-

Posts

3,871 -

Joined

-

Last visited

-

Days Won

41

Everything posted by ILLMAS

-

Big box places would probably charge +$250 for a 1040 & Sch A, and I really don’t know if they offer tax planning, but why can’t you compete with big boxes in prices? A couple of years ago a new client brought in their prior return and they only paid $35.00 for 1040, I told them my fees are not even close to that, so you might want to go back and pay the $35 again, they said hell no, I rather pay your fees then to wait for 3-4 hours in line.

-

You: Its my duty to inform you that you must comply the current IRS rules and I recommend you pay it until there is further notice from the IRS ..... (sent in an email that you can always go back to) Me: I am not going to pay the damm bill because #@$!!.... (it`s my problem, now)

-

Delete the SS# and re-type EIN XX-XXXXX... the dash is what makes the differences.

-

Is that the hole picture and the hole truth?

-

http://www.epicfail.com/2018/01/16/im-getting-tired-bullshit-tom/

-

Q: if you have the payroll module, can you file quarterly returns electronically? And is it as straightforward like submitting 1099’s? For the past years I have been using it for efiling 1099s and always paper printed quarterly returns and have clients mail them. QB has the option but requires prior IRS approval.

-

I used to be a Proseries user and when I moved to ATX I kept on using it.

-

It’s also a good idea to have an excel spreadsheet to do the calculations, I use one that allocates the sales price (pro-rate) amongst building, lands, improvements etc...., then I tie it to the tax program.

-

QB has released the payroll tax update, it requires a manual update, see below: Intuit has released Payroll Update 21804, with revised tax tables. Several forms updates are included for Standard and Enhanced Payroll customers. This email also provides the following: Federal E-File and Pay Updates New Federal Withholding Tables To confirm that you have received the update, open QuickBooks and choose Employees > Get Payroll Updates. If you don't see a message that says, "You are using tax table version: 21804," click Update. Get complete instructions. To turn on the automatic updates feature in QuickBooks so that you automatically receive payroll updates when they are released, choose Help > Update QuickBooks. On the Options tab, select Yes for Automatic Update and check the Mark All box to ensure that you receive all updates. Get the Payroll Update The Payroll Update ensures that you will be in compliance with legislation that affects your payroll. For details on the contents of this update, go to Employees > Get Payroll Updates > Payroll Update Info. Federal E-File and Pay Updates Form 940 E-filings E-file for Annual Form 940/Schedule A, for Reporting Agents (available for Enhanced Payroll for Accountants subscribers only), Employer's Annual Federal Unemployment (FUTA) Tax Return, has been updated. Form 944 E-filings E-file for Annual Form 944 for Reporting Agents (available for Enhanced Payroll for Accountants subscribers only), Employer's Annual Federal Tax Return, has been updated. New Federal Withholding Tables This update also includes new Federal withholding tables and new Non-resident Alien withholding tables for 2018. Note: These new Federal withholding tables use current W4s, however we expect the IRS to update the W4s and provide an updated online calculator to better determine withholdings. For more information regarding the Tax Reform Bill, click here.

-

- 3

-

-

-

If they are all 27.5 yr depreciation, lump sum in one Sch E, however in some cases you do have to separate them if it’s mixed use (commercial).

-

Typically they would go in one Sch E, however I could someone that charges per Sch E separating them to collect more fees.

-

I am visualizing QB payroll, it doesn’t matter how many allowances the employee is claiming but one can manually adjust federal withholding to basically anything. However I see this as a billable service to employees and not the employer, also I had clients in the past receive IRS notices to adjust their allowance, could this be a temporary end to that notice?

-

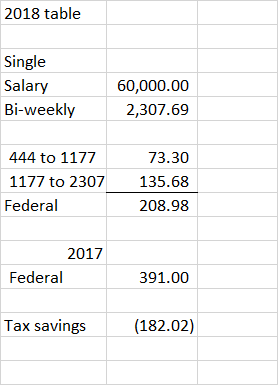

I did use the married table by mistake, but $71 is not bad either.

-

That's correct.

-

Zero for 2017, and I used the table for 2018

-

What's going to happen to those employees that claim infinity allowances but never file tax returns?

-

I am trying to figure if this person would be an investor or flipper that would be subject to SE tax. Facts: 1. Person is a real estate agent and buys houses, contracts people to do all the work and then sells them. 2. From the proceeds, another house is bought and so on. 3. Sometimes not all the proceeds are reinvested in a new house. 4. On occasions, another person invests 50% on the purchase of the a new house and improvements, proceeds are distributed 50/50 when the house sells. TP only reports their share on 1120S. 5. Buys 3-5 houses a years. 6. Houses are bought through an LLC that files an 1120S, owner gets a K-1. 7. TP does not draw a salary, takes a distribution occasionally. 8. In the prior tax return, properties were reported as inventory 7. TP paid ordinary tax on the proceeds from the K-1. Questions a. Should the sales be reported as capital gains? b. Or as ordinary income since the properties are considered inventory? c. Ordinary income plus SE tax? Concerns i. If this person was an investor no doubt they would be paying capital gains, or if they were reporting it on a Sch C then they would be subject to SE tax. However, by putting it a on a 1120S it seems they can avoid paying SE tax, but if it's determine this person is a flipper, can one make the K-1's income subject to SE tax? Thanks

-

Paid Preparer HOH Due Diligence.pdf

-

bitcoin in a nutshell.pdf

-

I think my parents still have some plates they bought/exchanged with the stamps lol.

-

IRS asking for taxpayer representatives’ personal information

ILLMAS replied to jklcpa's topic in General Chat

This is going to go down the drain just like the PTIN renewal fee, most of us do not get paid enough to put up with this -

Client comes to your office in their brand new Corvette You: Did you use your refinance/line of credit funds to improve your residence? Client: Of course

-

Imagine if they required for real estate agents to become employees?

-

If a worker at a trade or business is an independent contractor, and the independent contractor swipes payment cards on behalf of the trade or business in the normal course of business (in other words, the trade or business, not the independent contractor, receives the proceeds), should the trade or business report payments to the worker on Form 1099-K or Form 1099-MISC? In this situation, the trade or business should continue to report payments made to independent contractors on Form 1099-MISC as they have done in the past. However, the business will receive a Form 1099-K for these payment card transactions from the payment settlement entity. https://www.irs.gov/payments/general-faqs-on-new-payment-card-reporting-requirements