-

Posts

386 -

Joined

-

Last visited

-

Days Won

14

Everything posted by Patrick Michael

-

Merry Christmas and Happy New Year to everyone.

-

Had one last year. Client received a W-2 for the part of settlement that was for back wages and a 1099 for the rest of the settlement. I also asked for a copy of the final judgement that showed the break down between pain and suffering, emotional distress, medical payments , and punitive damages.

-

If the company is less than 60 days old you can purge all data and start over. Did this once, many years ago, and I believe it deleted all the GL accounts, except for mandatory accounts. Here's a ink to instructions https://quickbooks.intuit.com/learn-support/en-us/help-article/intuit-subscriptions/delete-data-start-quickbooks-online/L0cpXkDlh_US_en_US

-

Thanks for all the responses.

-

Client had dementia and was in a nursing home. Her daughter misplaced client's 2022 SSA 1099. Daughter was working on trying to get a replacement, but she (daughter) passed away before she was able to get it. Client passed away a couple of weeks ago and a family friend is now trying to get her affairs in order. Any ideas on how the friend can obtain a copy of the SSA 1099?

-

I also seem to have a couple of these clients every year, most retired on a fixed income. I always tell them that, even if they can't pay, to file the return. It's not going to go away by ignoring it and will only get worse. I explain the failure to file penalty of 5% per month of the amount owed, 1/2% a month failure to pay penalty, and the interest. I then urge them (and offer to help them) to set up an installment plan to stop the penalties. I like to follow up the discussion with an email to document that we had the discussion so they can't come back and say I didn't inform them.

-

But, at least here in NY, property taxes rise every year by 3% to 4%! My home owners insurance went up over 20% last year. And, if I can get someone to come out to do repairs, the cost has risen dramatically.

-

You have to use the date of the submission as the payment date. It usually takes a day or two to get the acknowledgment back from NY, and the money comes within a couple of days.

-

So sorry for your loss. I had a "greeter" cat for many years and most clients looked forward to seeing him every year. Only problem is he liked to sit on my lap when I was preparing returns and if I wasn't paying the appropriate amount of attention to him, depending on his mood, he would start tapping on the keyboard, making for some interesting results.

-

" Taxpayers' eagerness to use free software provided by the Internal Revenue Service to file their taxes may be exaggerated because of the way a survey was designed, according to a new report." "Taxpayer interest in a Direct File tool may be overstated due to the design of the surveys conducted," said TIGTA. "For example, the Taxpayer Experience Survey did not provide a 'neutral' option for participants. Research shows that developing a survey with a five-point scale, to include a neutral option, rather than a four-point scale as used by the Taxpayer Experience Survey, is preferable because it does not put taxpayers into a "forced choice" response scenario. In addition, the survey prompt may have led taxpayers to believe that the tool would have more options than it will immediately have available, such as the ability to file State tax returns. An independent study by a Federally Funded Research and Development Center found that 60% of taxpayers would choose their current software when State tax returns are excluded from an IRS Direct File tool. The decision was made to proceed with a Direct File pilot based upon a 72% interest in a Direct File tool, per the Taxpayer Experience Survey. However, only 28% were 'very interested' compared to 45% who were 'somewhat interested.'" Goes to show a survey can be constructed to get the desired results. Looks like we may have more job security then we thought.

-

- 2

-

-

This is why I always tell clients to get, at a minimum, a certificate of mailing, certified mail with return receipt preferred.

-

"The Internal Revenue Service is reducing the annual cost of a Preparer Tax Identification Number after a court ruled that the charge was too high. The application and renewal fee will be reduced to $11, plus an extra $8.75 for payment to a third-party contractor, the IRS said in interim final regulations. That's considerably lower than the 2023 fee of $30.75 for renewing or obtaining a PTIN. The move comes after a federal district court ruled earlier this year in the case of Steele v. United States that the IRS was charging excessive PTIN fees from fiscal years 2011 to 2017."

-

From Accounting Today (https://www.accountingtoday.com/news/nearly-1-000-millionaires-havent-filed-tax-returns?utm_source=newsletter&utm_medium=email&utm_campaign=V3_ACT_Daily_2023%2B'-'%2B09292023&bt_ee=fMQ78G8x0gMlOszDL6tIXguYXicXpBsOOKz85EP29RhzrWYKXQsNoj1cFfCpLDXp&bt_ts=1695989439817) "Close to 1,000 taxpayers who earn over $1 million a year failed to file tax returns over multiple recent years, potentially owing $34 billion in taxes, according to data from the Internal Revenue Service. Senate Finance Committee chairman Ron Wyden, D-Oregon, revealed the data in a letter Thursday to IRS Commissioner Daniel Werfel, and urged the IRS to step up its enforcement efforts against wealthy taxpayers. Werfel announced efforts earlier this month to do that by focusing more of its audits on high-income taxpayers, large partnerships and big corporations. According to IRS data, the top 500 high-income individuals who still have not filed returns for each year from 2017 to 2020 owed $923 million and yet were unlikely to face serious consequences. However, only two of those 2,000 individuals were under active criminal investigation by the IRS and only 58 have been subjected to financial penalties such as liens or levies. The data showed that over 1.4 million wealthy tax cheats had still not filed required tax returns for tax years 2017 to 2020 and the total amount of unpaid taxes potentially owed by this population amounted to $65.7 billion. "Many of these high-income nonfilers are repeat offenders," said Wyden. "According to IRS data, 10,272 taxpayers still had multiple years of unfiled returns and six figure balances of unpaid taxes going back to 2017–2020. In fact, nearly 1,000 taxpayers making more than $1 million per year have failed to file tax returns over multiple recent years." Due to resource constraints and prosecutorial discretion, he noted most of the cases never get referred to the Department of Justice for criminal prosecution. Of the 10, 272 repeat offenders, only 154 have ever been under criminal investigation, and only 31 were in active criminal investigation this year. " Another reason why the average taxpayer has little confidence in the IRS. They send my clients, many who are retired and living on fixed incomes, letters threatening to place levies and liens on their assets over a $500 tax bill, yet these cheats get away with owing millions. Imagine what the return on investment would be if they hired more investigators and prosecutors to go after these tax cheats.

-

Non profit- fundraising - benefit to attendees

Patrick Michael replied to ILLMAS's topic in General Chat

You would have to determine what the motivational speaker usually charges the general public to attend one of his presentations. If the speaker does not normally charge for his presentations, then no value would have to be included. I believe the DJ and photo booth have a insubstantial value, and do not have to be included. The attendee's didn't receive any tangible benefit, good, or service and would probably would have attended even if the DJ and and photo booth were not included. I would make sure I documented the information that was used to make the "good faith estimate" of the FMV of the goods or services received. -

Had a colleague sign up to be a Ramsey "Endorsed Local Provider" after they promised he would get many good referrals and grow his business. Turned out he spent most of his time answering questions for free, with few new clients.

-

From Accounting Today (https://www.accountingtoday.com/opinion/tax-strategy-irs-expands-focus-on-digital-asset-reporting?utm_source=newsletter&utm_medium=email&utm_campaign=V3_ACT_Daily_2023%2B'-'%2B09252023&bt_ee=7jXmSOk9k89v2KKJINwG%2BptBxryLwmkr26gmdBbyuzYmd2vNQetW91Wy8I1QODYQ&bt_ts=1695643801434) "It appears that there will be a new broker reporting form, Form 1099-DA, to address the reporting of digital assets. For every digital asset sale, the broker is required to report the following: 1. Name, address and TIN of the customer; 2. Name or type and number of units of digital assets sold; 3. Time and date of sale; 4. Gross proceeds of sale; 5. Transaction identification number; 6. Address from which digital assets were transferred; 7. The type of consideration received, such as cash, other digital assets, other property or services; and, 8. Any additional information required by forms or instructions. Regs with respect to the computation of gain or loss and the basis of digital assets are proposed to apply to tax years after the finalization of the proposed regulations. The proposed rules with respect to broker reporting of gross proceeds apply if the sale is on or after Jan. 1, 2025. The proposed rules on broker reporting of adjusted basis apply if the sale or exchange is effected on or after Jan. 1, 2026. The information required to be reported may relate back to Jan. 1, 2023." Thankfully, most of my clients are older and want nothing to do with digital assets. Last year I only had one that did anything with cryptocurrency.

- 1 reply

-

- 4

-

-

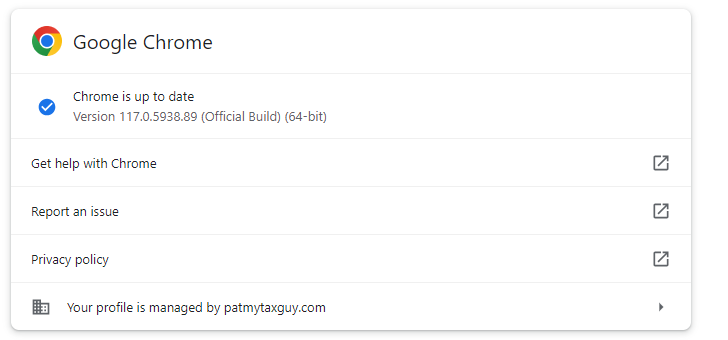

I go to the home page first thing every morning to make sure I'm up to date. I'm up to 117.0.5938.19.

-

In NY they look at a variety of factors to establish state of residency. In addition to the normal things they look for (time spent out of state, DL, voter registration, location of medical providers, banks, etc.) they also explore the old adage "home is where the heart is" to determine where items of personal significance were located, such as photo albums and other family keepsakes.

-

How do these companies get away with this for so long? After the first couple of missed payments why aren't they shutting these scams down? It seems to me this would be some low hanging fruit that would be easy to stop.

-

Most of the "We are trying to reach you about your car warranty" calls have been replaced with "Your company qualifies for huge tax credits because you stayed open during the pandemic" calls. I must get at least 10 of these calls a week. And I don't qualify for the credit, no employees and my income actually went up during the lock down!

-

Simplifying the tax code will never happen because it's used for far more than raising revenue. It is used to reward supporters through loop holes and credits and to push social agendas. Want to push EV's even though the market is lukewarm to them because they are not piratical yet, offer a credit. Want to reward your biggest donors, create credits and tax breaks that favors them. But it's not always bad. IRA's, 401K's, and other retirement plans do make it more attractive to save for retirement, raising the quality of life for seniors.

-

It's not that the IRS is having trouble understanding and applying this particular area of tax law that is troubling and evidence of cultural rot. It's that the IRS attorney's find it OK to back date court documents. If this was an isolated incident, you might conclude that this is a rouge employee stepping outside the rules. "But there are other watchdog claims made by three other partnerships—Arden Row Assets LLC, Basswood Aggregates LLC, and Delwood Resources LLC—who are asking the IRS to admit its staff backdated penalty approval forms in their cases as well" (https://news.bloombergtax.com/daily-tax-report/irs-backdating-court-order-spotlights-culture-attorneys-say). If a DA filed a criminal indictment, and back dated the indictment to get around a statute of limitations problem, would that not destroy the public's confidence in the system? As I learned in auditing class, the fish usually starts rotting at the head. The fact that these IRS employees felt it was OK to back date court documents should raise questions as to the integrity at the top. If there was a culture in the organization that condoned and penalized this type of behavior it most likely wouldn't happen. And it does impact our clients and society at large. Maybe not directly, but it does erode any confidence that tax payers have that they would be treated fairly if they ever had an issue with IRS. And it makes it easier for them to justify padding a deduction or not reporting the income from that side job if they feel, "if the IRS isn't playing by the rules, so why should I."

-

I had a class mate who ended up working for Grant Thornton. She was assigned to the team auditing the Social Security Administration and she told me the materiality threshold was in the ten's of millions (can't remember the exact amount). Leaves a lot of room for errors and fraud.

-

I found auditing very boring too so opted out from going the CPA route. After a couple of staff accounting jobs at private business's I landed a position as an accounting manager with the 3rd largest vegetation management company in the country. They also owned a Canadian company and I found the international component and consolidation work very interesting. They even paid for me to get my CMA with a nice raise when I passed.