor may also get bought out by non-acctg, non-tax, buyers.

-

Way I heard it, the "confusing" aspect was going to be computer letters and taxpayer calls and responses in advance and after those - when they still have millions of unprocessed returns in stacks on tables.

-

I noticed that as well.

-

If I recall correctly, my method of reporting 1099-K transactions that do not affect taxes and are solely to prevent CP2000 letters (or state equivalents), came as a suggestion from either an IRS or state tax agency employee, when 1099-Ks were new. Their interest is "is there taxable income here?" only. If the answer is no, they don't want to be bothered with someone selling off their personal used work shoe collection.

-

This one is very hard. You need to talk to husband first. Get him to authorize, in writing, a third party (adult child? friend? attorney?) someone else to contact and discuss the situation if it gets out of hand. With the lady, perhaps sit with her and husband and suggest it's time for husband to take over tax papers. But you cannot contact anyone outside your clients without their written permission.

-

I think you are misunderstanding me. This method obviously does not apply to gamblers, or hobbyists, or an asset sale not reported on a 1099-B. Think of the person cleaning out their closet after quitting a corporate job. Never going to wear the "sensible pumps" to an office again, or the fancy suit either. Sells them on eBay, over the course of a year, one at a time as she gets around to it. None of the items are recent enough that she recalls where she bought them or what she paid for them, except to know she's selling for way less than they were purchased for. Gets a 1099-K for $610. None of that belongs on Sch D - they're extraneous possessions, not assets. Basis? Not recoverable. the only reason to report is to avoid any chance of an IRS nastygram two years from now when no one remembers anything about the transactions. I think that in such cases reporting on one line "1099-K from eBay, $610" and on the next line "personal items sold at a loss, -$609" represents what really happened, in a way that does not ask for a CP2000 letter, and without affecting taxes or adding forms and complications that just really don't belong and do not in any way affect the correct tax liability of the taxpayer.

-

Thank you, my friends here at the ATX Forum, for being such a wonderful group and such a wonderful resource for yet another year. May you all have a wonderful holiday season with family and friends, and a terrific year in 2023.

- 3 replies

-

- 12

-

-

-

That method doesn't work very well, @Sara EA, if what you have is someone selling little bits here and there on eBay and otherwise has no need for a Schedule D. Over a year it adds up, but also it doesn't even add up to a hobby let alone a business. Since I charge by form, adding in a Sch D/8949 charge when I could put it on the "other income" line and back off all but a buck (and that just to make the detail transmit, which it does not when it zeros out completely) is not fair to the customer and does not properly present the situation. I should think that reporting on a 8949/Sch D also opens the client up to IRS queries about why a 1099-K item was not then reported on a 1099-B instead.

-

To you and your family as well, Elrod! Plus, of course, everyone here.

-

The preliminary report-ers just haven't gotten to that section yet. Or did not understand what they were speed-reading.

-

How much does it cost to have a living trust set up?

Catherine replied to Pacun's topic in General Chat

One attorney I know takes a $10 bill from the trust creator and staples it to the attachment page of the trust, showing it has indeed been funded. -

What I usually do is enter the full amount of the 1099-K as "eBay payments" (or whatever), and on the next line back off $1 less, as "personal items sold no profit" so the detail transmits. $1 of taxable income won't change anyone's tax return situation overall.

-

13 composers fighting over the last slice of cake. Very well done. Seven minutes.

-

I'd rather blow $3.49 each and get EFileMyForms to take care of it all. I know for certain-sure that their system works.

-

How much does it cost to have a living trust set up?

Catherine replied to Pacun's topic in General Chat

If you don't fund it, you just spent a heck of a lot of money for raw materials for a fleet of paper airplanes. -

If there's an EIN, I file and mark it final. Last thing I want is a letter, two years from now, and having to dredge up the old information.

-

I have the signer sign "FName LName, under POA" - I've found there isn't room to be legible if there's more than that. Copy of POA stays in client file, not with the 8879.

-

Were you on the Eric Green class? I was there, too, and heard the same information.

-

1099-k that's not taxable is usually reported to the states (for reference, not for taxation), not the feds. There's an entry field in the general state tab.

-

I'll have to try the blue light blocking lenses. My progressive computer glasses live at the computer; there's a case there that holds my regular glasses when I switch. Never thought to deduct them, but they are right at my work-only computer and it's the only place I use them. I've found that with focus at computer distance they're fine to answer the door, fetch in the mail, talk to a client etc - they're all just a little fuzzy. I'd only try to drive in them if my regular glasses got crushed, though! And it would be straight to the eyeglasses store for replacements.

-

Ready for download. It required a bunch of microsoft .NET crap this year. Probably mandated "security" features or some such.

-

Love how the cat is having none of that.

- 1 reply

-

- 2

-

-

From what I read, at least one company claims it was "not aware" this was being sent and shut down the entire info feed immediately. For whatever that's worth. But yes, total violation of Circ 230 if they had any knowledge. If truly without knowledge & consent, then felony thefts of sensitive information. Public hangings to commence after speedy public trial and conviction?