-

Posts

5,207 -

Joined

-

Last visited

-

Days Won

325

Everything posted by Abby Normal

-

APIs are application programming interfaces, which enable different applications to exchange data and could be used to move IRS data to the cloud and access it there. DOGE has expressed an interest in the API project possibly touching all IRS data, which includes taxpayer names, addresses, social security numbers, tax returns, and employment data. Great. That's all we need. All our IRS data easily accessible in a cloud server.

-

Efile 1040X

-

With low mileage and high vehicle cost, actual will likely be better until it's fully depreciated. But it's always a tough call.

-

I give them 2024 1040-V forms.

-

If he was using software, the loss would automatically be carried forward... unless he deleted the Sch D because there were no transactions that year. Try getting the oldest transcript the IRS has, get a POA for 2000 through now, and maybe call the IRS after tax season.

-

I'd tell him that unless he has proof of the loss and also proof that it wasn't used up by capital gains in the interim, I can't deduct anything. I find it hard to believe that any preparer wouldn't be deducting that capital loss every year, and carrying it forward.

-

Brain Dead - Need help with NR state allocation

Abby Normal replied to jasdlm's topic in General Chat

That's a good question. I guess I'd see what the other state says about S corp distributions, but my inclination is to go with resident state, like the W2 does. -

Negative pressure cases, the typical old style, had fan(s) that blow out, which makes the case suck in dust from every crack, crevice, drive, etc. Positive pressure cases, have fan(s) that blow into the case giving you one access point for dust. Most just have a screen that catches most of the dust, but some actually put a thin filter over the inlet that you need to clean. In the days of big computer rooms, the entire room was positive pressure to keep dust from crashing hard drives that were not sealed. The hard drives even had filters on them to keep dust out. I remember changing those filters on a mini computer I worked with. /end stroll down memory lane

-

I only buy positive pressure cases. Are they all made that way now?

-

Just want to verify I am doing this correctly

Abby Normal replied to joanmcq's topic in General Chat

Is there any income to be distributed? Was the house sold at a loss, like it usually is? The charities get their specific bequests and the bene's split the rest 1/3 each, but so 33.33333 is correct, but make one 33.33334 so it adds up to 100. -

About $500 if MFJ. Probably $800 for MFS.

-

List as part of proceeds, or as part of basis?

Abby Normal replied to Catherine's topic in General Chat

Someone's got broccoli brain! -

My last computer lasted 12 years, thanks to swapping in a solid state drive. I ran Windows 8 that entire time. I thought Windows 8 was the best OS Microsoft ever made, and I'm not sure my opinion has changed, yet. I skipped 10 and I'm tolerating 11.

-

I had a huge book with a disk called DOS Power Tools and I was DOS wiz. I hated having to start over with windows, and waited until Win95 to make the move.

-

List as part of proceeds, or as part of basis?

Abby Normal replied to Catherine's topic in General Chat

It's late season which means it's also fried brain season. Good luck! -

All contributions are entered in the same place, 8889 line 2. You can use the jump arrow twice to get to the input worksheet. If the birth dates indicate that they are over 55, the limitation will automatically increase.

- 1 reply

-

- 2

-

-

List as part of proceeds, or as part of basis?

Abby Normal replied to Catherine's topic in General Chat

On the 8949 it's a columns f and g adjustment code E for selling expenses, which reduces the gain as an addition to cost basis. -

Maybe they can find a computer museum that wants them... or just some nerds.

-

I would NEVER do a return without Sch L because it proves that the return is in balance.

-

I can't remember the brand of my first laser printer (Panasonic?) but it was around $700 and printed 4 pages per minute, but dot matrix printers were more like 4 minutes per page. I was still on DOS at that point so I liked that I could set the number of lines per page on the printer to 72, from the default of 60, since 72 lines was exactly 3 print screens at 24 lines per monitor, and it was nice to have long reports fit on fewer pages.

-

Might want to stock up on some printers now before the tariffs increase prices by 25-50%.

-

Iowa Public Employees Retirement System - EIN?

Abby Normal replied to jasdlm's topic in General Chat

I use Ecosia search. I think it's better than Google. https://www.ecosia.org/ -

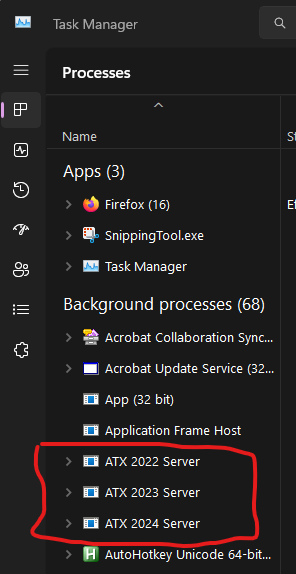

Bring up Windows Task Manager and end the ATX Servers tasks. You end them by right clicking on them and choosing End task, or by selecting them and pressing the Delete key (DEL). Knowing how to end or restart tasks is an essential ATX skill. To start Task Manager, you can use the menu and type 'task' or right click the taskbar and choose Task Manger or my preferred method, Ctrl+Shift+Esc.