-

Posts

4,515 -

Joined

-

Last visited

-

Days Won

191

Everything posted by BulldogTom

-

Minister exemption from socsec/medi tax question

BulldogTom replied to Catherine's topic in General Chat

I struggled with this with a client I had many years ago. I just let them work it out with the government and God. They had the signed form, I filed the return. On one hand, they cannot opt out of SS when working outside the ministry. So they are only taking back what they were forced to pay under the threat of loss of property and liberty. On the other hand, if they really have an objection to taking government money, they should not take government money. I think a lot of ministers don't really know what they are signing when they opt out of SS. Most think it is just a loophole that the government gives to ministers. Tom Longview, TX -

^^^^^ What Judy said. 100%. Another thought....did you ever consider swapping roles with your trainee and working for that person for a couple more years? None of my business how you run your business...just talking out loud. Tom Longview, TX

-

I would guess her financial plan includes low enough income from years 60-65 to qualify for ACA insurance. That is a strategy I see a lot of people taking. If you have enough stashed to live off of and only generate interest/CG to get you above poverty level and below 200%, you get basic medical insurance for free. Smart planning IMHO. Tom Longview, TX

-

Will it affect our ATX software in any way? Or is that still to be determined? Tom Longview, TX

-

Can I ask some dumb questions? I have heard about ARM chips/motherboards, but I thought they were only for advanced applications (Data Centers, cloud computing on large systems). Are they coming to desktops and laptops? What is co-pilot and why would I want it? Tom Longview, TX

-

I think you are overthinking it. It was presented as a scholarship and it was used for tuition. I think it should be included like any other scholarship when you start looking at the education credits. Tom Longview, TX

-

@jklcpa Assuming the father lives for 1 year, do you think the transaction survives scrutiny by the IRS if the OP is carried out as planned by the taxpayer? Tom Longview, TX

-

IRS could invoke the Step Transaction Doctrine. Tax Advisor has a nice article on it - https://www.thetaxadviser.com/issues/2021/may/step-transaction-doctrine.html If you don't like links (like me) here is a brief overview. The IRS may apply the step-transaction doctrine, a rule of substance over form, in a variety of taxpayer circumstances to deny tax benefits derived from a series of transactions that should more properly be treated as a single transaction. The courts have developed three tests to analyze whether the step-transaction doctrine applies to a series of transactions: the end-result test, the interdependence test, and the binding-commitment test. Under the end-result test, if the separate transactions were component parts of a single transaction intended from the outset to produce the ultimate result, the step-transaction doctrine would apply. Tom Longview, TX

-

I agree with Judy (which is almost always the case!). I don't know that he will be better off if he took investments at the same value because we don't know the basis of the investments that he got. But for sure she gets full basis in their combined hands to calculate the gain and then 250K tax free of that gain. I don't see him getting 250K tax free gain from the investments. It could be her lawyer got her a better deal because the investments are very low basis and he will have a bigger tax bill because of it. If it was my client, I would stay out of questioning the divorce settlement. She had a lawyer to protect her interests and what came out of that is now fact. Looking back at the divvy up of assets will only run you down a rabbit hole you have no business sniffing around. Not telling you how to run your practice, but I am telling you how I would run your practice, because, well, you asked..... Tom Longview, TX

-

It is 39 Year property. 3K of depreciation makes 117K the office basis, which if it was 10% of the home it gets you to a 1.2MM home. Plausible. 3000 square foot home with a 300 square foot office? 7K of expenses does not sound like such a stretch if the home is worth that much, especially if there is a mortgage on it. Not sure about IL property taxes, but again, if the home is worth that amount, the tax bill is not cheap. Not saying these are facts, just making an observation that everything is plausible. If you wait until you file the 2024 return, you could slip in a 1310 and get the depreciation back....that is not the correct way to do it, you should amend and notify the plan administrator of the corrective distributions needed and pay the penalty for the excess contribution. You will get a 2024 1099R from them that includes the earnings. Tom Longview, TX

-

Just saw the Weather Channel and there is a big storm just north of Rita. Too close for comfort. Stay safe out there. Tom Longview, TX

-

Three magic words: "First Time Abatement". But consider if you want to use that up on this one. I would probably go with reasonable cause first. Take a POA, write the letter and put all the mangled docs in and ask pretty please to abate for reasonable cause. If they reject, then speak the three magic words and it will go away (providing you have not spoken the 3 magic words before). Tom Longview, TX

-

That is the 64 thousand dollar question. I am amazed that the IRS spends so much energy on not talking to the very force multiplier that they need, US! We can talk to them and get them what they need to close their cases, but they have treated us like the problem and not the solution for the last decade. Congress and the tax code are the IRS problems, not reputable tax pros. The IRS knows who I am. They gave me my EA license. They hear from me every three years when I renew. They gave me my PTIN. They collect a check every year for that number as well. They gave me my EIN for my company. They gave me my EFIN number. They gave me my CAF number. They know my SSN. They require my software provider to know my information before I can use a software that they approve every year. They can look up how many returns I prepare and how many POAs I have on file and how many times I call in and the number of returns that are selected from my client list for audit and the resolution on those audits. The Commissioner knows me better than anyone except my spouse. And they treat me like I am the problem instead of the TurdoTax software they allow on the market. I am just so fed up with the incompetence of the IRS leadership, especially the Commissioner. I wish he would realize I can get his backlog on my clients through the system faster than his staff can without me. Just staff the PPL line and let us work with the quality revenue officials, like we used to do when I first got my license. Stepping down from my soap box now. I feel better. Tom Longview, TX

- 15 replies

-

- 10

-

-

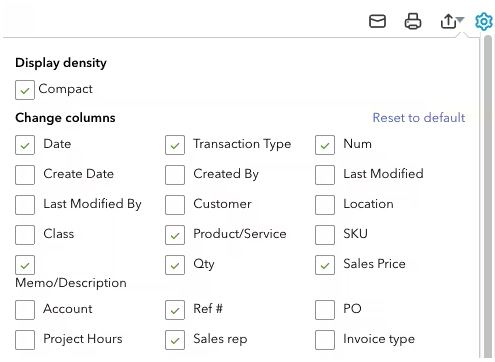

That is not it. On every report, there is a gear icon on the report itself that allows you to customize the report. It is how you can add columns (in my case, a customized field that I created) that are not included in the standard report. That gear icon does not have the tools showing anymore. Just the display density This is what I see.... This is what I should see..... Tom Longview, TX

-

I cannot customize my reports anymore in QBO. I went to the little gear icon and the boxes that you need to customize the report are not there anymore. So I get on QBO chat support and after 30 minutes, the chat "expert" ended the session after only verifying my account. Who do you think has worse customer support? IRS or QBO? Any QBO experts out there who know what I am talking about and know how to fix it? Thanks Tom Longview, TX

-

The client's lawyer should stick to writing wills and trusts. Disagree...this is just as much a tax issue as choice of entity is to a business. How to make the most cost effective transfer of wealth considering the circumstance and wishes of the client is something we can and should do. Tom Longview, TX

-

Why are you concerned about the rental use of the property? I don't think it is an issue. The trust is revocable, so the income while the grantor is alive will still go on Sch E on her personal return. When the grantor passes, the son will still get stepped up basis. He can then choose to keep it a rental or sell it as investment property. It seems to me that taking the property through probate is an unnecessary step (no matter how easy it is in the state) when you can just title it now in the trust and not have to take that step after the grantor passes. What am I missing that you are concerned about? Is there something else I should be considering? Tom Longview, TX

-

When you say son will get NJ home, is that per the will or the trust document? If the will states he gets the NJ home, then it goes through probate, but you said the will states everything goes to the trust? IF the NJ home is not in the trust, then the will controls and NJ home moves to the trust after going through probate, then gets titled to the trust and then distributed to the son as a beneficiary of the trust (if that is the way the trust is written). Seems very messy. I think the will is in the way as it relates to titled property. All the titled property (real estate) should go to the trust and is distributed per the terms of the trust after death of the grantor. The will can move the personal items of the decedent into the trust normally without probate unless there is a large amount of value associated with that personal property (Heirloom jewelry, expensive silver, artwork, etc) and if so these items should be listed as assets of the trust. IRAs should never, IMHO, be transferred to a trust. They should properly designate the beneficiary and move by operation of law to the designated beneficiary on death. Same with bank accounts and brokerage accounts that are supposed to go to an individual. TOD is a better option. If the trust is supposed to get the cash accounts, then title the account to the trust. Others may disagree, this is how I would advise the client based on your posted scenario. Tom Longview, TX

-

Sale of condo after death with life estate

BulldogTom replied to Margaret CPA in OH's topic in General Chat

And I learned something new today. Thanks for the education. Tom Longview, TX -

ATX payroll compliance is a very basic 941/W2/1099 program. It works. Tom Longview, TX

-

secure file sharing alternatives to Drake Portals

BulldogTom replied to artp's topic in General Chat

Can you walk me through the process a client has to go through to sign electronically through that application? I am finding more and more of my clients cannot print, sign, scan and upload back to me their 8879s. I want something cheap and easy that does not sell their personal information to the highest bidder. Tom Longview, TX -

I am not touching it. The potential for the client to not give updated information to report in the required timeframe scares me. The penalties are just too high to justify the potential revenue from the client. Plus, if I understand the rules correctly, you have to report yourself as the preparer of the document. Some will do this, I will not. Tom Longview, TX

-

ATX entry question - before the server move

BulldogTom replied to BulldogTom's topic in General Chat

Thanks. I will double check my material. I probably read it incorrectly. Appreciate you! Tom Longview, TX -

ATX entry question - before the server move

BulldogTom replied to BulldogTom's topic in General Chat

@Abby Normal Is half year appropriate? My understanding was you get the full year (20% of total costs) each year. Am I wrong? Thanks for the appropriate classification. Tom Longview, TX -

Asking now before I start this return - before the board goes dark and I go into withdrawal symptoms..... Have any of you done the amortization of R&D costs on an 1120 return yet? I have one in my extended pile that I have been holding waiting for the Senate to act on the bill that is stalled. I have not even started the return yet, but I am curious if there are any issues with entering in ATX. I know it is a 5 year asset (but which one). I think it should be SL, but how do I keep ATX from taking mid-year? I am getting to this return in a couple of weeks and would appreciate any advice on how to enter in ATX Fixed Assets. Thanks - this is my first return with R&D costs. Tom Longview, TX