Leaderboard

Popular Content

Showing content with the highest reputation on 02/06/2023 in Posts

-

2 points

-

I question that. For example let’s say charitable organization distributes meals to shut ins. Meals are delivered by employees of the org. and volunteers. Employee’s and volunteers all use their personal vehicles; and are all reimbursed under an accountable plan using the standard federal mileage rate. The standard rate is bases on the estimated cost per mile of operating your vehicle. For whatever reason, IRS does not allow you to deduct the full cost for medical or charitable travel. However, the cost is still the same whether you are driving for business, medical or charity. So if a volunteer/client came in and said they received $xxx.xx from charity as reimbursement for travel under accountable plan, I would offer the position that it is not taxable income over the standard rate for the charitable deduction. Instead, they have been reimbursed for the cost of operating their vehicle for the benefit of the organization. That also appears to be the position taken by Oregon DAS as mentioned above.2 points

-

Also, Direct Deposit for efiled 2021 1040 X is being worked on. Direct Deposit for efiled 2020 1040 X will not become available.2 points

-

"Next week the IRS will begin accepting electronically filed 2022 amended returns with direct deposit information. The IRS will not allow direct deposit if an amended return is paper filed." Every little bit helps1 point

-

"IRS issues statement about the taxability of state payments The IRS is aware of questions involving special tax refunds or payments made by states in 2022; we are working with state tax officials as quickly as possible to provide additional information and clarity for taxpayers. There are a variety of state programs that distributed these payments in 2022 and the rules surrounding them are complex. We expect to provide additional clarity for as many states and taxpayers as possible next week. For taxpayers uncertain about the taxability of their state payments, the IRS recommends they wait until additional guidance is available or consult with a reputable tax professional. For taxpayers and tax preparers with questions, the best course of action is to wait for additional clarification on state payments rather than calling the IRS. We also do not recommend amending a previously filed 2022 return."1 point

-

MN issue Covid Frontline Worker Pay, a bonus for folks who had to keep working onsite during 2020, and met certain income qualifications. It's non-taxable for state, but taxable for fed.1 point

-

There seems to be endless possibilities here. I think estate would have burden of proof that it was already taxed by decedent. Otherwise I agree with Sara, estate steps into the shoes of decedent and it becomes IRD.1 point

-

MA at least called these payments tax rebates, tying the payment to state taxes. If the client did not itemize, we're ignoring it. If they did, we'll check the property tax amount. For many in eastern MA, the $10K state tax maximum is more than covered by real estate taxes alone.1 point

-

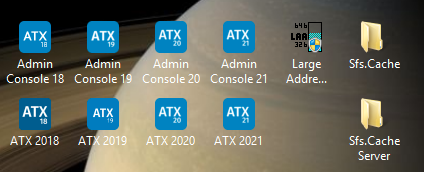

Program is in Program Files(x86)\Wolters Kluwer. Data is in ProgramData\Wolters Kluwer You can see the program location by right clicking the ATX icon on your desktop and choosing properties. You can see the data location by running ATX's Admin Console, which should be in your Windows menu, but I always put a shortcut to it on my desktop for easy access, as well as the Sfs.Cache folder. The cache folder contains temporary files that should be deleted if you're having trouble with ATX. I wish they'd delete every time you close ATX.1 point

-

1 point

-

And after all the trouble just opening the notice from VA, it tells you to go to their website to get your 1099G!1 point

-

Any state refund is taxes you previously paid coming back into your pocket. The state is just treating this as an increase in your refund, and is sending out the usual statement for refunds including this amount. What is interesting is that the people who had a balance due in 2022, and paid it before this "refund" was issued are getting a card saying they got this amount as a refund for 2022. So I guess we put the entire balance they paid in as taxes paid in 2022, and then put this amount in as a refund on page 1 of the return rather than netting the amounts? To top it off, instead of the usual post card VA sends, they have printed the postcard form, perforations and all, on 8.5 x 11 paper, and are mailing it in an envelope so i am getting calls asking what this is like i needed something to do this time of year.1 point

-

I believe that there are about 10 states that issued these payments. The problem is that many of the state laws implementing these payments, including California, did not legally refer to these payments as State Tax Refunds or State Tax Rebates, which is why the IRS needs to provide more guidance. Note: Washington, which does not have a State Income Tax is calling their payments a Rebate of State and Local Sales Taxes Paid . Film at 111 point

-

The state payments are a refund of taxes paid. So, unless they took a deduction for it off of their federal return, not taxable. Even if TP does not pay state income tax, they are paying sales tax. If TP income was so low they have no state income or sales tax, they aren't going to be having federal tax either. Same general concept as credit card rebates. If the rebate was for personal purchases, not taxable as it is deemed a reduction of payment. If the charges are for business purposes, then taxable because the full (pre rebate) amount was deducted.1 point

-

You have to open the return and use the E-file menu to Display Rejection Errors, even though it wasn't rejected. ATX needs to rethink this mess. Alternately, in E-file Manager, select the return and press Ctrl+R.1 point

-

And that makes messages useless because we'll all stop looking at them. 'Accepted' is really the only part I care about.1 point

-

California has already issued 1099-MISC to any "refund" sent. The letter with it states to contact your tax professor or read IRS publication 525.1 point

-

Unless the TP itemized state taxes and were not limited to the 10K, I don't see how this could affect federal tax????1 point

-

1 point

-

That wasn't it. Not a big deal and I'm not going to work on it but it's weird. I think I'll hide completed just so I know to look elsewhere.1 point

-

Did you mark it as "complete" and have the completed returns hidden? I do that so that I don't see the entire list all the time, only the returns that are in and not yet completed.1 point

-

Yes, but if you close out the message you can keep working. Abby gets the credit for that workaround. I do shut down the program every few returns, another Abby recommendation1 point

-

Marilyn, we are so alike. I nominally say I charge by the hour/time involved in my client cover letter but I am the timekeeper. Sometimes all the time isn't recorded/remembered or charged. I am aware of the situations of most of my clients and am sensitive to those struggling. Although my engagement letter states payment must be received before returns are transmitted, I have held to that once. And I always remind folks that I know where they live . In over 25 years I have been outright cheated once. I'm okay with that. And the vast majority of my clients are really friends, too. I recall one who broke down in tears the first time she came to me as her prior preparer 'fired' her and she was bereft. We worked it all out and she never cried again. And, at 76, I still work because I really do enjoy the work and the money pays for my exotic dive trips and my husband cannot say a word .1 point