Medlin Software, Dennis

Donors-

Posts

1,813 -

Joined

-

Last visited

-

Days Won

83

Everything posted by Medlin Software, Dennis

-

Tax Form Availability

Medlin Software, Dennis replied to Medlin Software, Dennis's topic in General Chat

Ours recently had two weeks of in patient rotation with repeated issues of things not moving, requiring manual assistance. Dues paying, but also very enlightening. -

My one useful reminder here. If you are waiting or looking to see if a certain tax form is available, check the tax agency's web site before asking the tax form software vendor. For the IRS: https://www.irs.gov/forms-instructions-and-publications I click on the posted date until it sorts to latest first, then scroll for the latest date (something I look at nearly every day). You can also use the search to look for a specific form. I have never seen any non public availability, so it is likely the case if not in this list, it cannot possibly be included in your tax software either. Over the years, the reports here are anything from a few days to a few weeks between form release and form including in your tax software. With fewer using paper forms, the delay is likely all programming and priority (meaning volume), not any sort of wait for IRS approval. For DRAFT IRS forms: https://www.irs.gov/draft-tax-forms Use the drafts to get an idea, but while not often, they sometimes change from raft to release. The one draft form I will usually include before release is 940a, as the form rarely changes other than the credit reduction % (which is known weeks before the form is released). And as always important this time of year, and never too often to reconsider, there is no such thing as an accounting emergency! which ties nicely to what our medical student offspring will say "this too shall pass", coupled with drink more water!.

-

Another clue is since the IRS csv is limited to 100 forms, but is not restricted to only 100 forms per EIN, multiple submissions is not an issue. On another note, I would add a late fee of some sort for those who bring in data after saying it is all there. Something someone here long ago suggested to me (along with firing at least one customer every year).

-

The start of the calm, before the storm. To all of us here, I wish some rest and clear minds in the next few weeks. (My storm is all Dec and Jan, and partial Feb.) And the will to remember the storm is what feeds us and ours, and that there is no such thing as an accounting emergency, not ever! so stick to your personal time at work ability, not a minute more.

- 1 reply

-

- 2

-

-

I have no worries. I have been using them since they started. Better than asking here, contact them directly to answer your questions/concerns. While worrying about the security of others, clean your own house, such as have a physical firewall (I use Firewalla), a computer which is encrypted (like surface pro devices), separate connections for work and non work devices, etc. Firewalla is interesting to watch. How many incoming attempts "hit", and what your software might be sending out. The only issue is on our family connection, there is a game SWMBO uses, which sends/receives ad data to a server in a county I block. I setup a separate pipe for her device so she can play the game. At this point, I would never be without something like Firewalla again, including having a second one for travel.

-

AI is often plain old theft of copyrighted material. Most see the problem with things like a magazine or other "news" source getting caught using AI generated articles. The old way of learning, such as reading encyclopedias cover to cover, classroom, or even using a search engine to find relevant information, is not theft, while using copyrighted material as your own is. There was something in the news about using AI to spit out what AI used to create their data has been done (hacked), which might prove useful for those fighting to protect their rights. A live example. I pay a company for certain tools to use which keep me from having to learn and keep up with certain very specific things. Essentially, I pay for the work of their employees. I could use AI to create the framework code to replace this service I use, but I would rather rely on actual experts in the field, rather than the skills of some programmer who is searching and compiling data others created.

-

In case someone wants to read the details directly: https://www.federalregister.gov/documents/2023/02/23/2023-03710/electronic-filing-requirements-for-specified-returns-and-other-documents "T.D. 9972 affects filers of partnership returns, corporate income tax returns, unrelated business income tax returns, withholding tax returns, certain information returns, registration statements, disclosure statements, notifications, actuarial reports and certain excise tax returns. The final regulations reflect changes made by the Taxpayer First Act (TFA) to increase e-filing without undue hardship on taxpayers."

-

Check out the notice in the federal register for the actual rule text. Online "experts" often skip over some parts, or are maybe even AI generated pieces. What is most often missed in general public discussions is the entity type can also be a trigger no matter the quantity of filings. And the often discussed change from counting per form type to the aggregate of the specific types. The reality is, one must treat it as efile being required unless they are sure they meet the exceptions. If in doubt, efile.

-

In some cases (certain org types), efile is required no matter the number of returns. The biggest change is not the threshold, but using the aggregate of the affected forms, rather than a threshold of each form separately.

-

Splashtop.

-

I get to tell stories about the part of our family who were here before the pilgrims.

-

I suspect the password, post other login, is to protect the data at rest. That is the most important, as that is where it is more likely compromised (compared to someone gaining live access). It makes perfect sense to require new/reset passwords to meet whatever "new" formula they desire, rather than make all change at once. Sort of like we have to still support the pre Trump W4 (with allowances) and the post Trump W4 (with implied allowances). I actually deal with this almost daily as for me, any change to any of the W4 data means we require a current W4. No "playing" with it so see the results, verbal requests for a different setting, etc. (The current admin may be the first in decades not to monkey with withholding, because the prior admin cut below zero, leaving nothing left to play with. Meaning it is not a red/blue issue, both sides have done it.)

-

The day after is a great day too!

-

There must be hundreds of "references" online, any law office taking these cases on likely has a FAQ which will get you started.

-

IRS announces changes to 1099-K requirements

Medlin Software, Dennis replied to BrewOne's topic in General Chat

Maybe the PTB are waiting for a TY where there is not a huge concert series and the resale profit... but seriously, likely comes down to perceived profit. Maybe the cost of processing the increase in forms is not thought to be covered by increased revenue?. Or maybe even easier, not in a presidential election year. -

Risks of CTA Beneficial Ownership Reporting

Medlin Software, Dennis replied to Lee B's topic in General Chat

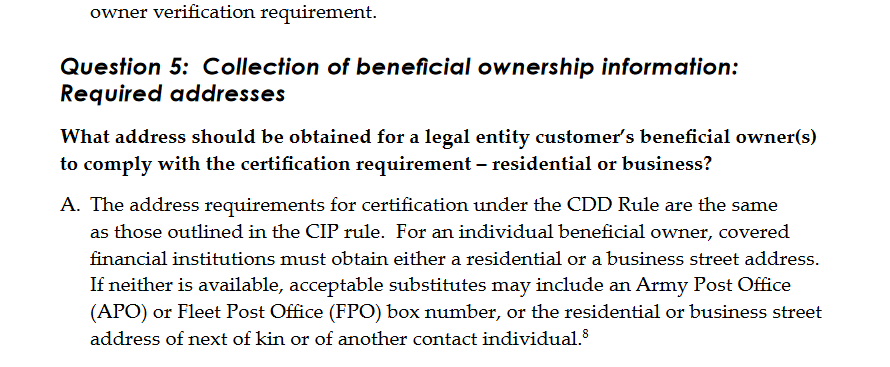

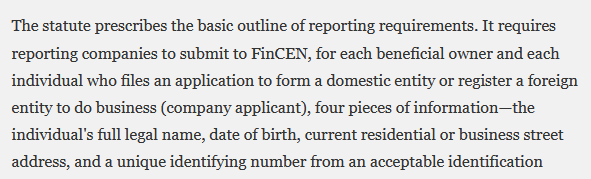

I have not dug into the definition. Plain language reading, and I am good, personally, with RA or the PO Box's street address, in my case (where I am locally prohibited from using my home address). My DL has the same PO Box on it. My PO Box is my legal business location because of my local rules. The above examples refer to "or" "business street address". I have two possibilities to use, RA or the street address provided by USPS for the PO Box. The first example even specifically mentions if no residential or business street address is available, so fincen has pondered this and offered at least a couple of valid alternatives. next of kin, nope, not doing that, but "another contact individual" looks good for using RA. -- I do get it, some may think why bother. But, when you have had those with mental/moral issues contact you at your residence, you think differently. I am not the only one who lives in our home... -

Risks of CTA Beneficial Ownership Reporting

Medlin Software, Dennis replied to Lee B's topic in General Chat

That is what one pays an agent for. I am not listing my home address on anything work related. I have not looked at the rules for this "new" reporting yet, but the USPS does give street address versions of their PO Box addresses, if it gets to that. To comply with my local regs, I am never allowed to use my home address for business purposes. I am also keenly aware of what those who are full time travelers do, such as setting up a domicile they only ever have to visit once (SD is very supportive). The first image is from the fincen site. The second is from the federal register. Since our official business address is either our registered agent's, or the street address for our physical PO Box, I see no reason I cannot meet the "or" and not use any of our personal addresses. -

Risks of CTA Beneficial Ownership Reporting

Medlin Software, Dennis replied to Lee B's topic in General Chat

At least in CA, this is not completely new. Annual corporate CA filing requires similar information. One of the reasons we keep a PO Box, so no one has to list their home address. Also is an odd requirement of my city, no home offices can list or advertise their home address (exceptions for things like piano and swim lessons). Not to far back, a person who had a wrap on their car was getting dinged for parking in their own driveway... -

Risks of CTA Beneficial Ownership Reporting

Medlin Software, Dennis replied to Lee B's topic in General Chat

While yet more work, I am not sure what the big deal is. If many types of entity had applied for credit or banking accounts/cards/loans etc. in the last many years, the app has to include the same or similar info. Certain entities also have annual filing which has to include same or similar as well. So while this will be new for some (publishing new info, for many is is just more of what is already being reported one or more other ways. For tax preparer relationship, I suppose there are many of these types of suggested notices which are mandated by insurers. The n my case, it will be interesting to see if preparer or corp agent mentions this item (same office, different specialists). -

Real Estate Sale Complex Issue-NEED HELP

Medlin Software, Dennis replied to artp's topic in General Chat

Sounds like a nasty mess, which should have three attorneys (with in house CPA and tax) resolving. Once settled, your client can get you the settlement agreement to file your client's return(s). Sounds like the three TIC have not agreed on anything, so no chance to get the other 2 to credit for the 1's tax payments, without some sort of intervention. --- Good time =for all who read this to consider their own demise and what happens to their stuff. Sharing never seems to work out. Not doing this to those I leave behind, and not looking forward to it - again - when an older family member passes someday (a split of all asserts, not sale and split proceeds, I have seen the documents). -

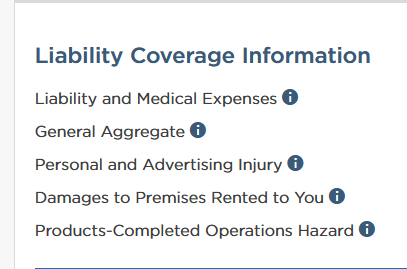

I'll share my details, but only via PM. This is a public searchable and accessible forum, so I am not comfortable putting this type of information in the public domain. Hartford, via online source. Never spoke to anyone, don't care to. Second year with them. Premium went down about 6% from first year with them. My limits are likely higher than the majority here as I have to think about my family, and two other families (shareholder families). I also cover a home office other than mine, an employee's home office. The last line in the image is what, for me, relates yo your E&O, even though my software is licensed, like most, "as is". Note, my primary concern is paying to deflect/defend whatever someone may file. After 40 years, never happened, although a few have said they were. Still, as a corp, I would be derelict if I did not have reasonable coverage.

-

For those who want an idea of what could happen if SS were to have a second tier, or simply apply to all wages... CA's SDI (state disability, such as injury, pregnancy, etc.), paid by employees as a (currently 1.1%, next year .9%) wage deduction, is REMOVING the subject wage limit (currently 153164) which will make all wages subject to CA SDI. As I was waiting for the Queen + Adam Lambert concert to start last week (GREAT show), I was thinking of how the Warriors players, and all other entertainers who do a gig in CA, will be paying more taxes (an actual issue for trying to sign free agents to play in CA - and the other CA too). There was a time when many team performers were getting a fair chunk in personal services income, but I think that went away with the salary cap rules, so I suspect they get wages for all earnings.

-

Mine was static. But, no public access, just two home offices. I see a similar question often for auto and RV insurance. As it gets explained, it is a shared pool, so if the pool you are in gets drained, all who swim in the pool have to pay more. RV or vehicle garaged where there were recent winter storms? Increase. Home where there was a recent fire, or even protective utility safety outages? Raise. I am a self shopper, so I shop around near the end of every term, and will change for a fair savings. I stick with one agent for personal items, because I like my agent, and their service, and their rate is acceptable. The risk of changing is if there are any discounts for renew/multiple lines (I mean penalties for being new and not having many lines with them). I don't think my business lines have any discounts/penalties, but I do switch them from time to time... PLUS, I am in CA, which is one of the most regulated places to be an insurance provider (so the above may not apply in less regulated states).

-

No trouble for me doing mine. I was in the id.me for other reasons recently, which is different from your case. I always look at my deposits before making another to reduce the chances of the “what were you paying for” letters. My other usage was trying to get through the Byzantine requirements to get to where I can “play” with the 1099 efile system.

-

We do not offer job accounting/tracking. The phone recording says you can contact us directly via email, or via an email form on our web --- We stopped offering phone support in 2019. This allows us to be fair, and efficient, with our support. We stopped allowing voice mail messages in 2021, as many were not leaving their email information, customer ID, etc. We stopped accepting text/SMS messages as well, for the same reasons, and because they are simply inefficient, as they do not contain any of the previous information. We were also getting SMS messages such as "help", or "what is wrong", in other words, messages it is impossible to give a solution to. Since at least 2010, the overwhelming majority support questions have been arriving via email. When we get a stack of messages awaiting replies (such as overnight, waiting for a reply when we open for the day), it is not fair to bypass the queue and allow a phone caller to jump the line of those already waiting. We have pondered offering paid support, but we run into the same issue of fairness. We are not comfortable with someone having to wait longer because another person paid to jump the line. Even on our most busiest days, Mondays and Fridays in September, December, and January, we are usually able to reply within an hour. We strive to offer a usable reply/solution in our first reply, saving you from waiting longer to get back to work. We also OFTEN reply outside of business hours, especially if the message contains complete information explaining the issue. Thank you for your understanding.