Leaderboard

Popular Content

Showing content with the highest reputation on 09/21/2023 in Posts

-

The clothing donated throughout the year totaled more than $5000, was not appraised and the deduction was denied. Other items donated (furniture, toys, etc), when aggregated by like type, did not total more than $5000 each, so those deductions were allowed.3 points

-

Be careful that your client is not getting into a partnership with their renter. If they are sharing income and expenses, it sounds a lot like your client is putting in land and the "renter" is putting in labor to produce a crop that each will then share the profits from. That looks a lot like a partnership. If that is what they are wanting to do, that is fine, but there are tax/legal implications to consider. Tom Longview, TX2 points

-

The estate should have an appraised value for the property at DOD, and if you are lucky, it will break out the land from the improvements. If the estate did not do an appraisal, or if they did but did not break out the irrigation improvements, then it would be best practice for your clients to have an appraisal done when they get the property. If they have to get an appraisal done, it would be a good idea to show the appraiser the valuation at DOD so everything matches up. I believe the irrigation improvements will be 15 year property, but watch for anything that can be segregated out that is less than 15 year property. There may not be any, but you could potentially accelerate some of the assets if they are a different class. Tom Longview, TX2 points

-

A couple of resources: https://www.irs.gov/forms-pubs/about-publication-225 https://taxschool.illinois.edu/?s=Farm And, lots more from the U of I Tax School: https://taxschool.illinois.edu/2 points

-

Over $500 requires Form 8283. Over $5,000 requires an appraisal. The $5k applies to like-kind items, so if you donate clothes all year long and the total FMV is over $5k you have to get the whole lot appraised. Same with furniture.2 points

-

2 points

-

It is a combination of 7 year and 15 year. The above ground pivot is movable while the well and underground pipe are permanently attached to the land. A separate appraisal might be needed for the pivot by an equipment appraiser. A RE appraisal might not include the details. I don't see where it would matter.1 point

-

I agree. I keep paper copies of almost all of my financial records, etc. My granddaughter has two missing W2s and refuses to get them. "They were small, Grandma!"1 point

-

It is not just a school issue. Many people fail to PRINT AND RETAIN the proper records, personal, business, or professional. If I had a dime for every person who asks me if I have paper records of their data... Or my computer failed, do you have my data... I suspect at least one person here does not have all required paper records (PDF is common), but does not follow the rest of the "I don't keep paper" requirements. Same for the often shared idea of not keeping any records once there is no legal reason to (no items from 10 years ago for example). --- I gave up beating the drum on the rules allowing non paper record keeping. I guess folks are fine with the one item which nags at me, essentially giving warrant-less search rights to anything connected with your e data storage. The rules were set in the 90's (or earlier), and have not been updated (why should the IRS want to give up rights?). The second item is having to proactively report ANY possible data issues, which can be something like changing computers or a power issue. If the IRS has updated the rules, I will be glad, but no one has shown me anything less onerous being allowed, and I stopped looking/monitoring.1 point

-

DBerg, You are correct. I finally figured out that it's the lack of W2 information that is stopping the whole process. She lost her W2s from her original return or "it's on my phone somewhere". She got wage statements from the IRS and it does not show entire FED ID#s or address. I told her to find them or get copies. I have the copy of the 1040, but apparently the W2s are the holdup. I wish that the schools around here would teach some personal finance so that these kids would be able to function and know what things are important to keep.1 point

-

And I was reminded that our pledge forms ask about time, talent, and treasure. It is and has been possible to pledge to offer time for maybe committee work and/or talent to be in the choir, provide IT services, etc. No pledge of money is required - although it would be nice1 point

-

No raffle ticket was purchased but money was exchanged. From the description here, only those who bought/paid for groceries were entered into the raffle. Was it possible to have been part of this event without having 'paid for' groceries? Maybe you got a gift. But you paid for the groceries to even qualify for the $5. In my church case, no money will be exchanged, nothing purchased to qualify. The only way to enter is to submit a pledge by a certain date. Even then, there is no legal, just moral maybe, obligation to actually pay the pledge which would be to the church, not the donor of the trip.1 point

-

Since there is no raffle ticket cost involved, it is a gift from one person to another and value of a four night stay at a time share resort will be well below the gift reporting requirements.1 point

-

I only read the headings before posting. I guess they were talking about appraisals. (I wouldn't defend a return like this one not even in front of a revenue officer... for sure not in tax court). "Tax Court Says No to $25,500 Deduction for Clothing Donations MAR. 27, 2023 Duncan Bass v. Commissioner DUNCAN BASS, Petitioner v. COMMISSIONER OF INTERNAL REVENUE, Respondent United States Tax Court Filed March 27, 2023..."1 point

-

Another Random Thought....these fractional CFO companies may have to be included on the reports as CFO's are explicitly included in the section on persons having significant control over the company. And the "catch all" provision states that the work you do is determinative of the requirements for reporting, not the title. So a CFO cannot have their title changed to "Finance Manager" just to escape the reporting requirements. I wonder when FinCEN is going to start auditing the reports, if they ever do? Tom Longview, TX1 point

-

I agree that the plain reading of the guide seems to exclude C&Fs. It appears that the trigger for most of our clients is a formation document filed with the SOS of the state in which they are formed. Just a random thought, companies that form after 1/1/24 have to include the "applicant". Lawyers and Public Accounting Firms who set up these entities are going to have to be included on the report as the "applicant"? But Law Firms and Public Accounting Firms are exempted from the reporting requirements. I wonder how that is going to play out? Tom Longview, TX1 point

-

I downloaded the guide and it is pretty well written for a government document. Cleared a lot of my questions up. Notice that there is a "Catch All" for each class of reportable persons...very slippery when a $500 per day penalty is on the line. I sent a .pdf copy to all my clients who have LLCs, Corps & Partnerships. Told them I can't do the reporting for them but as a courtesy I was providing the guide to let them know about their requirements. Tom Longview, TX1 point

-

1 point

-

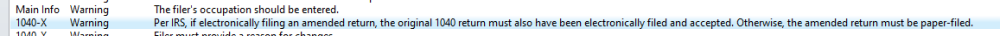

I'd call support. The only requirement should be met is by IRS, that the original was efiled. The program used to create the amendment shouldn't matter. I've done amended returns in my program for new clients, not ATX though.1 point

-

1 point

-

"A “Reporting Company” is a domestic or foreign corporation, limited liability company, or similar entity that was either formed or registered to do business in any state or jurisdiction by filing a document with a secretary of state or other similar office and which does not qualify for an exemption. " (There are 23 exemptions) Depending on how this is interpreted, it could include any entity with an "Assumed Business Name" registration with any state. Including Schedule C, E and F without ABNs appears somewhat unlikely. "We will see what happens"1 point

-

I attended two classes on this and one speaker said yes for C & F and another said no. I guess I will be waiting until the rules are more clear.1 point