-

Posts

119 -

Joined

-

Last visited

Profile Information

-

State

NY

-

Gender

Female

-

Interests

Taxes, Reading, Family and Pets

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

Form 9465 efiling with return - how does pymt work

Carolbeck replied to schirallicpa's topic in General Chat

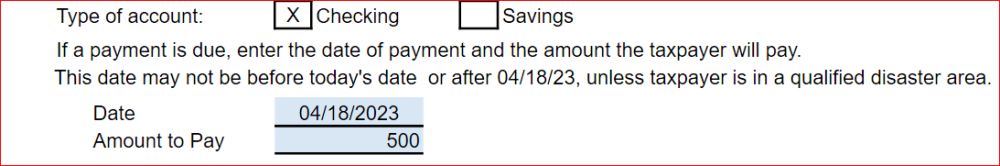

I have one this year that will be paying with the 9465 via direct debit. At the bottom you put how much they want to pay with the return on the installment on 04.18.2023. -

I Agree Catherine! I upgraded to the Final QuickBooks Accountant Pro 2021 (Desktop Version) last Fall. It works great, No subscription fees etc. No Nagging Critical Upgrade Notice. The only caveat I found that I had available with the previous version was that you could open a 2nd company at the same time. I found this very helpful with my Intercompany Transactions, but not a game changer of going subscription version for the 50 entities I do the accounting for. I will use excel or green ledger paper first before going subscription mode.

-

The message is "Thank you for using efile" Really IRS!!!

-

I Agree the 30% Backup withholding applies if recipient refuses to submit a W-9. However, hard to collect the Backup Withholding from a recipient when it was a one-off service and payment was already issued prior to having the mess of providing the 1099NEC etc that is dumped in your lap on January 28th... Just Sayin..

-

37 Years for Me. Started in 1985 working for Farm Credit working with Farmers. Become a Tax and PC Specialist over the 10 years working for them. I so love working with the Farmers. Started my home base business in 1995 after having my second child on April 14th of that year! Learned at lot there with Farm SP, Partnerships and s-Corps. Worked at Intertek Tax Department for a Very Large Global Corporation with companies all over the world. Moved Tax Department to Houston and I was laid off after 15 Years of working for them. Have kept my Home Base Tax Preparation business all during this time. Work now fulltime with an Environmental Consulting and Real Estate Dev company with 40 Different S-Corps and Partnership Returns along with all the accounting. I usually prepare around 80 to 100 Personal Tax Returns, mostly family and the Farmers I still work with after 30 years. Have no intention of retiring either any time soon. Hope every one has a wonderful relaxing and well deserved break until next season. Stay Safe and enjoy!

-

Thank God she is ok! Sending prayers and hugs. I so appreciate this forum too. My daughter had someone hit her from behind last week while stopped at an intersection waiting to turn on Route 13 in Ithaca on her way home from work at Cornell. Person not paying attention and on a cell phone. Her Tacoma has $7K in damages, but she is ok, and no injuries for either party. Most grateful.

-

Congratulations!! She is so beautiful! That is so exciting when it happens and you get to see.

-

Possible Solution for ATX not rolling over Drivers License info

Carolbeck replied to Abby Normal's topic in General Chat

Maybe I am old school, I just go into the ATX prior year and print the main page to pdf or printer. This way if the dates have expired, and NYS has a fit about that, I can ask for updated license. Plus we need the Doc# for NYS which can be anywhere on the license (Front, Back, etc) -

Where I had the NYS EITC issue is with the Federal Return allowing the taxpayer to use their 2019 Earned Income if that gave them a better EITC they could use the 2019 Earned Income vs 2020. Well NYS does not allow for that, you have to manually change the the earned income for NYS to be the actual 2020 amount, not just the 20% of the Federal EITC. Have many not so nice words for NYS Tax Department for this fiasco including dragging their feet with the Federal Non Taxable UE change. Yes it is Taxable, NO its not, wait we are thinking about it. No, passing legal marijuana legislation is so much more important! /s

-

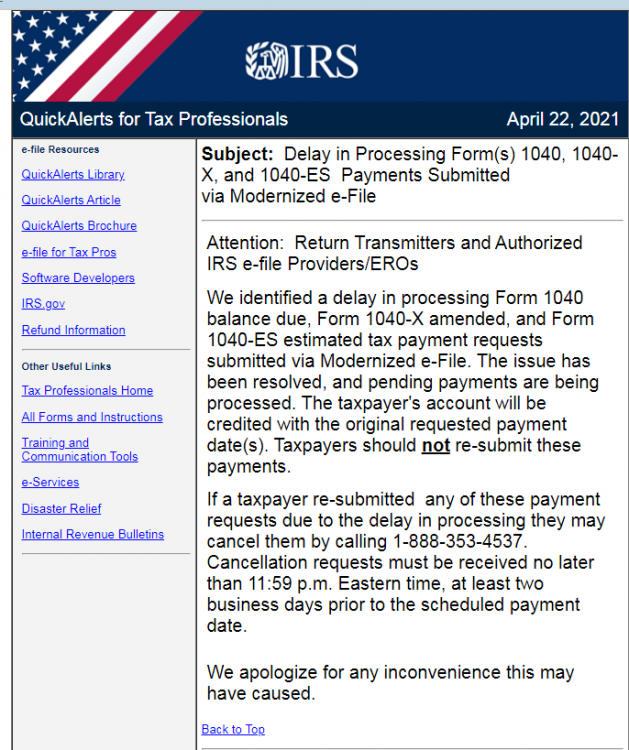

1040-V same issue like 1040-ES not being debited

Carolbeck replied to ILLMAS's topic in General Chat

-

-

Yippee!! I knew NYS would never go for non-taxing of something they can collect tax on. I held off filing until I knew for sure for clients with Unemployment. The early ones I had already included, so I do not have to file an amended. It certainly has been a long long tax season.

-

And we may not be out of the woods for not having to file Amended returns for the UCE. As per the IRS Newsroom Notification today: https://www.irs.gov/newsroom/irs-to-recalculate-taxes-on-unemployment-benefits-refunds-to-start-in-may For example, the IRS can adjust returns for those taxpayers who claimed the Earned Income Tax Credit (EITC) and, because the exclusion changed the income level, may now be eligible for an increase in the EITC amount which may result in a larger refund. However, taxpayers would have to file an amended return if they did not originally claim the EITC or other credits but now are eligible because the exclusion changed their income.

-

Just a Heads up if you are using ATX and open a early return already filed without the Unemployment Exclusion to see if corrected. The Federal is fine, but the NYS is not. When you include the IT-558 for the code A-011, the IT-201 is doubling adding back the excluded UCE. The only way to correct is to delete all the NYS forms but not the e-file form for NYS, (IT-201, IT-196, and the IT-558) and add the forms back in. This is just for the early ones that will have already filed before the American Rescue Plan became law. This is not an issue if you have not filed yet, but double check Lines 18 and 19. Also, NYS really has not made a definative decision yet. What a fun tax season!