-

Posts

7,731 -

Joined

-

Last visited

-

Days Won

510

Everything posted by Catherine

-

I don't want my client to call in response to CP14

Catherine replied to RitaB's topic in General Chat

The first page is *always* short - summary of problem, why our position is right, resolution required. The "bury them in paperwork" is the backup pages with anything and everything an ignorant IRS drone could want to look at before resolving anything. Basically I do NOT want any return letters stating "we are still missing corroborating documentation" of any kind. -

Client sold all shares in a small business stock in Dec 2015. Was paid the total agreed-upon price in December and cashed the check. Delays in paperwork (new principal too busy to deal with the lawyers, from what I am told) leaves the stock certificate still in her possession. Is this a completed sale, since there is no more money to change hands? Or do I now have an installment sale with no second year (2016) of money changing hands?

-

And NY will say that only shows the federal. Perhaps the 9325 and the NY efile ack both?

-

Also a great (silent) comment to her...

-

I don't want my client to call in response to CP14

Catherine replied to RitaB's topic in General Chat

Good point! -

Really interesting; thank you!

-

I don't want my client to call in response to CP14

Catherine replied to RitaB's topic in General Chat

That's always my aim. Plus burying them in enough paperwork to satisfy their supervisor, make the agent think there is nothing else left to give, and thereby justify agreeing with me, fixing the problem, and closing the case. -

Niven and Pournelle together - sounds great! Do you follow Pournelle's blog, Chaos Manor, by any chance @Gail in Virginia? I tend to read it sporadically. https://www.jerrypournelle.com/chaosmanor/ is the site.

-

Is eservices available to retreive W-2, 1099, 1098 etc?

Catherine replied to cred65's topic in General Chat

Or take a calculated guess at it. I have found that Massachusetts will NOT give out withholding information -- but if you put something reasonable down and file, hey presto like magic they find the un-findable info, correct the tax due or refund amount, and send a letter. Since we are a flat-tax state, I simply calculate 5.15% of the wages over the exemption. It ends up being remarkably close most of the time. -

If you have Amazon Prime you can also borrow one book a month, same reason. Not all books are available through Prime Lending. But I will check out the library, too -- thank you, @PaulH!

-

@Margaret CPA in OH one of my goals is to read it in conjunction with an Italian version. There is an old Italian saying: "Traduttore, tradittore" which means "the translator is a traitor." Not as stark as it sounds; rather it is a statement that there are *always* trade-offs to be made. Do we keep the scansion here, sacrificing these two nuances of meaning? Or do we keep the nuances and ruin the flow of the text? So my idea was to see if I can learn more, and more deeply, by reading both together. "S'io credesse che mia risposte fosse a persona che mai tornare al mundo, cuesta fiamma staria sensa piu scosse." "If I believed that my response was given to a person who might return to the world, this flame would cease all movement." Ah, but you lose the sense of the shocked stillness, the frozen-ness, of that cessation. Traduttore, tradittore.

-

I love the sample book feature; I have avoided purchasing a load of turkeys that way and also took a chance on something out of my ordinary that turned out to be great. There are also lots of free books - but sometimes it's better to pay a small amount for a version with better e-formatting. I got Dante's "Divine Comedy" and opted for a paid version with reviews that lauded the formatting, as the reviews on the freebie version said navigating was hard due to the lack of e-formatting.

-

There was a call for "pithy sayings in four words" -- such as "this too shall pass" -- and my contribution was "Common sense isn't very."

-

Ah, even these, in this day and age. My mother in law had some rare (like, pristine first edition) books including Audubon bird books. None of the rare book dealers wanted them. We gave a lot of them to a library (and even they didn't really want them and had to be persuaded). The Gutenberg Project and Google Books has killed the rare book market. If you really want them to have good homes and you are done with them personally - sell 'em on AbeBooks before your AJE.

-

can i do anything about error on 2011 return

Catherine replied to schirallicpa's topic in General Chat

My general procedure is to drown them in paperwork and assume I am explaining the situation to a 8th-grader who doesn't give a flip (make it simple, make it easy to agree with your position, give them all the backup they need if their supervisor asks questions). As a result, I have a high percentage of requests granted. -

Or for those who don't want to click, IRS Warns of Latest Scam Variation Involving Bogus “Federal Student Tax” IR-2016-81, May 27, 2016 Español WASHINGTON — The Internal Revenue Service today issued a warning to taxpayers about bogus phone calls from IRS impersonators demanding payment for a non-existent tax, the “Federal Student Tax.” Even though the tax deadline has come and gone, scammers continue to use varied strategies to trick people, in this case students. In this newest twist, they try to convince people to wire money immediately to the scammer. If the victim does not fall quickly enough for this fake “federal student tax”, the scammer threatens to report the student to the police. “These scams and schemes continue to evolve nationwide, and now they’re trying to trick students,” said IRS Commissioner John Koskinen. “Taxpayers should remain vigilant and not fall prey to these aggressive calls demanding immediate payment of a tax supposedly owed.” Scam artists frequently masquerade as being from the IRS, a tax company and sometimes even a state revenue department. Many scammers use threats to intimidate and bully people into paying a tax bill. They may even threaten to arrest, deport or revoke the driver’s license of their victim if they don’t get the money. Some examples of the varied tactics seen this year are: Demanding immediate tax payment for taxes owed on an iTunes gift card. Soliciting W-2 information from payroll and human resources professionals (IR-2016-34) “Verifying” tax return information over the phone (IR-2016-40) Pretending to be from the tax preparation industry (IR-2016-28) The IRS urges taxpayers to stay vigilant against these calls and to know the telltale signs of a scam demanding payment. The IRS Will Never: Call to demand immediate payment over the phone, nor will the agency call about taxes owed without first having mailed you a bill. Threaten to immediately bring in local police or other law-enforcement groups to have you arrested for not paying. Demand that you pay taxes without giving you the opportunity to question or appeal the amount they say you owe. Require you to use a specific payment method for your taxes, such as a prepaid debit card. Ask for credit or debit card numbers over the phone. If you get a phone call from someone claiming to be from the IRS and asking for money and you don’t owe taxes, here’s what you should do: Do not give out any information. Hang up immediately. Contact TIGTA to report the call. Use their IRS Impersonation Scam Reporting web page or call 800-366-4484. Report it to the Federal Trade Commission by visiting FTC.gov and clicking on “File a Consumer Complaint.” Please add “IRS Telephone Scam” in the notes. If you think you might owe taxes, call the IRS directly at 1-800-829-1040.

-

This time the "Federal Student Tax" - see all the details on the IRS website: "Student Tax" scam

-

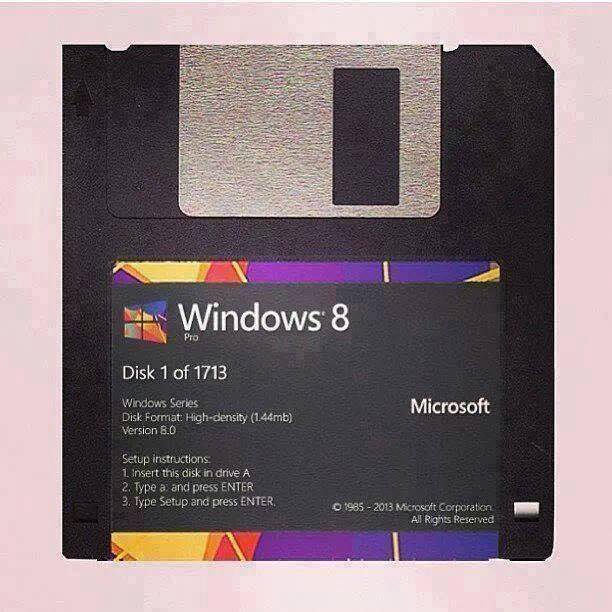

Don't you just LOVE the number of diskettes needed, though, @mcb39?

-

I love my (now ancient) Kindle Keyboard; wireless only. You can't beat the e-ink for reading even in bright light. It is *just* an e-reader; in theory it has a rudimentary browser in it but it is abysmally slow trying to do anything online. It does download books quickly. As it ages I have found the wireless gets flaky at times and forgets the password to our wireless network which I find annoying. I also wish there was an easier way (say, via the desktop application) to put books into collections. However, for reading I love it. You can still get them, and you can get the Kindle Unlimited which is like an online subscription library: read a book, return it, get another -- and unlimited means what it says. Then you have the option to purchase any book you want to keep, also to loan books you have purchased to others. They also have a discount program to buy paper copies of books you have on Kindle, should you wish. You can share Kindle books with all your electronic devices (computers, tablets, phones) should you wish. But Amazon retains ownership; once you are gone there is no library left behind for your family. That I don't like.

-

-

Form 3800 employment credits. Specifically, work opportunity credits. Form 5884 that then flows to Form 3800. WOTC Chart Form 5884 at IRS site

-

Books signed the returns.

-

A cute spoof of all the no-tax nonsense we all hear about. Sent by a friend; the link goes to YouTube. How To Pay Zero Income Tax