All Activity

- Today

-

Deb Campbell joined the community

-

Part Year Resident of 2 States - Sale of Real Estate

gfizer replied to gfizer's topic in General Chat

Thanks everyone. My client is Old Order Amish so no drivers license to change. The property was under contract prior to the time the physical move was made. It just did not close until after the move. The farm was actually split into two tracts when sold - one was unimproved farmland and the other was the sawmill and the house and lot. The house was built on the property after original acquisition in 2010 so figuring the exclusion for principal residence was not too difficult. I will talk to the client to see if residency in WI was fully established by the date the closing occurred or if there was still a lot of going back and forth at that point. Thanks for your input. -

yesterday Catherine White EA was the presenter for Tax Practice Pro, a c.e. provider. Her presentation was a case study of what happens when a client changes tax professional, and issues with prior years are discovered by the new tax pro. Kudos to Catherine on a well developed and perfectly presented class.

-

After reading all that, for one of my biz clients similar to my example, from what I've seen of them in action, I'd say the H&W are but the kids are not. In another one of my biz clients, I'd say all four are. In both cases, I think the one with the ownership interest would disagree with me (for different reasons in each case). So, I really don't want to be involved in these filings. Less and less the more I read. I'm sticking to tax!

-

That's covered on the FinCEN site's BOI page of FAQs. See section D. https://www.fincen.gov/boi-faqs#D_5

-

I wasn't asking if the preparer must send two emails. Based on what Margaret said here: ...what I meant was, for example, must each party signing the 8879 have his or her own separate email address.

-

I did get a renewal notice from Drake, with different options. I'll be looking at them soon. Still recovering from bronchitis.

-

As long as they are in a Workspace thread with both people, you set up the two signers. It goes to #1, automatically to #2, then back to you once signed.

-

What is substantial control? For example, husband owns 80%, wife 20%, adult son 0% but VP of marketing, and high school daughter 0% but VP of finance. Both H & W are the producers of the local TV shows as well as being the on-air talent. Does only husband report? Or, some combination of 2, 3, or all 4? Would it matter if the responsibilities stayed the same, but the "kids" didn't have VP titles? Is there a difference between the kid that's over 18 and the kid that under 18? I guess I have to go read the details at the website! Thanx, Lynn, for your post. That's what I'll send my clients, with the website in large font, bolded, and highlighted.

- Yesterday

-

How do your clients verify their identity before going to the signature lines in Verifyle? I use CCH eSign for signatures. I use FileShare that already included as a part of my CCH SiteBuilder website. See if your tax software or website or phone provider or other vendor you already pay for has what you need included or as a bundled (i.e. low cost) option.

-

Well that was my point. She is not a full time student. But SHE can get the AOC herself.

-

Does a form requring 2 signatures need to have two separate emails?

-

secure file sharing alternatives to Drake Portals

Margaret CPA in OH replied to artp's topic in General Chat

I'm not Lynn EA but can answer. I upload the client copy of the returns, pdf. I then upload what I call the signature pages, beginning with 8879. The signer(s) are part of the portal with their email address originally entered as a client. The software prompts me to determine if I want to add signatures. For the client copies, no, but I click Yes for the signature pages. All is then uploaded for client access and I am prompted to indicate which signer is to sign first, i.e., taxpayer. I scroll to the signature line and highlight it. Then highlight the date line. I also highlight for initials the bank information and selection for payment or refund. At the end, I am prompted for the next signer, if there is another. Repeat the process, review if desired, send. The clients receive an email (each one) and are directed to the highlighted spaces to accept/enter. When the first signer is finished, an email is sent to the next one. I am notified at every step. A few of the folks were reluctant until I or someone explained it's similar to the now ubiquitous signing pads everywhere. I think you can try it out. -

secure file sharing alternatives to Drake Portals

BulldogTom replied to artp's topic in General Chat

Can you walk me through the process a client has to go through to sign electronically through that application? I am finding more and more of my clients cannot print, sign, scan and upload back to me their 8879s. I want something cheap and easy that does not sell their personal information to the highest bidder. Tom Longview, TX -

Thanks Lynn and Margaret. Sounds very interesting. I will certainly checked them out.

-

secure file sharing alternatives to Drake Portals

Margaret CPA in OH replied to artp's topic in General Chat

Verifyle is only $9 per month if you are not with one of those organizations. I have been using it for 3 or 4 years and am very pleased with the service and responsiveness to my questions at the outset. I use workspaces, one for each year, and request that all client communication be managed there. That way I can keep messages for each client in one place. At the end of the season, I copy the message string to my client file for each one for each year, just in case. -

Thanks Randall for your comments. Those are some good thoughts. I am a numbers guy, and I do like to do payroll. What I hate is paying an overpriced service a ton of money for the pleasure. I understand it costs money to breathe, but not that much. Thanks!

-

I'm not doing it for clients either. I'm waiting to see if they change the requirement. Otherwise, I'll let them know about it and send them to a website for info.

-

I have the client sign the 8879-EMP each quarter. Also with ATX, I have to create a 'new client' for each client for each quarter. I put the date or 1,2,3,4 QTR as part of the name. Maybe I'm missing something but that's how I've done it. I only have one of these though and not 10. I'm winding down and payroll is becoming more of a hassle every day.

-

I have about 10 clients I process the 941 payroll forms for, and have always done this by paper. I have the ATX MAX software, and need to start doing this electronically. 1. Is this an easy transition? 2. Do you have your clients sign the 8879-EMP each quarter? 3. What other software do you use if it's not ATX MAX? 4. Any other filing tips or advice for this transition would be helpful, thanks.

-

secure file sharing alternatives to Drake Portals

Lynn EA USTCP in Louisiana replied to artp's topic in General Chat

If you are a member of NATP, NAEA, Tax Pro Fellowship, these organizations offer free subscription to Verifyle, a secure document sharing platform. Also included, and free, is electronic document signature. -

I have been using Drake Portals for several years and it has worked fine for my needs. However, I am considering moving to a different tax software provider and looking for alternatives for secure sharing of tax data with clients. Any suggestions would be appreciated. I have a small tax practice so cost effectiveness, ease of use and of course security is important.

-

That box has always been there and I almost always check it, for whatever reason

-

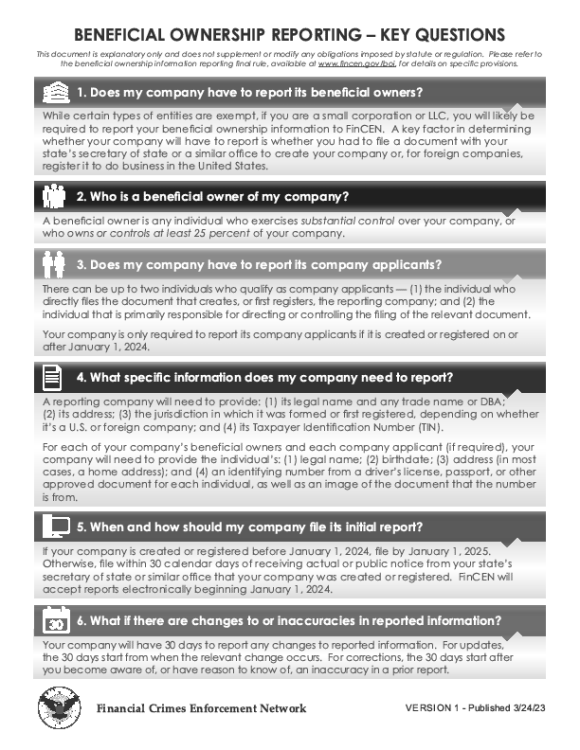

Fortunately for me, the Oregon Secretary of State has published a two page guideline with live links that I am going use. I am also going provide a live link to FINCEN'S guidelines which is 51 pages long

-

I'm hoping to find something (hoping to not write something myself) that says Congress passed a Corporate Transparency law that requires certain businesses to report their Business Ownership Information on the FinCEN site. Read more about it here to see if it applies to your business... Something short and sweet that tells them to do it themselves, maybe talk to your lawyer, but this is all I know about that, so do NOT ask me any questions. I've heard about preparers creating how-to flyers with steps, screen shots, whatever. I do NOT want to do that. The gist of the law is WHO are owners, not how to report on FinCEN. And, the WHO is exactly what I do NOT want to be involved in deciding. Knowing which grown kid or minor kid has a hand in your biz isn't any thing I know or have the time to know. It's up to the biz owners to self identify. I'm decades past retirement age and have no desire to add more work, especially non-tax work.