-

Posts

89 -

Joined

-

Last visited

-

Days Won

1

Everything posted by frazzled

-

At the beginning of last week, I was up over the last two years, but not by much. By the end of the week, i was down. It was a very slow week. Hopefully, this week will be better.

-

Goodbye and good luck....

-

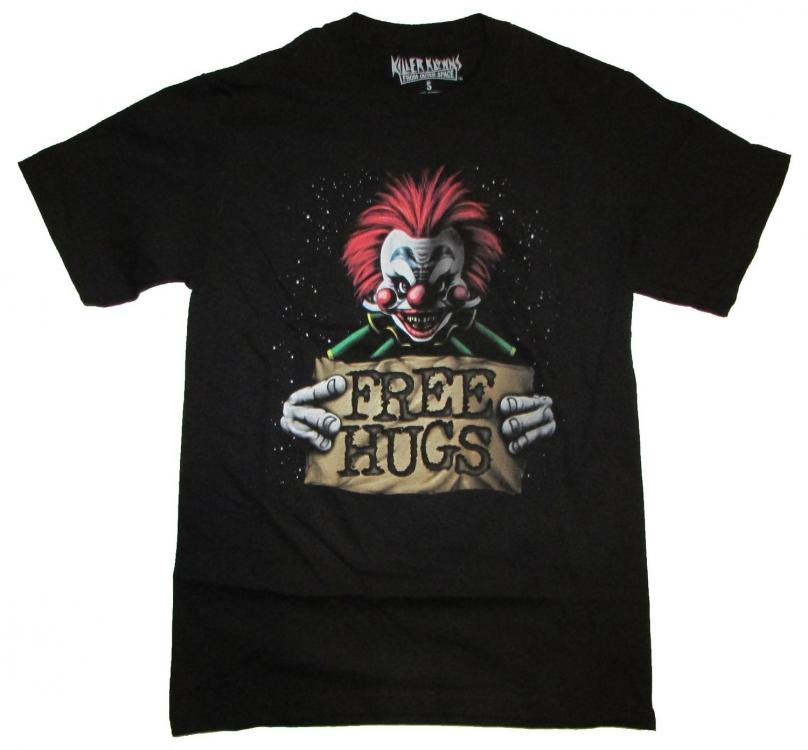

I was thinking about wearing this to work today. And Rita, I think this would be perfect for you too!

-

Maybe the taxpayer advocate office could help?

-

After yesterday's massive rush, today has been too quiet. T-minus 2 hours and 14 min and 32 seconds. and there are still about 20 ready to be picked up.

-

I had 18 drop offs yesterday! I couldn't believe it. I hate people today.

-

I discovered the do not disturb feature on my phones this year! And I plan to use it ALL day today!

-

He probably lied. They probably told him to contact the IRS. After repeated failed attempts, he probably gave up and decided to contact a local tax preparer for info. Cause we have time... BTW, when people call information around here, ask for H&R Block and choose to be connected, their call is sent to me! I have never been affiliated with H&R.

-

that's the plan Let's hope they get the wrinkles ironed out SOON!

-

Yes, I have already mocked up a fake 1095-A, but we decided to hold off on filing. We didn't want the IRS to be confused and cause a big processing debacle. As Janitor Bob stated, the IRS is looking and comparing - so if the marketplace doesn't have her form ready, then the IRS will not have the form, and then letters will begin flowing. My client is a basket case over this - AND she has to pay back ALL the subsidy, to the tune of nearly $2000. I found this last night: "Q8. I purchased qualifying Marketplace coverage, and advance payments of the premium tax credit were made to an insurance provider on my behalf. I have not received a Form 1095-A, Health Insurance Marketplace Statement, and have not yet filed my income tax return. Should I wait to file my return until I receive a Form 1095-A? A8. If you have not yet filed your income tax return, you should file Form 4868 (request for an automatic extension) by April 15. Then, once you receive your Form 1095-A, you should file your tax return using the information from the form. Please note that if you file a Form 4868, you have an extended time to file, but not an extension to pay any tax you owe. Form 4868 provides further information. Form 4868 is available on IRS.gov, through tax software or from a tax professional. Of course, if you receive your Form 1095-A before April 15 and are able to file using the form, you are encouraged to do so." http://www.irs.gov/Affordable-Care-Act/Individuals-and-Families/Questions-and-Answers-Incorrect-Forms-1095A-and-the-Premium-Tax-Credit

-

I currently have a client who has yet to receive any 1095-A from the market place. She has called numerous times, and they say a copy will be mailed. Still waiting. Last week, I had the client come in and we contacted the marketplace together. Got the same canned response from the CSR - so, I requested a supervisor. The supervisor could tell me what her premiums were, how much she paid, and the subsidy amount, BUT he stated that a 1095-A was not available for her account yet. When prodded, he admitted that the unavailable 1095-A's were a known issue. And he could not give me an estimated fix time. So, I have placed my client on extension. This ACA is a clusterf***.

-

So sorry for your loss, Jack. Prayers for you and his family.

-

Here's one i sent early this year for an out of state client who kept sending her papers to me later and later every year and was nearly impossible to get a hold of. Dear XXXX, Hello, I hope you have been well. After careful consideration, I have come to the conclusion that I will be unable to continue to prepare your tax returns. Due to the demands of new onerous tax legislation and the absence of my executive administrative assistant, I anticipate being overwhelmed with work. I also feel that you would be best served by a tax preparer local to you. It has been a pleasure serving you through the years. Thank you so much for the past business and trust that you placed in us. I wish you the best of luck in the future. Thank you, Of course, insert your own excuses...

-

NT - why i should have sold my business last year

frazzled replied to frazzled's topic in General Chat

Thanks so much for the hugs and prayers, they sure mean a lot. Sorry, Lion. You are outta luck. No electronic copy. Try a local printer. They should be able to print some for you. Rich, I may still breakdown and sell to one of the big guys after the season ends. But probably not. Hopefully after a good post season de-stress session, I will feel better. I planned to do this job until I died. But I will seriously entertain the idea of selling. Maybe I will stumble across a new career opportunity in the off season. I just cannot believe how burnt out I am, especially, so early in the season. I feel like crawling into a dark, quiet cave for awhile (maybe not, now i feel claustrophobic). -

These are the top ten reasons I should have got out last year: 1. Wouldn't have had to try to operate without my well seasoned administrative assistant. 2. Tangible repair regs 3. late tax legislation (again) 4. ACA 5. Wouldn't have come in to a flooded office... 6. ...after having heard about a friends suicide and trying to mentally deal with that. 7. Form 3115 8. Wouldn't have had to scramble to get my parking lot plowed (after being closed 2 days due to the flooded office), because my guy never showed and his number now belongs to someone with limited English skills. 9. My back wouldn't have went out while trying to clean the flooded office... 10. Less stress - and more sleep Thanks for listening to me cry. it has been a very tough week

-

I still have a couple HP laserjet 4's working with WIN7 64bit!! Which one is older HP 4 or HP1200? lol

-

I have all of those resources. I am wanting something simpler and generic for $0 adjustments.

-

I am trying to do my first ever Form 3115 to comply with the new regs. Any and all insights are welcome. Background - simple Sched E taxpayer. One rental single family home. House is the only thing on the depreciation schedule. He placed in service in 2008 - no other improvements. Repairs and supplies have been minimal. Always used a $200 threshold for expenses. The client and I decided to file a form 3115 with a $0 481(a) adj to err on the side of caution. Do I need to get all detailed and throw section codes out right and left? (how do you make that weird section code symbol anyway?) Or can I use more generic language? My sample generic wording: for line 12: Item being changed: Taxpayer is adopting the Tangible Property Regulations issued by the IRS on 9-13-2013. Present Method: In compliance with the temporary regulations. Proposed Method: Compliance with TD 9636. for line 13: Rental property - single family home Line 25: The taxpayer reviewed its prior accounting records through 12-31-13 and determined there were no assets that were incorrectly capitalized under the prior regulations. Conversely, it was determined that there were no materials, supplies, or repairs that were incorrectly expensed that should have been capitalized under the new regulations. No 481(a) adjustment is required. I think simple taxpayers deserve simple solutions. But Keep It Simple Stupid does not always work with the IRS. Some of the examples that I have seen are way overdone (IMO) for our simple little guys. Is the generic wording acceptable? Thanks Debbie

-

Father must file single if mom takes the dependency exemption.

-

No, they cannot split the tax benefits. See pub 17, page 31 Sometimes, a child meets the relationship, age, residency, support, and joint return tests to be a qualifying child of more than one person. Although the child is a qualifying child of each of these persons, only one person can actually treat the child as a qualifying child to take all of the following tax benefits (provided the person is eligible for each benefit). 1. The exemption for the child. 2. The child tax credit. 3. Head of household filing status. 4. The credit for child and dependent care expenses. 5. The exclusion from income for dependent care benefits. 6. The earned income credit. The other person cannot take any of these benefits based on this qualifying child. In other words, you and the other person cannot agree to divide these benefits between you. The other person cannot take any of these tax benefits for a child unless he or she has a different qualifying child.

-

What Word and Excel type programs are you using?

frazzled replied to Tax Prep by Deb's topic in General Chat

I purchased new computers last year. I am trying out OpenOffice - free and acceptable for small business use. So far, it has been an adjustment, but doable. If i get too frustrated with it, I will just fire up the old computer and use Office.