KATHERINE

Donors-

Posts

140 -

Joined

-

Last visited

Everything posted by KATHERINE

-

Hi dear friends, Just get confused on something. A person passed away in 2020, a few of her rental properties didnot transfer to her kids untill2021. I am doing 2020 now: I prepared 1041, 1040 and 706 (to show the step up basis). Should I do 709 as well in 2021 along with 1041? if I dont do 709, how can i show IRS the step basis transferred to beneficiaries? Sorry to bother with these basics, but cannot find any answer except here. Thank you so much! Kate

-

IRS reminds tax professionals that it’s time to renew PTINs

KATHERINE replied to Elrod's topic in General Chat

Thank you! -

Hi Jackie, I incline to claim her because he was step father before, and he is supporting her. marriage does not stop that, does not it? Hope someone else can give clear answer on this. Thank you! Kate

-

Hi CBSLEE, thank you! If it can give some sample will be helpful

-

Hi dear friends here, Q&A 36: Is IRS allowing deduction? Currently the tax paid through IT2658 are not deducted? Any one deducted the tax paid on IT2658? Thank you! Kate

-

When I call tax department, I felt people from outside NY always more nicer except CA.

-

Hi CBSLEE, hope the software can help with. ATX can import K1, I usually dont keep track basis in excel, that will kill me. Do you keep track basis outside software? Any better way to do it? Thank you! Kate

-

Thank you, sir. I agree with you. The interest is all passive income because they are not in a active lending business. It is more like help a seller finance or help a friend out. It is investment income and investment expenses is not deductible in personal so should reflect on K1 so it will get same treatment after import to personal level. The old accountant put on first page of 1065 which I will not follow. I will do the full interest in box 5 of k1 as interest income, and the accounting fee & NYS filing fee in box 20 code B, as investment expenses, because NY is still allow old 2% misc deduction. Thank you!! --Kate

-

OK. I decided to put K1 20B, hope that is correct. thank you!

-

Hi dear CBSLEE, They are not in business of lending money, both spouse are doctors. This mortgage they lend out is the only lending they have. Instead of lend it through their personal, they created an LLC for it, so the LLC reports the interest income on schdule K and flow to K1 box 5. I dont think they want to report on their personal Schedule B. What I think is if it is a rental, which is passive, I will report the expenses on 8825, so it will be net out, but there is no form for this type of activity. So, it is not deductible, because it is not an ordinary business; it is investment, and investment expenses at personal level is not deductible, right? Thank you! Kate

-

Hi dear friend here, Another question again. A client lend money out as a mortgage through the LLC jointly owned with wife. So, they got interest income. Where should I deduct the annual state filing fee and accounting fees? Should I report on first page of 1065 without any ordinary income (interest income is seperately listed income on Sch K already)? Thank you for your valuable time on this. Kate

-

Thank you all friends listened my problem. I was thinking about the 12 months, I am always lack of confidence, so I am afraid of lose the 20% down payment, and I knew he is broke because his 2020 business had loss and he was collection unemployment. The officer accepted all my paper, but he added the living together girl-friend monthly income into the total income, then reduced claimed expenses due to shared expenses (the standard things). The client had all together about $19K assets (the car, computer, cell phone, the bank account, etc). I offered less because there were $10K in bank was a customer deposit just got, which he had to spend to buy material for a project. Since he had access to that money, so I agreed and let them take it, but I did not agree on the income, because, she did not marry him, they do not have common kids, he had a kid from previous marriage, she had her own job and income , he never transfer money from his personal or business bank (the officer had almost 10 months bank statements for both business and personal to prove that). How can he add her income, besides that, he even did not ask me how about her expenses? I was shocked when I saw my offer get rejected like this. The officer is also very rough. I asked him to show me the IRM or IRC which says the roommate's income will be consider available income in the offer, he told me : "go to the IRM". I told him the IRS didnot say that (IRM only mentioned share expenses) and request citation. he did not provide any, instead, he said: "you are wrong". Even the rejection letter did not have any citation on the IRC or IRM. I was confused, because any letter from IRS, it always comes with tax code, which is standard format. I am not very knowledgeable on this, but I just feel we were mistreated or bullied by the officer. when I ask the supervisor, I called and left message, no one call back. Then the rejection letter was sign by the supervisor. My client was scared. He was afraid they will come to lock his business bank and he will be doomed. I told him I will appeal, and since the officer already examined my paper, and I have 30 days as the letter said, they should not lock down his bank, also, if appeal, I told him, they should not request more recent month documents, because it is appeal, they should look at the paper the original officer received and accepted already. I am just going to ask appeal to remove her income away, so his available income will be below zero, so let them take the $19K. I told him should not be worse because they wanted $50K. I dont know whether my advice is correct on this, can the appeal officer start over the whole process, which will be a lot work. Good thing is: he gave me his work cell phone and work email. He wanted to talk on the phone, but I didnt, so all these conversation was saved in email. I will work on appeal this weekend, and I will keep up with friends here. Thank you! Kate

-

dear Mr. Tom and Mr. Max, I am so glad to have your answer here. The reject letter was signed by the supervisor followed by the agent's analysis (which clearly in the income section, included roommate income, which he stated as VERIFIED BY IRS at the proposed by the agent). They want me to sign to agree or not agree (if not, need to list details), then there is an option to appeal. I did ask for the supervisor contact before, which the agent gave and I called. She never returned my call, instead, she rushed the rejection letter to me. The offer was started last year around October 2020, the agent contact me this year around June said the case was transfer to CA but he didnot get the documents yet. After verify his identity, I offered to send everything digitally to him. He said bank statements were too old., I sent him most recent ones. He accepted all the assets part, which was $19k. but he didnot take the currently income projection, other than that, he took average of 2020 and 2019. Besides that, he added roommate income as household, and I told him roommate is non liable and he didnot transfer any assets to him, instead, she is paying bills and get reimbursed from him. Their bank and everything have no current transfers. He said she is considered as household income and significant. While, he didnot take any of her expense, but reduced his expenses. so instead of use his negative income, he used her net of $1500 for 24 months and resulted the offer has to be more than $50k. My original offer was $7k because out of $19k assets , there are $10k was not belong to him which i have proof. I think the supervisor signed the rejection, which means no need to talk with the agent nor her anymore. I will fill out a not-agree with detail and start to find other ways , like appeal. Thank you so much for your help. God bless all of us good people. Kate

-

Hi, I just had a similar case, you need to call IRS and they will trace the check. quit fast. they will not notify you the trace result, because if the original didnot get cashed, they will just replace a new one. Through the call, you can confirm with them the valid address. Thank you! Kate

-

Hi dear friends here, I have a problem now. A client owes a lot, so I started a OIC. When I filled out 433A, the rent lease was not under his name, but he pays to his living together girl friend. The Officer wants her tax return to calculate his share of house hold expenses. Which we gave. Then, the officer reduced the expenses we claimed because her income is higher, and they are living together. But the office also included her income as monthly income. In this situation, my client got hit twice, first the living expenses get reduced (and the girl friend's expenses was not included); second, the officer included her income (she has a job, he doesn't have a steady job). They are not married, no common kids, and all financial are separated from each other. I felt something is wrong here, but the officer refuse to provide IRC and IRM. Because from IRM i read, only expenses could be reduced. Any thoughts will be appreciated. Thank you! Kate

-

Thank you, Judy! I felt the same way, I have to file 2019 a F1065 and attach a disclosure to void penalty. It was a new company if the disclosure fails, then I may try first time abatement because it is a late to file case. Thank you again!

-

Hi dear team here, I have a question: last year, there was an LLC owned by a couple, since they came late and I dont have enough information and it was pasted 03.15. So, I filed it as two schedule C for that LLC on husband and wife. Now, it seemed like it was a state registered LLC and then I filed 2020 extension for 2020. Should I file 8275 to submit myself to void the not filing penalty? The reason they came late because the previous account was very sick. Any advice is appreciated. Thank you! Kate

-

CA LLC FORMS: CA 568, CA FTB3522, CA FTB 3536, CA FTB 3537

KATHERINE replied to KATHERINE's topic in General Chat

Thank you so much, Mr. Tom and Mr. Mai! I started to get some idea now. I saw the software label the 3522 as year 2021. On the 568, when I click the payment (see above screen shot), it lead to 3522. I thought 2021 was not finish yet, how come it linked to 2020 568. Is that mean I am always pay advance? Just curious, can I claim refund if someday I close the business because that won't be used anymore? This is their first time to get penalty for late pay? Does CA offer first time forgiveness? The old CPA passed away last year, is that a good excuse? Thank you both so much again! -

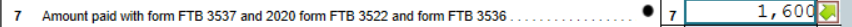

Hi friends, Hope some one can help with this. CA LLC got notice for late paying tax. For 2020, the company had gross sales $623,967. on 03.14.2021 I filed CA 3537 with $800.00, efile success; then, I filed CA 3536 with payment of $2,500 on 05.02.2021 but was rejected; then, I filed CA 3522 with payment of $800 and CA 568 with payment of $1700 on 05.02.2021 and both were success. I was so confused on CA FTB 3536 and CA 3522, those forms seem like you use current year software to pay next year as estimated tax, so when should I claim those payments as credit? My understanding is: the CA charges LLC two type of tax, one is flat at $800.00, then based on sales volume they assess another LLC tax, both are based on currently filing year, so what CA 3536 and CA 3522 for? On 2020's CA 568, box 7, it says: The amount of FTB3522 FTB 3536, and FTB3537 were from my 2020 software or 2019 software? Thank you so much! Kate

-

I used ATX for a few years, prior that, I tried so many different ones. I used TaxWise, Drake, TaxAct, OPL, Ultra Tax (currently still use in my day job), and took trial on Proseries. I am happy with ATX. It is easy to find spot to enter data in ATX and efile process is simple and clear. Yes, ATX has some customer service issue because they did not enough extended hours. (ATX is a little more expensive compare with others and even dont allow do 1099Q , they told me need to upgrade another version with extra payments which is not nice. ) You may try trial for all, and find the one you like the most.

-

Hi Max, I have a questions, if I input income without enter from 1099NEC., am I going to get IRS notice for under reported income? I knew people do tax in their own custom ways, and not get a letter, but what is the right way? I think I would input the xxx-xx-xxxx into xx-xxxxxxx format to get it efiled. Thank you!

-

Do you charge more during the last week of tax season?

KATHERINE replied to ETax847's topic in General Chat

Like all of you, we are trying as sweet as we can, but there are always people we dont like. Especially, relatives, soo hard, late and demands time and fees, how can I ask a fair fee from relative. I always wish they forget and I can put them on extension, but they wont, they pop up at last moment and say, it is easy..... so sad.... -

Hi Mr. Tom, I am so grateful to receive this detailed and precise explanation. Yes, the letter comes with some figures already filled in, so, I think the county was trying to help. Yes, I saw they had a column supplies, what kind of supplies they were referring to? Are they referring to those smaller fixed assets which were write off in the same year through bonus depreciation and /or section 179? Because the bonus / section 179 expensed them in the same year, they wont carry any book value and sometimes people take out from balance sheet, the county want to assess on them, right? Thank you so much. Kate

-

Yes, sir. The webpage was down so I didnot see your message. Can you help me with that so I can fill it correctly, the due date is very close from now? Thank you! Kate

-

Since I'm on such a good grumbling roll lately

KATHERINE replied to schirallicpa's topic in General Chat

Congratulation!