KATHERINE

Donors-

Posts

140 -

Joined

-

Last visited

Everything posted by KATHERINE

-

Thank you, Medlin. When down to details on the compliance, I am still uncertain. I just signed up with CALSAVERS website, that is not hard. Then, download an excel template to collect EE information. I dont know yet what next untill I add those EE in the CALSAVERS program. Thank you!

-

Hi Max, is your client filed 1040NR by paper? I have one like that, prior a letter said X form was processed, they sent multiple said 2019 was not filed, or 2019 needs more time to be processed. I did mail them duplicated copies because they threaten to collection. I think they got confused about the duplicates I mailed as amended returns. If you pull transcript, you may see the refund date is assigned, the refund amount on transcript matches with the original filed paper return. What I think is as long as the refund and all information on transcript are correct, we don't do anything. I told client to expect a refund check.

-

Thank you, Max! That is very thorough. I use ADP. I will ask ADP to see if they can help to calculate, withhold and forward the money to the CALSAVERS. Thank you!

-

Dear Friends, I have CA question again: Can anyone explain to me how the CA SAVE works? Client received letter from CA said employer with at least 5 employees and does not have retirement plan, then are required to register in CA state CASAve program. It say there is no additional cost nor administrative work on the employer side. I checked their web, it is didnot see is that mandatory to put people in, how about no employees want to participate? While if someone wants to, how to take money out from their pay, how can we forward the money to the program? Is that mean, money employee put will be deferred from income tax? Thank you! Kate Golias

-

Thank you all caring friends. My mistake. Really appreciated the reminder.

-

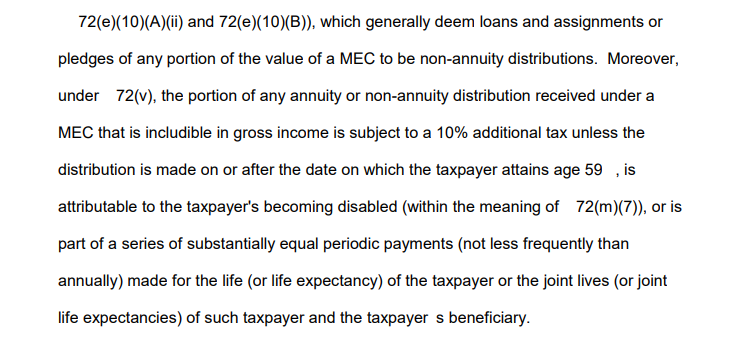

Tuition Paid from Modified Endowment Contract Distribution

KATHERINE replied to JohnH's topic in General Chat

Hi dear friends, what exactly below says then? Thank you! https://www.irs.gov/pub/irs-drop/rp-01-42.pdf -

30? Is that too old to be qualified kid for HOH status? Is the kid disabled? Thank you!

-

ok. I think they have made the e service log in very confusing. Why not put PTIN, POA and TDS and so on in same webpage? Anyone else has issue with that? Thank you!

- 1 reply

-

- 2

-

-

I am glad to see friends are working so hard, which makes me feel better. I still have full time job, which is so difficult, I dont know when should I quit my full time job, so scared go solo and then find out not enough money, but I feel so tired. How did you make the decision to quit the previous job? It was a hard decision?

-

Thank you dear friends here. I will do as suggested. Thank you!

-

I had one, the penalty is very high, it is based on % of total payment, even replaced payment right away before they sent letter. Still don't know how to remove that penalty yet. Any suggestion how to remove the penalty. Thank you!

-

Hi Ms. Lion, if you have his previous year return, you can add him/her to you own TAX.NY.GOV master account and pay it. Or, he/she needs to call the state. It is very confusing because NY put multiple accounts with same access, so if they have business express, or any other accounts, use same email, the tax.ny.gov will say they already have accounts. Thank you!

-

Hi Witax, I think the net proceeds are $341K, then use $341K to calculate the gain. then 83.57% gain (285K/$341K) will be allocated to the new house and reduce new house basis by the gain ($285K - 83.57% Gain=new house depreciable basis). then pay tax on the 16.42% gain. Let us wait others comments on this.

-

I think a lot people here want to volunteer as either substitute grandma

-

ATX 2021, Fixed Assets not linking to Schedule E Line 18

KATHERINE replied to TechUnsavy's topic in General Chat

Hi May try to delete the schedule and add it back, it happens with me with other forms. Thank you! -

Hi Pacun, I agreed with you. If they did two MFS, then, split and take advantage of ability of double dipping is nothing wrong now, it is allowed. Then if divorced parent with rotation of custodial every other year, then, they will benefit a lot for this. How IRS is going to prevent that? Thank you! Kate

-

Hi everyone, good morning! In above case, what status will the husband wants to : MFS, or HOH? Thank you! Lan

-

looking for filing advice on retention credit on tax return

KATHERINE replied to WITAXLADY's topic in General Chat

Hi Darlene, What I do is: make adjustment entry , use the refundable credit reduce wages expenses; use the non refundable one to reduce FICA tax cost, then carry the net to tax return. I think that is what IRS wants us to do too. so the tax return wages may not match with W3 which is ok. Thank you! Kate -

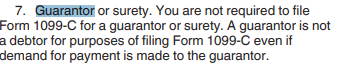

Hi Kathy, he was taking personal guarantee but he is not the borrower itself. If I accept both 1099C, then the IRS will count other income twice; otherwise, how should I offset it, report as nominee?

-

I went 1099C instruction, it said so, I think I will check with bank again. It is so confusing. Thank you, Kathy!

-

Hi dear friends here, I have question: the business owner used personal guarantee to get a loan liable by his company. The debt got cancelled by bank. The bank issue 1099C to both the company and the business owner. I think it is duplicated and request the bank to remove the one issue to the business owner. They refused. How should I handle this? Thank you! Kate

-

Can you get the energy credit on LEASED solar panels?

KATHERINE replied to giogis245's topic in General Chat

Hi Abby, I remember also has to be first owner, right? -

Hi, try to remove the forms, and add it back, it may work.

-

Hi Catherine, ok, I will check Efilemyforms, currently I use tax1099.com, which is good but they dont efile 941s.

-

Thank you! Really appreciate you and other friends here bring us up by giving all your kindness advice. I wish I would do the same to others too. I am starting to build my methods fit me.