-

Posts

1,400 -

Joined

-

Last visited

-

Days Won

14

Everything posted by Yardley CPA

-

I offer the Venmo and PayPal option to my clients. I would say around 35% are using it. I provide my email address as their link to pay me. I also believe you can send an OR Code or "Request Payment". I used the OR Code option once. Overall, it's worked well for me and is very efficient and easy to use. One caveat to keep in mind, if the client pays via a credit card Venmo and PayPal do take a fee, around 3%, to process the payment...at least they have for me. Anytime a client has paid via a direct debit option from their bank account, I have received the entire amount I invoiced. Both Venmo and PayPal have business account options that offer services beyond opening a personal account. I think the business accounts charge a fee regardless as to how the client pays.

-

I've also had a few inquiries from clients who have yet to receive refunds. I have informed them the IRS is taking longer this year and also provided them with the link from the IRS website "Where is My Refund". In some case, I have also provided the IRS phone number and instructed the client to give a call if it made them feel better. It was a long season in so many ways.

-

I have downloaded the Drake evaluation program and I agree with this comment that the forms option is not close to what ATX offers. And maybe it isn't meant to be, it's not a form based program essentially. With that said, I'm not a Drake user and I'm sure those who are love the product as evidenced by comments in this ATX forum. I prefer ATX.

-

I've been reviewing Pro Series and I'm very impressed with what I've been exposed to so far. It has a similar feel and layout to ATX and it's program offers form based entry which I prefer. The package also provides access to a portal and advanced calculations as part of the base price. Their staff have been very receptive my questions. I highly recommend downloading the trial version and seeing if it fits your needs. Good luck.

-

She is beautiful. Congratulations!

-

Thanks very much. I'm not interested in Drake but appreciate the heads up.

-

Hi, All...I am a long time customer of ATX. This year, I'm taking a look at Pro Series. I've completed my own return on the program and find it offers similar navigation and feature -- generally speaking -- as ATX. It has a more refined feel and seems to be user friendly. Pricing for 1040 Complete seems a bit high but it does offer a fair amount of options, including portal access. I would appreciate feedback from those currently using the program. What do you like, what do you not like as much? Any other thoughts would be greatly appreciated. Thank you.

-

I normally hear from my ATX sales rep by early April. This year, not a peep. Wondering if anyone has renewed their subscription and if you can also provide an email contact for your rep? I've been with ATX for over 20 years, back to the days of Parson's Technology and Saber. Overall, I've had good luck with the program and I have not experienced the many headaches others have described here. With that said, I am planning on taking a look at ProSeries to see how that program has evolved. I used it when I worked at a CPA firm, fresh out of college. Time will tell.

-

Here is some information I found on the topic. It would seem your client can use it on her remaining lots and the condo since they haven't generated income. Not sure about the sold lot. Hopefully someone with more experience on this topic will chime in and confirm my thinking. IRC Regulation 1.266-1, Capitalize Taxes & Carrying Charges Election; Reg 1.266-1(b)(1)(i) provides that a taxpayer which owns unimproved and unproductive real estate can elect to capitalize annual taxes, interest on a mortgage, and other carrying charges. The election must be made annually. The election requires a statement in the taxpayer's return setting forth the description of the property and the expenses to which the election applies. In addition, if the property produces income in a given year, the election is not available. As far as finding previous post, maybe if you follow the post - option in the upper right hand corner - it will allow you to more easily keep track of them? There is an option within your profile to manage posts you're following.

-

Do you charge more during the last week of tax season?

Yardley CPA replied to ETax847's topic in General Chat

For those clients who are routinely late, my invoice calculation seems to come up charging more than I normally would. Hmm. -

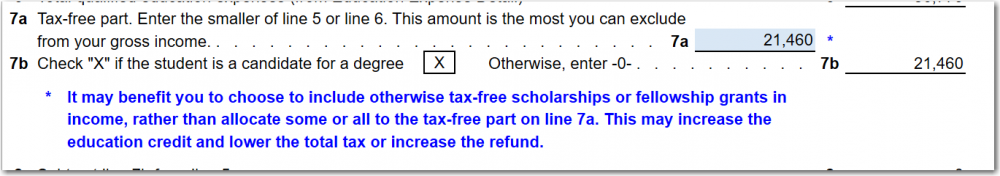

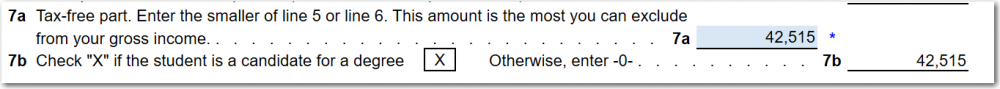

Hoping someone with a bit more experience dealing with education costs can chime in and provide some guidance. I have a MFJ client with two children in college. I completed all the necessary forms on ATX. Here is what both students Scholarship Worksheets look like: The note on ATX indicates it may be beneficial to choose to include otherwise tax-free scholarships in income. Where exactly does one include the amount in income? After including an amount in income do you decrease line 7A on the scholarship tab by that same amount? I would appreciate any input you can offer on this.

-

Abby...how do you turn off the auto-start again?

-

I guess I should have expected this, Lynn...anything is possible when you throw in some $$$.

-

Not sure if this was posted or not but, My Wish For ATX is to have them send the client an email notification or text that the return was efiled and approved. It would be a nice touch to receive that automatically once the return is approved.

-

PA expert - please answer my ? the way I want you to.....

Yardley CPA replied to schirallicpa's topic in General Chat

It depends on whether the town they live in has a local tax or not. This link may help you determine if your client's town has a local tax that requires a return to be filed: https://dced.pa.gov/local-government/local-income-tax-information/ Not sure that's the answer you were looking for!? -

I've been meaning to post that the Unread Replies Bar is a nice feature that certainly helps when scrolling through posts. Thanks for that upgrade, Eric.

-

- 7

-

-

How exactly would you take it in and out? + Other income - Other Income ?? And what would the explanation be?

-

I think your client has bigger problems than filing her return. With that said, filing with some type of explanation may get the IRS to be sympathetic?? Can't hurt. Explain the situation and ask for an extension of time.

-

Consider not dancing anymore? Maybe Software God's took offense to it?

-

How many of your clients have you actually met in person? My practice consists of preparing returns at night and on the weekends. I have about 100 clients. I have not actually met 25% of those. While we exchange information virtually and speak by phone/Zoom when we need to, we never met in person (unless you consider Zoom "in person"). They were referred to me through other clients and most never asked to meet in person even though that was always offered. Do you have similar experiences?

-

Max...I'd appreciate it also. Will send you a PM. Thank you.

-

Non Paid Preparer and Efile without Form 8867

Yardley CPA replied to Robin Morris's topic in General Chat

Great idea! -

I've asked my clients to recheck. To go through their bank statements again and also try to jog their memory. That's as far as I take it. If they say, they didn't receive it a zero goes on the line and I document my inquiry accordingly. I'll also mention, I have two older clients who want nothing to do with direct deposit. Every year it's the same thing...paper checks. Well, both had their stimulus payments direct deposited into their accounts for stimulus #3. They swear they've never provided banking information to the IRS.

-

Non Paid Preparer and Efile without Form 8867

Yardley CPA replied to Robin Morris's topic in General Chat

Robin...I'm just curious, why do you feel the need to show it as "unpaid"? Maybe I'm missing something but I also prepare my returns and my children's returns (both full time students) on ATX and show that I am the paid preparer. I keep sending my kids invoices and past due notices. I'm going to have to get a collection agency involved. -

Did they share any type of rate with you?