Leaderboard

Popular Content

Showing content with the highest reputation on 12/20/2022 in Posts

-

8 points

-

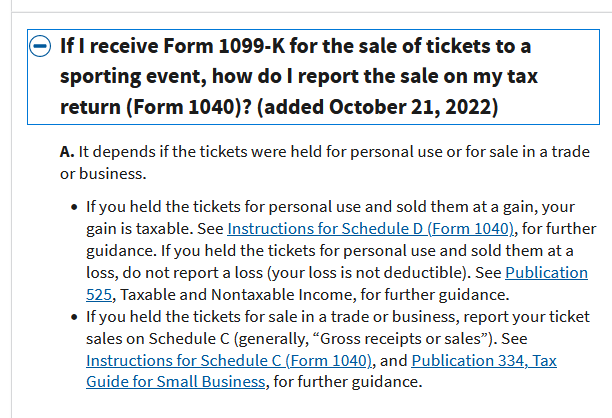

I don't get the advice to not report anything on the tax return if selling whatever at a loss when a 1099K is received. I suspect IRS computers will be busy matching those forms with tax returns and spitting out notices if matching amounts aren't found. If you paid $2000 for your couch and sold it for $1k, PayPal will send your a 1099K. I'd put it on the 8949 and code it as personal so the loss won't compute.6 points

-

4 points

-

Use saline eye drops, such as Refresh, many, many times per day. Eye doctor also has me on Restasis morning and night. The blue-light-blocking multi-focus glasses help a lot. And, close your eyes frequently during the day. Cataract surgery was a huge blessing. I was reading a restaurant menu after my first eye was done; something I couldn't do before with dim restaurant lighting and tiny fancy fonts on the menu. Hubby said I was just showing off!! I had both eyes done during December 2019.3 points

-

3 points

-

Windows 11 is mostly minor refinements, minor new features, and a fresh coat of paint compared to Windows 10, not a huge overhaul like the new version number would suggest. I would say that if your software vendor says it's compatible, and manufacturer of your peripherals (printers, scanners, etc) are supporting Windows 11, then you're safe to use it. Do whatever you're comfortable with. https://support.atxinc.com/includes/atx system requirements.pdf I think doom and gloom rants about either choice (sticking with Windows 10 or choosing to buy a Windows 11 computer) are probably a bit of an over-reaction. I don't think there's much risk either way... but if you're the type to get flustered by technology changes, then right before tax season might not be the ideal time to start getting acquainted with a new version of Windows.3 points

-

That method doesn't work very well, @Sara EA, if what you have is someone selling little bits here and there on eBay and otherwise has no need for a Schedule D. Over a year it adds up, but also it doesn't even add up to a hobby let alone a business. Since I charge by form, adding in a Sch D/8949 charge when I could put it on the "other income" line and back off all but a buck (and that just to make the detail transmit, which it does not when it zeros out completely) is not fair to the customer and does not properly present the situation. I should think that reporting on a 8949/Sch D also opens the client up to IRS queries about why a 1099-K item was not then reported on a 1099-B instead.2 points

-

This is brilliant and makes everything that I had to play for my umpteen recitals look like nothing.2 points

-

Fortunately, I have one gal who loves digging through the papers and sorting out the expenses. She comes in when I need her and does an awesome job. Believe me, she looks at everything and questions that lunch at McDonalds or that bottle of Bourbon and isn't afraid to call the client on it. When she is ready, she calls them in and puts them on the "hot seat" and ties up all the loose ends. When she is finished, all I have is totals. At the same time; she is doing a great job of whipping them into shape. She isn't interested in tax prep, but loves the numbers and loves coming here just to be a part of the "fun"! One client has 9 rentals and tries to bring in reports that are a mish mash of a mix up. He knows that when Gen wants to talk to him, he had better have his answers ready.2 points

-

About 90 % of my annual income comes from 7 monthly Write up/Payroll/Business Entity Tax Return/Business Owner Tax Return clients. Five of these clients I have had for over 25 years. Including these clients I did less than 40 total tax returns last year. It's a very viable practice niche with less hours and a lot less stress.2 points

-

13 composers fighting over the last slice of cake. Very well done. Seven minutes.1 point

-

There are reports that SECURE 2.0 has been included in the Omnibus Bill: "Among the key provisions contained in the final bill include: The establishment of a new “Starter K,” supported by the ARA which will allow employers that do not currently sponsor a retirement plan to offer a starter 401(k) plan (or safe harbor 403(b) plan). Research sponsored by the American Retirement Association indicates that it could expand coverage to over 19 million American workers; A 100% tax credit for new plans; An enhanced Saver’s match that will modify the existing Saver’s Credit with respect to IRA and retirement plan contributions by changing it from a credit paid in cash as part of a tax refund to a government matching contribution that must be deposited into a taxpayer’s IRA or retirement plan. Research sponsored by the American Retirement Association suggest that more than 108 million Americans would be eligible for this government match; A new “pension-linked” emergency savings provision; A new student-loan matching program to treat student loan payments as elective deferrals for purposes of matching contributions; Higher catch-up limits at age 60, 61, 62 and 63 (beginning after Dec. 31, 2024); Increasing the required minimum distribution (RMD) age; Expansion of the current QLAC limits; Provisions for auto-portability; Establishment of a Retirement Savings Lost and Found; Expansion of the Employee Plans Compliance Resolution System (EPCRS); and Reforms to the family attribution rules by removing attribution for spouses with separate and unrelated businesses who reside in community property states, and removes attribution between parents with separate and unrelated business who have minor children. " These are mostly provisions that will benefit the Upper Middle Class Baby Boomers.1 point

-

1 point

-

I had the surgery several years ago and remember having similar issues as NECCPA. They told me to use eye drops that were Preservative Free. I had problems and my husband had none, we had surgery the same day by the same doctor. I think the fact that I only use one eye at a time entered into it. Just let me say that after the healing and the glasses adjustment is over; it is the most miraculous and wonderful thing that I ever experienced. I couldn't read the numbers on the microwave without grabbing cheaters. Now, much of the time I don't wear any glasses at all. Once again I say that these new glasses are wonderful. Nobody ever suggest blue light protection before. It is a game winner. Sun on a LOT of snow such as we have today, would have made it very difficult to work before. For two years I struggled with glasses that they never could get right. Went to a different vendor this time and what a difference. Good luck, happiness and a very happy Holiday Season to all of you. We all know what lies ahead for us.1 point

-

I love the distance vision in my right eye after having cataract surgery last Wednesday.I am going crazy trying to work. I had super dry eyes and the healing process was so painful over the weekend. I have my right eye patched when I am working, because it is straining too much trying to help. They took out the lens in that my old glasses so that I can see my computer with my left eye. I am alternating them with two different kinds of readers for reading paperwork. My vision in the left eye is terrible and my right eye must have been carrying most of the load. I can't wait until Wednesday this week for that one to be fixed. I'm just hoping that the bad weather stays away until after my surgery. I'm having terrible headaches from the eyestrain.1 point

-

1 point

-

From my perspective, my daily checking and savings do not need to be in the trust, since it is a relatively small amount (not even a month's expenses). The accounts will automatically transfer to the person who will be managing our estate, enough to keep things going for a couple of weeks in case other access gets held up. Same for a life policy, it is a small one, and will go directly to two desired people, outside of anything else. Our main cash holding accounts are in the trust, as is our home. We monitor to make sure anything not in the trust will be probate proof (small estate exception). A trust is not an end all/catch all, it is part of an overall plan (to me).1 point

-

What I usually do is enter the full amount of the 1099-K as "eBay payments" (or whatever), and on the next line back off $1 less, as "personal items sold no profit" so the detail transmits. $1 of taxable income won't change anyone's tax return situation overall.1 point

-

If you have a gain, I'd report it on the Schedule D but I think if it's not a gain you still need to report is on the tax return. That's what I listed above. For example if you are selling junk on Ebay or Facebook to clean out your basement, you'll receive a 1099-k that isn't for a profit.1 point

-

Watch/ask for any additional costs, such as bank or charge card fees between time of purchase and time of payment. Make sure the 1099 is accurate, and shows the amount actually paid out. IOW, watch for the broker fees. Candidly I bought as many tix as I could for a certain performer's LV shows. Sold all but 2 right away, at a multiple profit (which more than paid for our personal tix, flights, and hotel), but lower than what most were asking. Those we held for personal use, we let go right after the "cancellation/postponement". The entire process turned us off so much, I did not try the same for another recent performer whose online sales process failed, even though it absolutely would have been profitable, and we have a few family members who would have wanted to go... Team tix may be slightly different as many/most will have a controlled resale portal which may have been used.1 point

-

I got my new glasses and they are wonderful. The blue light protection is wonderful. Also, I can spin around in my chair to client across the desk and see the client perfectly. I can see the bird sanctuary outside my window as well. Very happy.1 point

-

I'd rather blow $3.49 each and get EFileMyForms to take care of it all. I know for certain-sure that their system works.1 point

-

If there's an EIN, I file and mark it final. Last thing I want is a letter, two years from now, and having to dredge up the old information.1 point

-

I have the signer sign "FName LName, under POA" - I've found there isn't room to be legible if there's more than that. Copy of POA stays in client file, not with the 8879.1 point

-

Were you on the Eric Green class? I was there, too, and heard the same information.1 point

-

Like every time they stop at a fast food joint for lunch or a package store classified as "meals and entertainment"? I prefer the clients who classify half their entries as "ask accountant." My least favorite are those who don't have separate business debit/credit cards and just give you their bank statements. Everything is in there--groceries, gas, shoes, dating services, and of course cell phone payments for the entire family. Bookkeeping can take a LOT of time, but if you can charge enough for it, go for it. The answers are more black and white than positions on a tax return--if you can get the details from the client.1 point

-

Both our family practice Doctor and our Ophthalmologist have retired in the past two years; both relatively young men. In my practice, I am seeing more and more clients opting for early retirement as well. Some have a side line; some just want out. (Of course, some of them want their wives to continue working and carry health insurance); not always a happy situation. On the other end of the spectrum are those of us who have no plans to ever retire until absolutely necessary. Huge retirement plans are fueling some of this; some just think they have enough wealth accumulated. I am finding myself asked to help with more financial planning than ever before. I have had some clients lose thousands by following careless advice from their professional financial planners. There appears to be a severe lack of work ethics in some of the generation that is currently moving into the work force. On the other hand, I have grandchildren making more money than we ever dreamed possible when we were their age and with only trade school educations. I don't know the answers, so I just quietly and happily continue to build my cushion and hope that we never have to use it.1 point

-

Us boomers have not done a great job of raising those who follow. Also, we are just getting farther and farther from the greatest generation... There is hope, like always, at least if we try to make a difference in our own circles and trust that those folks will build their own positive circle. Politics aside, folks like Mike Rowe, and creating more trades people, and showing the pride in being in the trades, may turn things around. I am a product of shop classes in MIDDLE school, and actual job training in high school. I was a paid mechanic at age 14, and GED'd out of HS to work full time at 16. I eventually taught myself computer programming so I did not have to rely on what I could produce, every hour, spinning wrenches, or how/if I could shortcut book time. (It was great when I was contracted for a specific race team though, since it was not hourly rate.) If we can make trades strong and proud again, the the white collar jobs will follow. Not everyone can work at home in their PJ's.1 point

-

The retirement of baby boomers is significantly impacting many professions, including accountants, family practice doctors, dental hygienists, veterinarians etc etc etc.1 point

-

I believe it. They are backlogged, period. It was not always great pre pandemic, but pandemic will take years to get past. Personally "waiting" on a deceased filer's 2020 return to be processed... --- So many entities struggle to get caught up, and are still falling behind. Even if there were enough skilled workers who returned, there is not yet enough (maybe not for a long time) ready to step in to replace those who moved on, or to actually add to the number of folks processing/working.1 point

-

1 point

-

Thank you, all. And, thank you for the above, which I remembered but could not find. Where did you get that cite?1 point

-

"Whether the IRS can accept a durable power of attorney in place of a Form 2848 depends in each case on whether the following requirements are met. As a very general starting point, the IRS will accept a durable power of attorney instead of a Form 2848 if the durable power of attorney includes all of the elements specified in IRS procedural regulations at 26 CFR sections 601.501 – 601.509 (reprinted as IRS Publication 216, Conference and Practice Requirements.). See 26 CFR § 601.503(b)(4) (discussing durable powers of attorney). Specifically, the durable power of attorney must include all the elements of section 601.503(a): Taxpayer’s name and mailing address Taxpayer’s TIN (i.e., SSN, EIN, etc.) An employee plan number, if applicable Name and mailing address of the appointed representative(s) A description of the matter or matters for which the representation is authorized that must include, as applicable— Type of tax involved; Federal tax form number involved; Specific year(s) or non-annual period(s) involved; and Decedent’s date of death in estate matters. “A clear expression of the taxpayer’s intention concerning the scope of authority granted to the…representative(s)."1 point

-

1 point

-

1 point

-

1 point

-

If I, as a tax preparer, shared any of this personal data with anyone it would be considered an ethical violation under circ 230 and my professional standards. Why is the IRS not cracking down and fining these software companies when the agency has other ridiculous standards for us such as the size of micro-shredded chips and all the various other rules for safeguarding taxpayers' data and privacy? This is infuriating!1 point

-

I attended on 1 Hour online CPE class this morning where Nina Olson, the former National Taxpayer Advocate was the main presenter. One thing she said really caught my attention, that the IRS has a current Backlog of 10 Million Non Filers waiting to be processed. Unbelievable!0 points