-

Posts

1,034 -

Joined

-

Last visited

-

Days Won

62

Everything posted by FDNY

-

Let me know how much champagne you’ll need

-

Same here, I have 4 that I know about. I did call Priority line on one and it was due to an amended return that I filed about 2 weeks later, so taxpayer will probably get one refund once they figure it out. Agent knew that was the reason.

-

So many songs that I couldn’t say which is my favorite. But I remember as a kid “The Times They Are a Changin’ got me thinking and was probably one of the first songs I actually listened to the words. Blowin’ in the Wind is another

-

I agree with Yardley. I gave Drake a try twice as I did ProSeries and did like the newness like I had a new toy to play with. But in the end I just feel comfortable with ATX, and for all it's problems and complaints we can all be like martyrs in the tax preparation world. There's so much to be upset about, but it brings us closer together as we don't have to suffer in silence or isolation.

-

Very interesting thought. The thought never really occurred to me, as I'm someone who has no kids. I do have a number of friends' kids who look to me for guidance in a number of different matters, usually financial but there has always been tangents to health and some social issues. I've gotten close to some of them and actually named one as my executor. I always say, I know a lot of good kids, now they're in their 30s and 40s, and would like to think I had something to do with their successes. Catherine has a wonderful life ahead as she watches little Cordelia Rose grow into a fine person. And Cordelia is fortunate to have a terrific grandmother.

-

Congratulations Grandma!

-

I have 2 clients where NYS didn't withdraw scheduled funds

FDNY replied to schirallicpa's topic in General Chat

Same here. I thought this was odd. Have more than 2. Thanks for posting. -

Recently I read an article on 50 best places to live in America. Mostly small cities near schools, health care, outdoor activities, entertainment and good food and drink. I live near two of them, Cambridge and Boston. While on the more expensive side it has everything I mentioned. But my preference if I eventually get my way I would spend the winter in Key West, specifically the Truman Annex area. Don’t need a car, walk and bike everywhere, entertainment and music in the streets, Cuban food, fresh seafood, great sunsets, an airport, and a hospital. Brunch everyday with unlimited mimosas. What’s not to like.

-

I did renew with the 15% discount. Received a letter about 2 weeks ago. No call or email. I’m on vacation now so I don’t recall the final price.

-

More leisure activities are on my calendar. This tax season has been too long, too hectic, too stressful, and felt like two seasons in one. I'm looking to go to a better place before too long. I hope all of you do too.

-

Thank you Judy, this didn't come up on my knowledge base search. Can't thank you enough, I should be your servant for a day, this was driving me crazy.

-

I'm trying to e file a 2019 amended return with a one page attachment and I get the following reject: A binary attachment submitted in the PDF format must begin with the file header "%PDF-" I did once before have same issue and I can't for the life of me remember what I did after reading up on %PDF which was way over my head. I thought I put in the header 1%PDF- then the name of attachment but it didn't work this time. Maybe I'll try with quotation marks. Would anyone know what I need to do? Thanks

-

Thank you everyone for this discussion. Now I know more than I could ever know on my own, and without the doubt that something may be incorrect. You guys are simply the best!

-

You know, now that you made me think about it that makes a lot of sense. I’m going with it. Thank you for your help, and keeping with the theme of these posts, Cheerio my good friend.

-

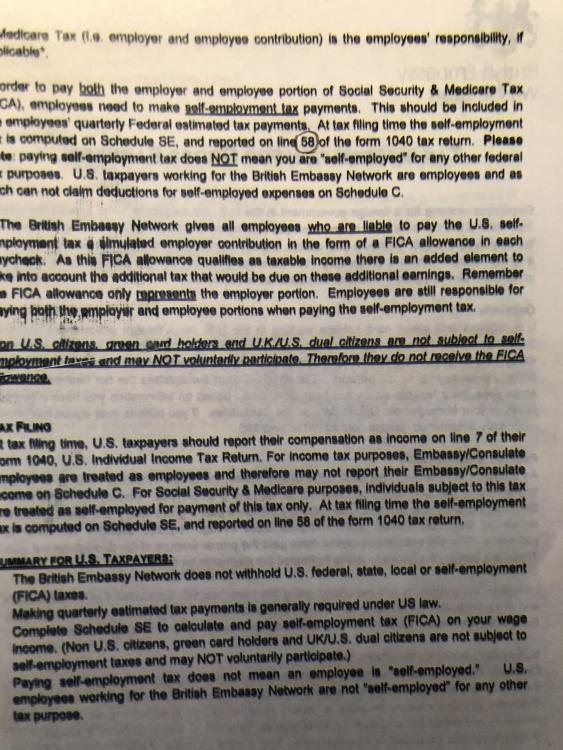

I do have him paying estimated taxes. I don’t think I can deduct 1/2 SE tax as he’s not self employed. I guess foreign embassies are special employers. He’s not highly paid, he’s probably a translator. I know sometimes I have trouble understanding the accent. Tea and crumpets, a nice benefit. My wife once worked for an English law firm and tea and crumpets everyday at 3.

-

Letter explicitly says to use Sch SE, as a way to pay both ends of employment taxes. I wonder if the Queen knows about this.

-

-

Yes, sorry, there’s an EIN on W2, Employer name is British Embassy. Last year I was able to jury rig the short SE schedule.

-

Second year client US citizen works for the British Embassy. No taxes withheld including SS and Medicare. They give him a letter each year saying he is responsible for both ends of SS and Medicare tax because they have no way of withholding. Although they do have a tax ID# on W2 so this makes no sense to me. The letter goes on to say to use form SE but taxpayer is not eligible for self employment deductions, that’s fine, it’s W2 wages. In order to use form SE the only way I could get it to work is to use the clergy entries then at the bottom override the 1/2 SE tax deduction. Form 8919 doesn’t apply here. I forget where I was going with this, oh, anyone have any different method of doing this? And does this even sound fair?

-

I put the info in myself. I found on 2 other forums of people having same problem. One of the responses was from an "IRS employee" that IRS is aware of the problem. I think it was the Intuit forum. That's good enough for me to tell clients to have patience, I have too much going on now to deal with this further. I hardly ever check WMR for clients and tell them to do it themselves, but clients saying there's an error just added more stress to an already stressful year.

-

So it appears this is a problem on IRS end where WMR is telling people incorrect info has been inputted. They say they are working on it, among things.

-

Yes, one return included UI before the change. The other didn't have anything unusual. Thanks Max, I'm going to try the priority line, like I have nothing else to do.

-

I have 2 returns that I know of that were accepted in March but WMR says error, check if your info is correct. I thought I saw this somewhere that this has been happening. Would anyone have any knowledge of this problem?

-

I think so. If you open return and change something it lets you know

-

I just love when I try to get financial statement and parent tells me kid has no clue. Same with getting a kids 1099G, kid lost all forms of verification, we’re doomed.