-

Posts

407 -

Joined

-

Last visited

-

Days Won

1

Everything posted by Chowdahead

-

Tax professionals can now order more transcripts from the IRS

Chowdahead replied to Elrod's topic in General Chat

How difficult is it for a tax pro to sign up for this service? Seems like it would save me a ton of time when I occasionally need to help a client pull a transcript and the taxpayer online request side is a nightmare of complexity and works 50/50. -

I was thinking the same thing, but I assumed that if the reported amount doesn't match was was reported on the 1099-G, it may cause it to be flagged anyway.

-

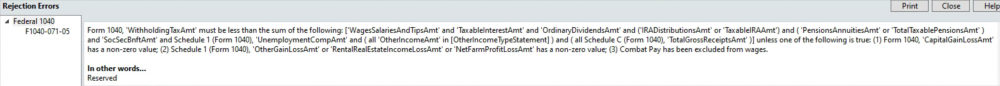

I have a client who made just over the Unemployment Compensation Exclusion: $10,341. When the exclusion is applied on Sch 1, the remailing amount is only $141 that transfers to the 1040, because she had no other income. However, she had $1,026 federal tax withheld from her unemployment compensation, so she's due a refund. She also claiming the Recovery Rebate Credit, but that's unrelated. However, I keep getting this E-File reject message (see attachment) which seems to be be a bug based on a rule before the exclusion existing. I can't seem to delete the exclusion either, and even if I could it would probably cause a delay anyway. Any ideas? I hate to tell this woman she needs to paper file. She may not see the refund until 2022.

-

Apparently the IRS will make the calculation automatically and refund the difference https://www.nytimes.com/live/2021/03/18/business/stock-market-today

-

I'm assuming this won't affect those taxpayers who used their previous year AGI to calculate their Child Tax Credit and Earned Income Credits, because this will just make their 2020 income even lower than 2019. And do we know if this will impact EIC eligibility? Or will the EIC still calculate the full 1099-G amount as part of eligibility for the credit? If it impacts EIC, I can see many people filing amended returns to both save on the taxes and gain EIC.

-

I had a similar client. Better to get it over with and pay the income tax. Also, to my knowledge the 10% penalty has been waived for 2020, and is not deferred, which is big.

-

So here is a weird one. I have some clients from 2019 who are Rideshare drivers. In 2020 their Rideshare income is way down or zero, they may taken a part-time job with little wages, and they also collected some unemployment benefits. They have kids but their 2020 EIC is near zilch. First of all, clicking the box on the EIC Questions tab to use 2019 Earned Income doesn't pull from the 2019 Work Sheet B for the Sch EIC. It pulls Line 1 of the 2019 1040 which is Wages. However, these folks have income on Line 7A from the 2019 1040, which is business income. When I open up the client's 2019 Sch EIC and go to Worksheet B, on Line 6 of Part IV, it says exactly what the Earned Income was for 2019. This is what doesn't carry over to ATX 2020. The strange part is that if I manually plug this number into the 2019 income on the Sch EIC, It generates a bigger refund than 2019 because although the same income amount is being used to calculate the 2020 Earned Income Credit, there are no self-employment taxes to be paid because the income was earned in 2020. This all sounds logical and perhaps it's a inadvertent benefit to self-employed filers but I just wanted second opinions if this sounds correct.

-

Came on here to ask about this as well. This is horrible. I too noticed the missing language related to Coronavirus on Line 12N of 5329. When I went to check the Form Update Report I saw a change was made to 5329 but no exact information about what was changed. This is horrible. I don't think I have any clients that hadn't been transmitted before this change was made. I was about to transmit a return and noticed the client now had a tax due when the penalty was reinstated and that's how I caught it. However, I'm wondering what is going to happen to those clients who I transmitted beginning Feb. 12 that had the old form. This doesn't appear to have been handled in the best way.

-

This is good news. I've read conflicting info on this. Also, can anyone confirm whether they would be eligible for both the (EP1) $1,200 and the (EP2) $600? Or would they only get the $500 for EP1 if they file a 2020 return and they are not someone's dependent?

-

Something new this year that I am seeing as a blue informational message when running error check is in the 1040 EdExp Tab. Client received a 1098-T with $1,500 in Box 5 Scholarships or grants. This reduces the otherwise amount i Box 1: Payments received. The blue message indicates "It may be more beneficial to choose to include tax-free scholarships or grants as income rather than allocate some to be tax-free." When I include the Scholarships amount on the 1040 under "Other Income" instead of on the 1040 EdExpTab, the client's tax obviously goes up but the refund goes up because the Lifetime Learning Credit increases due to not the scholarship income not reducing the amounts paid on the 1098-T. For some reason this does not seem correct, or am I interpreting this message wrong?

-

Thanks you. Forgot to mention, this is a single-family home and they lived in it for about 10 years consecutively. I will go through the 982.

-

With all of these e-mail alerts from the IRS about new scams and identity theft, I wonder why the IRS continues to do two specific things: When making a payment the voucher instructs the taxpayer to write their SSN on their check or money order. I advise my clients against doing this because a digital image of that check or money order could turn up anywhere and in anyone's hands. Even the voucher only has the last 4 digits of the tp SSN so I don't understand why the IRS continues to ask people to do this. When replying to a notice, there is a spot on the IRS that asks for the phone number and best time to call. Yet in all of the scam alerts from the IRS they specifically state that the IRS will never call a taxpayer, and that they communicate via mail, and if a person receives a call from someone stating they are with the IRS, then it is a scam. So then why request the phone number and best time to call? I'm sure I have seen other things, but these seem like the most glaring...

- 5 replies

-

- 10

-

-

Good afternoon. I need a clarification. When filing Form 982 based on a taxpayer receiving a 1099-C due to a short sale of their principal residence, does any of the amount from the 1099-C need to be included on the 1040, or does entering the excluded income from the 1099-C on the 982 and filing it with the return appropriate? I know that ATX doesn't carry any amounts from the 982 to the 1040. The reason I as is because including the excluded income it on the 1040 creates quite a tax liability. I just want to make sure it doesn't have to be included and the IRS will calculate the reduced liability after processing the Form 982. Thanks!

-

Good to know, but that's not free. They have to pay the $55 plus tax and then sit there and do all the work themselves and question if they missed something. Plus they need to make sure they retain access to a copy of their return for the future of they have to pay. I don't charge clients for copies.

-

So the IRS isn't asking. The software companies aren't asking. And TurboTax will update their software Mar. 1 to not even ask users the question. But you will continue to ask or require them to answer Yes or pay the penalty? Perhaps they should choose whether the box should be checked. I think many people may need that extra $695 or $1390 dollars in their pocket now rather than have to file an amended return in a year to get it back.

-

Many free programs either don't provide the option to file the state return, or they charge for that. Not expecting that, I suspect many filers simply don't file the state or put of for later and probably forget or never get to it. It baffles my mind that someone would use a free file program to avoid paying yet leave hundreds or thousands of dollars in a state refund uncollected...

-

Last week, in the middle of a busy day and sitting with a client I received a call at my office from a number listed in Georgia with the IRS identifying it as "IRS". Another staff member picked up the line but when they transferred it to me the line was dead. Several minutes later my cell phone rang with the words "US GOVT" on the screen and the number 1-678-537-8873. I answered and the male voice asked me for by first and last name. I was immediately on the defensive because I know the IRS does not call and does not ask for identifying information. However, the person sounded professional and identified himself as being from the IRS, gave me his name and ID number and said he was calling to follow-up on a certified letter sent to preparers in October (me mentioned the specific date) reminding of them of due diligence requirements for the EITC and ACTC etc. However, I know that many preparers received that letter so it was common knowledge. Then he said he needed to confirm some information from me. I was immediately skeptical but I felt that if he didn't ask me for any info that wasn't already public info, I'd play along. He asked me to confirm my name and full office address. Then he asked to verify the last 4 digits of my EFIN or SSN. At that point I told him that I could not provide such sensitive information over the phone For a second he seemed to stumble for words, then he stated that then he could not continue with the phone call. He gave me a phone number and e-mail address (which was printed on the October letter I believe) to contact if I had any questions. Then the call ended. I did a Google search for that number and there seem to be quite a few complaints online from people receiving a calls fake IRS agents from this Georgia phone number and they warn not to give any personal information. Obviously there have been IRS scams has been perpetrated on the public for at least a year but they usually involve claims of IRS debt and warnings of arrest or garnishment if not paid. Even I got one of those spam calls over the past summer. But this is the first time I have been targeted as a preparer. My guess is that this individual would have said he couldn't verify the last four digits of my PTIN then would have asked me to ready my full PTIN or SSN back to him to verify. Then he may have attempted to get me to provide personal information on my clients. I tried several times to call that number back but the lines goes dead immediately. Or maybe I'm wrong and it was actually the real IRS and I didn't cooperate with the phone call . But I'm skeptical because the IRS explicitly stated that they never call. They communicate via letter. I also find it doubtful that they would be calling On Feb 7. in the middle of peak tax season, when they are just as busy. My thought is this is a scam timed to take advantage paid preparers being busy and distracted and perhaps more susceptible to being duped. I wanted to warn you guys in case you see a similar call.

-

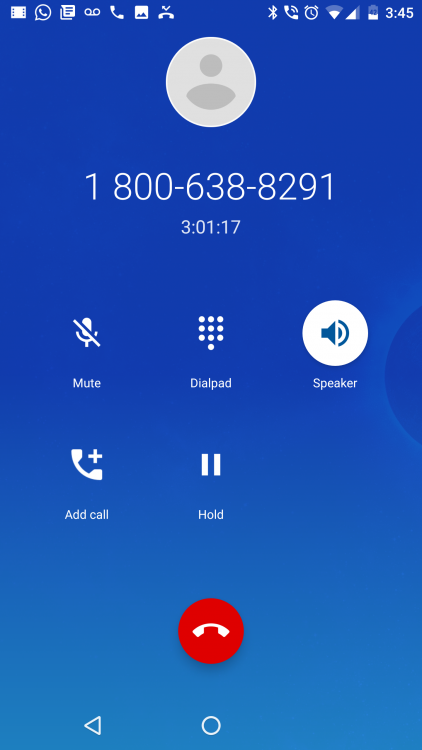

Yes I did at just over 3 and half hours. It was bitter sweet because the Rep I got was amazing. He was patient. He apologized twice for the other Rep disconnecting me. And best of all he was knowledgeable. He remoted in on my PC and was able to assist me. What happened was at the beginning of January ATX sent me a link to download the PaperlessPlus software but it still had the 2015 version. So that's why my activation code would not work. The two versions look almost identical. He was also able to clean up some networking issues and transfer my database over. I thanked him a million times. It was worth the wait. I am glad I didn't hang up.. I was tempted a few times.

-

Or you can can simply send them to the IRS's own FreeFile or TurboTax or Credit Karma etc and they won't be required to show any proof of anything to those services and file their taxes faster than the interrogation we are being asked to give them. But I digress... The 8867 and Due Diligence also do not stipulate what dates the documents need to contain Does the document need to prove more than 6 months of residency of the child in 2016? SO do we need a doctor's statement from January and another from July? What if the client only has a Jan 2017 document? It's mind-boggling... The IRS is slowly driving people to two different types of preparers... free or low cost online software on which they will probably make mistakes and not get the full refund they deserve, or shady fly-by night operations who will ask not questions and charge extremely high fees, and disappear after tax season. The honest, moderately-priced tax preparers are being squeezed out.

-

The ID Types make no sense. You can select Driver's License / State-issued ID, or Utility Bill or Bank Statement that requires a government ID to obtain, or a Non-Governmental ID. So what if someone only has a U.S. Passport, or foreign passport, or U.S. Permanent Resident Card? What do you select?

-

From an opinion piece on Fox News today: http://www.foxnews.com/opinion/2017/01/26/andrew-napolitano-trump-has-committed-most-revolutionary-act-ive-seen-in-45-years.html If a client faces a $695 or +$1,000 penalty, why would they want to pay it with the knowledge that it probably won't be returned to them if they pay it, and it won't be collected if they don't because the ACA is dead? Seems like a hard sell...

-

-

At 1 and half hours I was connected to a rep. I jumped right in. He started to look into the issue I am having with PaperlessPlus... and then I got cutoff, just to hear waiting music again. Back in the queue again. Are you freaking kidding me!! I am at 2:07 wait time now....

-

1:09 to be exact... and counting... this is crazy.