-

Posts

389 -

Joined

-

Last visited

-

Days Won

14

Everything posted by Patrick Michael

-

No, that's not what I meant. I'm sure people have not filed for a number of reasons. What I am saying is I don't see what the downside is to filing now is since the information is already available and it's looking more and more like it's going to be required.

-

Most of my clients have already filed. I filed mine a long time ago and don't remember giving any information that isn't readily available from other public sources. The only people I see this affecting are the ones trying to hide ownership through a series of holding and/or shell companies.

-

Divorce/Retirement Benefits/Gilmore Election

Patrick Michael replied to peggysioux5's topic in General Chat

I had a client who didn't want to pay an attorney to represent them in a divorce since it was "cut and dry", so he just signed the paperwork from the spouse's attorney. The client had a nice pension from the state and they had to give half to the ex. The ex filed the paperwork with the state and started to receive half the pension. Tax time came and the 1099R was for the entire amount, including the wife's share. No QDRO was filed with the divorce decree, so he was stuck paying the tax on the ex's share. Ex refused to reimburse for the tax owed on their amount and it cost the client twice as much in attorney fees to straighten it out than they would have paid to do it right the first time. -

After the last tax season wrapped up, I received calls from 3 local preparers asking if I was interested in purchasing their book of business. Others have raised their minimum fee to over $500 for a personal return. I have been getting many people in panic mode looking for a new preparer. It looks like it's time to raise my minimum fees too!

-

The people who need the money the most end up paying outrageous fees to get their money back a couple of weeks early. Never offered them.

-

The mother's discretionary income does not matter when looking at the support test. Food, clothing, shelter, education, medical and dental care, recreation, and transportation make up support amount. The amount she saves, gives to charity, gifts the the kids and grandkids, etc., are not considered in determining her support amount. The amount of support for shelter costs takes into account the fair rental value of the lodging, including a reasonable allowance for the use of appliances, utilities, and furniture, not the actual amount spent. So if it would cost the mother $1,000 a month to rent a furnished apartment equivalent to what the daughter is providing, that is the amount used for the 50% support test.

-

I tell my clients that as long as their home is their principle place of business under § 280A(c)(1)(A) (“principal place of business” includes a place of business which is used by the taxpayer for the administrative or management activities of any trade or business of the taxpayer if there is no other fixed location of such trade or business where the taxpayer conducts substantial administrative or management activities of such trade or business) they can deduct all mileage, from the time they leave the house until they get home, as long as they are logged into the app and ready and able to take on passengers, under Rev. Rul. 94-97 (Rev. Rul. 94-47 amplifies Rev. Rul. 190 and Rev. Rul. 90-23 to provide that, if the taxpayer’s residence is the taxpayer’s principal place of business within the meaning of § 280A(c)(1)(A), the taxpayer may deduct daily transportation expenses incurred in going between the taxpayer’s residence and another work location in the same trade or business, regardless of whether the other work location is regular or temporary and regardless of the distance.

-

I don't understand enough about how Uber works to tall intelligently about there behind the scenes processes. He was a salesman all his life and really missed the personal interaction when he retired.

-

The "Check Box" expiring after a year is so frustrating. I often wonder why they even have it since, in my experience, most issues come to light after the year is up. It should remain in effect for at least the 3-year SOL period.

-

It's been almost 25 years since I took my cost accounting class and am looking to see if this makes sense or if I'm missing something. I am using round numbers. A friend started driving for Uber and we discussed whether or not it was financially worth the effort. He is not concerned about his time since he is retired, he enjoys it and it gets him out of the house. He had made about $10,000 and racked up about 7,500 miles. His taxable income would be $5,125 ($10,000 less $4,875 mileage deduction), $3,900 after taxes. This got me thinking: is this the true income? I would argue it is not. The only true variable cost in the mileage rate is gas. He would have to pay for insurance and licensing whether or not he drove for Uber. Repairs and depreciation are a mixed cost, as he would still have to make the repairs and the car would still depreciate even if didn't drive for Uber. I used Kelly Blue book to see what impact the added mileage had on the value of the car, which was $600. He had $500 in repairs (none of which were directly attributable to driving for Uber) and the business usage was about 40%, making the repair costs attributable to business use $200. He gets 25 MPG and gas in this area is $3 a gallon, 12 cents a mile, making his cost for gas $900. Looking at the cash flow, the true cost of driving for Uber is $1,700 ($900 for gas, $200 for repairs, and $600 for depreciation) making his true income $8,300. After taxes, he has about $7,000 more in his pocket driving for Uber.

-

There is no need for apologies. I have been using Drake for about 20 years and find some new features every year! I just filed it and it worked just like any other e-file, sending the form to Drake. I have to wait anywhere from 2 days to 2 weeks for acknowledgment. This is only if the 114 is more than 2 years old. Current and prior year can be done through Drake.

-

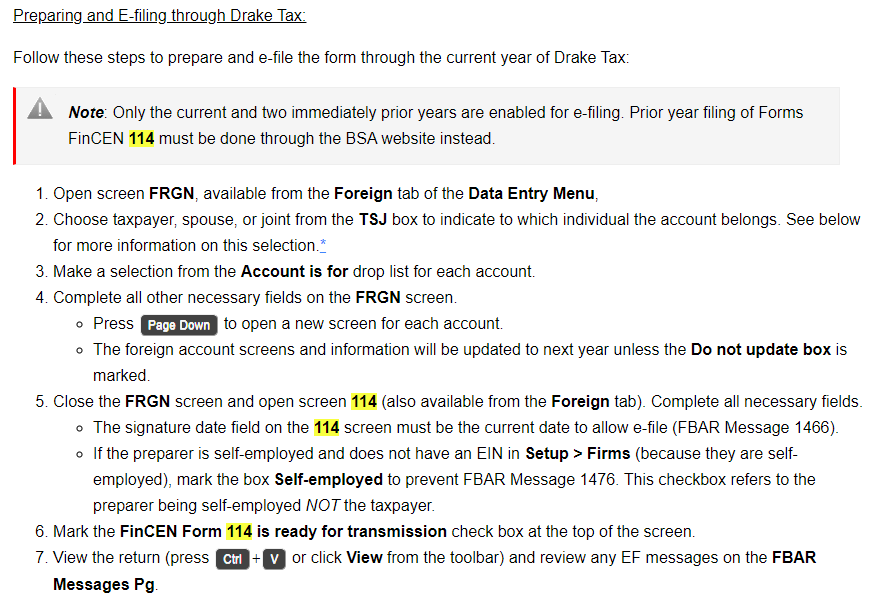

Judy, I'm a little confused. Here are the instructions from the Drake Knowledge Base on how to file e-filing through Drake. Am I missing something?

-

Thanks for the information. I use Drake and believe I can file it using the software. And I am charging for this.

-

After 25 years I finally have a client with a foreign bank account with a balance over $10,000. I have read up on it and is it really as easy as entering the bank name, address, account number, and maximum value on Form 114 or am I missing something? They don't meet the filing threshold for Form 8938.

-

Depreciation setup for apartment building rental

Patrick Michael replied to jklcpa's topic in General Chat

I'm not sure what program you are using for tracking the depreciation. Many years ago I used a program (I believe it was MAS 500 Fixed Asset Manager) and it had the capability to assign a department to an asset that could then be used to generate reports based on the department. So instead of setting up separate categories, we used the department field to assign the assets to the specific units. -

What a great father! Mertz's father was an 80% owner of the company and left his son holding the bag.

-

I freelanced for a CPA firm and helped with several ERC claims. We would analyze to ensure they are qualified and provide the client with a detailed report with the numbers. The payroll provider would have a form to fill out and file the 941X and either give a copy to the client or make it available on their website.

-

You can not use the installment method if there is a loss. See Pub 537.

-

Same here in NY. I do a quick calculation to see if they are close to the NY standard deduction. If yes, then I'll ask for missing items; if not I don't bother. Most don't come close.

-

Insurance Rider for Instacart driver

Patrick Michael replied to Patrick Michael's topic in General Chat

From what I know Instacart requires you to have auto insurance. But most personal policies do not cover you if get in an accident while making deliveries (and many companies do not offer the riders). Not sure if Instacart checks to make sure you actually have insurance and it covers you while making deliveries. I am surprised NY, which highly regulates the insurance industry, has not addressed this issue. -

Client recently started driving for Instacart and obtained a rider on their car insurance policy to cover them while delivering. They asked if the premium for the rider, which is separately stated, is deductible in full as a business expense. At first, I thought it is included in the insurance portion of the standard mileage rate, so no additional deduction. But then I got to thinking that it would be deductible, in addition to the standard mileage rate, since it only covers them while making deliveries and is separately stated, so you know what the amount of additional premium is. Has anyone else run into this situation and what are your thoughts?

-

If itemized deductions revert back to the old rules I dread the "use the number as last year" responses when asked about charitable contributions and the "I donated thousands of dollars of used clothes". Right now about 95% of my clients use the standard deduction and I may retire if I have to go back to filing out Schedule A for a majority of them.

-

any NY payroll workers comp experts here?

Patrick Michael replied to schirallicpa's topic in General Chat

Workers’ compensation coverage IS NOT required for partnerships, LLCs, and LLPs that do not have employees. Members and partners are not considered employees for the purposes of obtaining workers' compensation insurance, but may voluntarily cover themselves under a workers' compensation policy. I would respond with a copy of a copy of their most recent 1120S showing they are a single member LLC. https://www.wcb.ny.gov/content/main/coverage-requirements-wc/llc-llp.jsp -

McDonald's recently announced that they were scrapping their test of using AI to take orders. Although they did not give a reason, insiders say the system was getting orders wrong. If AI can't handle my order for a Happy Meal, how will work with much more technical issues?

-

I had the opposite problem with a practice I purchased several years ago. She was charging less than the going rate. I figured I would raise those rates by 15% every year until they aligned with what I charged. I lost some clients in the first and second years but it didn't matter since I only paid her for returning clients. The third year came around and many of the clients that had left returned when they didn't like the cheaper preparers.