-

Posts

845 -

Joined

-

Last visited

-

Days Won

9

Everything posted by Richcpaman

-

I reach across the desk and take the entire stack from them.... "I can sort this stuff and talk about what is important, and put the stuff where it goes in the (unused) organizer instead of you trying to pull the *right* document out each time" Then I SMILE. Works like a champ. Rich

-

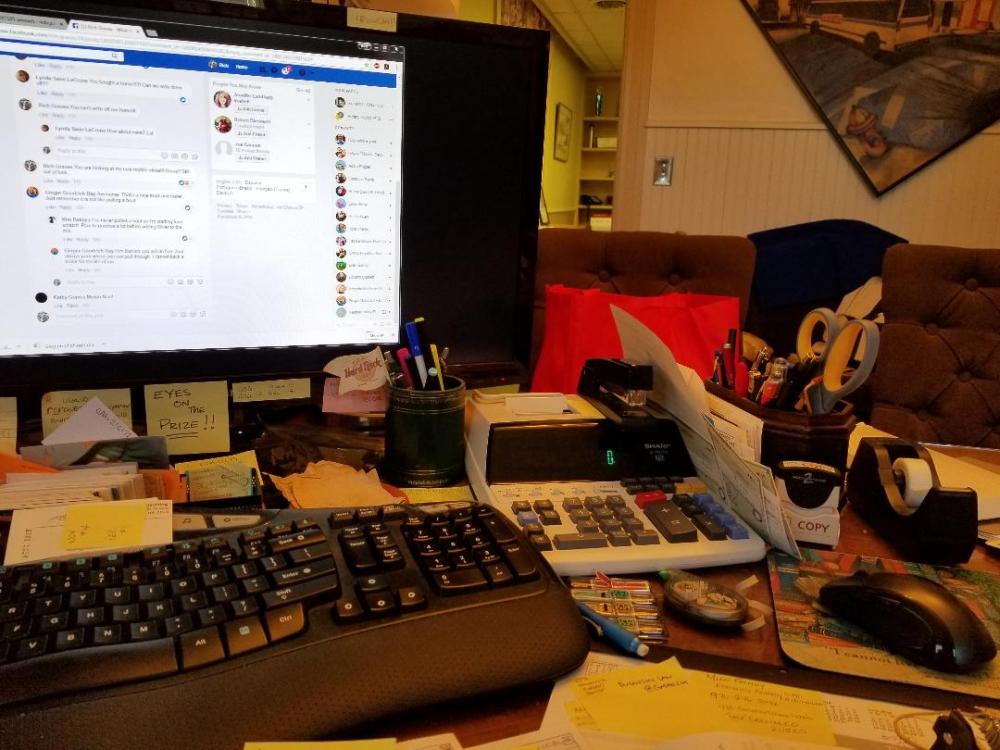

Congratulations!!!! A much deserved win! And... What is wrong with having an Adding Machine or calculator on the desk! I use it all the time! And this in my "work" desk, I meet clients in the other room. My plant is right behind the screen. Rich

-

He told me that he had an offer that I couldn't refuse....

-

Had Al Capone just put down something....

-

Thank you, Judy! You should be the Tax Star! Rich

-

I use Go To My PC as well. I can log in from anywhere. I would use Square if I was not otherwise integrated with Qbooks. Rich

-

Interesting question this week: If your parent passed away while receiving RMD's, and then you as the beneficiary are to receive the RMD's going forward, can your transfer direct to a charity amounts from your RMD? Rich

-

I have been using it for years. I have desktop Qbooks. I invoice everything thru Qbooks, and then if they want to pay by C/C, I use receive payments and select C/C, and input the C/C data. I also get C/C info with the organizer and can use that to get paid later. Works well. Not the least expensive option, but works for me. Rich

-

From that... to Tax Stud. What growth you have shown! LOL! Rich

-

IT's a Trap! Don't do IT!

-

Conservation easement charitable deduction?

Richcpaman replied to Jack from Ohio's topic in General Chat

Jack: Yes, be cautious here, if you have not done one of these before. First, get an appraisal within 90 days of the actual closing. That determines what is the number for the charitable contribution. The $ received can be used to reduce the basis in the land. The $40k charitable contribution is, I believe, 30% of AGI deductible, but don't quote me. The organization getting the easement is usually a font of information as well. They have done them before, and can provide you guidance. There is "fraud" in these area's, but really most of the Tax Court cases are about not following the rules. Sort of like the 1031 exchange rules. Follow them correctly or die on the tax gallows. Rich -

I would recommend a Code Section 529 plan for her.

-

Tell your client to get that child the Social Security Survivor Benefit as well. Aunt may not be able to claim the child, as she is NOT providing more than half of her support. $20K? Is Aunt paying $20,001 for her care? Rich

-

Why? So the client hasn't filed. They can be lazy , stupid, scared, cheap or all of the above. I take a measure of the client and make a decision. If I decide to move forward, and I get the client back in good graces with the various taxing authorities, I have a client for life. Yes, my standards have raised somewhat since I started this biz 15 years ago. But at its basis, we are service providers. We tell to many folks to scram, we don't have a biz before long. Collect a retainer? You betcha. Make sure the paperwork makes sense, and avoid too many "Look there on the ceiling, my business mileage!" Yes. Rich

-

Also... This was new to us, and we carried over the amortization treatment of the points, they should have just gone to the basis on the building anyway, correct? Rich

-

Client owns building and paid points and costs to secure the loan. Client pays off loan in 2017. There is unamortized points of about $3,000. Are these now deductible since the loan was paid off? This is not personal residence or home mortgage, a straight building loan. Used in the active conduct of their business if that makes any difference. Rich

-

In the new tax "reform" bill, what got killed? Increased Standard Deduction, Eliminate exemptions, Eliminate Misc 2% deductions and 2nd mortgages, increased diligence on EIC/AOTC/ACC Seems that someone from the IRS was sitting in the room when this law was getting drafted. They were at least being listened too... They blew up all the area's that you could "play". Not saying that you can't "play" on a $14.5k Schedule "C" cleaning "biz", or a Sch E but... Those folks are not here on this forum. Rich

-

Hats: Welcome to the ATX community forum! How many times have you heard this? Especially in light of this: File the missing 1120S. File the missing 1040's. Get paid. Let the IRS send the letters and you get paid to sort them out. Easy peseay. Rich

-

Possi: I do not believe that you need a 3115. Could the difference be Land? When its time to populate the 4797, add an item for land, and include the purchase closing costs to it as well. If they had not sold it in 2017, you might file the 3115 to get the depreciation right this year. Rich

-

Rita: We are all planners here.... LOL. If we do not get this on the schedule, we will never go. Pick a weekend that works for you, and then we will see who can make it. Rich

-

I don't let them escape tax free on any of the housing allowance that is worth more than renting my house Really. $4,333 a month? In Nashville? That might be light. Rich

-

SEP IRA when employee part year sch C part year

Richcpaman replied to BulldogTom's topic in General Chat

Yes, he can fully contribute to the SEP It has nothing to do with the 401K at the former employer. There is no limitation to $18k, that would only be if he set up a SIMPLE or 401K plan, not the SEP. Rich -

Catherine: If we are going descend on Rita's (and I hope she has Margarita's) The whole summer works for me except for the last two weeks in June. Maybe next year we go to Catherines! Rich

-

The 30% Interest Deduction limitation is for businesses with more that 25 million in sales, so I don't think that will be a problem, and anyway, there is a real estate exemption for that as well. File your interest tracing attachments this year.... Problem Solved Rich

-

Seems that when you need to use the MD502CR (Credits), it populates it with a deduction for firefighters of $30,000... Code RR. So, watch for it before the fix comes out.... Rich