-

Posts

845 -

Joined

-

Last visited

-

Days Won

9

Everything posted by Richcpaman

-

I would go with his age calculation. I think somewhere, in the Social Security rules, they count the first day of the new year as the last day of the previous year. If they send a letter, I would use his argument. He has reasonable basis. Rich

-

The IRS IS matching the 1099K. I have seen the notice and written the response. Weird situation, federal sales were for a Subsidiary. Reported under EIN #1, but belonged to EIN #2. IRS asserted Tax on C-Corp for not reporting all its sales. Rich

-

Contemporaneous Acknowledgement for Contributions

Richcpaman replied to Cathy's topic in General Chat

Did your client amend both years? The year of the original contribution removing it, and then the "new" year of the contribution. I would have gotten the acknowledgement for the $142k in the first year. That is too big a number. "Anonymous" can mean no public notice, but it can also mean that it stays within top leadership and the donor. I would have the client come in, and then fire them. Did that this year. Client amended last years return. Because turbo tax is good software and let him do it. Shove off, A-Hole. Rich -

This is SPINAL Tap. Rich

-

Client... Makes $271k this year... Taxable is $219k. Sends an email to complain about the $300 in underpayment penalties, because *he* decides when he wants to fund his estimates. Which generally means he is light early in the year, and then pays more later. Which, as *we* all know, results in him owing an underpayment penalty. I point out, that due to the composition of his income, he paid taxes of $22k on that income, and that is 10%, and only 8 per cent of the gross income figure. He keeps being argumentative. Finally, I send a short email: Client, I can annualize your income, please send me what you earned 1st, 2nd, and 3rd Qtr, and it may increase or decrease your penalty. He responds: That may be too much work! Guess your time isn't worth $300 an hour, is it? ZAP! Rich

-

I don't do Zombie... I do prickly. I can go along with about anything... Until you go to far, and then its... ZAP. Gotta be careful with that. Rich

-

Same with me... met with 14 clients, however. So, there is THAT!

-

Well... My Goal was thirty. I got 20 done. Computer system went down Saturday Evening and I couldn't get anything done. Started early Sunday, and caught up. This is Hell Week. 45 returns on the schedule to come in. Probably another 20 drop offs. Plus the ones that are here... Not including entity extensions for after April 17th, My "stack" in the office is at 206. Lets see, there are 23 days until 5pm on April 17th. That would mean at least 12 a day right now. Slice of Pastry.... Rich

-

I don't think we can do that anymore... Rich

-

I hope from 3:30pm EST, until about 10pm on Sunday, to get 30 returns done. Lots of new clients this year, and some hiccups have slowed things down. Need to catch up.... Rich

-

Why would you mail or scan something to the IRS that they already have? I would send something in if there was a large error that I felt they needed further clarification. So, I recommend that you STOP. Rich

-

Abby: You have to stay off of Reddit... Rich

-

...so... I will put down $10 for each account...

Richcpaman replied to Hahn1040's topic in General Chat

I want to salvage a confessional from an old church.... and put it in the corner of my office. When the client says "Do I..." I would just say "Go over there and tell them your sins..." LOL -

Just Checkin' ya! Rich

-

What about Momma's Social Security? Rich

-

OMFG! Isn't that the truth... Give me the freaking childcare providers info! Someone just texted me... Oh, I have a 1099-C for a credit card, do you need that? And I paid it off as well...

-

New client is blowing up my phone and Email, "Where is my 1120S?" Give her a call, "I am working on it, will have an answer soon, sorry about the delay..." I look at the return prepared last year and the date on it after I hang up... Dec 10, 2017. I am SHOOTING the bluebird of happiness. ARRGHH! RIch

-

The sole Shareholder has a tax issue. Nothing more in the corp. Allocate income via percentage for the time before the buy in 250/365x(100%), and the time afterwards 115/365x (75%-25%). Basic calculation. If the shareholder then deposited the funds into the biz, that is a loan from S/H. If the Corp sold the share to the 25% SH, then you have other issues. Rich

-

Ryan: Don't know all your answers, but did the Corporation buy the stock from the departing shareholder, or did the incoming or existing shareholder? Rich

-

Who Will Be Our Next Tax Star - week of 3/3 - 3/9/18

Richcpaman replied to jklcpa's topic in General Chat

This stuff ends when Men start calling out the other Men. Rich -

I HATE that Form. And ATX's process for getting it done right for anything over $500 is atrocious. Rich

-

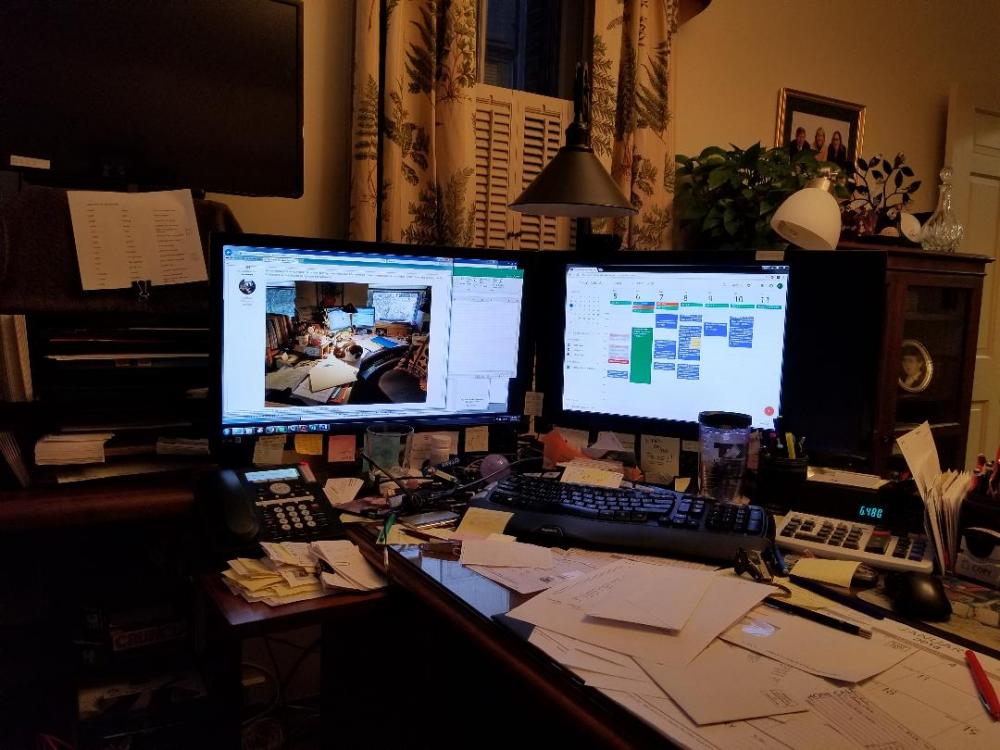

The light is bad in my office, and the phone camera shows that. Better light here than in my old office. I hate fluorescent bulbs and that is what I had there. I have two different desk lamps as well. My office windows face north, so the natural light is muted. I have to get one of these movable desks like Abby has. Pick up the entire surface. Rich

-

I say this a lot as well^^^^ Rich

-

Now you can see the entire workspace: Lion: That is cheating! What does your desk look like today! I have rolodex too, behind me. I also noticed some 3.5 Floppies on Catherine's desk! On the right monitor? My schedule....

-

You can't see my other screen! I had the ATX Community Board on that one!!!! Doesn't that count?