-

Posts

4,625 -

Joined

-

Last visited

-

Days Won

26

Everything posted by Pacun

-

It's complicated (some peoples relationship with taxes)

Pacun replied to ILLMAS's topic in General Chat

File 2021 at once and request an ITIN for wife. Attach a letter signed by both stating they want to treat spouse as a resident for tax purposes and that they are reporting world-wide income. It doesn't matter when the taxes are filed in the foreign country since you file a calendar year not a fiscal year in the USA. With the pandemic schedule, it will take a couple of years for the spouse to get a social security number and that's what the ITINs are for. Remember that filing for 2020 will give him stimulus 1 and 2. So, I would file since it is not my fault that money was given away like crazy in 2020 and 2021. -

I thought where is my refund ONLY checks current year.

-

I thought most preparers hated home office due to the fact that we know that very few people comply with the exclusive use requirement, but I guess I am wrong. This is my idea: I will suggest my clients to make a tiny room big enough to have a chair and 12 inches for leg room (Maybe 40X30 inches). have a chair over there and have the driver go every day, sit at that chair, with cell phone on hand check where the uber heavy business volume is for the day, check if your payment hit your bank, etc. That will cover the exclusive and regular use. Again, it seems that Uber is now counting every mile as soon as the driver opens the application and connects to the uber platform.

-

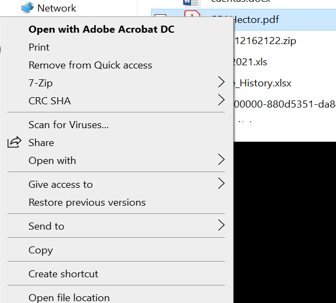

Place a pdf file on your desktop, make sure it is not a shortcut and then right click it, properties and select Acrobat reader. My picture was cut, the very last choice should be "properties". I am almost sure that edge is the program selected as the default program to open pdf files on your computer and that's why you are having issues. You could also select acrobat reader for .pdf files but that's more elaborate.

-

locate a pdf file, right click, properties and select acrobat. Let me know if it works.

-

If someone filed last year jointly with two kids 8 and 10 (for example), and this year is filing Separate, don't forget that this person will get on line 28, $4,500 as child tax credit and on line 30, it will get $1,400 as stimulus. A lot of people don't bring the stimulus letter and when you ask them about the stimulus, they say "I received all the stimulus" and it is easy for the preparer to forget to click on line 30.

- 1 reply

-

- 4

-

-

DC, MD and VA have a reciprocal agreement and you pay income taxes ONLY where you live. So nothing is needed for MD in your case. I will limit my comment to DC. There is no need to mention the apartment in this case. File as a part-year resident from 8/15/2021 to December 12/31/2021. The standard deduction for a single person will be something like $1,000 per month since it is the same as the Federal standard deduction. So in this case you standard deduction if single will be about $4,500. You go to DC-40 form and look for the light blue box on page 2 line 8 and enter the income received in NY (while a non-resident).

- 1 reply

-

- 1

-

-

House is in MD. Expense was about $10K. Is there a federal tax credit for energy efficient Windows for 2021? MD preparers: Any credit at the state level?

-

I was looking for the word cohabitation in the rules and didn't find it.

-

If you received $3,300 that's the amount you should receive on 1040 on top of withholding and EIC. That's true when the client didn't refused any advanced payments and when the number of children are the same. Knowing that will help you know if the program is calculating correctly. This is what I would do in this return if I have doubts. I would save the return, delete the K1 with the loss, and then check if $3,300 shows as child tax credit on line 28 1040. If it looks correct, I would close the return without saving, reopen it and see where the issue is.

-

I think the wording is live apart without "the good part" of cohabitation. As a rule of thumb, I don't think about HH when they got married after June 30th.

-

Keep in mind that the first account will get stimulus 4 if any.

-

I just go with what the report says. I don't add miles to it. It is my understanding that Uber now count the miles when you first connect to their application. So technically, you could drive a lot of miles before you pick up anyone and those miles will be reported. Remember that it is a business need for the uber driver to move to busy areas after each food or passenger is dropped otherwise they could stay parked all night. I personally hate home office because they are painted gray. I have done only a few in my life time and for sure NOT for uber drivers. Most of the records they present are pulled in two minutes from uber's website and they consist of their 1099 forms and report at tax time.

-

Let me assume that the wife makes less than $50K and that the old child is 7. If the mother claimed the old child, she will not have to return any of the $1,500 she got in advanced and the husband will get $6,600 as child tax credit. If they split the children, they will get $1,500 less child tax credit. Regardless, don't forget that the new born will also get $1,400 stimulus.

-

In this case the husband will have to claim both children for the double dipping to occur.

-

I had a client that insisted that the IRS didn't send him $1,400. I asked him to check his bank for the months of April 2021, May and June. He found that the IRS had deposited $1,400. Another told me the same story. I asked him, have you filed for the last two years and he said "yes, you have filed for me electronically (sometimes.. I mean most of the time, I don't know who is who). I went to my records and I remember that the last two years he was all kisses and hugs with his girlfriend. I said, where is your girlfriend and he said, she left with another man... I politely said "call that guy that he took your girlfriend and your EIP3 because you signed a paper to have your deposit be sent to her account and the IRS uses the last bank account to send the stimulus". We both started laughing and he that was the end of the conversation. In this case, the IRS is right or at least the computer issued a check or direct deposit. I have not found one that is wrong but a few of my clients need to be reminded where the money went.

-

The IRS doesn't need to prevent that. The IRS only follows the laws and if the laws have flaws, the IRS doesn't have the ability to "prevent" people from applying the law and taking the credits handed to them. Our elected officials are the ones that handed all the goodies and we have to take advantage. Too bad that to benefit, you MUST have one or more children. EIC, Child Tax Credit and child care credit are the winners in 2021.

-

MFS. That's the only choice for married and living in the same house, besides MFJ. Remember that the rules for HH have not changed at all.

-

I thought you only input information from 1095-A for the filer, not the dependent. This year, you can efile and it will be rejected if info from 1099-A is needed. That's a big plus in comparison to last year that it allowed you to efile and then clients got a letter and refunds were delayed.

-

Grandmabee, Tell them the charge is for being too organized.

-

The appreciation should be taxable the same way that if you leave your money (collected from Card Rewards) and they earn interest, you pay taxes on that interest. It is interesting to see that you should have basis on the bitcoin the same way you have basis when you cash the rewards and leave it in your checking account, (you pay taxes only on the interest).

-

How much money are we talking about? If it is less than the standard deduction, I would use a 1099-NEC and redirect it to "line 7" (old school). I would be prepared to explain to the IRS if they question it.

-

It gets even better, for one child 6-18 years old, you don't have to return any penny if your income is less than $50k. Once you start plugging in the numbers you will notice that the calculation doesn't start owing taxes until you consume the reminder of the $2,000 original child tax credit. You will understand better if you plug in the numbers but keep in mind that any one that made less than $50K will not return any child tax credit. If the advance child tax credit was more than $1,500 per child, then returning money might start at $44K

-

Correct. IEP3 does not have to be repaid.. Advance child Tax credit doesn't have to be repaid if the person who received the monthly payments makes less than $40K. AND the person claiming the exemption this year can claim the EIP3 since it didn't receive it in April. The advance child tax credit depends on other factors. For example: You claimed a child from your current marriage. You receive $1,500 in advance. This year you don't claim that child but it is your turn to claim a child from your previous marriage who is 15 years old... Even if you make only $10K in income, you will have to "repay" those $1,500 by virtue of loosing the $1,500 that you would otherwise get for the child that you didn't claim last year.

-

That will make too much sense, something very hard to deal with for some people.