Leaderboard

Popular Content

Showing content with the highest reputation on 05/21/2025 in Posts

-

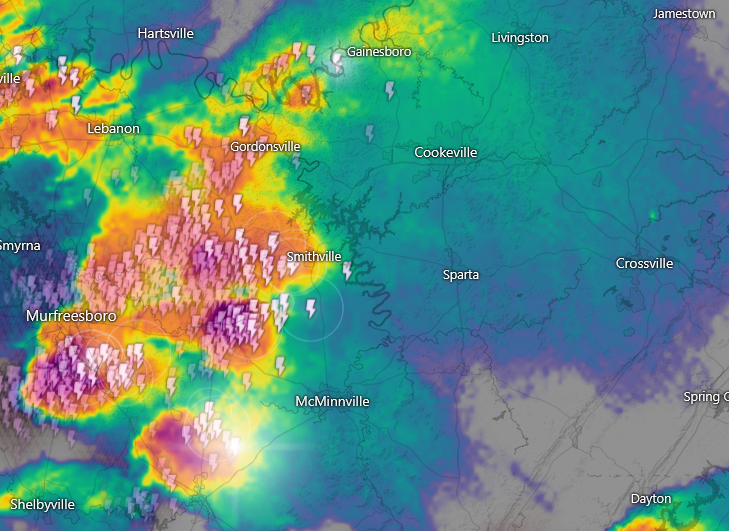

Tornado warnings all afternoon for Tennessee. Damage reports just now coming in. We're OK in Manchester - about an hour plus away from Rita.5 points

-

a local CPA contacted me late last week for my comments on the proposed raise in the SALT cap to $30,000. I advised her that in all my 36 years of practice I've never commented on a proposed bill.3 points

-

I also charge $25 - $50 for dependent returns, with the option I keep for myself to give them a courtesy discount down to $5 or $10 or even $0 (say if the kid had one W-2 and $27 in withheld tax). But I want to see it before I price-quote, and anything that involves credits, kiddie tax, and multi-state issues is not done for a measley $50.3 points

-

Standard response to client inquiries: there is no sense in discussing anything until a bill has been passed and signed. Until then, all bets are off.2 points

-

2 points

-

@Abby Normal what website did you get that radar image from. I have not seen one like that before. @RitaB take care of yourself. This spring the weather is not fooling around. Tom Longview, TX2 points

-

"Oh by the way, can you quickly do my kid's taxes, he doesn't have much??", as the client expects a simple return that won't take over 5 minutes. Right. You might get a kid of 14 who has unearned income over $1400. Or a kid whose been getting child tax credit for years, but has just turned 17. Or an 18 yearold whose W-2 is so high his parents can't claim him. Or a college student with educational credits who may or may not be able claim him, assuming his parents cannot (which brings on another question). Assuming a child's return has no issues may be one of the most underappreciated things we run into.1 point

-

Correct! I have 4 weather apps on my phone: Windy One Weather Google Weather Weather Wise I use mostly the Windy site on the computer. Also fond of https://www.lightningmaps.org You can add weather radar to lightning maps, too. It's a setting.1 point

-

I go back quite aways myself as I like many moved from the Maine produced software (Saber?) to ATX. I miss hearing from Rita and a number of others I no longer see post. I got ready to renew my software this AM and got a threatening email from WK that I appeared to be attempting to access my account from different locations! I had to replace my older computer about a month ago and suspect that is the problem. I have had no small difficulty in connecting with anyone at ATX. Unable to get my rep. What a hassle ! Finally got a call back from tech support which hopefully will resolve the problem. She advised that they had sent out a number of these emails so I am evidently not the only one. This after over twenty years as a client.1 point

-

Oftentimes the child is a student somewhere who has income in three states! Our fee for dependent returns is $50, like Patrick trying to avoid them claiming themselves and leaving us with a mess to clean up. More if the child has investments, plays with cryptocurrency, or has income in another state.1 point

-

The rule in CA is "where the benefit of the service is received, that is where the tax lies". In practice, it means that any client who is a resident of CA at the time I prepare the tax return received the benefit of that service in CA. Therefore, the income I received from that client is taxable to CA. Even if they come to my office in Texas, CA considers the benefit received in the state. I have a few clients that are non-residents of CA but who still have CA sourced income. Because they do not reside in CA, the preparation of the 540NR is not sourced to CA and I don't pay tax on it. The benefit of the service was received in their home state. I think OR is pretty much spelling out the same schema for their income tax sourcing rules. Tom Longview, TX1 point

-

1 point

-

1 point

-

I have had a couple of situations wherein I have changed S-Corps to LLCs or QJFs just to simplify things for small business clients. This may not make sense to some of you, but I always think of what is best for the client before what is best for me.1 point

-

I always tell the parent to send me the information, and I'll take a look. I don't mind doing the kids' return, but I also want to ensure I'm charging the right amount. If it's only a couple of W-2's I charge $25 for the dependent returns. Anything more and the cost goes up. I find it much easier to prepare the return than fix it later when the child didn't check the "Dependent of Another" box. I have also found over the years that most of these kids stay with me once they are out of school and working full time, and I get to charge them full price.1 point

-

Hopefully you have saved the payment confirmation and double checked the the payment type and year.1 point

-

Max: That worked, at least it shows my application status as completed. Thank you to all for assistance! Good luck Margaret with your move in July! If you need help when you do your changes for your EFIN, the Ehelp desk can access your application while you are in it. The young lady who helped me was great. E-help # 1-866-255-0654.1 point

-

I remember all the names. But I don't always remember what happened to them. I think KC retired.1 point

-

Click E-services; > e-file services > efile application. then click the little eye under View/Edit. This takes you to the summary page where you will see the categories underlined in Green at the top of the page. click the first one - Firm info, then start making changes. I just updated mine when I saw this post. The only problem is at the end they ask for a PIN to accept terms, but it won't take any input. Maybe its not required on an update? HTH1 point

-

I decided not to purchase stationery when I moved and got only new business cards. I do have shipping labels printed with my name & address that I can also use on tax folders, colors do match the folders so it looks nice. I don't use these regularly on folders for all returns, only oddball returns that I haven't printed out labels for at the beginning of the season. For letterhead, I created that as a template in MS-Word. I usually print on plain paper, but if you want it to be nicer without engraved stationery, you could buy heavier weight bond if you think the recipient notices or cares. No preprinted envelopes either. They are either run through my printer, again a template, or I use clear Avery address labels using the same font as the letterhead. I use these on a variety of envelopes including small return envelopes that go with invoices or balance due reminders. I guess it depends on how much your image depends on these, and how much your clients would notice or care. Mine don't care, and the template works better for anyone that gets the correspondence by pdf attachment rather than snail mail. Sorry for the derail from the Efin addy change, and if this portion gets lots of responses,I may move to its own topic.1 point

-

On the other hand, these rules strongly suggest that if I prepare any tax returns for residents of Nevada or Washington (states with no income tax) then that income would not be Oregon Income or subject to Oregon Tax. Hmm1 point

-

The same, and so many of them are being questioned. This was not the case throughout most of the tax season. Some of the questions don't make any sense.1 point

-

This might not be as bad as it sounds. The income threshold to file a return for OR nonresidents is about $2,700 single and $5.500 MFJ. That one OR client who pays you $500 is not going to trigger your filing in OR. Or is there some other rule governing tax preparers? EAs don't have to worry about it at all since those who reside in other states can't prepare OR returns anyway. So if you're a CPA preparing an OR return, be sure to keep your price at $5,495.1 point

-

This didn't even make it out of committee in the House and why I've always had a policy of not discussing any legislation until it passes.1 point

-

Not a surprise. But based on your earlier email they are not going to have out of state EA preparers anyways because they don't recognize our licensure. I don't have any OR clients, and I guess I never will. I will send anyone who asks to you Lee. Tom Longview, TX1 point

-

Thanks for all of the replies. I also got a suggestion from another local tax preparer who has used the free version of MordPass for several years and is well pleased so I am going to give it a try.1 point

-

Oregon has now adopted rules similar to California. The preparation of Oregon Tax Returns for residents or a business residing or located in Oregon by preparers located outside of Oregon is considered to be Oregon Income subject to Oregon Tax.0 points