Leaderboard

Popular Content

Showing content with the highest reputation on 06/05/2015 in all areas

-

I just saw another very good reason to use the "report" function here, or at least a very good reason for sending a PM. There was a link posted recently that took me to a site that one of my security software programs indicated was suspicious and cautioned me to not proceed. I've deleted the link so don't worry about that specifically, but what I want to say is that, in future, if anyone clicks on a link that is going to a malicious or suspicious site or that you are concerned about and think we should know, please consider using the report function, or consider PM'ing one of the moderators or Eric directly so that one of us can take a look. That report function doesn't have to mean that the poster has done something bad or wrong; it gives us a heads up to take a look at a post, and it gives us a link directly to the post making it easy and quick for us to find. A PM would also work but wouldn't necessarily get attention as quickly as a report would. Also, if you are the poster and are beyond the time allowed for editing, you are always welcome to contact us to fix a post too.6 points

-

I carry a cordless mouse with me to use on laptops. I DESPISE touchpads!! I can use them, but they are so restrictive!3 points

-

There will be a lot more than this that goes into the evaluation of a commercial building loan purchase and financing. I would suggest they talk to the banker. And you should give some serious thought to counseling your client to NOT put the building in the corporation. It may look appealing now, but if the S-Corp rules go south and you end up busting the S-Election for some reason, you have a very bad situation with the real estate setting in the C Corp. There was just a question recently, here or on another listserv I subscribe to, wherein the primary shareholder had passed on, I believe, leaving the beneficiaries owning the stock of a C-corp that primarily held highly inflated real estate. Some of the benes wanted to cash out which meant selling the real estate and paying a ridiculous amount of tax, Be careful here.2 points

-

Under no circumstances should the client call the IRS agent/RO or whatever. Most clients feel intimidated and will answer any questions asked of them. NECPA, despite saying the contrary, can get a POA that covers most possibilities. Form 1040 going back at least 10 years (we use 20). 941 all quarters going back 10 years. Civil Penalties - same as 941. If the client is a corp, then you would want the same, so maybe two POA's.2 points

-

That's what I was thinking. Client has a card from IRS and has the presence of mind to call the tax preparer, but just happpens to "leave the card at the office". I'd be inclined to tell them to not worry too much about the visit since they didn't seem concerned enough to communicate to me all the relevant info. I suspect the client knows more about the reasons for the visit than they are letting on. It will become crystal clear on Monday.2 points

-

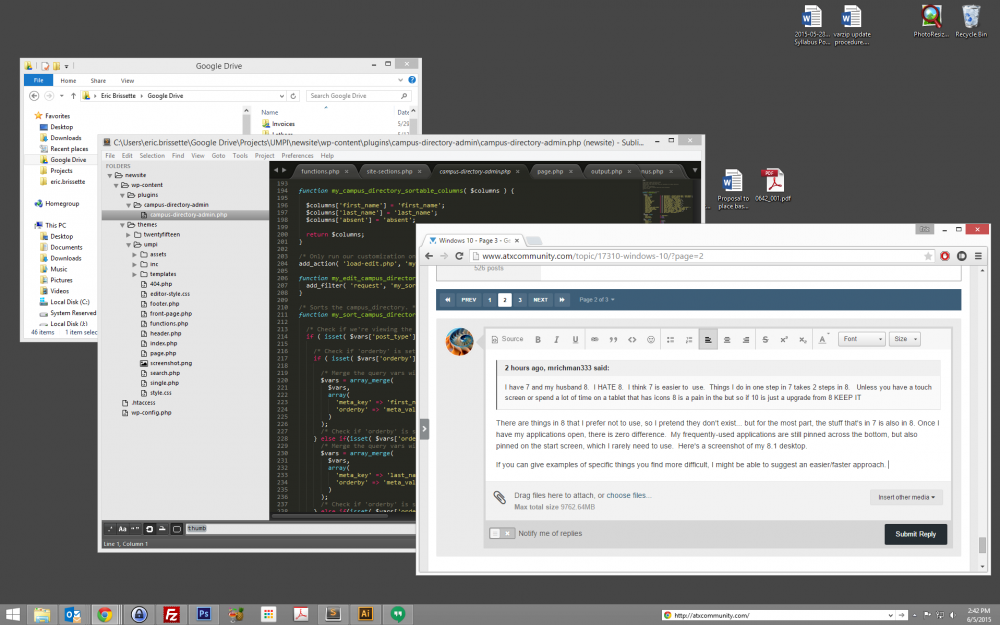

There are things in 8 that I prefer not to use, so I pretend they don't exist... but for the most part, the stuff that's in 7 is also in 8. Once I have my applications open, there is zero difference. My frequently-used applications are still pinned across the bottom, but also pinned on the start screen, which I rarely need to use. Here's a screenshot of my 8.1 desktop. If you can give examples of specific things you find more difficult, I might be able to suggest an easier/faster approach.2 points

-

IRS agents only visit corporate clients for unfiled payroll forms, or unpaid payroll taxes. Everyone is to make monthly payments since 2013, and that is probably the reason for the visit. Tell her to under no circumstances, allow the agent inside her home. Tell her to give NO information of any kind to the agent. Stress this very heavy. Those agents are trained to try to extract information from the taxpayers.2 points

-

I recommend the "Excel Tips & Tricks" webinar offered by CPAcademy, too. During this past Season, they offered a webinar on encrypting PDF files that I just couldn't time right to attend. I now drop in on this site periodically, to see what's offered next. Not only are its *free* webinars usually jam-packed with information, CPE is provided, and, once in a while, the discounts offered to attendees to engage further with the presenter are a real benefit, IMO.2 points

-

Even if the corporation keeps it's S status, somewhere down the road it may become desirable to distribute the property to the shareholder(s) which in an S Corp means that it will probably come out at FMV with unintended tax consequences. Sometimes reducing taxes as much as possible is not a good strategy, especially if obtaining a loan can be foreseen. Really it's a balancing act between tax reduction and credit-worthiness.1 point

-

1 point

-

I emailed my sales rep about enhanced fixed assets and he called and left a message that it was 279. I emailed back and said no thanks. I wouldn't pay more the 100 for it. He called back again and said he could do 100, so I signed up for it. This way I can evaluate it for a year and see if it's worth having.1 point

-

I have 7 and my husband 8. I HATE 8. I think 7 is easier to use. Things I do in one step in 7 takes 2 steps in 8. Unless you have a touch screen or spend a lot of time on a tablet that has icons 8 is a pain in the but so if 10 is just a upgrade from 8 KEEP IT1 point

-

This isn't about her *1* employee and missing 941/940 etc. Your client probably owes back taxes from before that. If your client is a new client, most likely this is what is going on. She comes back to her office, and finds a card on her door from the IRS, but does not have this card when she calls you? Hmmmn. Rich1 point

-

There is another possibility. The ES payments were earmarked for the wrong year, or no year was even indicated. I don't usually use or recommend the Taxpayer Advocate, but I would in this case as there are too many unknowns and too much red tape to cut through. Going to the field office? That would be the last place to go. They would just pass it up the chain, if they don't misplace it, and cause more delay. I have too many horror stories of clients coming to us after going to a field office and having returns lost, payments misplaced, returns prepared incorrectly, etc.1 point

-

Good point, Jack. About all one will be able to do is point to it and say "There it is. Yep, it's wrong."1 point

-

No one's sure what an upgrade from 7 to 10 will be like, because the release date is 7/29. I'll be test upgrading an old win7 laptop and report back here. My suggestion would be to wait until later this year to have the computer built to see what's being reported both about win10 and about upgrades from 7 to 10. As others have pointed out, sticking with 7 for the next 5 years is a valid option.1 point

-

There's usually a button right above the touchpad to turn it off. Mine is always in the off position. Like Jack, I much prefer a mouse.1 point

-

There are gestures for swapping between programs on Windows 8. They apparently work well on a touch screen, but are super annoying if you're using a laptop with a trackpad / touchpad. The trackpads on Windows laptops are almost universally terrible. http://www.makeuseof.com/tag/3-ways-to-disable-windows-8-gestures/1 point

-

There has been discussion on QuickBooks time to time, so I thought some of you might be interested in this upcoming webinar Yes, there is always a "sales" side to these things but --- no pressure as the CPAAcadem.org : http://www.cpaacademy.org/ actually has a lot of information --- it is just up to you to glean and also not buy something ---- unless you see a real benefit ---//// BUT the information is good regardless. Enjoy the summer, easytax HOSTED QUICKBOOKS DESKTOP VERSUS QUICKBOOKS ONLINE Available Date(s) Thursday, June 4, 2015 1:00pm Eastern 12:00pm Central 11:00am Mountain 10:00am Pacific CostFree CPE Credits1.0 hour Subject AreaSpecialized Knowledge & Applications Course LevelBasic Instructional MethodGroup Internet Based PrerequisitesNone Advanced PreparationNone Who should attend?CPAs and other accounting professionals Type of CreditCPE for CPAs Course DescriptionWhen you visit Intuit’s website you might come to the conclusion that QuickBooks Desktop has deceased and that QuickBooks Online has been overwhelmingly embraced. But today QuickBooks Desktop is as critically important to small business and accounting firms as ever, and QuickBooks Online may not be ready for prime time for years to come. Join Cloud9 Real Time CEO Robert Chandler in his discussion of QuickBooks Desktop hosted and QuickBooks Online. Learning ObjectivesWhat the Cloud is and the specific benefits the Cloud can bring to your accounting firm and your clients The explicit benefits of putting any version QuickBooks Desktop software in the cloud The particular differences between hosted QuickBooks Desktop and QuickBooks Online1 point

-

1 point

-

I love how they say you only need 3-10GB of drive space. My data folder with 2 years of about 400 tax returns is 18GB.1 point

-

Let us know how that works out... NOTHING gets expedited by the IRS in the last 18 months. Criminal Lois Lerner has screwed all of us.1 point

-

1 point