-

Posts

5,217 -

Joined

-

Last visited

-

Days Won

328

Everything posted by Abby Normal

-

Oh I feel like I'm whining a lot already - about printing

Abby Normal replied to schirallicpa's topic in General Chat

What?! That's a feature I actually use. -

Also a longtime user of Firefox. Never had the issue you describe. I keep my New Tab clean. I use Ecosia for searches now because it's private and they use profits to plant trees. They have a Firefox extension now. https://www.ecosia.org/

-

Discontinued. https://www.brother-usa.com/products/ads2800w#

-

I've never even seen a Brother scanner, but I only buy Brother printers. I lover my color Brother HL-L3280CDW. It has a nice bypass for envelopes, too.

-

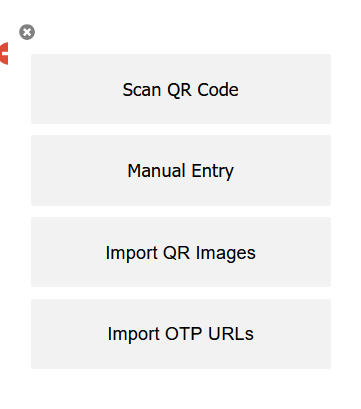

Having a backup Authenticator on your desktop!

Abby Normal replied to orst88's topic in General Chat

That seems nigh impossible. I just checked my phone and computer and they are two seconds off. -

Having a backup Authenticator on your desktop!

Abby Normal replied to orst88's topic in General Chat

I'm surprised that works. So you can use either authenticator and they both show the same code at the same time? -

Having a backup Authenticator on your desktop!

Abby Normal replied to orst88's topic in General Chat

Also, I have a password on my authenticator, so they'd need to guess that to even get the code. And my authenticator is an extension in one of my browsers, so they'd have to find it first. -

Having a backup Authenticator on your desktop!

Abby Normal replied to orst88's topic in General Chat

It probably is less secure, especially if you put a shortcut to your authenticator on your desktop, but any hacker would also need to break your ATX password, and 3 wrong guesses would lock them out and require a password reset, so I'm not worried about it. -

Having a backup Authenticator on your desktop!

Abby Normal replied to orst88's topic in General Chat

No because you can't have two different authenticator setups. The last one you do will be the only one that works. But I do agree that a desktop authenticator is superior to a phone based one because you can copy/paste the 6 digit code into ATX. -

https://www.forbes.com/sites/jayadkisson/2025/01/23/us-supreme-court-allows-beneficial-ownership-interest-reporting-to-go-forward/

-

Chaos is the order of the day.

-

Probably just delete the existing link and set up a new one.

-

https://www.thetaxadviser.com/issues/2007/nov/giftingofaremainderinterestinahome.html

-

Yes, you should paste it into a text document, and save it.

-

You can't copy and paste from your phone to your computer, because those are two separate devices. Just manually enter the code on your computer.

-

The program has encountered an unexpected error and needs to close.

Abby Normal replied to Kay2025's topic in General Chat

Restart your computer. Pause your malware protections. End all unnecessary tasks, and stop them from auto-starting on boot. Smudge your entire office. -

ATX requires an authenticator App on my phone and I don't have one

Abby Normal replied to BulldogTom's topic in General Chat

Are you installing it as stand alone on both your main computer and your laptop? Just spitballing here. Your best bet might be a different authenticator, but having two separate standalone installs might be the problem, but I would think having two different computer names would work. -

I used chat support today and the first tier joined the chat in less than 2 minutes. They quickly realized that my issue with a 1065 was beyond them and handed me off to a higher tier person, and we created a case in short order. I was able to override my way around the issue, which was good because the tech said it would take several days to resolve a 1065 calculation error. The error is on the 1065 K1 Cap Acct Summary tab. What it's doing is adding twice the amount of cash contributions entered on Sch K of the 1065 to current income instead of subtracting it once.

-

You could still put the ATX server on your server and only install ATX on the two computers that access it. They would be installed as workstation only. Or you could install the ATX server on one of the two computers and share the database folder to the other user. In which case the server computer would be Server/Workstation and the other computer would be workstation only.

-

efiling opens 1/15/25 for businesses, 1/27/25 for individuals

Abby Normal replied to jklcpa's topic in E-File

Always best to file an extension.