-

Posts

357 -

Joined

-

Last visited

-

Days Won

1

Everything posted by gfizer

-

Part Year Resident of 2 States - Sale of Real Estate

gfizer replied to gfizer's topic in General Chat

Thanks everyone. My client is Old Order Amish so no drivers license to change. The property was under contract prior to the time the physical move was made. It just did not close until after the move. The farm was actually split into two tracts when sold - one was unimproved farmland and the other was the sawmill and the house and lot. The house was built on the property after original acquisition in 2010 so figuring the exclusion for principal residence was not too difficult. I will talk to the client to see if residency in WI was fully established by the date the closing occurred or if there was still a lot of going back and forth at that point. Thanks for your input. -

I have a client who moved from Kentucky to Wisconsin in mid-April of 2023. He sold his farm and sawmill business and all related equipment located in Kentucky in May of 2023? Which state do I report the gains from the sale of the farm and business property to?

-

I agree wholeheartedly. I haven't been here much this year because it's been a crazy season for me but I always know that this is a place I can turn for good sound advice and knowledge. Thank you to Eric and to all who participate here. You are all appreciated very much. That said, I made my donation today.

-

Are you using the clergy worksheets provided in ATX? I believe it's worksheet 3 that calculates the SE subject amount (salary, Sch C profit and housing allowance less expenses). I usually right click on the business expense line and create an itemized list there. Then everything from that worksheet flows directly to the Sch SE.

-

Thanks everyone

-

I have a client asking if donations to private family cemetery are deductible. The cemetery does have an EIN but to the client's knowledge has not filed a Form 1024 for recognition of tax exempt status. I've done some research but can't find a satisfactory answer. Does anyone here have any experience with this type of thing? Thanks in advance!

-

In my situation, they are going to issue a 1099-NEC for the total amount paid, showing both the salary portion AND the housing portion as non-employee comp.

-

My question relates to the proper way to report ministry income. My husband is a minister so I'm pretty well versed in tax returns for ministers. I have a new client who is a minister. His pay was properly allocated between salary and housing allowance. The church wants to give him a 1099NEC but the proper way to report the income is on a W2 so that the salary portion can be shown in Box 1 and the Housing Allowance portion can be shown in Box 14. My question is can the church furnish a W2 when they haven't filed any 941 returns during the year? The 941 forms would've been informational only because there was no federal income tax withholding and the wages weren't subject to social security or medicare withholding. Thoughts?

-

I have a similar issue but different. My husband is a minister so I'm pretty well versed in tax returns for ministers. I have a new client who is a minister. His pay was properly allocated between salary and housing allowance. The church wants to give him a 1099NEC but the proper way to report the income is on a W2 so that the salary portion can be shown in Box 1 and the Housing Allowance portion can be shown in Box 14. My question is can the church furnish a W2 when they haven't filed any 941 returns during the year? The 941 forms would've been informational only because there was no federal income tax withholding and the wages weren't subject to social security or medicare withholding. Thoughts?

-

I have filed prior year 990-PF's before so I don't think it will be a problem. I certainly hope there's no issue since those are accepted by electronic filing only. They will (eventually) return anything you try to paper file. This I know from past experience.

-

I spoke with a rep yesterday. It sounds great. I have clients who sometimes get letters that take up my time and energy in the off season. They are often wrong but as you said still require a response. The rep said that I could opt to act as a middle man between them and my client or I could simply say, “I have a team of EA’s and CPA’s working with me who will handle the matter.” If I wanted to be completely hands off. I would probably opt to stay involved in the process but still it would be nice to have someone else to deal with the IRS. Also the $2500 return preparer error benefit was attractive. I’ve only had to cover minor penalties a couple of times in my 36 years but you never know.

-

Does anyone have any experience with protection plus? Seriously considering the firm level coverage but wanted to reach out and see if anyone has actually had any experience using them to resolve client issues and if so was the experience good, bad or ugly? Thanks!

-

Just received an email from my insurance agent stating that their tax preparers E&O insurance program is being discontinued. I am a small firm with only 1 employee. Any suggestions as to where I should look for reasonable coverage? Thanks!

-

I had a similar situation a few years ago with a client who received a notice saying she had received 16300 in royalties that weren't reported on her tax return. The 1099MISC showed $163.00. I simply wrote a letter and attached a copy of the 1099MISC and the IRS corrected it.

-

I have a client who is a self-employed heavy equipment operator. He is resident of Kentucky. He has been contracted to do a job in Hudson, NY. He expects the job will take him approximately two months to complete. Is he going to have a New York tax liability and/or filing requirement for 2022? Thanks!

-

Yes they are considered timely filed as long as they are not rejected by EFC

-

We have a large Amish community in our area. They have never taken the EITC or refundable child tax credit and returned all the stimulus money. They would however allow the non-refundable child tax credit to offset tax liability. This year many of them received the monthly advanced child tax credit. Some opted out after the first payment but many of them just simply didn't cash the checks. Now it's time to file their tax returns and some of them are owing because they've already received the advanced checks which are sitting uncashed or in some cases have been returned or destroyed. Still others are showing they are due a refund because now all of the CTC is refundable if it exceeds their liability. Has anyone else dealt with these issues and how are you handling it? I will try to get the ones that have held checks to cash them to apply toward their tax liability but as far as refunds go, do I override the amount of advanced credit received to make it zero out so they are only taking the credit up to the amount of the tax liability or let the refunds come in and have them return the checks to the IRS?

-

It would have to be repaid unless your client qualifies for repayment protection. From IRS FAQ: "A5. You qualify for full repayment protection and won’t need to repay any excess amount of your advance Child Tax Credit payments if your main home was in the United States for more than half of 2021 and your modified adjusted gross income (AGI) for 2021 is at or below the following amount based on the filing status on your 2021 tax return: $60,000 if you are married and filing a joint return or if filing as a qualifying widow or widower; $50,000 if you are filing as head of household; and $40,000 if you are a single filer or are married and filing a separate return. Your repayment protection may be limited if your modified AGI exceeds these amounts or your main home was not in the United States for more than half of 2021."

-

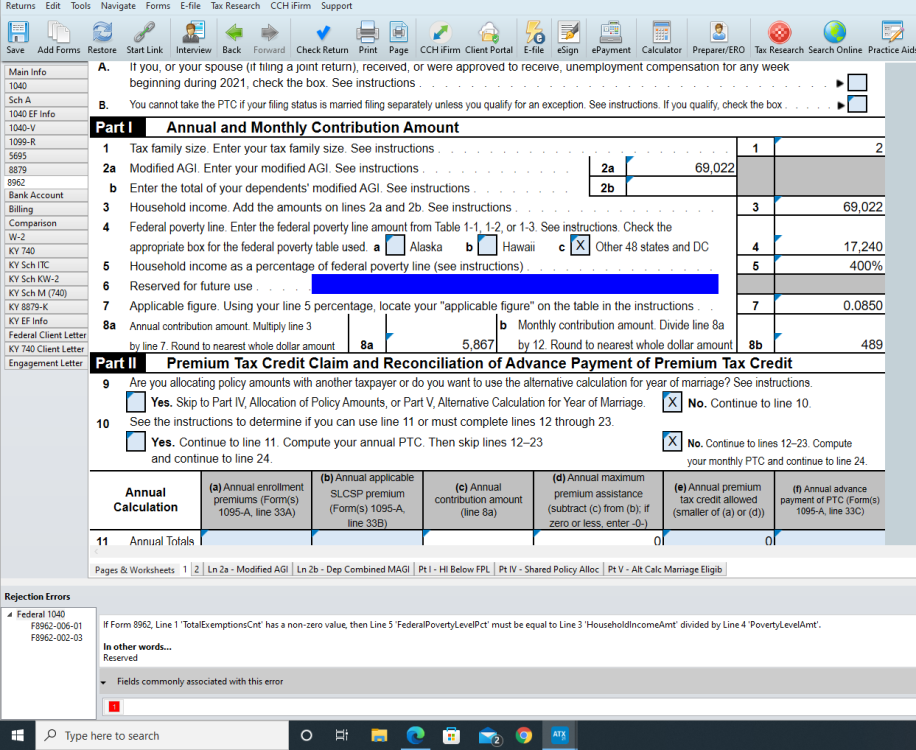

E-filed return with Form 8962. Modified AGI puts them right at the 400% poverty line (works out to 400.35962877% if you do the math - but ATX rounds down to 400%). E-file rejected by IRS with a code that says "If Form 8962 Line 1 "Total Exemptions Count" has a non-zero value, then Line 5 "Federal Poverty Level Percent" must be equal to Line 3 "Household Income Amount" divided by Line 4 "Poverty Level Amount". I've attached a screenshot of the form so you can see the actual figures. Any idea how to resolve this or do I just need to paper file the return?

-

My son married in July. His wife was claimed as a dependent on her mother's 2020 tax return and her mother received the $1400 EIP3 for her as a dependent. Now that they are married they will file jointly for 2021. Am I correct in saying they are eligible to claim the recovery rebate credit to get the $1400 for her even though technically her mother already got her EIP3 payment? The FAQ's on the IRS website seems to indicate so but I just want to be sure I am interpreting this correctly. IRS FAQ - "Dependents: I didn't receive the Economic Impact Payment because I was claimed as a dependent on someone else's 2020 return. Can I claim the Recovery Rebate Credit if I'm not a dependent in 2021? A9. Maybe. If you were claimed as a dependent on someone else’s tax return for 2020, you were not eligible for the third Economic Impact Payment. If no one can claim you as a dependent for 2021 and you are otherwise eligible, you can claim the 2021 Recovery Rebate Credit on your 2021 tax return."

-

Word of caution on at least some newer HP laser printers....I have an HP LaserJet MFP425 that is an absolute workhorse and I dearly love it. I can get generic toner online from Amazon very cheap (4 high yield cartridges for around $50). I needed a new printer for another computer in my office so I decided to move the current printer to that computer and upgrade to what I believed to be a newer model of the same printer - it's a MFP428. Mistake! I love the printer and it works great but the toner cartridges have a proprietary chip which so far I have had very little success in bypassing. I've had to buy OEM cartridges for it and the high yield cartridge is about $200! Needless to say, it's been moved to a location that sees very little use. I was able to purchase a lightly used Lexmark xm3150 which is a commercial all in one for little of nothing from a local business machines supplier and so far it's working out great.

-

I am working on finishing up extensions and just noticed on current return I am working on that the unemployment exclusion that was automatically populating as a negative figure on Form 1040, Schedule 1, Line 8 is no longer automatically populating. I had to manually enter the negative number. Anyone else noticed this?