Leaderboard

Popular Content

Showing content with the highest reputation on 02/19/2024 in all areas

-

Not necessarily. Those details run and hide until you ask for help, at which point they come out of hiding as if they had been there all along.6 points

-

enter "Plan Loan Offsets" in the irs.gov search box for some fun reading--IRC 172(p)-1. My reading of it is that it counts as an actual distribution--combined with Code 1, looks like a penalty as well, IMO.3 points

-

This is really cloudy right now because the rules have changed a bunch. If I understand it correctly, as an eligible beneficiary (because you are not more than 10 years younger than the decedent), you may take the RMDs based you life expectancy. Below is an excerpt from the IRS website: Non-spouse beneficiary options In 2020 and later, options for a beneficiary who is not the spouse of the deceased account owner depend on whether they are an "eligible designated beneficiary." An eligible designated beneficiary is Spouse or minor child of the deceased account holder Disabled or chronically ill individual Individual who is not more than 10 years younger than the IRA owner or plan participant An eligible designated beneficiary may Take distributions over the longer of their own life expectancy and the employee's remaining life expectancy, or Follow the 10-year rule (if the account owner died before that owner's required beginning date) Tom Longview, TX2 points

-

Hi, if happens to my client, I will amend and file jointly or MFS. because married is married in US or not. especially will involve with USCIS. if we do it wrong, and delaying in their process, they might blame us. Thank you!2 points

-

I wouldn't do a thing on this return unless and until the son agrees to cooperate. That said, should he agree, there are ways to reconstruct likely expenses and income, yes.2 points

-

Actually the answer is fairly complicated and can differ depending on state law. Please see the article in The Tax Advisor: https://www.thetaxadviser.com/issues/2022/nov/federal-implications-passthrough-entity-tax-elections.html1 point

-

If this was from an oversight of changing account from wife then yes, he needs to claim it; and get the account ownership transferred.1 point

-

Cash basis deducts when paid. MD makes you add back any PTE tax for the year it is passed out to the owners, so if you pay it after year end, you have ghost income at the state level, via the add back, in one year, but a federal deduction the following year when the tax is actually paid, without a corresponding add back. Refunds will be at the individual level, unless refunded to the business. There doesn't appear to be a built in method for the refund to be taxed for federal in the year it is received by the individual, even if the individual is itemizing because the PTE tax was never deducted on the Sch A.1 point

-

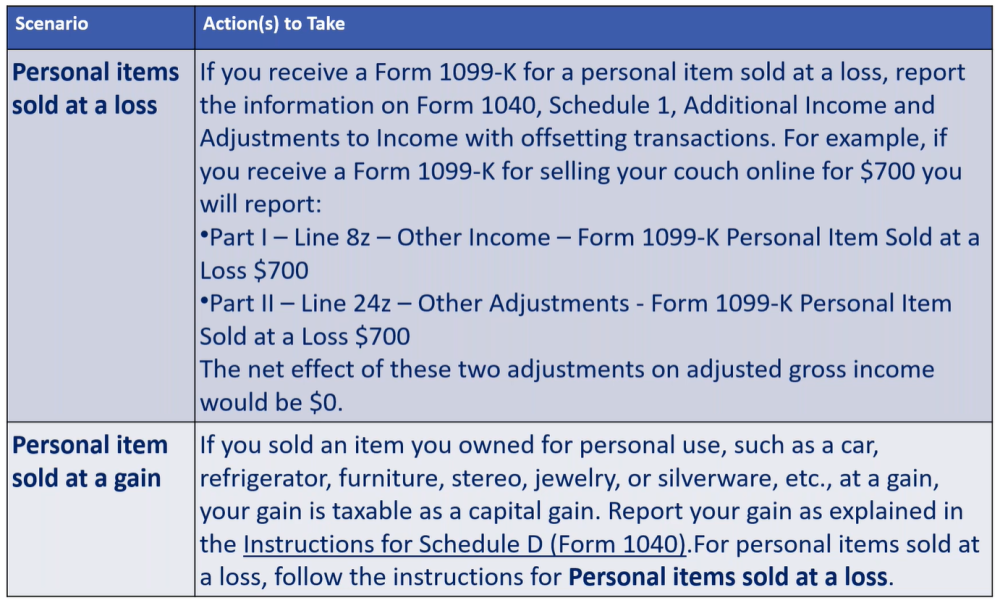

It depends on your software, whether or not you can pull down a 1099-K worksheet or have to make a direct entry. The "other adjustment" (negative amount) is a manual entry in my software.1 point

-

I would guess that your client "believed" he was paying the credit card company for the debts and the actual paperwork says he paid the debt relief company for their "services" of getting the debt discharged. Just my opinion, but I think your client is on the hook for the taxes on the discharged debt. Tom Longview, TX1 point

-

I would file MFS using their residences in the 2 different states if that's possible.1 point

-

If son is not interested, let it go - just tell him to pack her papers in a box, in case IRS ever asks... D/WI1 point

-

When we applied, the user fee was $1200. The cemetery does well to receive $300 per year.1 point

-

I was (unfortunately) appointed Treasurer of our family cemetery. I do know that the IRS does not challenge the deductible contributions to a church, but outside of that, I believe the only way to assure deduction for anything else is to exercise Form 1024 for a 501(c)3. I tried to do that for our cemetery association, but the IRS sent back the 1024 asking for a huge user fee. More money than donated revenue for five years. We declined. We do have a FEIN but I've told donors that the deductibility of their contributions could not be guaranteed. So few people in Tennessee are able to itemize anyway so it makes little difference to them.1 point

-

Forgot to add that supplemental information is showing ordinary income reported of 125.44 So the adjusted basis should be 2,683.58 (2,558.14 plus the 125.44).1 point

-

The interest income was from an annuity set up by her parents years ago. She has not pulled money out of it for years. I am not going to make her records up myself. I may just have to go with her Social Security and whatever her son can scrounge up. I don't know if he could find anything on her phone, because it's a flip phone. She was a nice lady, but was not very trusting.1 point

-

The way to reconstruct her income would require finding a list of her repeat customers, how much she usually charged them and how often she did housekeeping and when she stopped working.1 point

-

Is son personal rep? Maybe he would at least authorize bank to release statements to you. PR is responsible for filing final tax return.1 point

-

Who would authorize you to prepare the return? Unless the son will help you, there's nothing you can do.1 point

-

First of all, it'd have to be a true no-strings-attached donation with nothing in return, and with that appropriate IRS language on his receipt. Second, he can look up IRS-approved charities: https://www.irs.gov/charities-non-profits/search-for-tax-exempt-organizations1 point

-

1 point

-

I agree. Be careful with the Medicaid rules. Because the TP is a family member, Medicaid may call this an improper transaction and disallow coverage. I'm not sure on this but after caring for my mother for a few years and dealing with Medicaid, I wouldn't take any chances. The folks I dealt with in Ohio couldn't even add and could never get my patient responsibility correct. Very simple math, mom gets x dollars and you're allow to keep 50 dollars for personal care. Maybe it was because I was using normal math and they were using common core??? I was threatened with fines for failure to properly pay and accused of improper transactions because I did the spend down exactly as they directed me to. After one year and a couple of months they finally figured it out. Great!!!. Not so fast, somehow I overpaid. I paid the same amount every month for three years. The nursing home bookkeeper couldn't figure anything out and told me to quit asking cause she had no answers. It really became a joke after a while. That overpayment was applied to her funeral as Medicaid insisted it was right. My best suggestion to your client is keep every document from Medicaid and don't discard anything. Keeping the docs was my saving grace.0 points