Leaderboard

Popular Content

Showing content with the highest reputation on 06/15/2017 in all areas

-

https://www.irs.gov/uac/newsroom/irs-warns-of-new-phone-scam-involving-bogus-certified-letters-reminds-people-to-remain-vigilant-against-scams-schemes-this-summer Reminds People to Remain Vigilant Against Scams, Schemes this Summer IRS YouTube Videos: Tax Scams: English | Spanish | ASL Private Collection of Overdue Taxes: English | Spanish IR-2017-107, June 15, 2017 WASHINGTON – The Internal Revenue Service today warned people to beware of a new scam linked to the Electronic Federal Tax Payment System (EFTPS), where fraudsters call to demand an immediate tax payment through a prepaid debit card. This scam is being reported across the country, so taxpayers should be alert to the details. In the latest twist, the scammer claims to be from the IRS and tells the victim about two certified letters purportedly sent to the taxpayer in the mail but returned as undeliverable. The scam artist then threatens arrest if a payment is not made through a prepaid debit card. The scammer also tells the victim that the card is linked to the EFTPS system when, in fact, it is entirely controlled by the scammer. The victim is also warned not to contact their tax preparer, an attorney or their local IRS office until after the tax payment is made. “This is a new twist to an old scam,” said IRS Commissioner John Koskinen. “Just because tax season is over, scams and schemes do not take the summer off. People should stay vigilant against IRS impersonation scams. People should remember that the first contact they receive from IRS will not be through a random, threatening phone call.” EFTPS is an automated system for paying federal taxes electronically using the Internet or by phone using the EFTPS Voice Response System. EFTPS is offered free by the U.S. Department of Treasury and does not require the purchase of a prepaid debit card. Since EFTPS is an automated system, taxpayers won’t receive a call from the IRS. In addition, taxpayers have several options for paying a real tax bill and are not required to use a specific one. Tell Tale Signs of a Scam: The IRS (and its authorized private collection agencies) will never: Call to demand immediate payment using a specific payment method such as a prepaid debit card, gift card or wire transfer. The IRS does not use these methods for tax payments. Generally, the IRS will first mail a bill to any taxpayer who owes taxes. All tax payments should only be made payable to the U.S. Treasury and checks should never be made payable to third parties. Threaten to immediately bring in local police or other law-enforcement groups to have the taxpayer arrested for not paying. Demand that taxes be paid without giving the taxpayer the opportunity to question or appeal the amount owed. Ask for credit or debit card numbers over the phone. For anyone who doesn’t owe taxes and has no reason to think they do: Do not give out any information. Hang up immediately. Contact the Treasury Inspector General for Tax Administration to report the call. Use their IRS Impersonation Scam Reporting web page. Alternatively, call 800-366-4484. Report it to the Federal Trade Commission. Use the FTC Complaint Assistant on FTC.gov. Please add "IRS Telephone Scam" in the notes. For anyone who owes tax or thinks they do: View your tax account information online at IRS.gov to see the actual amount you owe. You can then also review your payment options. Call the number on the billing notice, or Call the IRS at 800-829-1040. IRS workers can help. The IRS does not use email, text messages or social media to discuss personal tax issues, such as those involving bills or refunds. For more information, visit the “Tax Scams and Consumer Alerts” page on IRS.gov. Additional information about tax scams is available on IRS social media sites, including YouTube videos. Page Last Reviewed or Updated: 15-Jun-20173 points

-

Jeepers, sounds like I have been involved in the wrong kind of class action suits! I couldn't even buy a large pizza with my settlement!3 points

-

Three or four years ago I received $ 4,954 from a class action lawsuit against Charles Schwab. It was related to the non disclosure of the risk associated with a certain kind of investment, in which my IRA was invested.2 points

-

I was involved in a class action suit with JCPenny's and basically had to do nothing except say keep me in. It finally settled and I ended up with $845.00 dollars in an e-gift card. Didn't really believe it, but went on their website and put in the number and pin number and there it was. I've been using it ever since and still have a balance. So I guess my point is you just never know. If they send them to me I will always respond, but I must say this is the biggest one yet!2 points

-

To start with why is this person filing taxes in other states. Is it because this income is sourced in other states, if that is not the case then all income should be reported in IL1 point

-

I got $13 and change from a class action suit some years ago. Yeah, they sound great - but the only ones who profit, it seems, are the lawyers. Maybe the bad guy gets spanked.1 point

-

This time travel discussion reminds me of a story by Lewis Grizzard (southern humorist for any of y'all who didn't know him). Atlanta Georgia is on Eastern Standard Time, while Birmingham Alabama is on Central Standard Time. It takes less than an hour to fly between the two cities. A local in Atlanta went to the airport to inquire about traveling to Birmingham on his first ever airplane flight. The ticket agent said he would depart Atlanta at 11:02 am and arrive in Birmingham at 10:54 am. As the customer stood there contemplating what he had just heard, the agent asked "Do you want to buy a ticket?" The customer replied "Nope, don't think I do. But where does it leave from? I'd sure like to see that sucker take off!"1 point

-

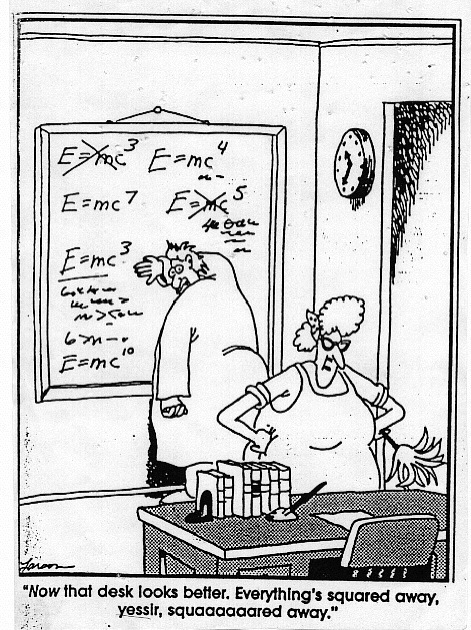

What E = MC^2 means, @BLACK BART is that energy and mass are equivalent, subject to a large correction (the speed of light, times itself). So how much energy resides in a tiny bit of matter? Astounding amounts (hence the amazing destructive abilities of nuclear bombs). How much matter could one form out of energy? Teeny tiny little insignificant amounts (it does go both ways, after all, and explains the electric bills of particle accelerators). The limerick, however, addresses a fact learned from Einstein's Special Theory of Relativity, which tells us that time is a PHYSICAL property. It moves more slowly with increased gravitation and with increased speed. Two cesium clocks, at different altitudes, run slightly differently (not so as we'd notice; the difference is less than a second per million years). Which one is right - BOTH are! Because time itself is different at different gravities - and higher up there is less gravity. Likewise, time slows down with increasing speed (you have to get to more than 40% of the speed of light to notice). Your link goes to the Time Dilation equation where you can calculate the effect for yourself. So if twin brothers split up, and one goes on a space journey to Alpha Centauri and comes back in - let's say fifteen years - he is a couple of years YOUNGER than his twin upon arrival home, because time slowed down for him. The speed of light is a theoretical limit (I am not going to go there, don't worry) but the limerick implies that if the barrier is broken, the girl in question can come home before she left. Great trick, as she can remind herself to bring whatever it was she forgot... no, wait, that gets us into time paradoxes. Let's not go there, either, at least right now. Relativity, Special Relativity, and Quantum Physics get weird and surreal *very* quickly - and anyone who is lacksadaisical about the implications of these principles really does not understand them at all. In fact, they are SO bizarre and ridiculous that the *only* thing they have going for them is that they are undeniably factual.1 point

-

1 point

-

I would ask the client a simple question,... and wait.... Long pause... and deep thought would follow..... Quite the young actress...Yeah..?1 point