-

Posts

6,673 -

Joined

-

Last visited

-

Days Won

166

Everything posted by Jack from Ohio

-

Karma can be a fun thing to watch from a distance. Make sure you return ALL of the retainer. That way there is not even a tiny string of connection. Your peace of mind and relief at getting rid of a PIA is worth FAR MORE than the $75. If they ever call back, simply tell them you are not their accountant and have nothing to say. Karma will kick them, you can be sure.

-

Here is the best article I have seen about dealing with the WIN 10 PIA bug... http://www.howtogeek.com/218856/how-do-you-disable-the-get-windows-10-icon-shown-in-the-notification-tray/ It is a little bit technical, but there are a couple of places with simple instructions. Microsoft has been changing to a bad-ass bully about this, and many users are fed up with it.

-

Agree it must have cooking, sleeping, and toilet facilities.

-

Indirect maintenance and repairs. Take total amount.

-

NT - Opinion requested - Software for security

Jack from Ohio replied to easytax's topic in General Chat

Send me a private message and I will share with you my process. Too controversial to share in open forum... This has been working for me for 5 years. -

ATX stopped being a spreadsheet based program in 2012. This has been a bittersweet thing...

-

I only e-file 1099's. I only electronically transfer W-2s. One main and overriding reason. ACKNOWLEDGMENT. If there is ever a question by the IRS, only electronic acknowledgment will be accepted as proof of filing. This also goes for extensions.

-

Enter them in alphabetical order. Only way I have found.

-

You love torture teasing us, don't you?

-

Send him packing. If the stuff ever hits the fan, you can be sure YOUR name will be in the middle of it. No way I would participate in such shenanigans.

-

The client should know how much they put into the HSA themselves. Amounts contributed by their company and through payroll deduction will show on the W-2. The more important document is the 1099-SA. Can't complete the return correctly without it.

-

When did a ROTH become subject to RMD? Did I miss something?

-

Honey Roasted Whole Cashews

-

I prefer not to override any fields. This can cause data to be sent to the IRS incorrectly. Enter it as seller financed mortgage and go on.

-

We just want you to be completely happy and pleased with our donations. We all understand the costs of running a business and the behind the scenes costs as well. All of us appreciate when we get quality professional service, and that is definitely what we are receiving from you.

-

I totally agree with Catherine!! Eric, could you post what your annual hosting bill is? Don't be shy. My gift may be too small, once I have some numbers to use for consideration.

-

When they do call, I tell them to call 1-800-829-1040 and ask why so long. I will not put in the time to wait. 90% of the time, the client KNOWS why it is being delayed. Besides, there is not one blessed thing we, or anyone else can do, to speed up the process. I find myself very lacking in tolerance of grown adults that CHOOSE not to read...

-

Looking for the cite that is NOT about Marketplace exemptions. We are talking about Shared Responsibility Payments. I want to see where it says that the time to exceed the two month safe harbor in a calendar year, must be continuous.

-

Here is what I/we tell clients right up front... *** THE IRS DOES NOT GUARANTEE A SPECIFIC DATE THAT A REFUND WILL BE DEPOSITED INTO A TAXPAYER’S FINANCIAL INSTITUTION ACCOUNT OR MAILED.*** Here is the official word from the IRS concerning the time frame for refunds: Most taxpayers should receive their refunds in 21 days or less after receipt by the IRS. Some may take longer. You may check the status of your refund starting 24 hours after the IRS receives your return at https://sa2.www4.irs.gov/irfof/lang/en/irfofgetstatus.jsp Please do not call our office about the status of your refund until at least 21 days after you have received your return.

-

Cite please?

-

Well, you find out things accidentally sometimes.

Jack from Ohio replied to RitaB's topic in General Chat

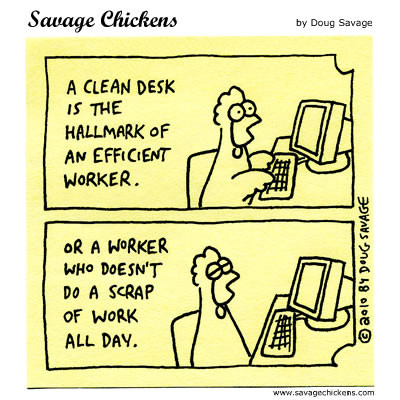

When my wife is in her cleaning mode, she is not allowed to clean anything in my office that is more than 12 inches off the floor. -

Well, you find out things accidentally sometimes.

Jack from Ohio replied to RitaB's topic in General Chat

-

There is no "usual." I donate the amount I think represents the amount of help I have received. Eric has been resistant, at times, to us contributing, but we simply ignore that and donate what we feel is appropriate.

-

Let me know how that works...