-

Posts

7,731 -

Joined

-

Last visited

-

Days Won

510

Everything posted by Catherine

-

I use TaxHelpSoftware to pull transcripts (one year fee ~$300. It's a HUGE time-saver, as it logs in and downloads all the client transcripts faster than I can log into e-services myself. Then, it takes those raw transcripts and turns them into *organized* reports, sorted by year and then by date, with every detail. Estimated payments made, return filing, letters sent, responses - everything. Other parts of the report show audit flags, CSED and tolling events, graphs... it's great. WAY less than Canopy, too.

-

Me, too. And the home computer once I get home tonight.

-

Our home network has to have a device's MAC address before it will even admit that it (the network) exists. And then you still need a password - although all the main machines are hard-wire. Wireless is for visiting daughters' phones, and my Kindle. But at the office, everything is hard-wire. Wireless is not even turned on.

-

We went with the Avery Viewables hanging folder labels a while back. Lemme tell you all, this is file cabinet porn. And a thing of beauty. As for finding ourselves online - yes, I searched for (and found) myself. But the client would have to know my username and the forum keyword from the name. A general search on my name doesn't bring it up. Phew!

-

Massachusetts is doing similar stuff these last couple of years. I could write pages, but instead will just say that they disgust me.

-

I wonder, too. All the live classes I go to I look around, hoping to see people under 50. Darned few; *darned* few. I hope that the younger ones are either taking online classes (heck, they do everything else online) or perhaps are going to other groups' offerings. I did go to an NATP conference a couple of years ago, and saw a number of younger people there. Not EA (NAEA, state, or regional) sponsored events, though. Guess EA is for old fogies, or something.

-

Whyever not!?!? Brand new grandsons are FAR more important than people who make stupid tax mistakes and then expect you to pull a hat out of a rabbit (any half-rate magician can pull a rabbit out of a hat; we're at a higher level, I guess. That baby is not going to have those precious toothless grins for too long - go enjoy him!

-

What credit card company do you use?

Catherine replied to Possi's topic in Business Development & Growth

I use three different sources, none of which charge me a monthly fee (per-transaction only). PayPal link on my web site, so people can pay from home. QuickBooks credit cards. Drake ePay built into the software, two options (monthly fee for lower %-age, higher %-age and no fee; I use the latter). I have a "stupid" phone, so the Square (and similar) is not possible for me. -

You and my younger daughter (age 24). She has a self-imposed restriction of NOT going into an office supply store without direct adult supervision. But, oh, you should see the beautiful filing and work flow systems she devises. *All* my systems for tracking documents and work flow have been refined to amazing precision by Gwen.

-

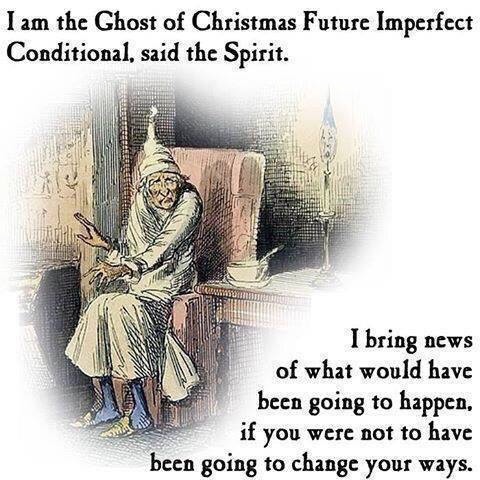

@rfassett - you say the sweetest things. A friend gave me a post card with those phrases on it a couple of years ago; I mentioned it in another thread yesterday but decided it needed its own topic.

-

As promised. "Unfortunately, I can't find those particular documents." Eheu, litteras istas reperire non possum. "I know why the numbers don't agree! I used Roman numerals!" Scio cur summae inter se dissentiant! Numeris Romanis utor! "This amount here, is that what I made or what I owe?" Haec summa, estne quod merui aut quod debeo? "Where do I sign?" Ubi signo?

-

Avogadro's number is fixed; the standard deduction changes annually. Even if I memorized it, I wouldn't trust that I was remembering this year's number instead of last year's number (or the one from seven years ago, for that matter). So I just look it up, every time I need it.

-

GREAT article. "something that resembles reality" yeah, that's the trick, isn't it?

-

A friend gave me a post card of Latin quotes for Tax Day a couple of years ago. I'll try to remember to post them tomorrow; they are quite funny.

-

It's the equation of the ideal gas law. (Pressure) times (Volume) is always equal to (the number of moles* of the gas present) times (universal gas constant**) times (temperature in degrees Kelvin). * 1 mole = gram weight of substance equal to atomic weight of molecule, contains 6.023 x 10^23 molecules. ** relates energy to moles and temperature; used all over in physics and thermodynamics. Really useful equation; starting point for all manner of things. How much helium to put in your weather balloon so it won't pop until it reaches altitude X. How cold your can of duster will get as the gases expand when you push the button. How much escaped gas it takes to displace oxygen making a lab's air unbreathable. And more! Aren't you glad you asked?

-

And thermodynamics is always fun! PV=nRT forever!

-

Faxed. Always. And they always say "2-3 days to get in the system" and it has never taken less than two weeks. Usually much longer. And sometimes I have to submit two or three times before they get through. Three different fax machines from two different locations over the course of a decade - the one consistent thread is how LONG it takes to get them put in.

-

You didn't get the "talking chickens" question? I just got a lame question that year on how many cats (zero) we had.

-

I've gotten the same arguments, and told them to take it up with the legis-vermin. I don't make the bleeping rules - but I *have* seen companies put out of business by DOL fines for mis-classifying employees. (Yeah, I had warned them, numerous times, and in writing with copies kept.)

-

Then why do mine always, *always*, *ALWAYS* take two or three weeks? Just sayin'... it's like my POA's all have "DELAY ME!" notes on them. Sheesh.

-

@RitaB and @rfassett -- OK you two... any minute now, you're going to start splitting infinitives in addition to ending sentences with prepositions. Then comes bad punctuation ("Let's eat Grandma!" -punctuation saves lives). Enough already!

-

I also have some older folks who prefer the single payment. But then I also get the calls in June, September, and December, asking if they have to send more money. I need to keep careful notes of who does what so I don't mis-advise them all... And there is an older couple that I worry about quite a bit. She has been fighting some odd type of cancer for some years. It's not curable, but it is treatable and they are managing to keep it in check. Every time chemo-latest stops working, they have (so far!) just come up with chemo-next. He has been taking care of her. But he also a bad fall a couple of years ago on an escalator and ended up with trauma-induced dementia which is worsening. Between the two of them, they make *one* fully functioning individual. It's really sad to see, and I worry about them. One loser son who would cheerfully rob them blind. One good son who lives far away. One excellent grandson (loser's boy) who has all the maturity (at 21-ish) that his father completely lacks - but who is also not that nearby, working (finished college early), and engaged, so a bit distracted with his own life.

-

Going "overpowered" is always better than "just enough" because once you get it hooked up, you'll realize you have smartphones and tablets that don't use data if they're on wifi; gee I can watch YouTube on my TV if I hook that up.... etc.

-

Mass had that law on the books since the original sales tax law was passed back when I was a toddler or something. No one bothered. So they put it on the Form 1, and have a "safe harbor" calculation. We used to use that a lot before Amazon started charging sales tax. We've gone back to mainly leaving it blank - because people DON'T track, and the safe harbor figure is wildly skewed in favor of the state. One of my persnickety clients who used to owe $75+ a year in use tax (pre-Amazon tax collection) went through last year and came up with less than $3 in tax due. We still ask - but don't worry about it as much when we get the blank stares and "I dunno" as answers.