-

Posts

390 -

Joined

-

Last visited

-

Days Won

14

Everything posted by Patrick Michael

-

Employer Provided Tuition for Child

Patrick Michael replied to Patrick Michael's topic in General Chat

We might be able to go that route The non-profit paid for all his living expenses while away. Parents are trying to see if they can come up with enough evidence that they provided over half his support but it will close based on the amount of time he was away. I think we can claim it was a temporary absence since he intended to return home. But we would rather not go down that route in case of an audit. -

Employer Provided Tuition for Child

Patrick Michael replied to Patrick Michael's topic in General Chat

He's tried for over a week but nobody answers the phone and he can not go the office due to Covid. He's freaking out because tuition is close to $60K a year (almost double what he makes). -

Client works for a major college and his son gets to attend the college tuition free as a benefit. He could not claim his son as a dependent in 2019 as he took the year off from school to perform missionary work. Son will be attending college in 2020, full time, is under 24 and will be living at home, so the parents will be claiming him in 2020. All was well until the college's HR department sent him a letter stating the tuition would be included in his taxable income for 2020 because he did not claim his son as a dependent in 2019. From my research I believe the tuition would not be taxable. I could not find anything that said the son would have to be a dependent in the previous year for the tuition to be tax free, only for the year the tuition was for. Am I missing something? Thanks

-

Recently all the calls about the stimulus checks have been taking up a lot of time.

-

Does anyone know where the name ATX originates?

Patrick Michael replied to Abby Normal's topic in General Chat

Started out with TaxAct in 2001, then switched over to ATX from 2005 until 2012 and been with Drake ever since. Part time gigs reviewing for other firms I have used Proseries , CCH Prosystems, and another god awful program whose name I have erased from my memory. -

Good point. I didn't think of that. If I put it on Sch E would it have to be depreciated and that depreciation "recaptured" when sold (which is what I'm trying to avoid)? How about putting the $645 on Line 21 and then a negative amount on Line 21 to net it out? Or just putting the $645 and eating the tax?

-

Happy Easter everyone! Client could not use her time share in 2019 and was able to rent out 3 of her 14 days. She received a 1099 for the $645 of rent and had $190 in commissions and other expenses related to the rental . Since this was a one time event and she is not trying to make a profit I was thinking of putting the $455 net income on line 21 as other income, not subject to SE tax. Would this be proper treatment or should it go on a Sch E?

-

NY is allowing UI for temporarily laid off workers. They had so many people applying online that their system crashed numerous times during yesterday and today.

-

Thanks for the article. The improvements do meet the definition of qualified leasehold improvements so sec 179 it is.

-

Are leasehold expenses eligible for sec 179 in 2019 or do they have to be depreciated over 39 years? I have read both that they are and that they were removed form the list of qualified property.

-

The two they missed is explaining to clients that their barber, brother-in-law, and/or co-worker is wrong and they can't claim that credit that "everyone" else is claiming. And why you have no idea why their neighbor is getting a bigger refund then they are!

-

When QBO first came out I hated it but have gotten use to it's quirks and figured out some work arounds, so I don't mind it too much. The best part about QBO is the money I make cleaning up the mess many clients create when they try to do it on their own. Usually costs them double or triple what it would have if I did it from the beginning.!

-

I have a similar client. A national replacement window manufacturer subcontracts the installation and the my client "works" for the sub. The sub tells him when and where to show up, provides all the materials and tools, and supervises the job. The sub told the client that since he (client) gets paid by the job (not hourly) and he does not have a regular schedule (sub will call a couple of days before the job and client can decline to work) he (client) is not an employee. Client does not have expenses to offset the income. Client enjoys the work and flexible schedule so he does not want to rock the boat . I file the Sch C and doesn't mind paying the SE tax. I explain to him every year that this sounds like this could be an employer/employee relationship, what his options are, and document the discussion. I believe I have done my due diligence in explaining it to the client and it's then up to the IRS and/or client to determine the relationship.

-

In NY these contributions have to be added back into NY income. But then you do not pay NY income tax on any the distributions after you retire. Not a bad deal.

-

Mystery solved. They were paying for a previous year on installments and the IRS applied one of the payments to 2016 instead of 2015. The bill has been paid off so IRS is applying to 2019. Thanks for the responses.

-

Client received a letter from the IRS that they had not filed for 2016 and there was a credit on account for tax year 2016. They did file in 2016, so they are not sure what it was all about They called the IRS and had to credit transferred to tax year 2019. Do I include this amount as a estimated payment or will the IRS just add it onto their refund automatically? Thanks.

-

The SE income question would depend on what the other income was for. I've seen 1099's where box 7 is used when it really should have been in box 3 and and not subject to SE tax. If this for one time activity and they are not regularly, frequently or continuously engaged in the activity they were paid for, no SE. I would file even if there was no SE to avoid a love letter form the IRS down the road.

-

Had a client that swore up and down that their original documents were not in the envelope with the return. I looked all over , could not find them, and agreed to pay for a year of Life Lock to placate her. A couple weeks later I ran into her at a store and she tells me "Guess what, I found the documents. My husband had taken them out the envelope and filed them away." Never apologized or offered to re-pay me for the Life Lock. Next year I charged her double and had her sign a receipt when I returned everything to her. Didn't come back after that!

-

IRS urges tax pros to use multi-factor authentication

Patrick Michael replied to Roberts's topic in General Chat

I'm using Drake and Microsoft Authenticator to generate the code. Don't have to wait for a text, open the app on my phone and the code is there. Drake also does not require the MFA code to log back in unless you have been inactive for quite awhile (not sure how long, but it's at least an hour), you only have to enter the password. I thought it was going to be a hassle, but found it doesn't take more than a couple extra seconds to log in. -

questioning my decision to change to Drake

Patrick Michael replied to schirallicpa's topic in General Chat

I switched over several years ago and do not regret it. It took a little while to get used to the new input screens but once I did I found it faster than ATX. One feature that I love is the macros that you can write to speed up repetitive inputs. Writing macros looks intimidating at first, but after you get the hang of it they are not hard and really does speed things up. -

In addition to an hourly rate, which is a little higher than minimum wage, I add a $5 per completed return bonus at the end of tax season if they stay for the entire tax season. I found it increased productivity, reduced turn over, and the more experienced preparers who can crank out the returns end up with a higher hourly rate at the end of the year than the going rate in this area.

-

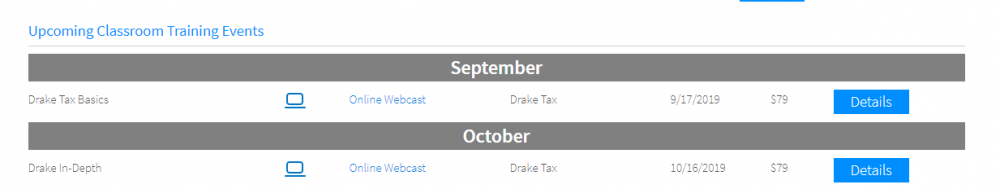

Catherine, I went to link and the only webinar for the 17th is $79. Is there a way to get it for free that I'm missing?

-

Thanks Max. Paper file it is!

-

Client passed away in 2017 and received 1099 -C in 2018. I am preparing the 1041. The estate is insolvent. I spoke with support who said there is no 982 screen to indicate the debt is not taxable due to insolvency. Any suggestions on how to report so that the IRS knows that income was reported but is not taxable? Thanks.